Investor Presentation May 17, 2022 Safe Harbor Statement Cautionary Note Regarding Forward-Looking Statements The information contained in this report may contain forward-looking statements.

When used or incorporated by reference in disclosure documents, the words "believe" "anticipate," "estimate," "expect," "project," "target," "goal" and similar expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements may include but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to certain risks, uncertainties and assumptions, including but not limited to those set forth below: • Operating, legal and regulatory risk; • Economic, political and competitive events; • Legislative, regulatory and accounting changes; • Demand for our financial products and services in our market area; • Major catastrophes such as earthquakes, floods or other natural or human disasters and infectious disease outbreaks, including the current coronavirus (COVID-19) pandemic, the related disruption to local, regional and global economic activity and financial markets, and the impact that any of the foregoing may have on us and our customers and other constituencies; • Inflation or volatility in interest rates; • Fluctuations in real estate values in our market area; • The composition and credit quality of our loan and investment portfolios; • Changes in the level and direction of loan delinquencies, classified and criticized loans and charge-offs and changes in estimates of the adequacy of the allowance for credit losses; • Economic assumptions utilized to calculate the allowance for credit losses; • Our ability to access cost-effective funding; • Our ability to implement our business strategies; • Our ability to manage market risk, credit risk and operational risk; • Timing and amount of revenue and expenditures; • Adverse changes in the securities markets; • Our ability to enter new markets successfully and capitalize on growth opportunities; • Competition for loans, deposits and employees; • System failures or cyber-security breaches of our information technology infrastructure and those of our third-party service providers; • The failure to maintain current technologies and/or to successfully implement future information technology enhancements; • Our ability to retain key employees; • Other risks and uncertainties, including those occurring in the U.S. and world financial systems; and • The risk that our analysis of these risks and forces could be incorrect and/or that the strategies developed to address them could be unsuccessful. 2 Safe Harbor Statement (cont’d) Cautionary Note Regarding Forward-Looking Statements Given the ongoing and dynamic nature of the COVID-19 pandemic, it is difficult to predict the continued impact of the COVID-19 pandemic on our business.

The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated. As a result of the COVID-19 pandemic and the related adverse local and national economic consequences, our forward-looking statements are also subject to the following risks, uncertainties and assumptions: • Demand for our products and services may decline; • If the economy worsens, loan delinquencies, problem assets, and foreclosures may increase; • Collateral for loans, especially real estate, may decline in value; • Our allowance for credit losses on loans and leases may have to be increased if economic conditions worsen or borrowers experience financial difficulties; • The net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; • A material decrease in net income or a net loss over several quarters could result in the elimination of or a decrease in the rate of our quarterly cash dividend; • Our wealth management revenues may decline with market turmoil; • Our cyber security risks are increased as the result of an increase in the number of employees working remotely; and • FDIC premiums may increase if the agency experiences additional resolution costs. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected or projected. These forward-looking statements speak only as of the date of the report. Univest Financial Corporation (the Corporation) expressly disclaims any obligation to publicly release any updates or revisions to reflect any change in the Corporation's expectations with regard to any change in events, conditions or circumstances on which any such statement is based. 3 Non-GAAP Financial Measures This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

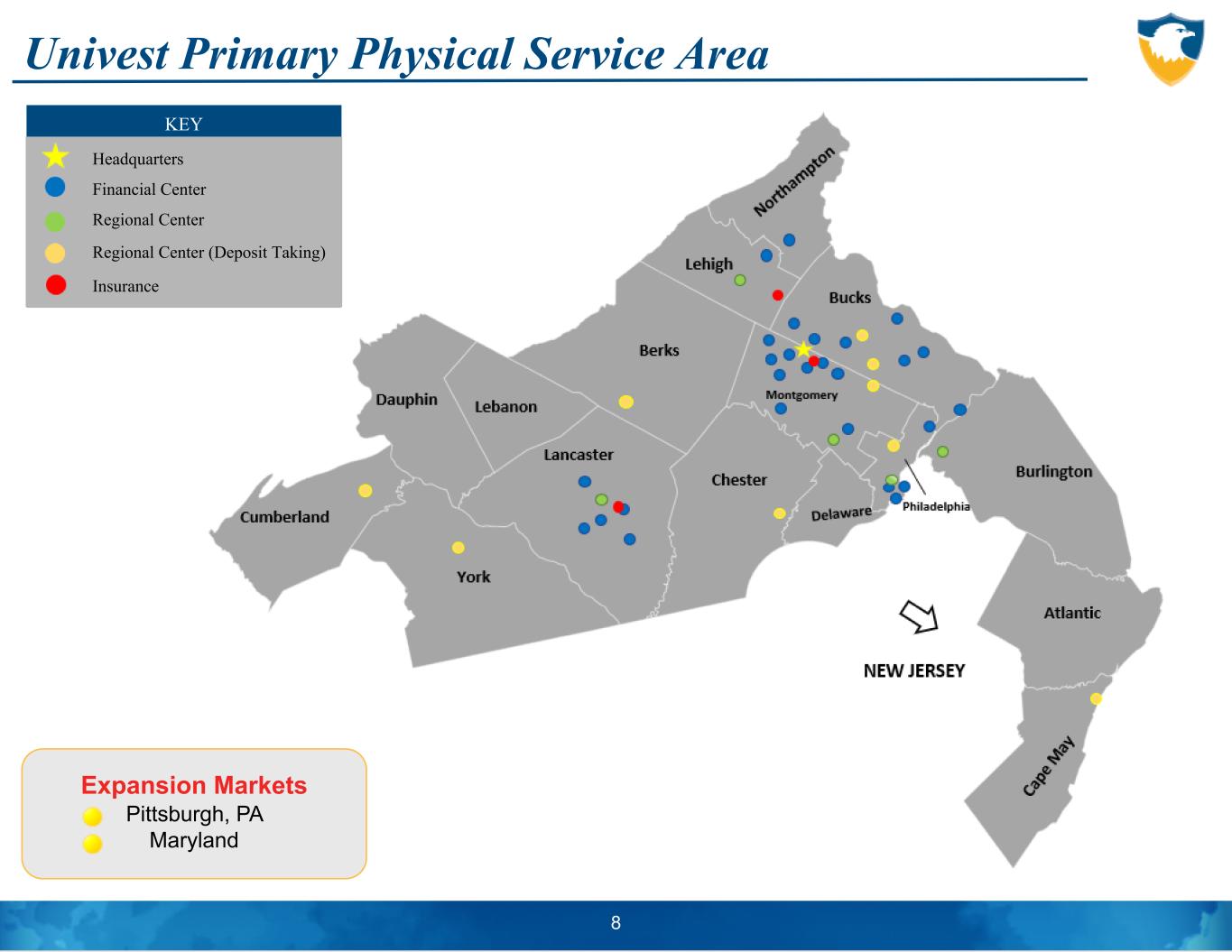

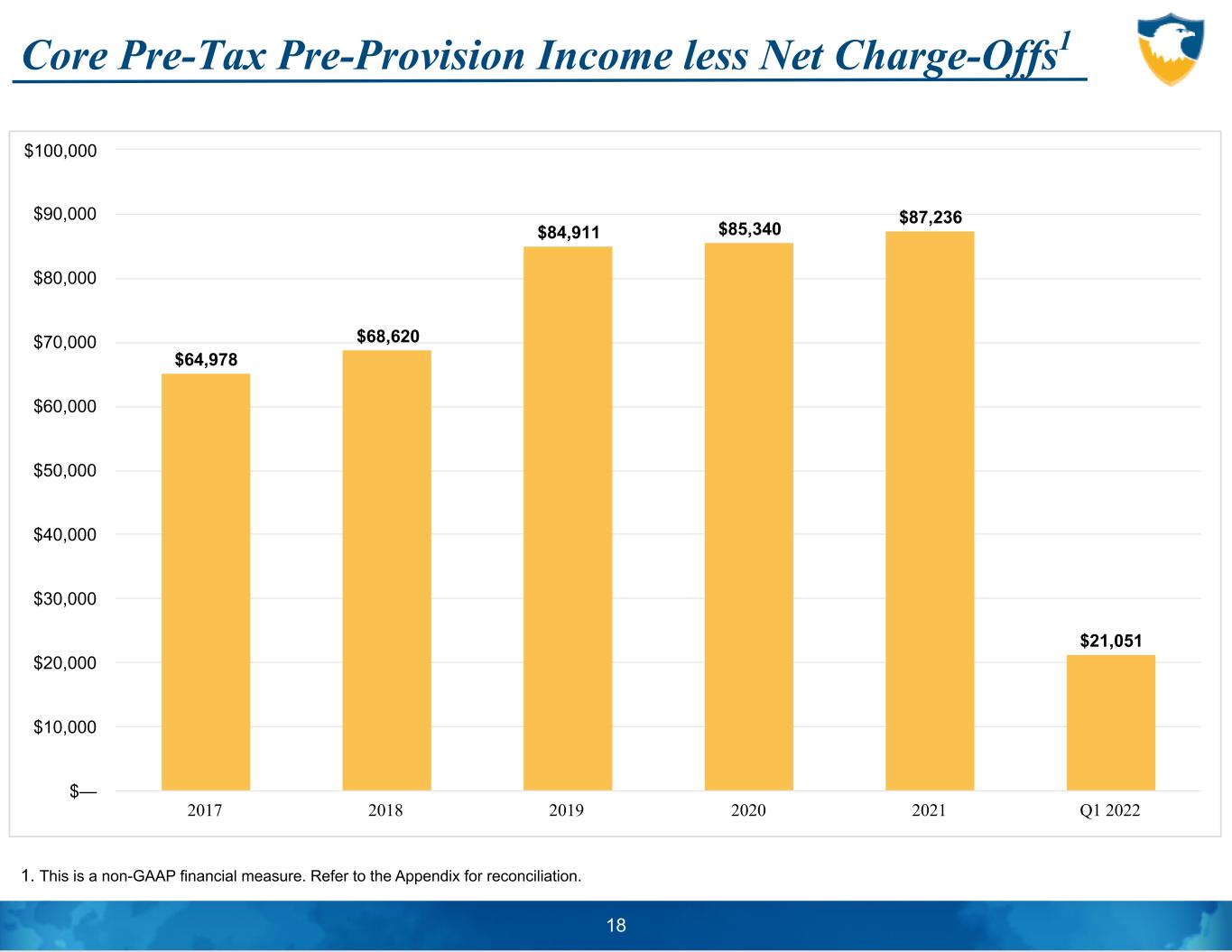

These non-GAAP measures include tangible common equity, core net interest income excluding PPP, core noninterest expense excluding purchase accounting (“PA”), core tax equivalent revenue, core pre-tax pre- provision income less net charge-offs (“PTPP-NCO”), average assets excluding PPP, and average interest earning assets excluding excess liquidity and PPP. Management uses these “non-GAAP” measures in its analysis of the Corporation’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Corporation believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation. 4 Univest Company Overview • Headquartered in Souderton, Pennsylvania (Montgomery County) • Bank founded in 1876, holding company formed in 1973 • Engaged in financial services business, providing full range of banking, insurance and wealth management services ◦ Comprehensive financial solutions delivered locally • Experienced management team with proven performance track record • Physically serving thirteen counties in the Southeastern and Central regions of Pennsylvania and three counties in Southern New Jersey; recently announced expansion into Western PA and Maryland • Customer base primarily consists of individuals, businesses, municipalities and nonprofit organizations • Operating leverage and scale with $7.1 billion of assets, $4.6 billion of assets under management and supervision and agent for $197 million of underwritten insurance premiums as of 3/31/22 6

COMPANY OVERVIEW

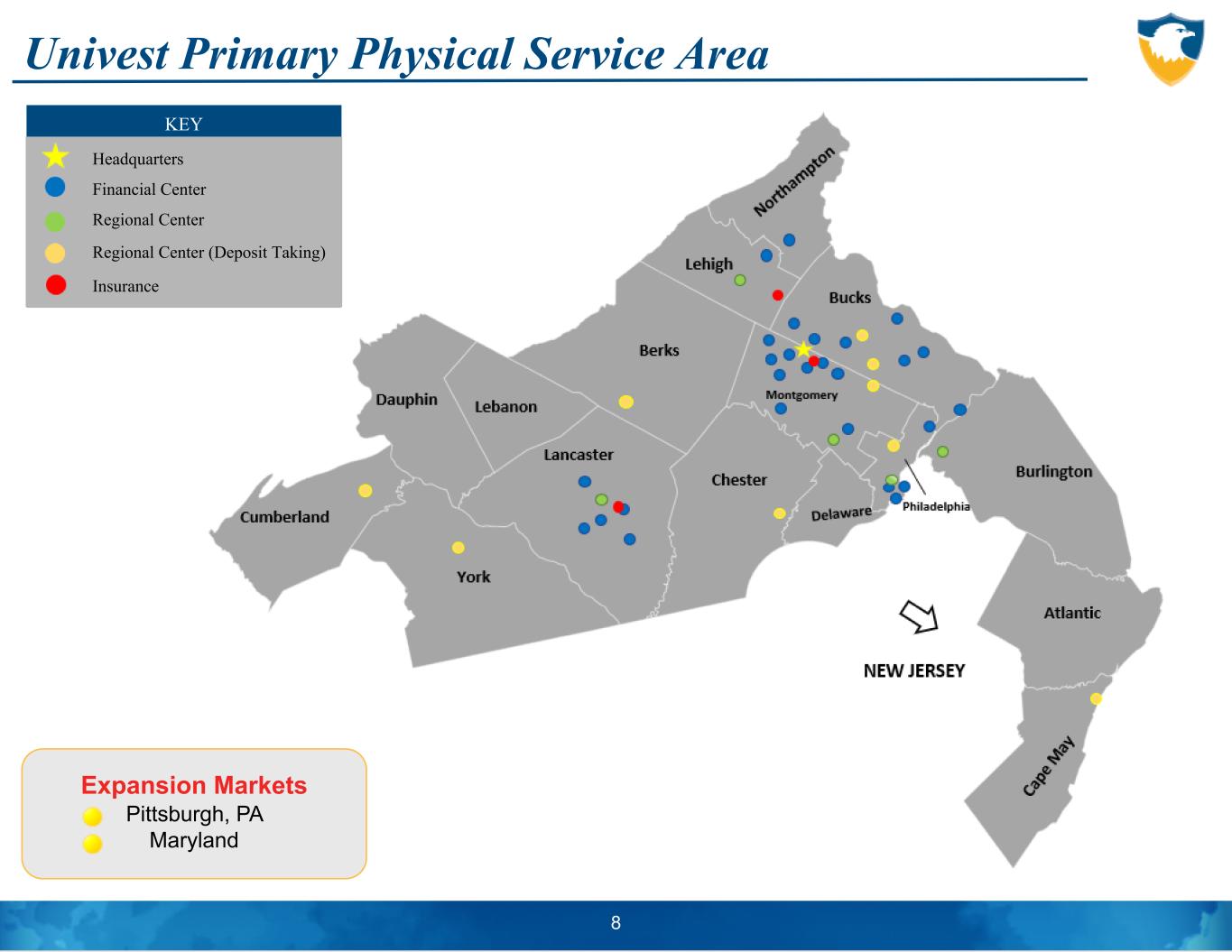

Executive Leadership Team 7 Name Age Tenure (yrs) with Univest Title Jeffrey M. Schweitzer 48 14 President and CEO, Univest Financial Corporation Michael S. Keim 54 13 Chief Operating Officer, Univest Financial Corporation and President, Univest Bank and Trust Co. Brian J. Richardson 39 5 Senior Executive Vice President, Chief Financial Officer Megan D. Santana 46 6 Senior Executive Vice President, Chief Risk Officer and General Counsel Patrick C. McCormick 45 0 Executive Vice President, Chief Credit Officer (joined Univest in April 2022) Michael S. Fitzgerald 58 5 President, Commercial Banking, East Penn and NJ Division Thomas J. Jordan 54 5 President, Commercial Banking, Central PA Division Christopher M. Trombetta 52 0 President, Commercial Banking, Western PA Division (joined Univest in April 2022) Matthew L. Cohen 39 0 President, Commercial Banking, Maryland Division (joined Univest in April 2022) Ronald R. Flaherty 54 13 President, Univest Insurance, Inc. David W. Geibel 49 8 President, Girard (Univest Wealth Management Division) William J. Clark 58 15 President, Univest Capital, Inc. Brian E. Grzebin 50 3 President, Mortgage Banking Division Dana E. Brown 54 5 President, Consumer Services Eric W. Conner 51 15 Senior Executive Vice President and Chief Information Officer M. Theresa Fosko 51 18 Executive Vice President and Director of Human Resources Annette D. Szygiel 59 18 Executive Vice President and Chief Experience Officer Briana J. Dona 41 21 Executive Vice President and Chief Banking Operations Officer 7 Univest Primary Physical Service Area 8 Expansion Markets Pittsburgh, PA Maryland KEY Headquarters Financial Center Regional Center Regional Center (Deposit Taking) Insurance

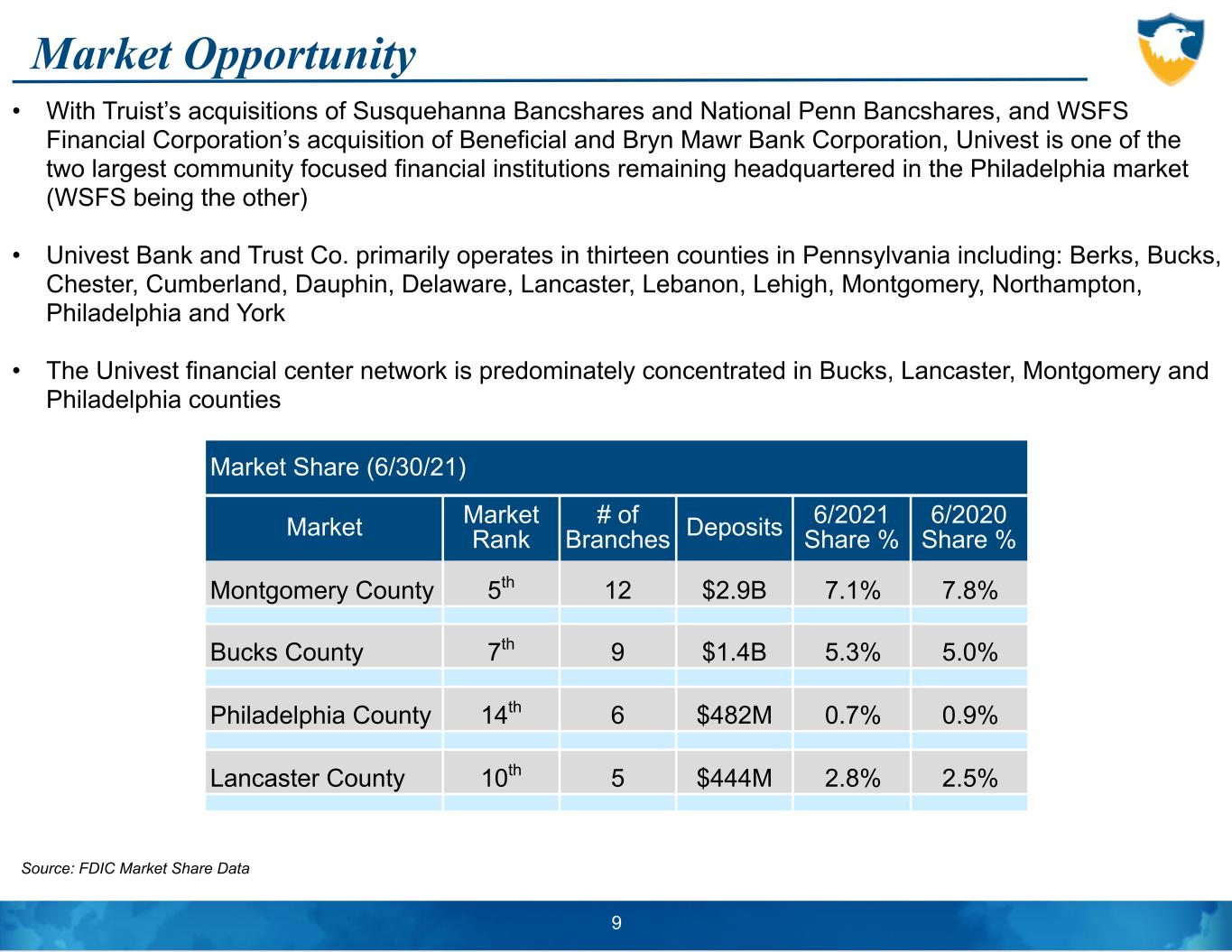

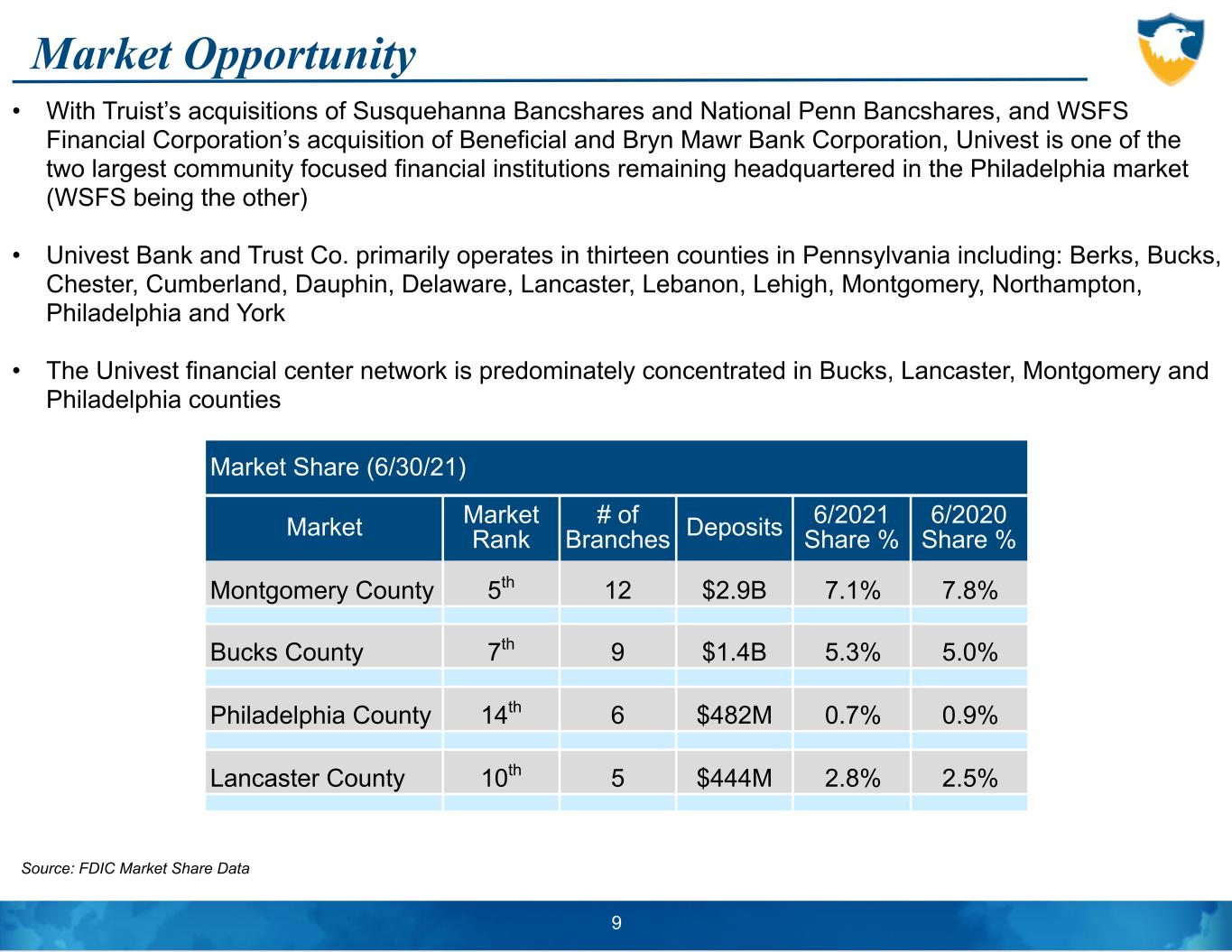

• With Truist’s acquisitions of Susquehanna Bancshares and National Penn Bancshares, and WSFS Financial Corporation’s acquisition of Beneficial and Bryn Mawr Bank Corporation, Univest is one of the two largest community focused financial institutions remaining headquartered in the Philadelphia market (WSFS being the other) • Univest Bank and Trust Co. primarily operates in thirteen counties in Pennsylvania including: Berks, Bucks, Chester, Cumberland, Dauphin, Delaware, Lancaster, Lebanon, Lehigh, Montgomery, Northampton, Philadelphia and York • The Univest financial center network is predominately concentrated in Bucks, Lancaster, Montgomery and Philadelphia counties Market Opportunity Source: FDIC Market Share Data 9 Market Share (6/30/21) Market Market Rank # of Branches Deposits 6/2021 Share % 6/2020 Share % Montgomery County 5th 12 $2.9B 7.1% 7.8% Bucks County 7th 9 $1.4B 5.3% 5.0% Philadelphia County 14th 6 $482M 0.7% 0.9% Lancaster County 10th 5 $444M 2.8% 2.5% Q1 YTD 2022 Results 1.

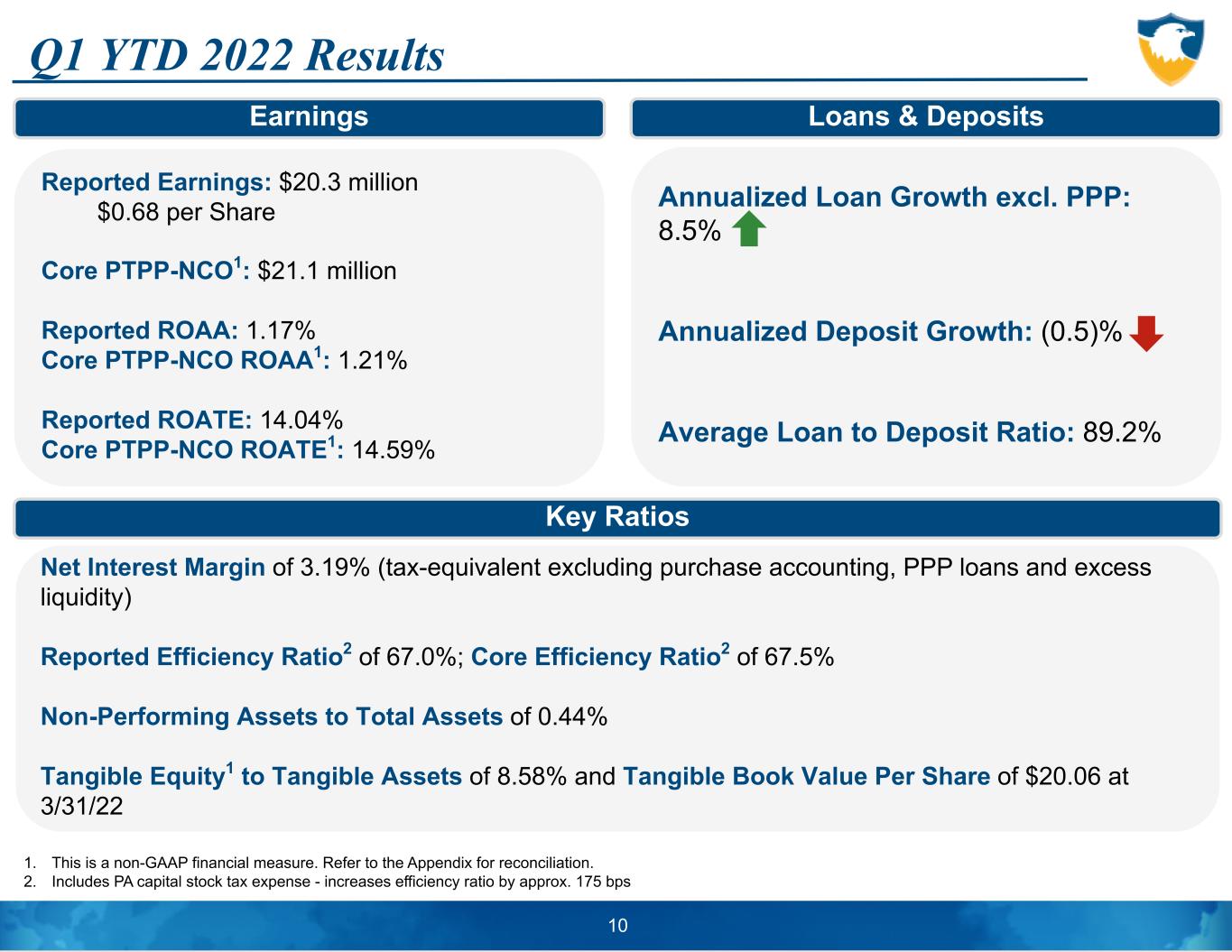

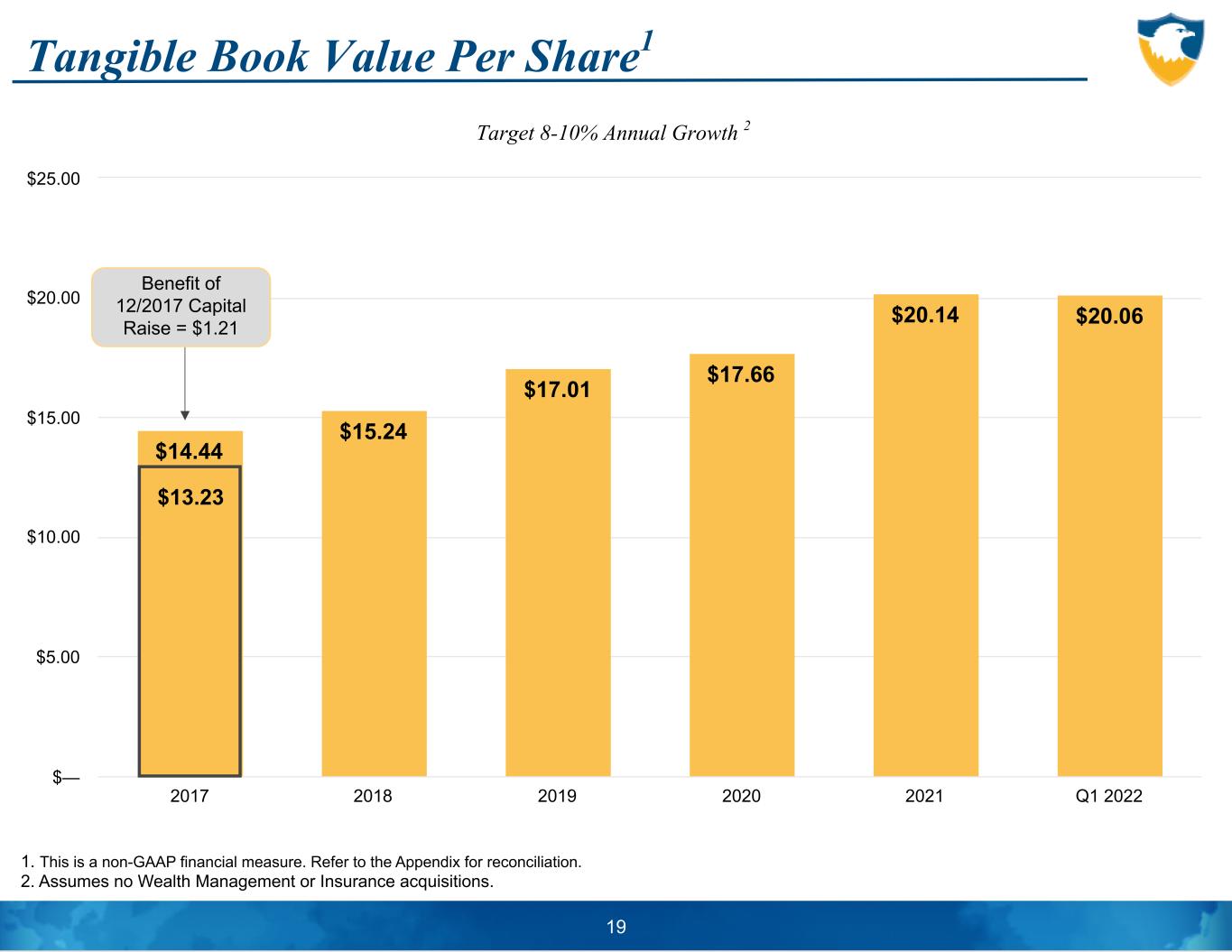

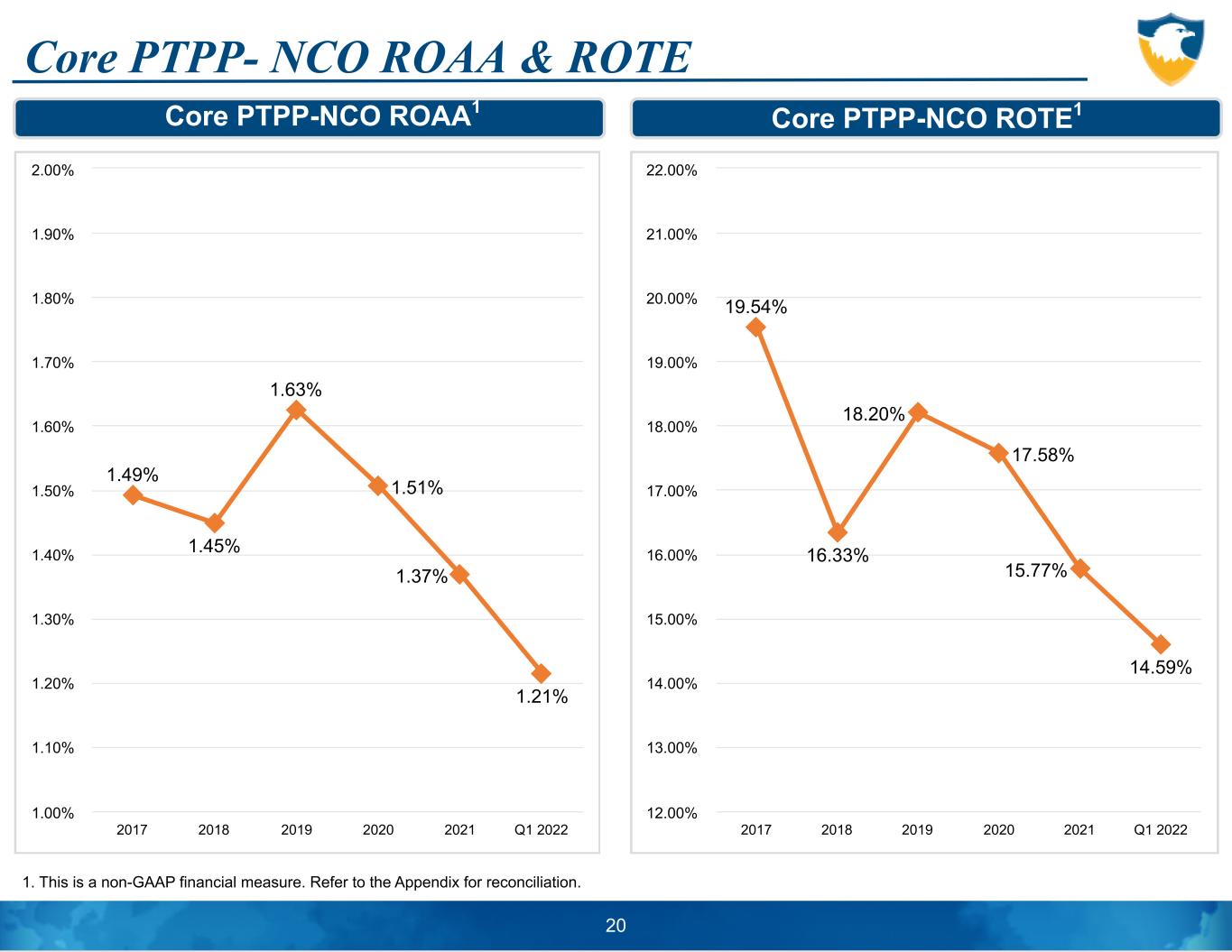

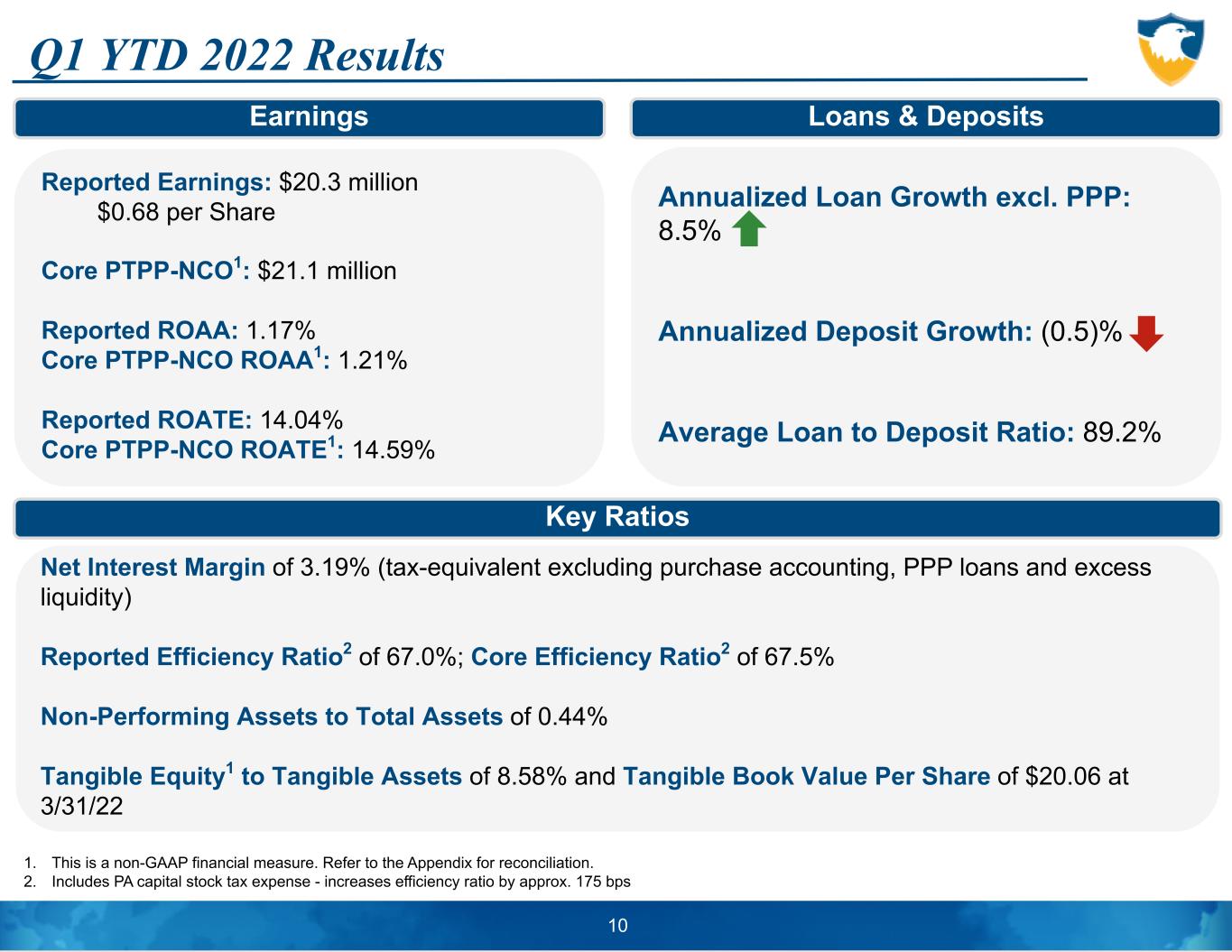

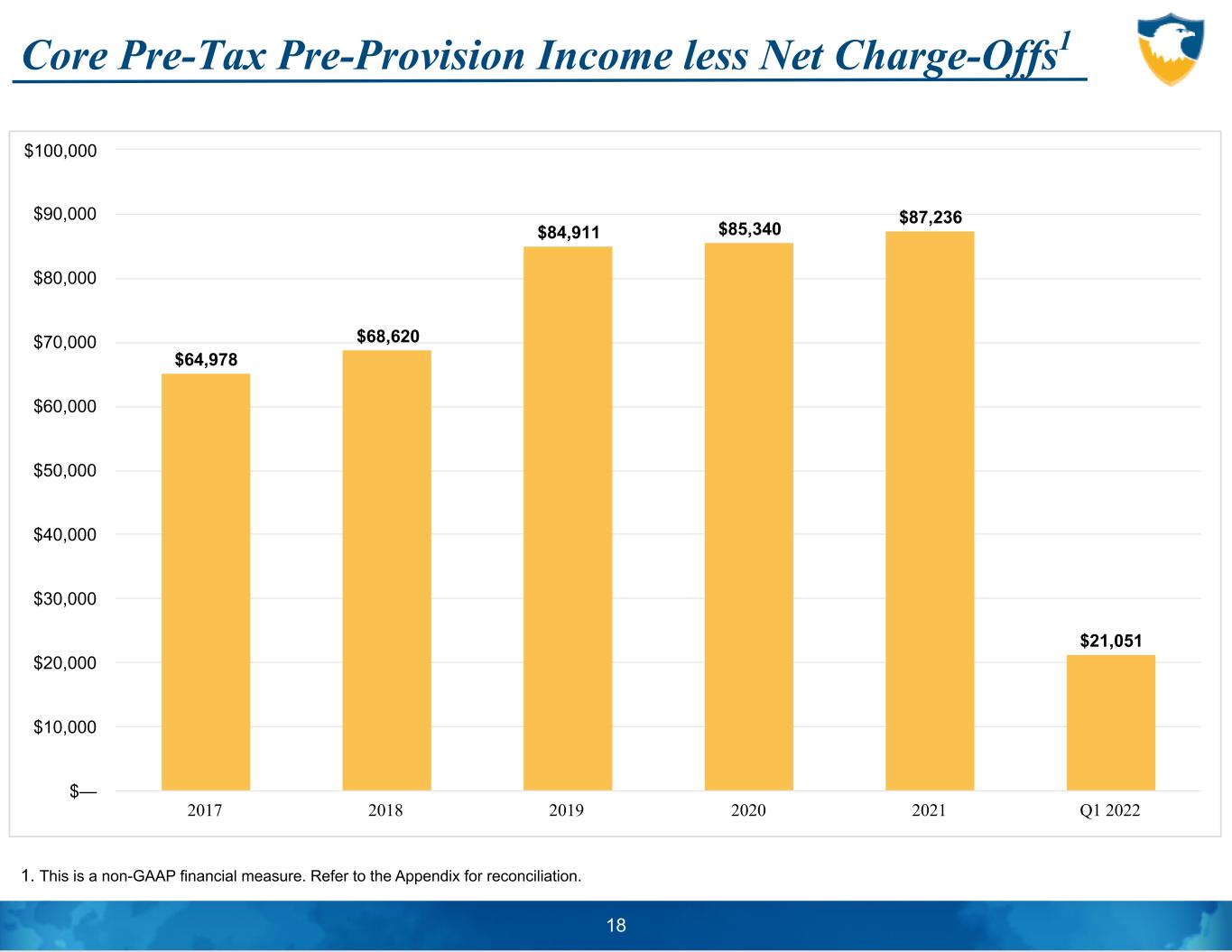

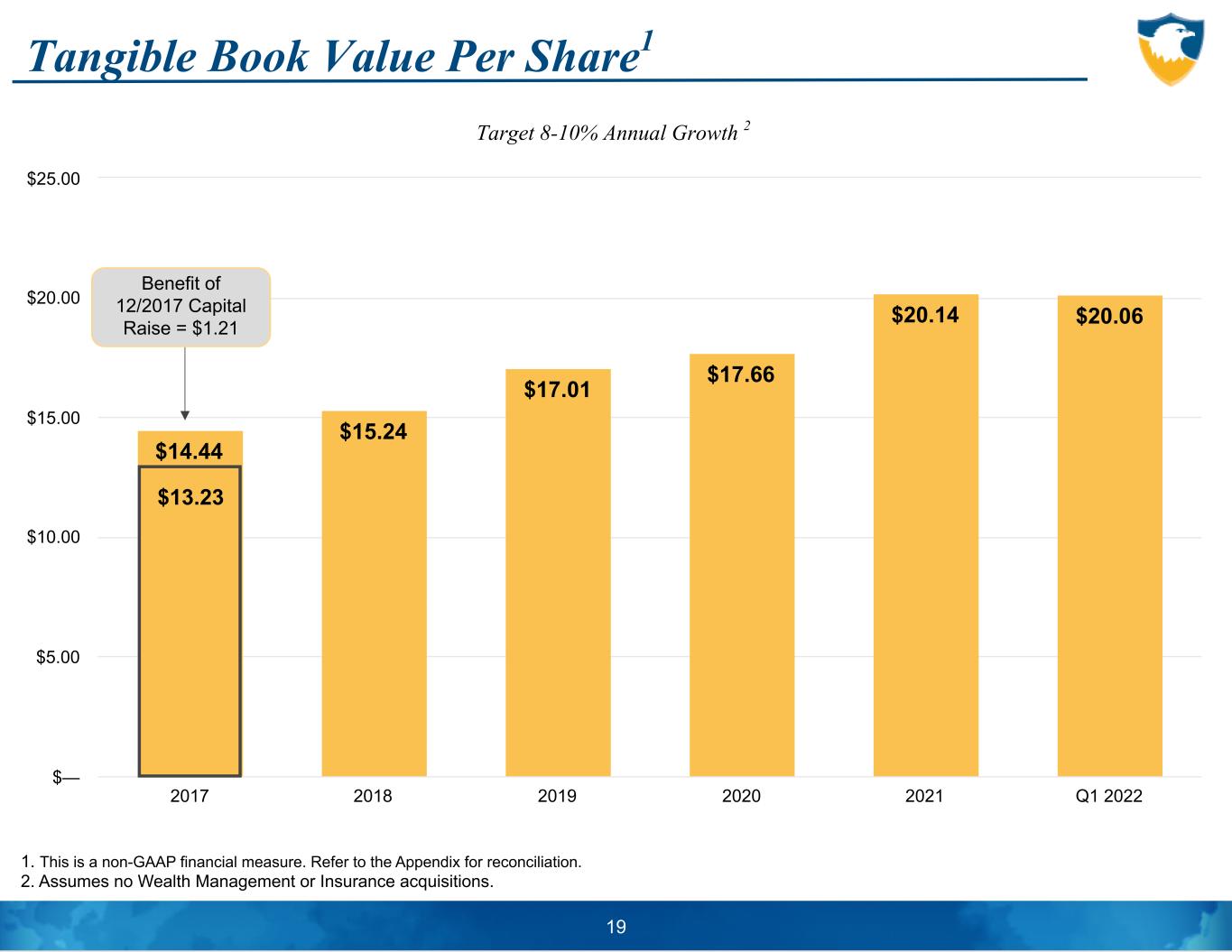

This is a non-GAAP financial measure. Refer to the Appendix for reconciliation. 2. Includes PA capital stock tax expense - increases efficiency ratio by approx. 175 bps 10 Earnings Loans & Deposits Key Ratios Reported Earnings: $20.3 million $0.68 per Share Core PTPP-NCO1: $21.1 million Reported ROAA: 1.17% Core PTPP-NCO ROAA1: 1.21% Reported ROATE: 14.04% Core PTPP-NCO ROATE1: 14.59% Annualized Loan Growth excl. PPP: 8.5% Annualized Deposit Growth: (0.5)% Average Loan to Deposit Ratio: 89.2% Net Interest Margin of 3.19% (tax-equivalent excluding purchase accounting, PPP loans and excess liquidity) Reported Efficiency Ratio2 of 67.0%; Core Efficiency Ratio2 of 67.5% Non-Performing Assets to Total Assets of 0.44% Tangible Equity1 to Tangible Assets of 8.58% and Tangible Book Value Per Share of $20.06 at 3/31/22 Attractive Investment Opportunity 11 1.

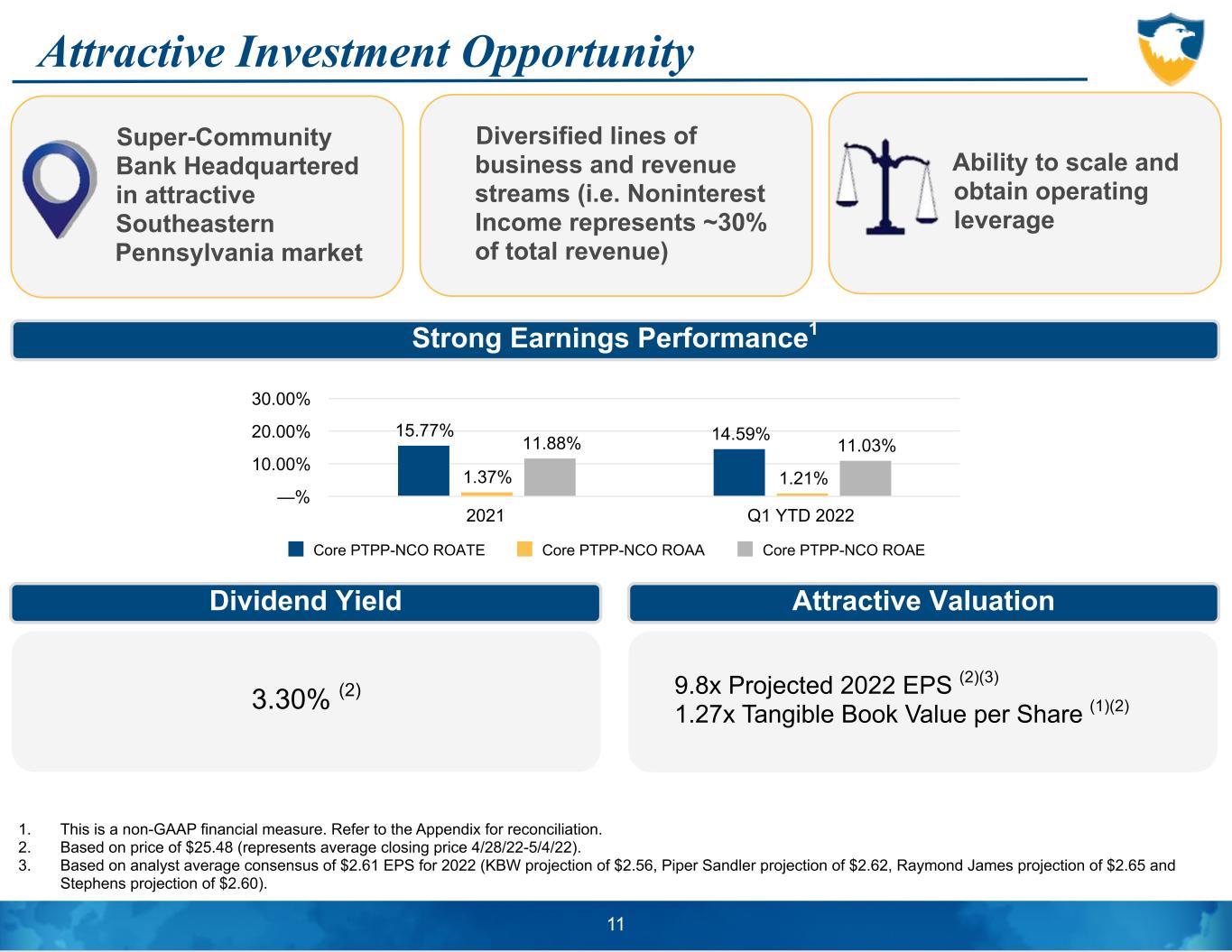

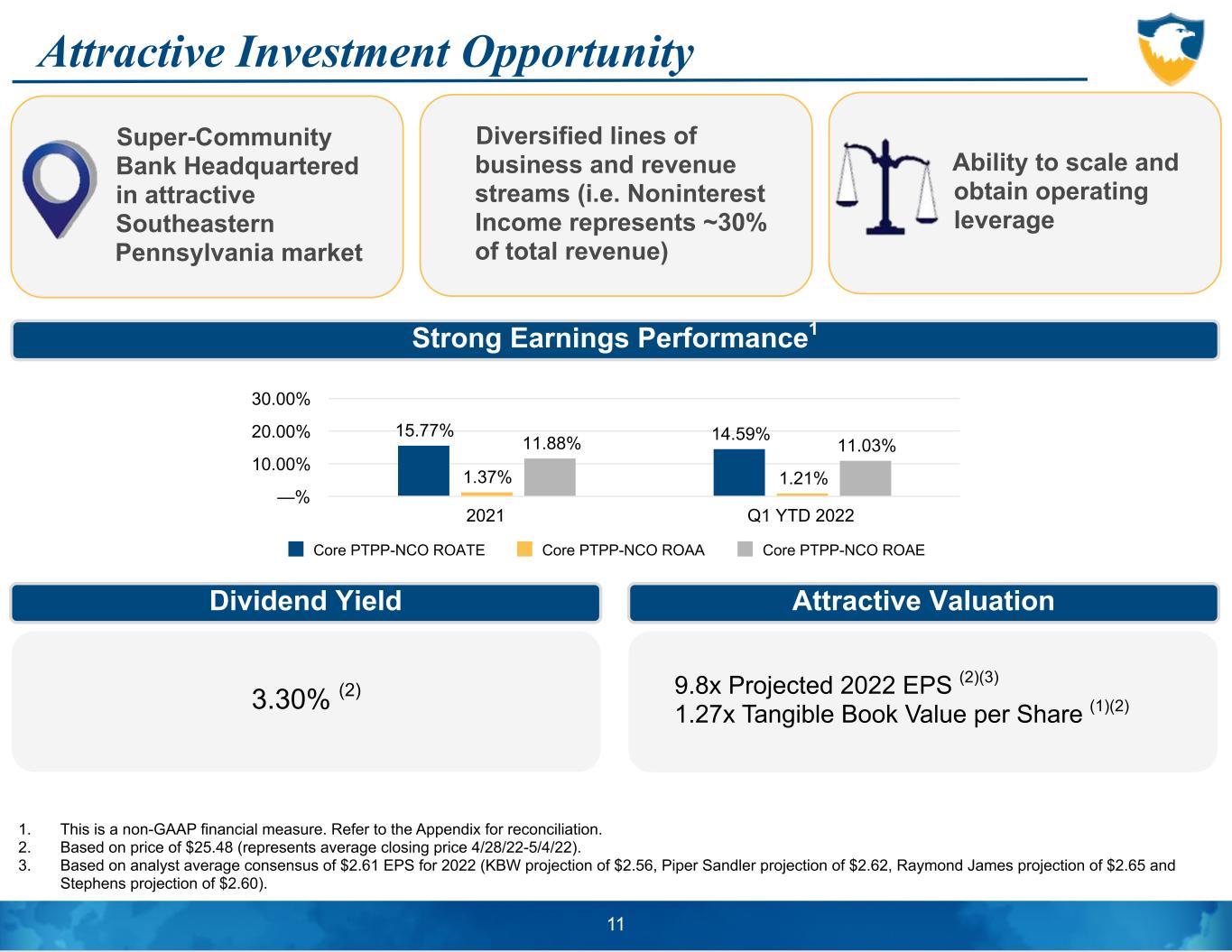

This is a non-GAAP financial measure. Refer to the Appendix for reconciliation. 2. Based on price of $25.48 (represents average closing price 4/28/22-5/4/22). 3. Based on analyst average consensus of $2.61 EPS for 2022 (KBW projection of $2.56, Piper Sandler projection of $2.62, Raymond James projection of $2.65 and Stephens projection of $2.60). 15.77% 14.59% 1.37% 1.21% 11.88% 11.03% Core PTPP-NCO ROATE Core PTPP-NCO ROAA Core PTPP-NCO ROAE 2021 Q1 YTD 2022 —% 10.00% 20.00% 30.00% Strong Earnings Performance1 Dividend Yield 3.30% (2) 9.8x Projected 2022 EPS (2)(3) 1.27x Tangible Book Value per Share (1)(2) Attractive Valuation Super-Community Bank Headquartered in attractive Southeastern Pennsylvania market Ability to scale and obtain operating leverage Diversified lines of business and revenue streams (i.e. Noninterest Income represents ~30% of total revenue)

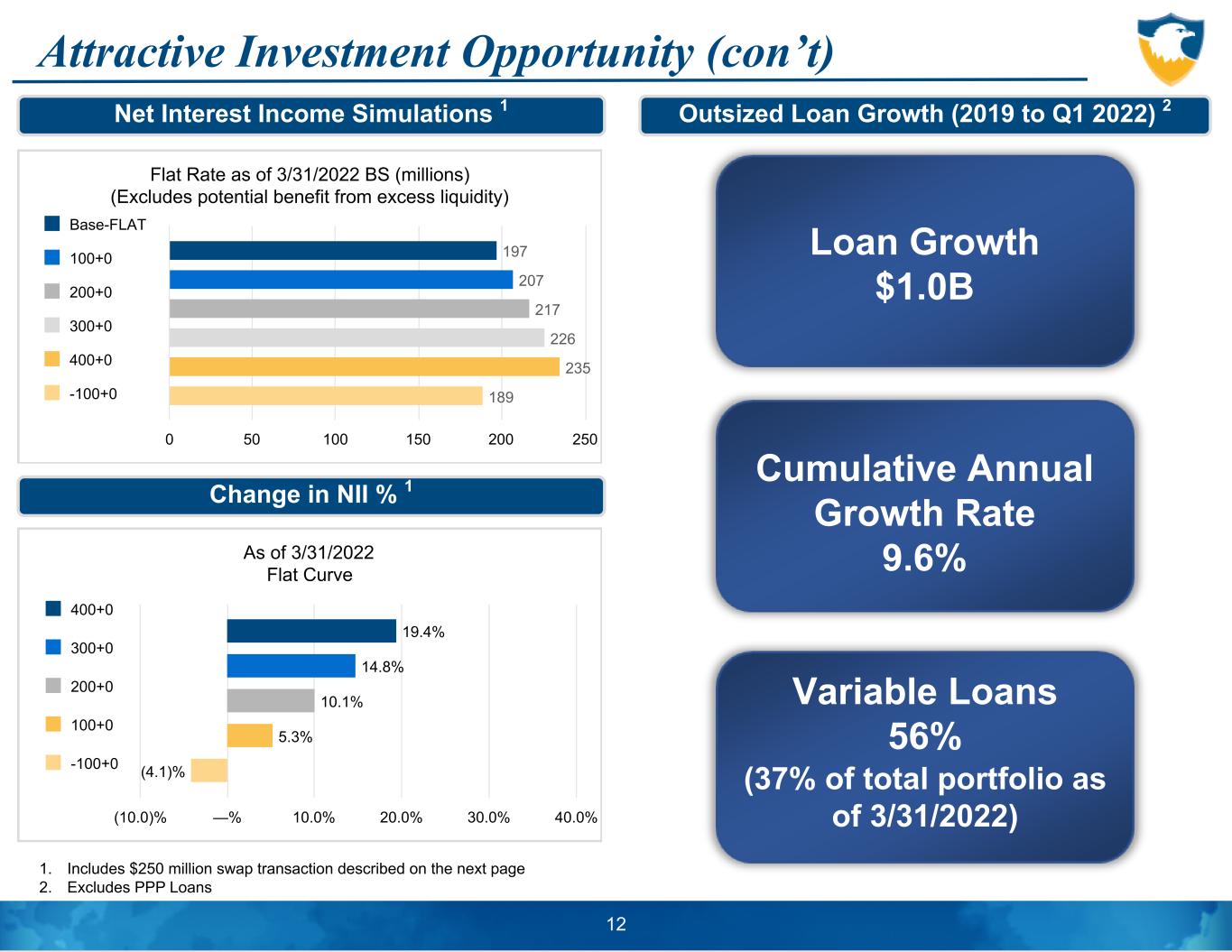

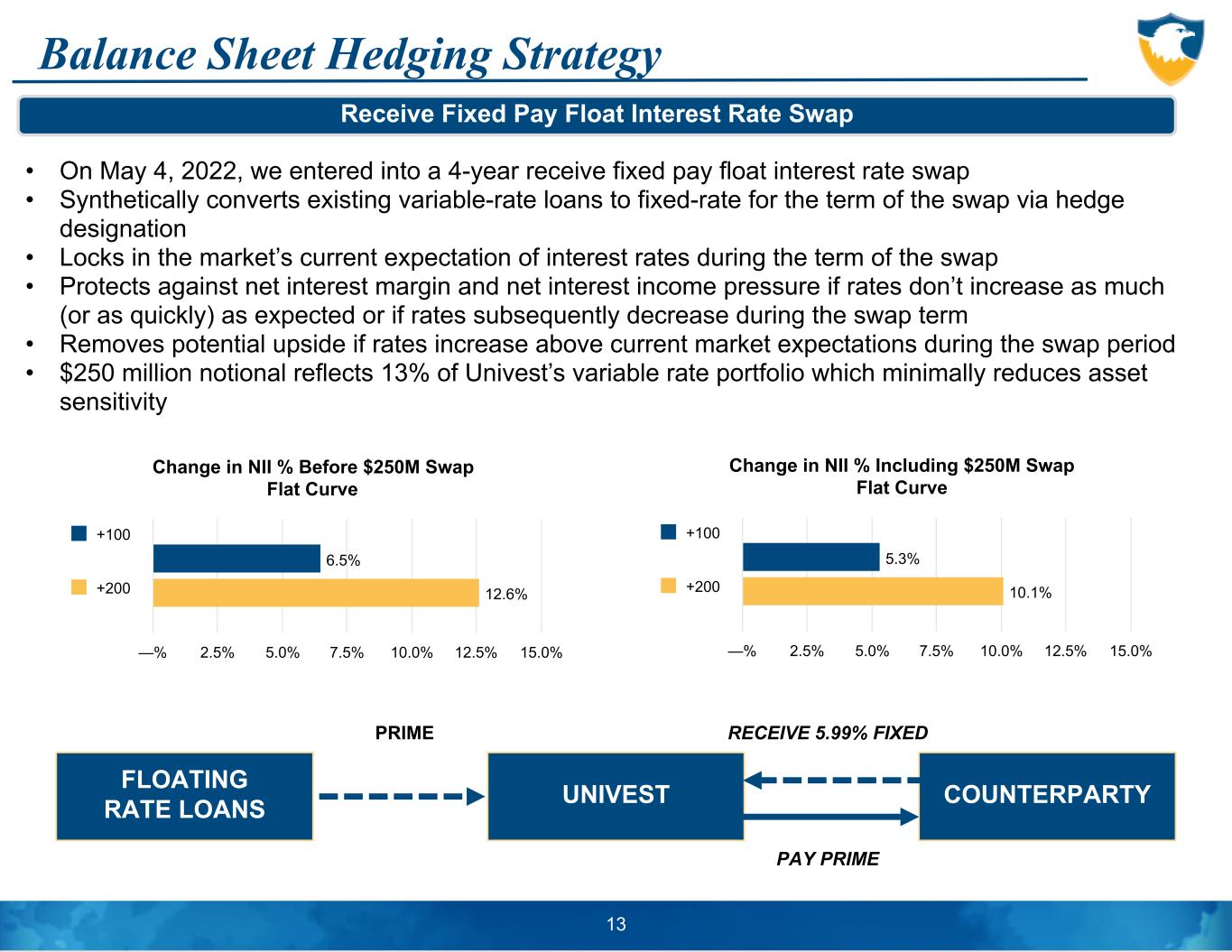

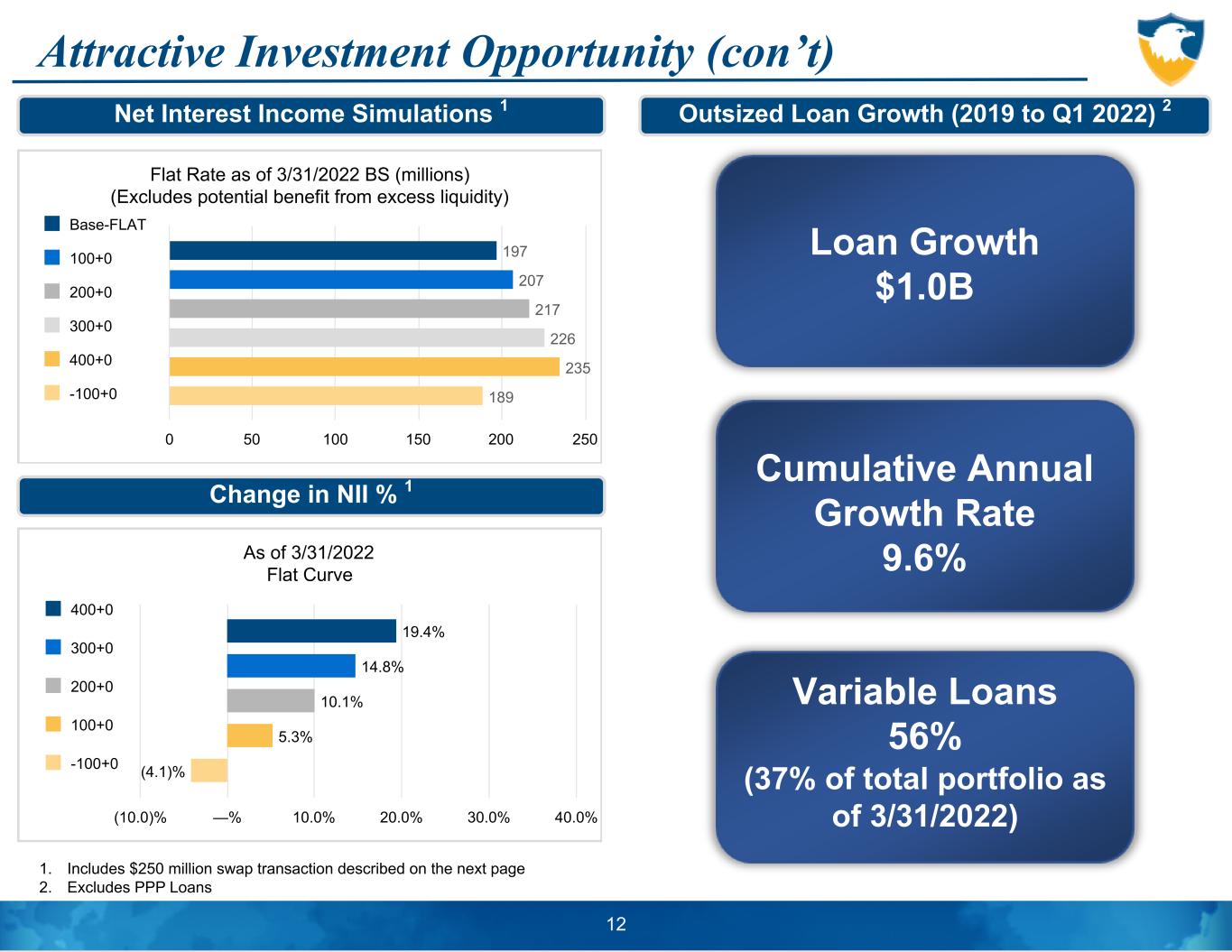

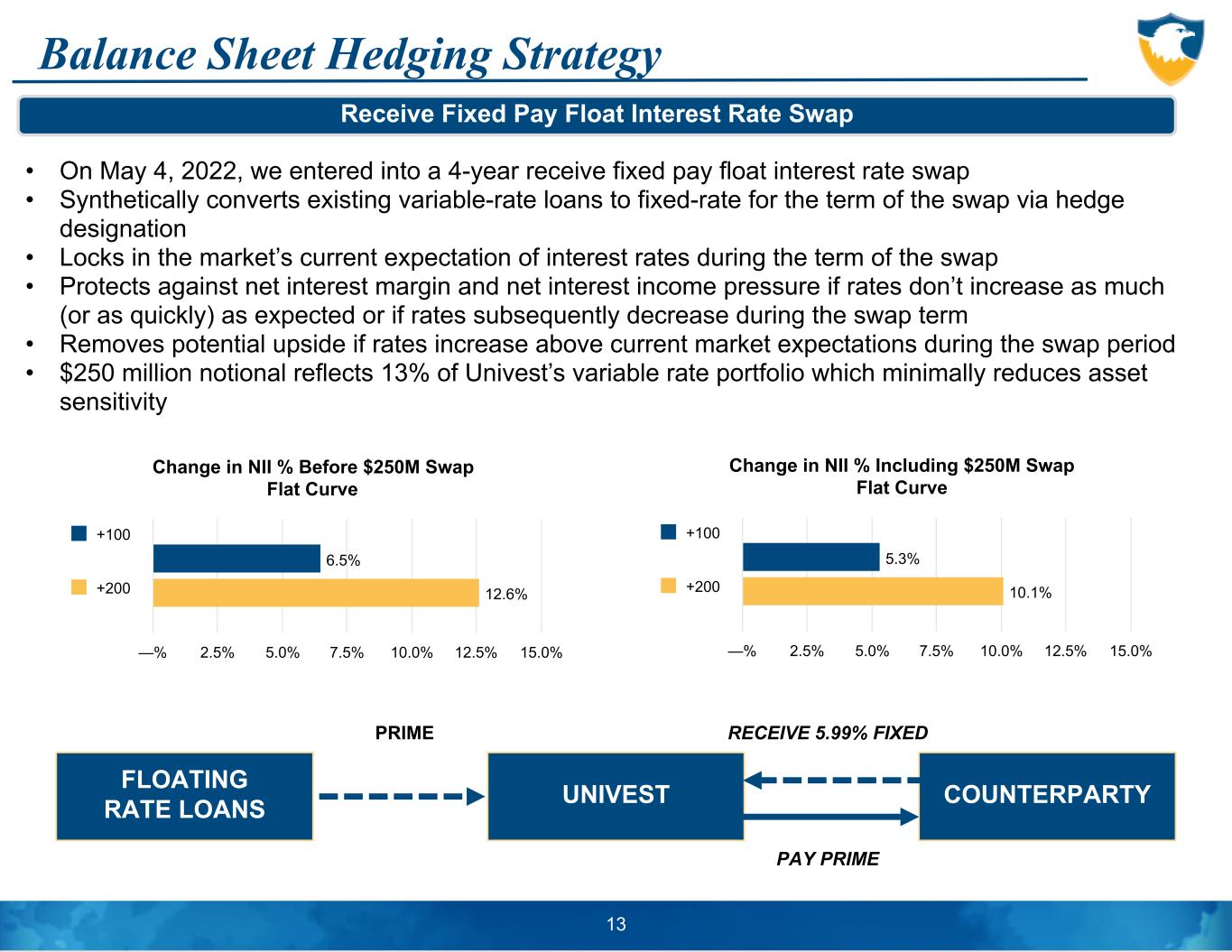

Attractive Investment Opportunity (con’t) 12 Net Interest Income Simulations 1 Flat Rate as of 3/31/2022 BS (millions) (Excludes potential benefit from excess liquidity) 197 207 217 226 235 189 Base-FLAT 100+0 200+0 300+0 400+0 -100+0 0 50 100 150 200 250 As of 3/31/2022 Flat Curve 19.4% 14.8% 10.1% 5.3% (4.1)% 400+0 300+0 200+0 100+0 -100+0 (10.0)% —% 10.0% 20.0% 30.0% 40.0% Change in NII % 1 Loan Growth $1.0B Cumulative Annual Growth Rate 9.6% Variable Loans 56% (37% of total portfolio as of 3/31/2022) Outsized Loan Growth (2019 to Q1 2022) 2 1. Includes $250 million swap transaction described on the next page 2. Excludes PPP Loans Balance Sheet Hedging Strategy 13 Receive Fixed Pay Float Interest Rate Swap • On May 4, 2022, we entered into a 4-year receive fixed pay float interest rate swap • Synthetically converts existing variable-rate loans to fixed-rate for the term of the swap via hedge designation • Locks in the market’s current expectation of interest rates during the term of the swap • Protects against net interest margin and net interest income pressure if rates don’t increase as much (or as quickly) as expected or if rates subsequently decrease during the swap term • Removes potential upside if rates increase above current market expectations during the swap period • $250 million notional reflects 13% of Univest’s variable rate portfolio which minimally reduces asset sensitivity FLOATING RATE LOANS UNIVEST COUNTERPARTY PRIME RECEIVE 5.99% FIXED PAY PRIME Change in NII % Including $250M Swap Flat Curve 5.3% 10.1% +100 +200 —% 2.5% 5.0% 7.5% 10.0% 12.5% 15.0% Change in NII % Before $250M Swap Flat Curve 6.5% 12.6% +100 +200 —% 2.5% 5.0% 7.5% 10.0% 12.5% 15.0%

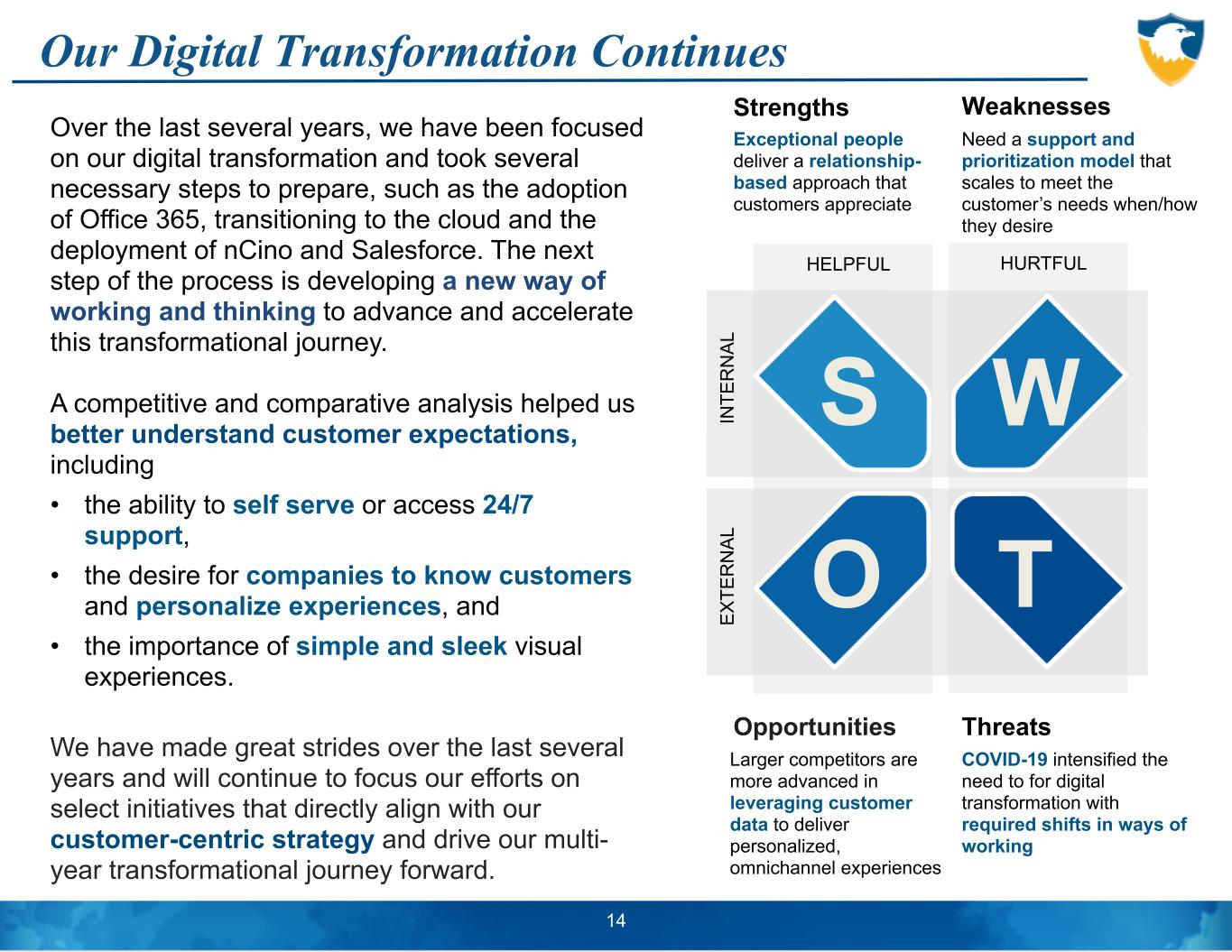

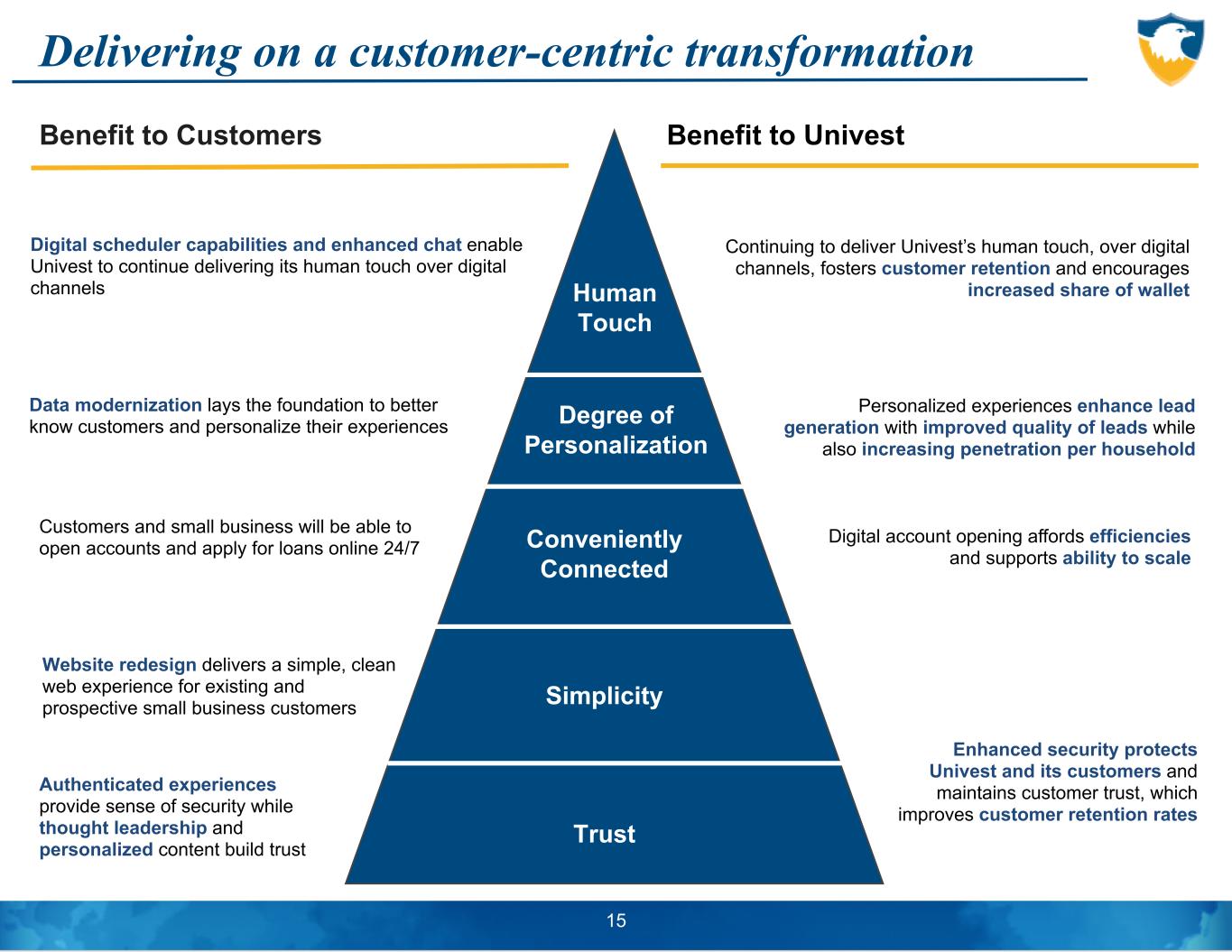

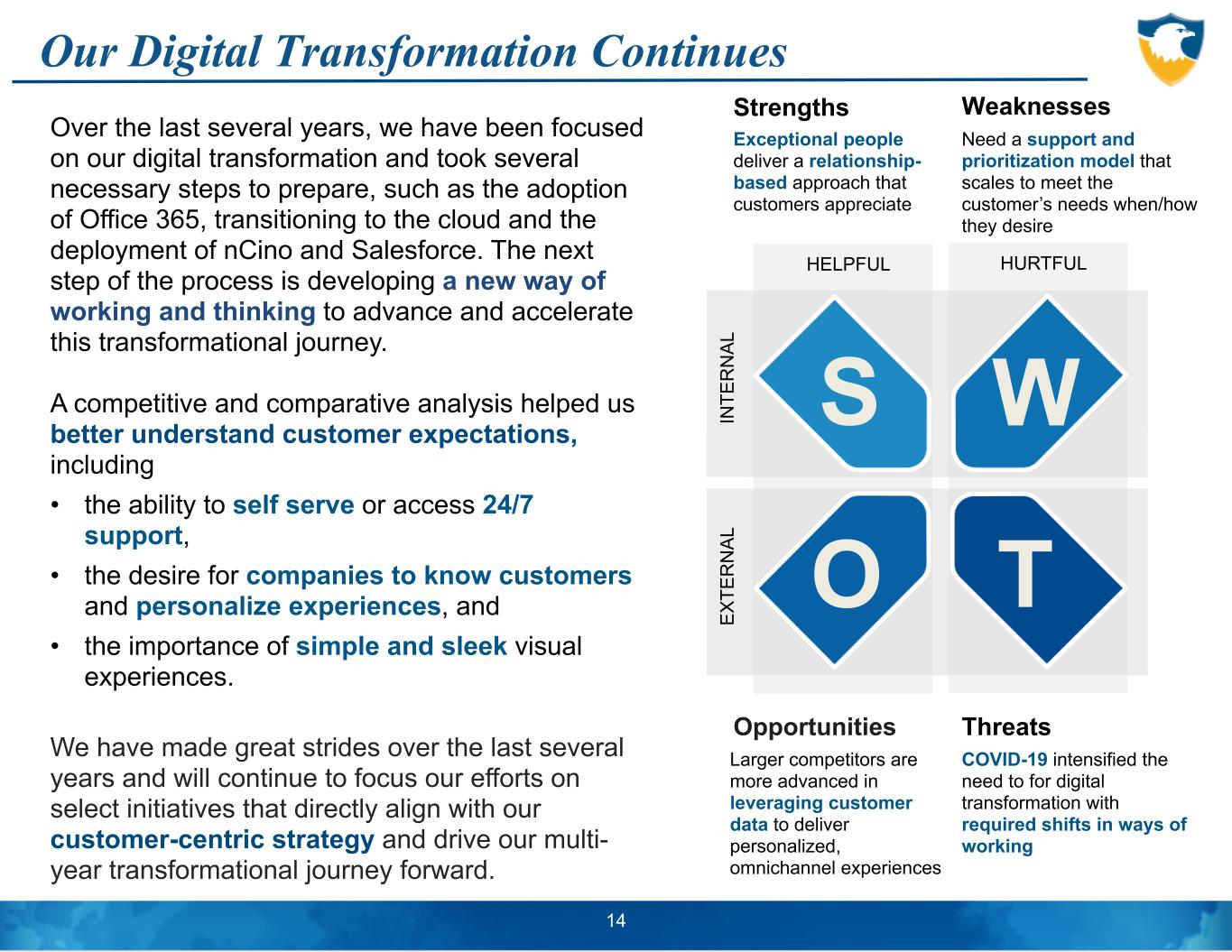

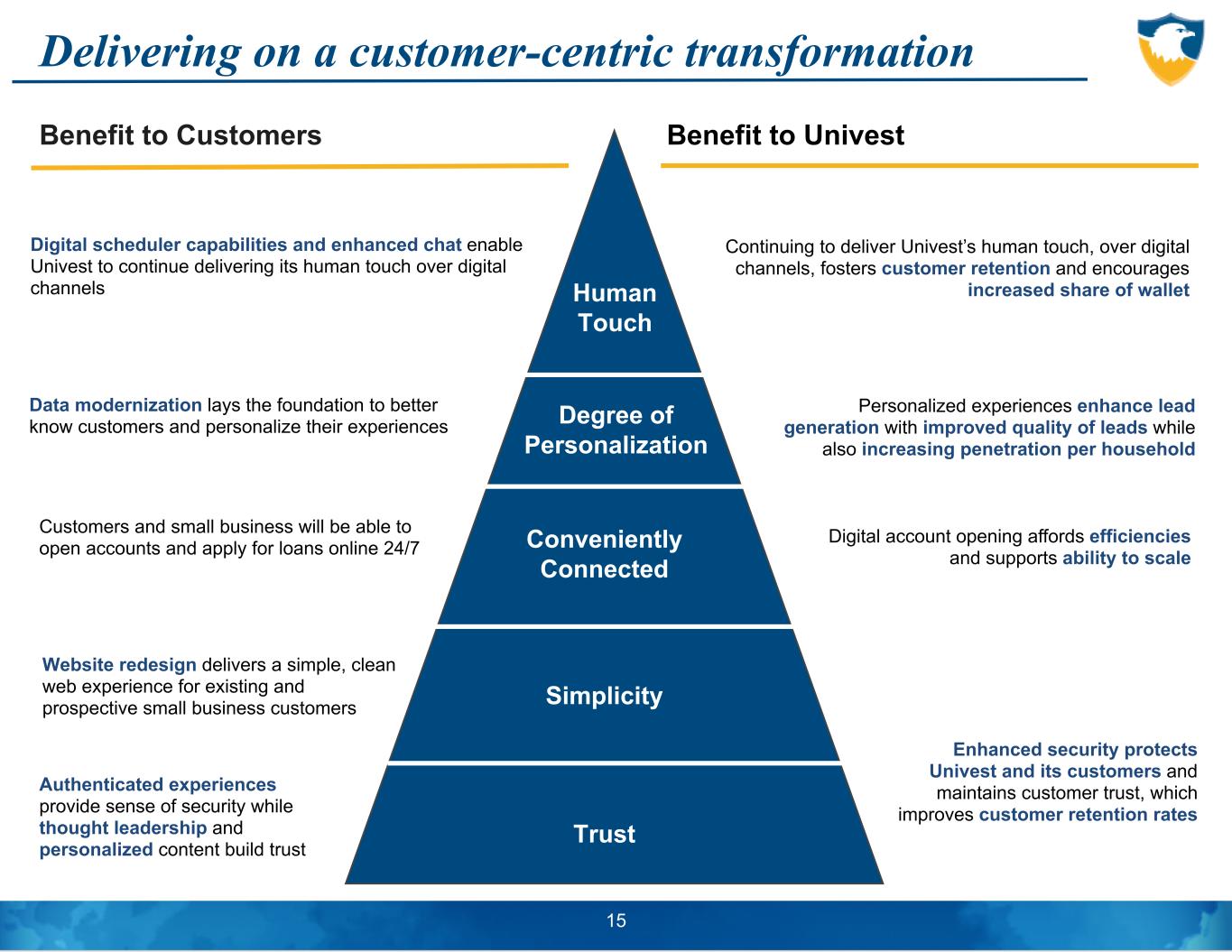

Our Digital Transformation Continues 14 Exceptional people deliver a relationship- based approach that customers appreciate Strengths Larger competitors are more advanced in leveraging customer data to deliver personalized, omnichannel experiences Need a support and prioritization model that scales to meet the customer’s needs when/how they desire Weaknesses COVID-19 intensified the need to for digital transformation with required shifts in ways of working Threats Over the last several years, we have been focused on our digital transformation and took several necessary steps to prepare, such as the adoption of Office 365, transitioning to the cloud and the deployment of nCino and Salesforce. The next step of the process is developing a new way of working and thinking to advance and accelerate this transformational journey. A competitive and comparative analysis helped us better understand customer expectations, including • the ability to self serve or access 24/7 support, • the desire for companies to know customers and personalize experiences, and • the importance of simple and sleek visual experiences. We have made great strides over the last several years and will continue to focus our efforts on select initiatives that directly align with our customer-centric strategy and drive our multi- year transformational journey forward. Opportunities HURTFULHELPFUL IN TE R N A L E X TE R N A L S W O T Delivering on a customer-centric transformation 15 Data modernization lays the foundation to better know customers and personalize their experiences Benefit to Customers Benefit to Univest Digital scheduler capabilities and enhanced chat enable Univest to continue delivering its human touch over digital channels Customers and small business will be able to open accounts and apply for loans online 24/7 Website redesign delivers a simple, clean web experience for existing and prospective small business customers Authenticated experiences provide sense of security while thought leadership and personalized content build trust Personalized experiences enhance lead generation with improved quality of leads while also increasing penetration per household Digital account opening affords efficiencies and supports ability to scale Enhanced security protects Univest and its customers and maintains customer trust, which improves customer retention rates Continuing to deliver Univest’s human touch, over digital channels, fosters customer retention and encourages increased share of walletHuman Touch Degree of Personalization Conveniently Connected Simplicity Trust

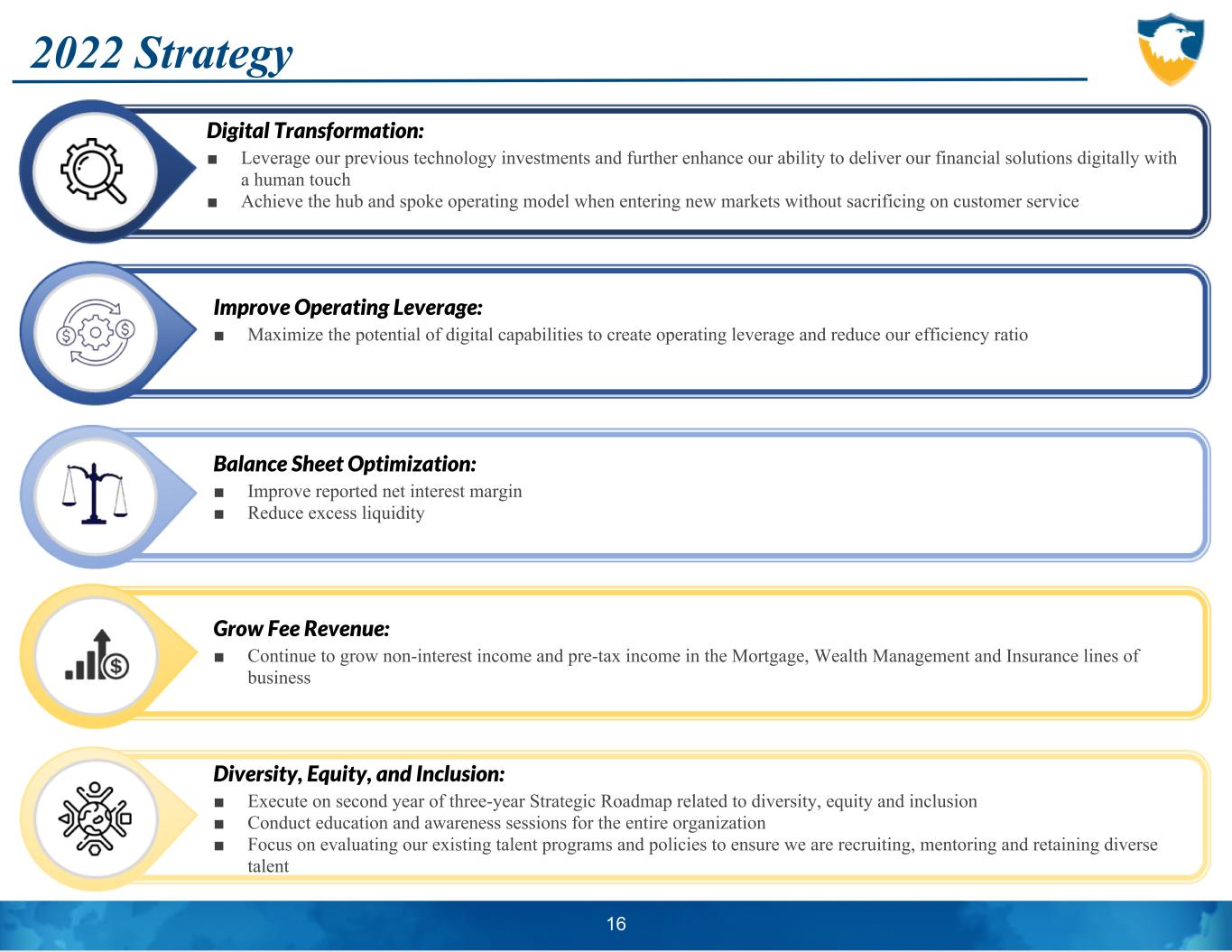

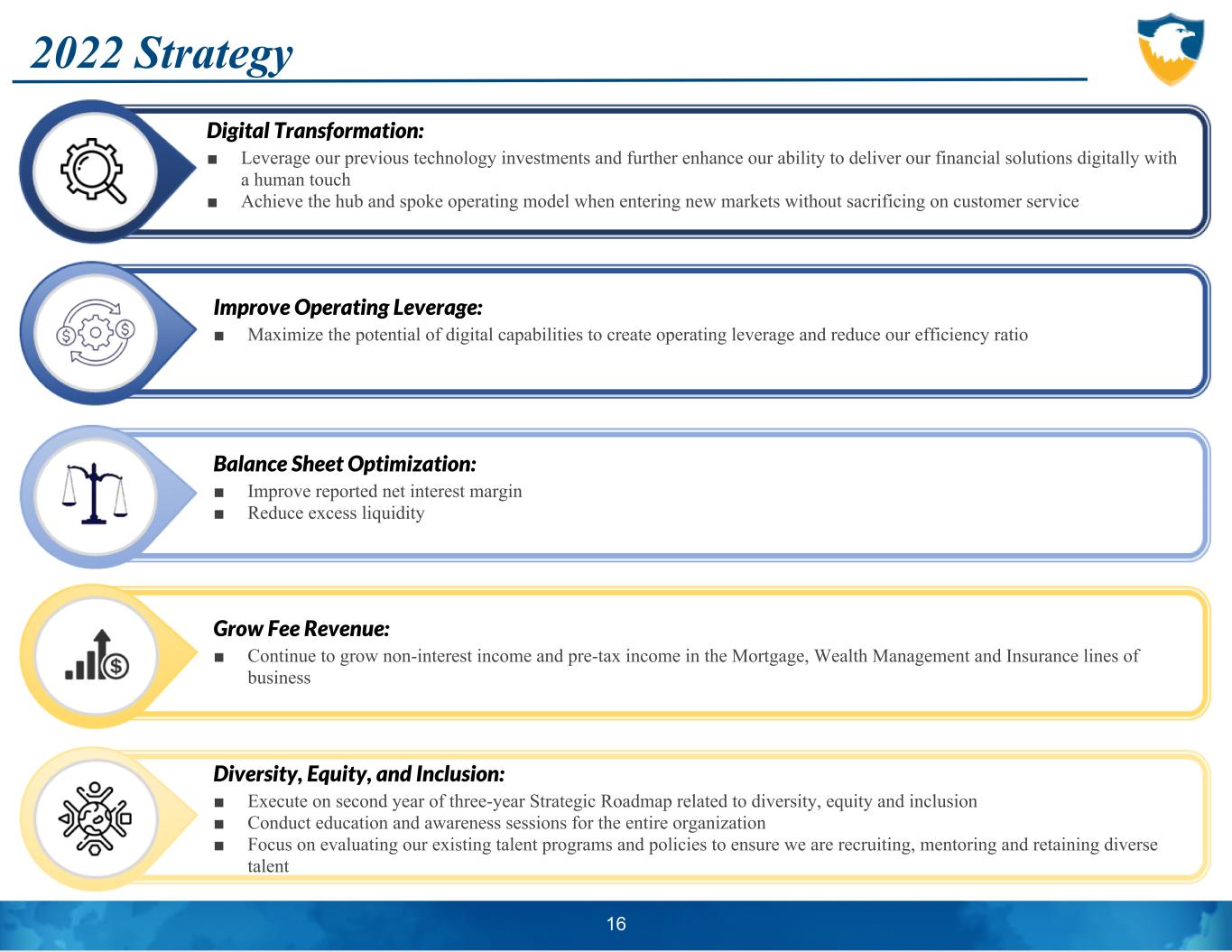

2022 Strategy 16 Grow Fee Revenue: ■ Continue to grow non-interest income and pre-tax income in the Mortgage, Wealth Management and Insurance lines of business Improve Operating Leverage: ■ Maximize the potential of digital capabilities to create operating leverage and reduce our efficiency ratio Balance Sheet Optimization: ■ Improve reported net interest margin ■ Reduce excess liquidity Digital Transformation: ■ Leverage our previous technology investments and further enhance our ability to deliver our financial solutions digitally with a human touch ■ Achieve the hub and spoke operating model when entering new markets without sacrificing on customer service Diversity, Equity, and Inclusion: ■ Execute on second year of three-year Strategic Roadmap related to diversity, equity and inclusion ■ Conduct education and awareness sessions for the entire organization ■ Focus on evaluating our existing talent programs and policies to ensure we are recruiting, mentoring and retaining diverse talent $64,978 $68,620 $84,911 $85,340 $87,236 $21,051 2017 2018 2019 2020 2021 Q1 2022 $— $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 Core Pre-Tax Pre-Provision Income less Net Charge-Offs1 1.

SUMMARY FINANCIAL HIGHLIGHTS

This is a non-GAAP financial measure. Refer to the Appendix for reconciliation. 18 $14.44 $15.24 $17.01 $17.66 $20.14 $20.06 2017 2018 2019 2020 2021 Q1 2022 $— $5.00 $10.00 $15.00 $20.00 $25.00 Tangible Book Value Per Share1 1.

This is a non-GAAP financial measure. Refer to the Appendix for reconciliation. 2. Assumes no Wealth Management or Insurance acquisitions. Target 8-10% Annual Growth 2 19 $13.23 Benefit of 12/2017 Capital Raise = $1.21 Core PTPP- NCO ROAA & ROTE 1.

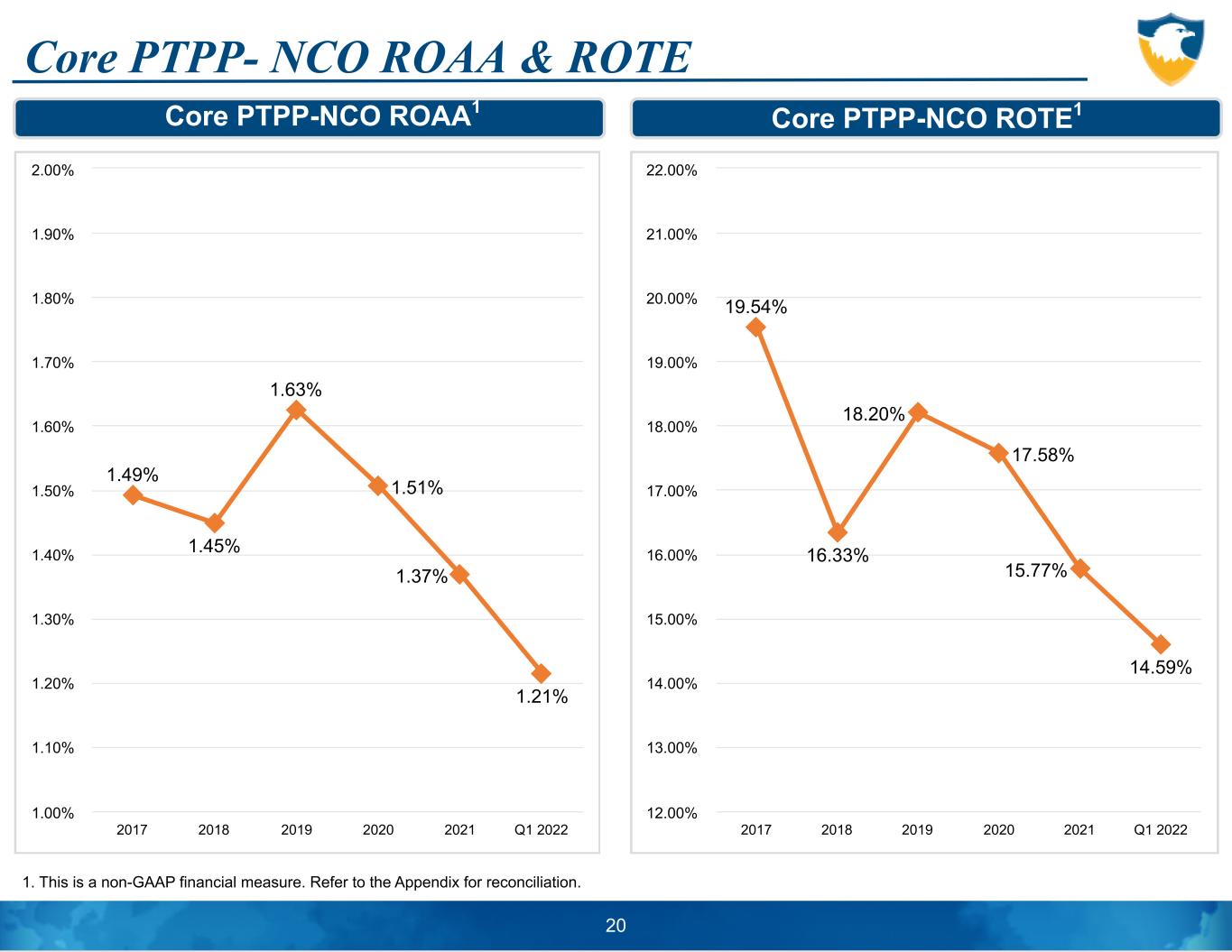

This is a non-GAAP financial measure. Refer to the Appendix for reconciliation. 1.49% 1.45% 1.63% 1.51% 1.37% 1.21% 2017 2018 2019 2020 2021 Q1 2022 1.00% 1.10% 1.20% 1.30% 1.40% 1.50% 1.60% 1.70% 1.80% 1.90% 2.00% 19.54% 16.33% 18.20% 17.58% 15.77% 14.59% 2017 2018 2019 2020 2021 Q1 2022 12.00% 13.00% 14.00% 15.00% 16.00% 17.00% 18.00% 19.00% 20.00% 21.00% 22.00% 20 Core PTPP-NCO ROAA1 Core PTPP-NCO ROTE1 Net Interest Income (Asset Sensitive) 1.

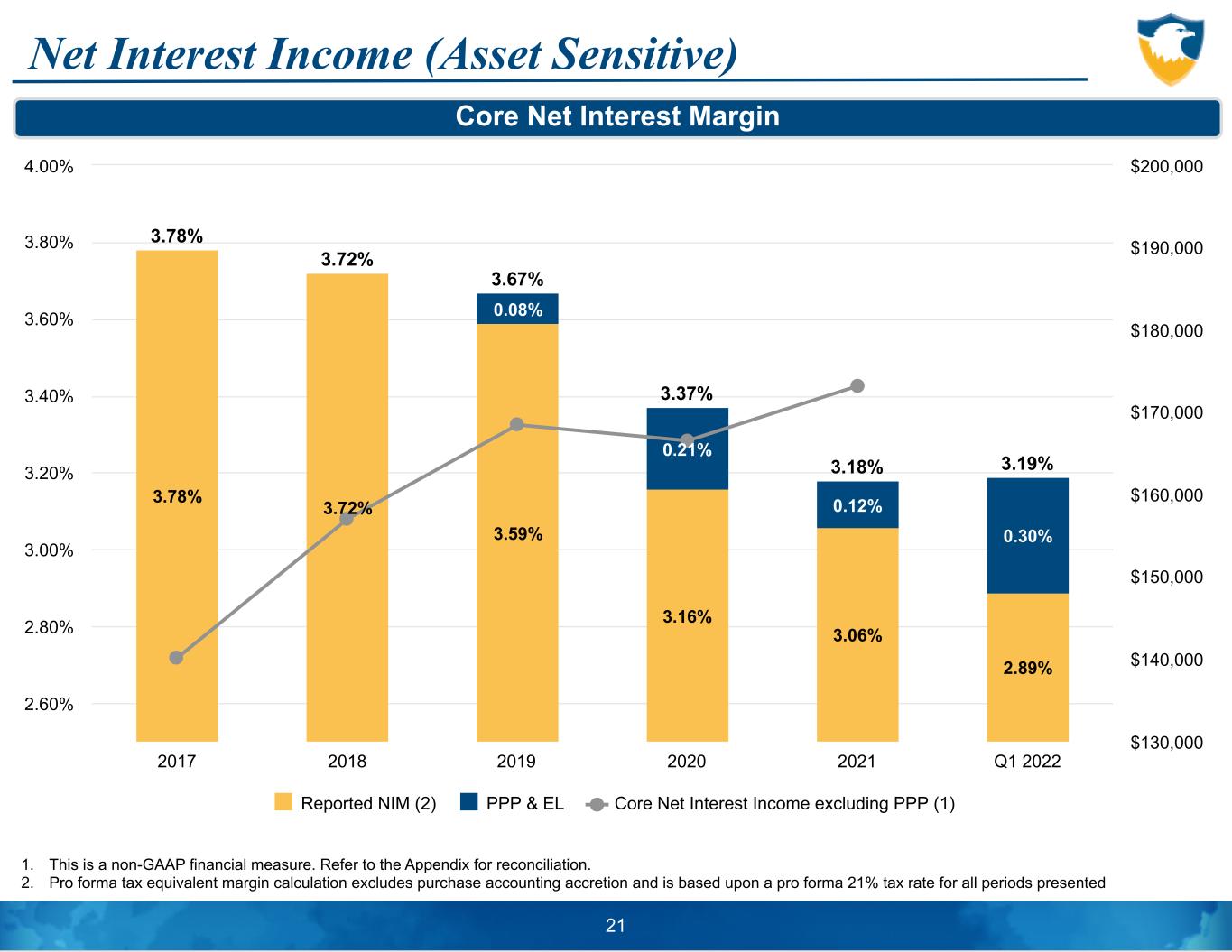

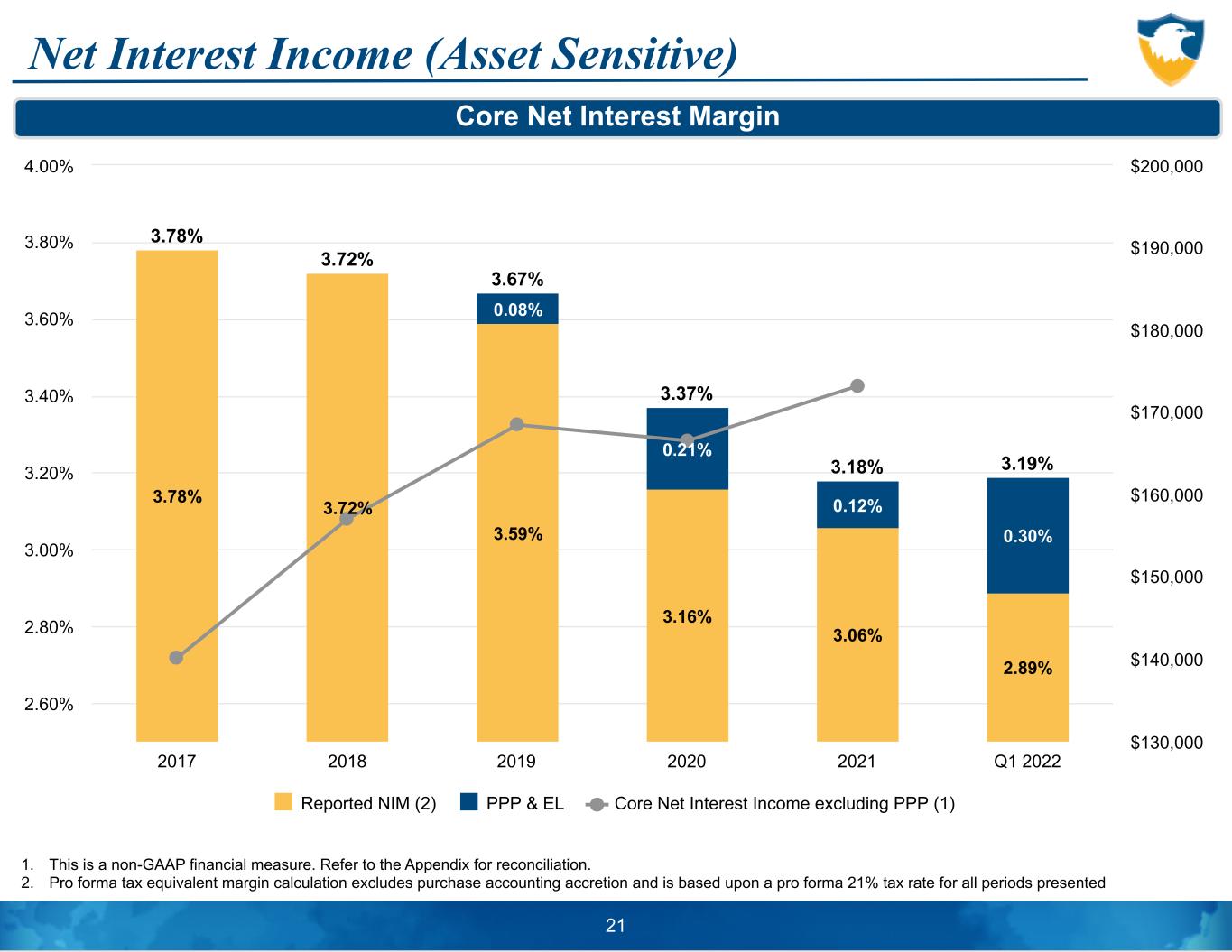

This is a non-GAAP financial measure. Refer to the Appendix for reconciliation. 2. Pro forma tax equivalent margin calculation excludes purchase accounting accretion and is based upon a pro forma 21% tax rate for all periods presented 21 3.78% 3.72% 3.67% 3.37% 3.18% 3.19% 3.78% 3.72% 3.59% 3.16% 3.06% 2.89% 0.08% 0.21% 0.12% 0.30% Reported NIM (2) PPP & EL Core Net Interest Income excluding PPP (1) 2017 2018 2019 2020 2021 Q1 2022 2.60% 2.80% 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% $130,000 $140,000 $150,000 $160,000 $170,000 $180,000 $190,000 $200,000 Core Net Interest Margin 64.6% 62.9% 62.3% 61.3% 61.6% 67.6% 62.5% 61.9% 61.4% 60.6% 60.9% 67.0% 62.5% 61.8% 61.8% 62.4% 65.0% 67.5% 60.8% 60.1% 60.2% 60.7% 63.2% 65.8% Financial Statement Efficiency Ratio (Noninterest Expense/Total Revenue As Reported) Reported Efficiency Ratio (Noninterest Expense/Tax Equivalent Revenue) Core Tax Adjusted Efficiency Ratio (Core Noninterest Expense/Core Tax Equivalent Revenue) (1),(2) Efficiency Ratio (Core Noninterest Expense Excluding PA Shares Tax/Core Tax Equivalent Revenue) (1),(2) 2017 2018 2019 2020 2021 Q1 2022 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% Efficiency Ratio 1.

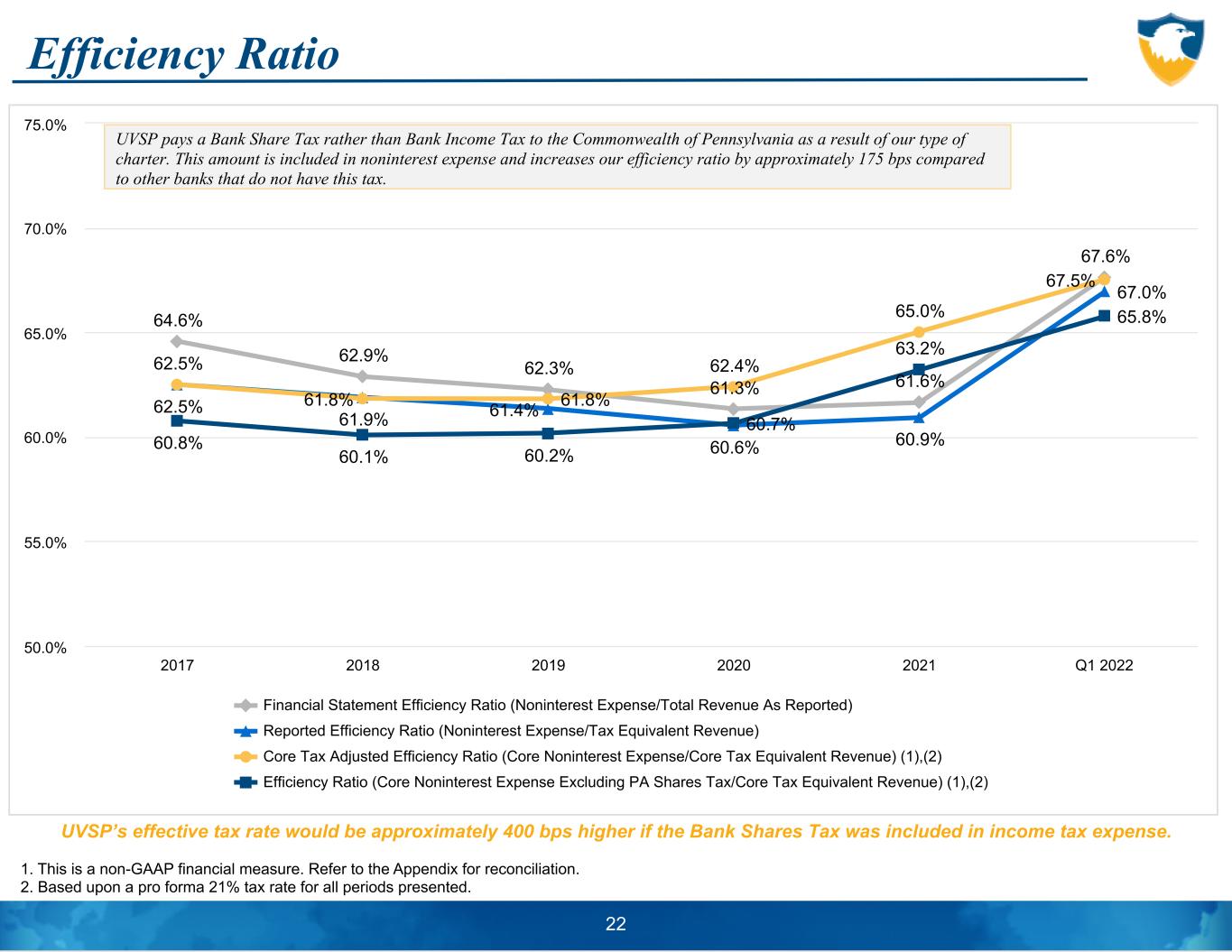

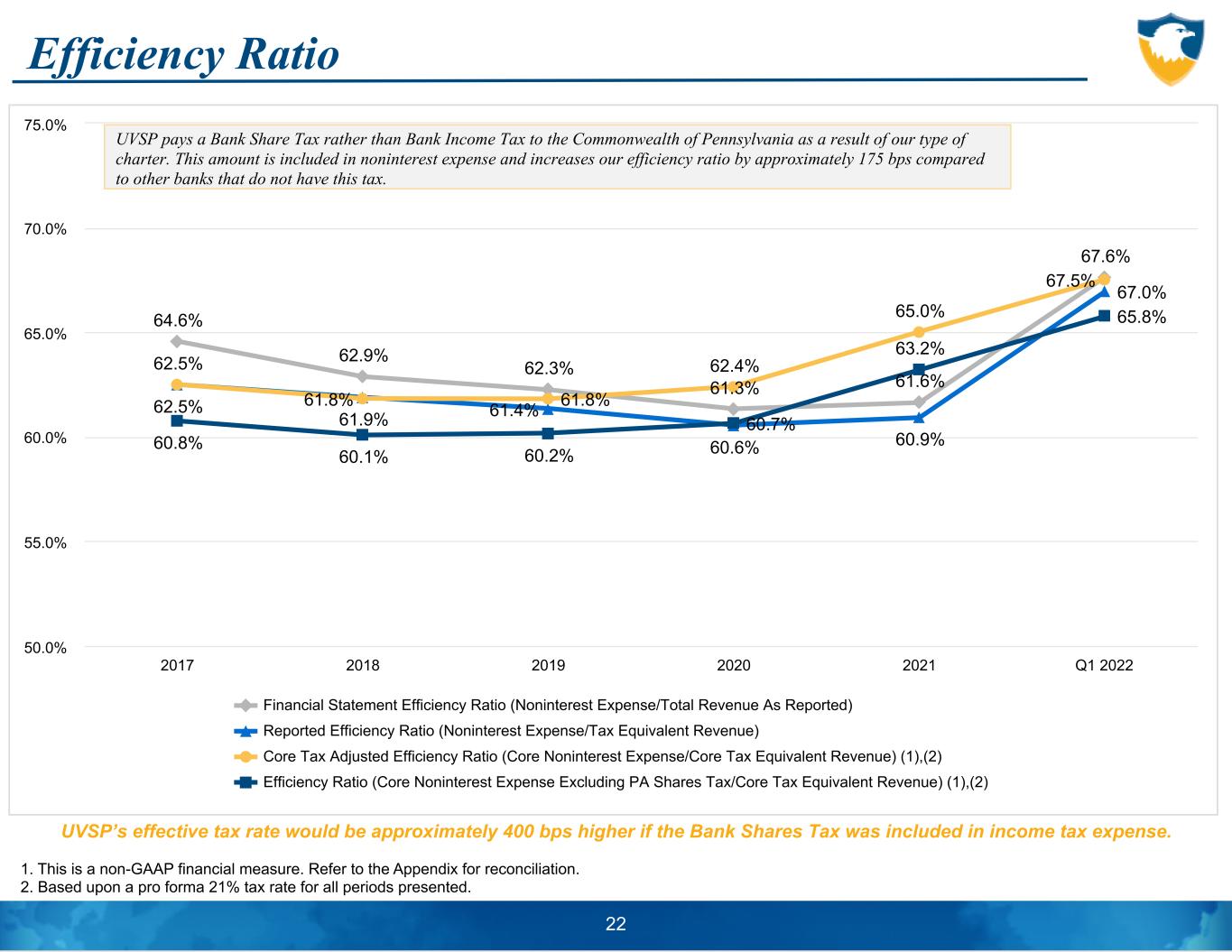

This is a non-GAAP financial measure. Refer to the Appendix for reconciliation. 2. Based upon a pro forma 21% tax rate for all periods presented. UVSP’s effective tax rate would be approximately 400 bps higher if the Bank Shares Tax was included in income tax expense. 22 UVSP pays a Bank Share Tax rather than Bank Income Tax to the Commonwealth of Pennsylvania as a result of our type of charter. This amount is included in noninterest expense and increases our efficiency ratio by approximately 175 bps compared to other banks that do not have this tax. UVSP’s effective tax rate would be approximately 400 bps higher if the Bank Shares Tax was included in income tax expense.

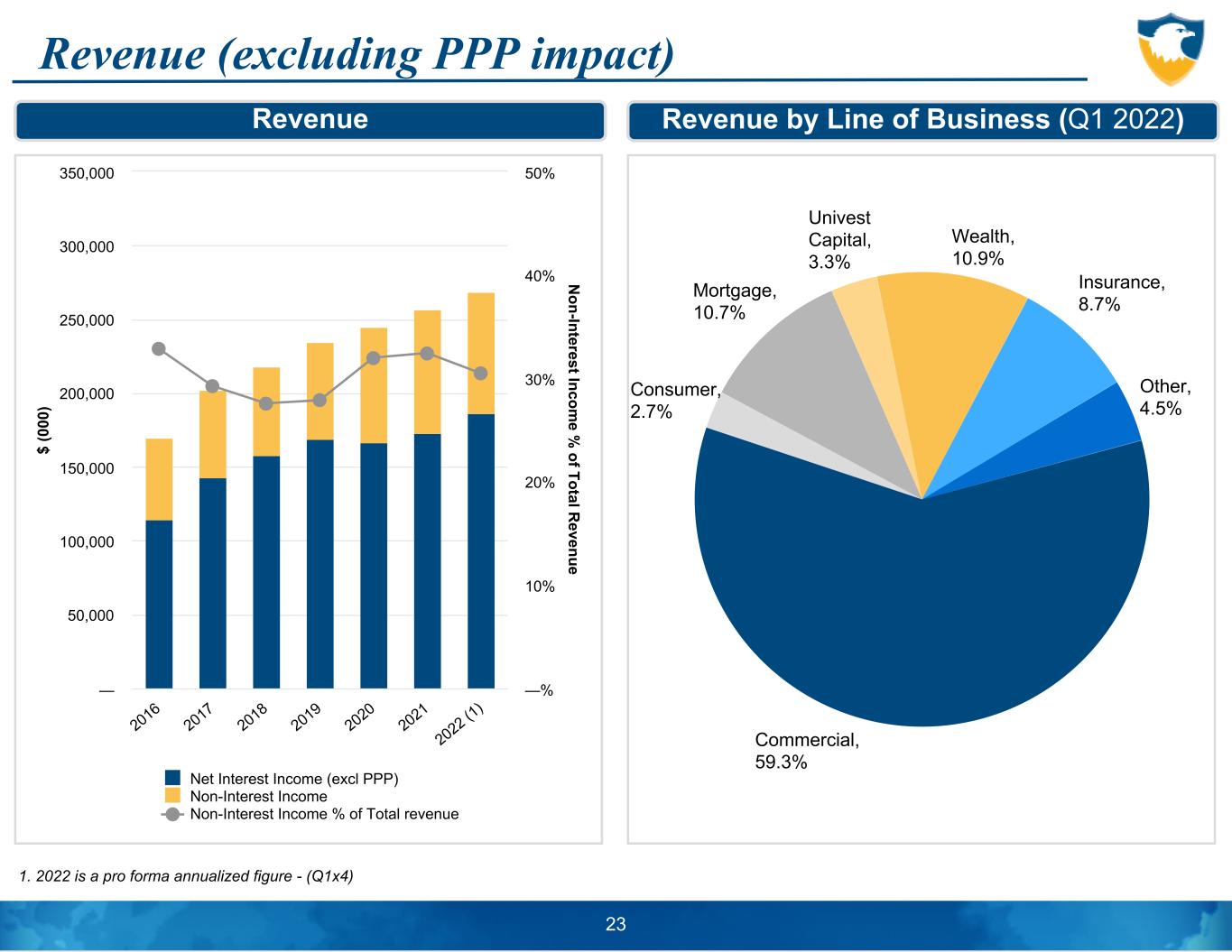

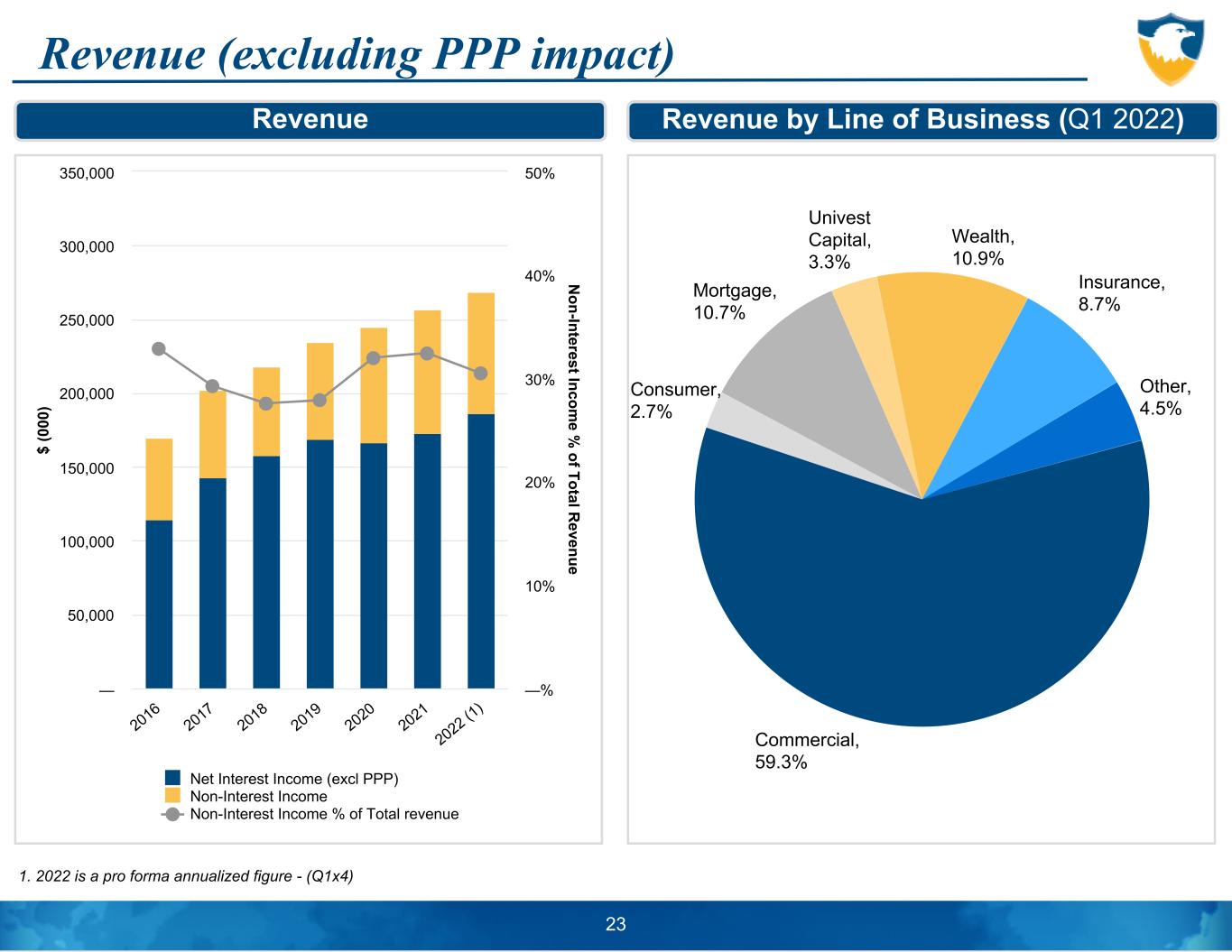

Revenue (excluding PPP impact) 1. 2022 is a pro forma annualized figure - (Q1x4) Revenue = Net Interest Income + Noninterest Income $ (0 00 ) N on-Interest Incom e % of Total R evenue Net Interest Income (excl PPP) Non-Interest Income Non-Interest Income % of Total revenue 2016 2017 2018 2019 2020 2021 2022 (1 ) — 50,000 100,000 150,000 200,000 250,000 300,000 350,000 —% 10% 20% 30% 40% 50% 23 Commercial, 59.3% Consumer, 2.7% Mortgage, 10.7% Univest Capital, 3.3% Wealth, 10.9% Insurance, 8.7% Other, 4.5% Revenue Revenue by Line of Business (Q1 2022)

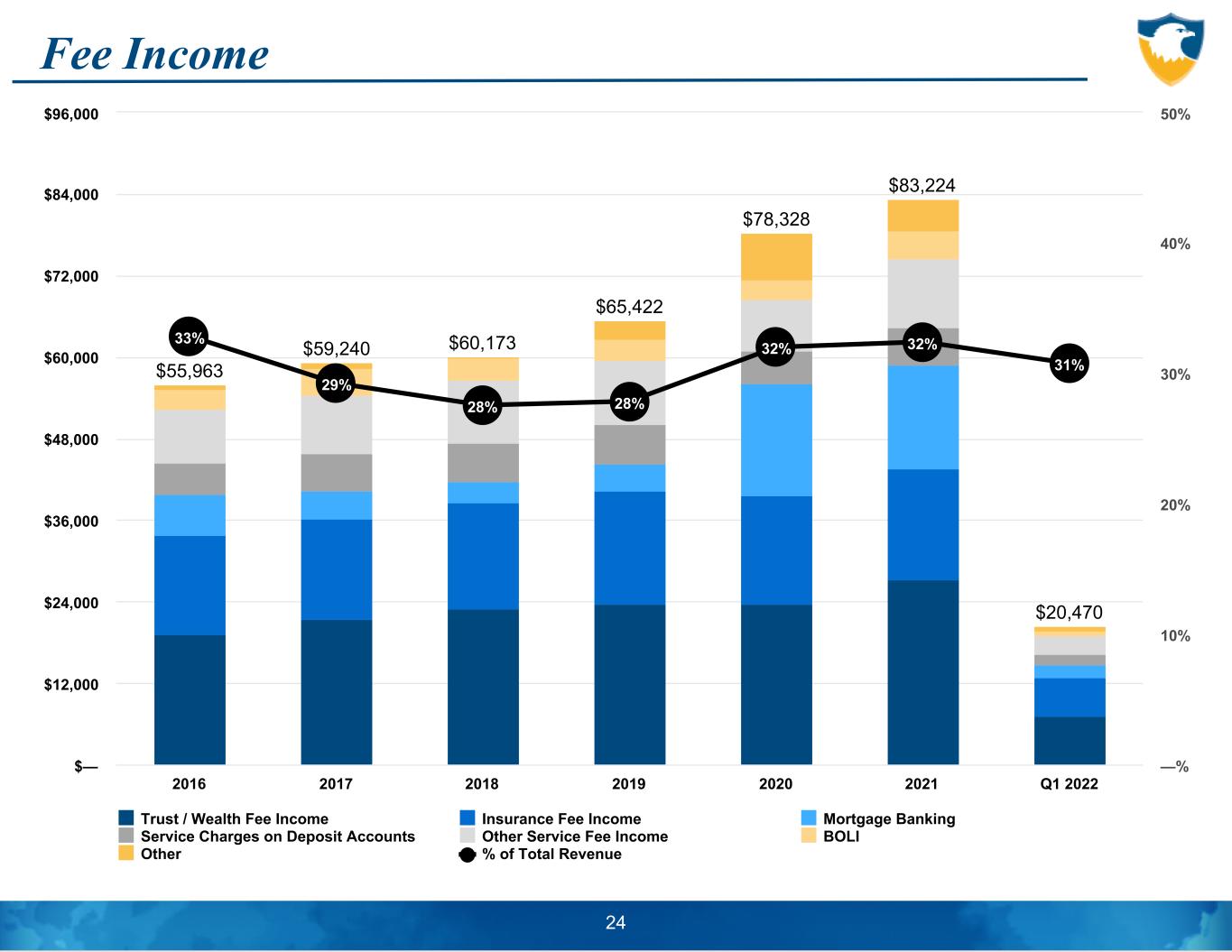

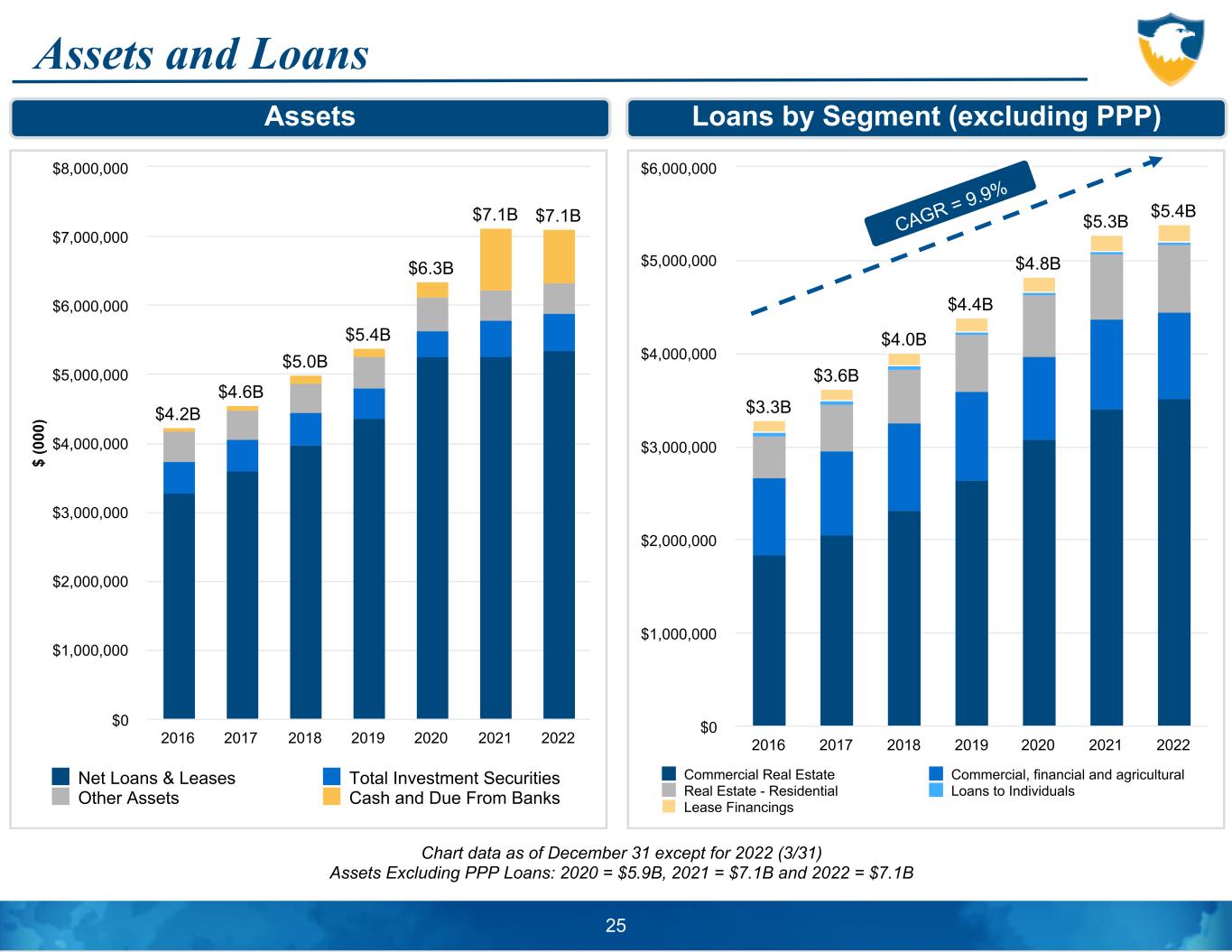

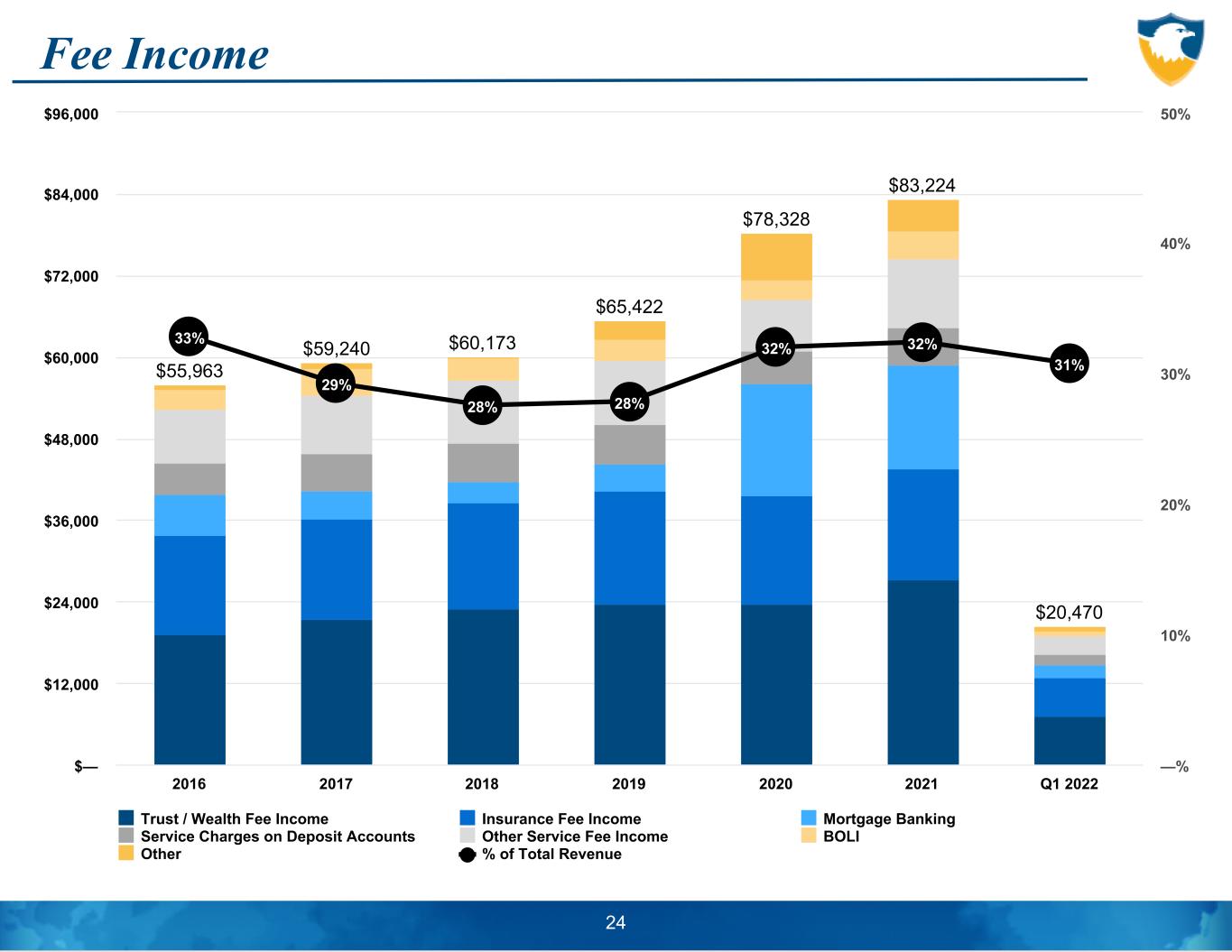

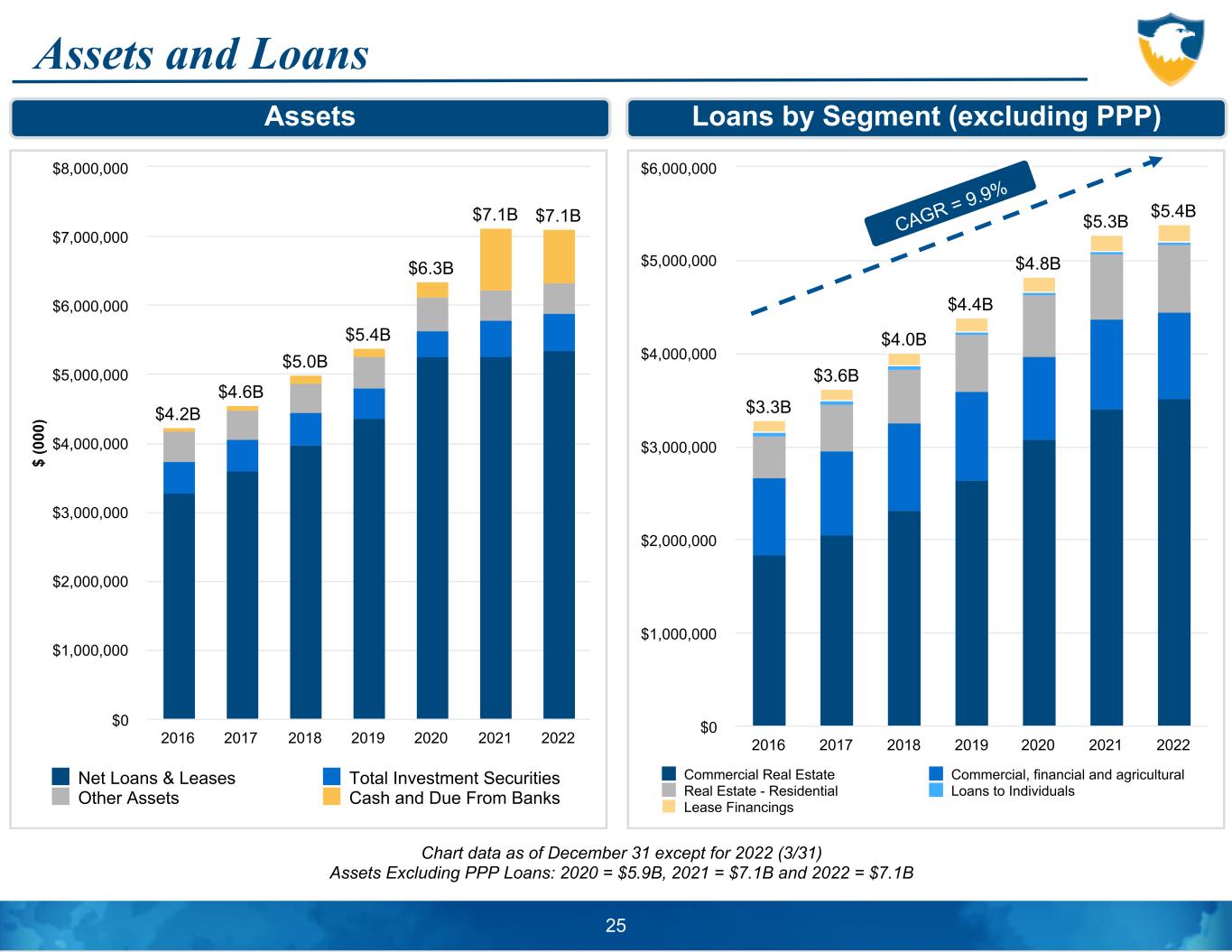

Fee Income 24 $55,963 $59,240 $60,173 $65,422 $78,328 $83,224 $20,470 33% 29% 28% 28% 32% 32% 31% Trust / Wealth Fee Income Insurance Fee Income Mortgage Banking Service Charges on Deposit Accounts Other Service Fee Income BOLI Other % of Total Revenue 2016 2017 2018 2019 2020 2021 Q1 2022 $— $12,000 $24,000 $36,000 $48,000 $60,000 $72,000 $84,000 $96,000 —% 10% 20% 30% 40% 50% Assets and Loans Chart data as of December 31 except for 2022 (3/31) Assets Excluding PPP Loans: 2020 = $5.9B, 2021 = $7.1B and 2022 = $7.1B $ (0 00 ) $4.2B $4.6B $5.0B $5.4B $6.3B $7.1B $7.1B Net Loans & Leases Total Investment Securities Other Assets Cash and Due From Banks 2016 2017 2018 2019 2020 2021 2022 $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 $8,000,000 25 Assets Loans by Segment (excluding PPP) $3.3B $3.6B $4.0B $4.4B $4.8B $5.3B $5.4B Commercial Real Estate Commercial, financial and agricultural Real Estate - Residential Loans to Individuals Lease Financings 2016 2017 2018 2019 2020 2021 2022 $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 CAGR = 9.9%

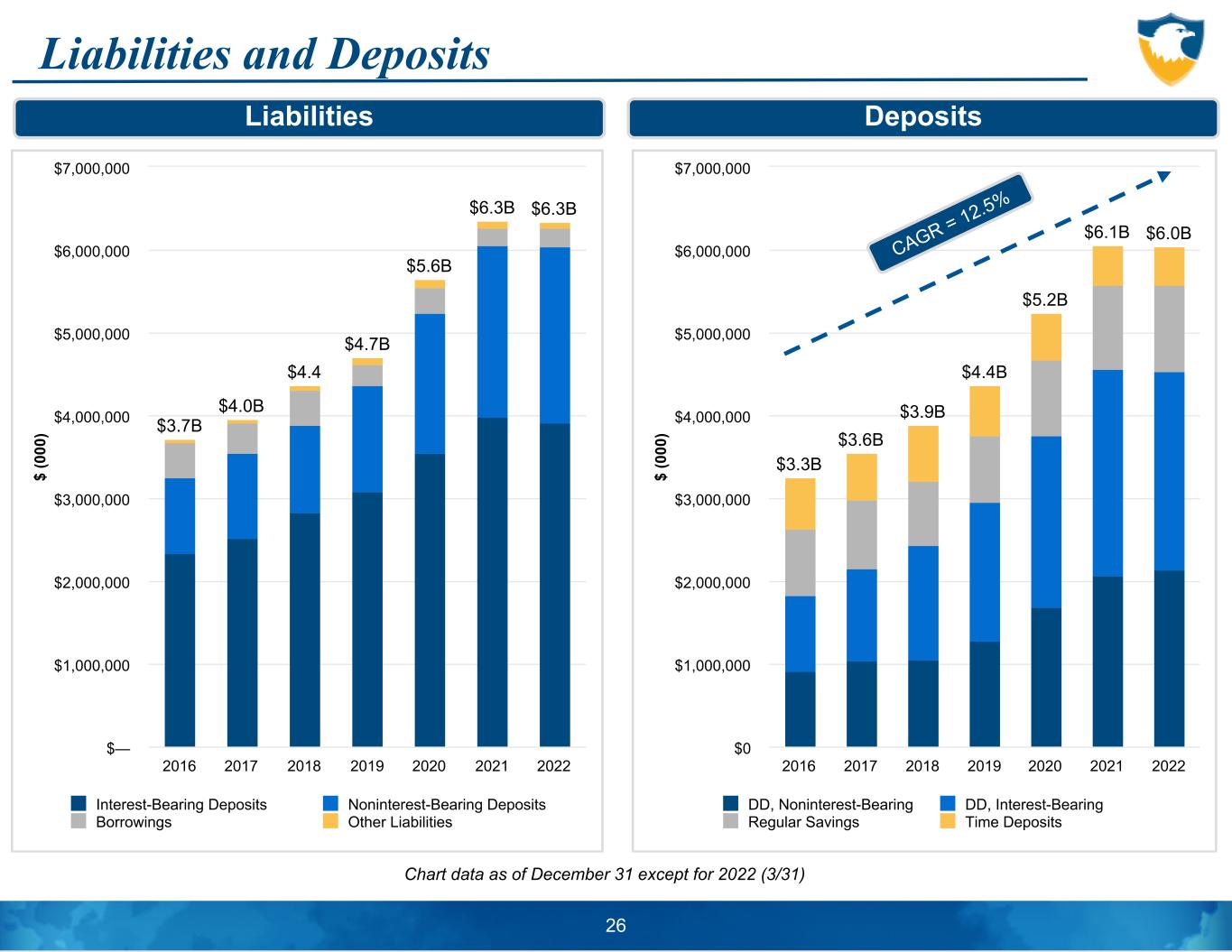

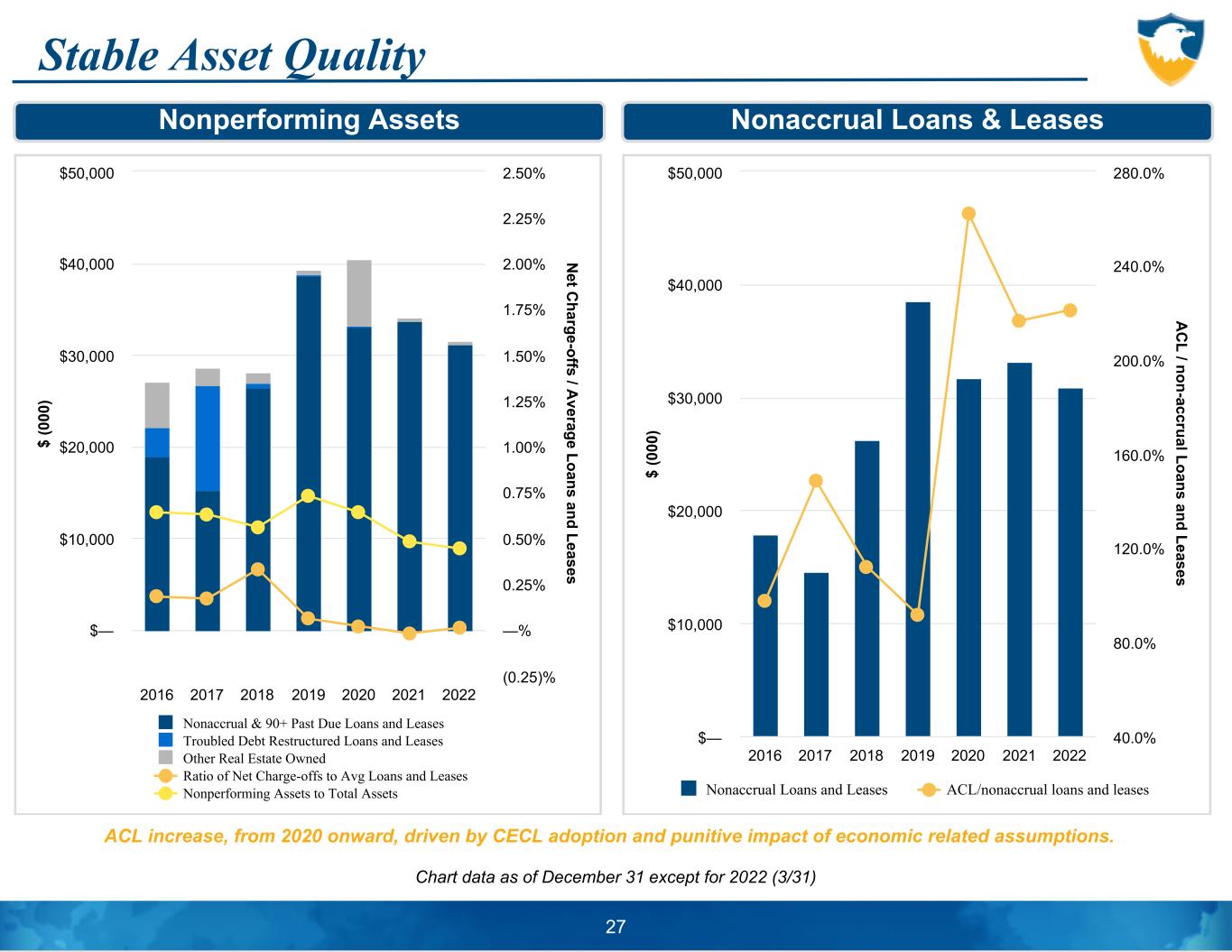

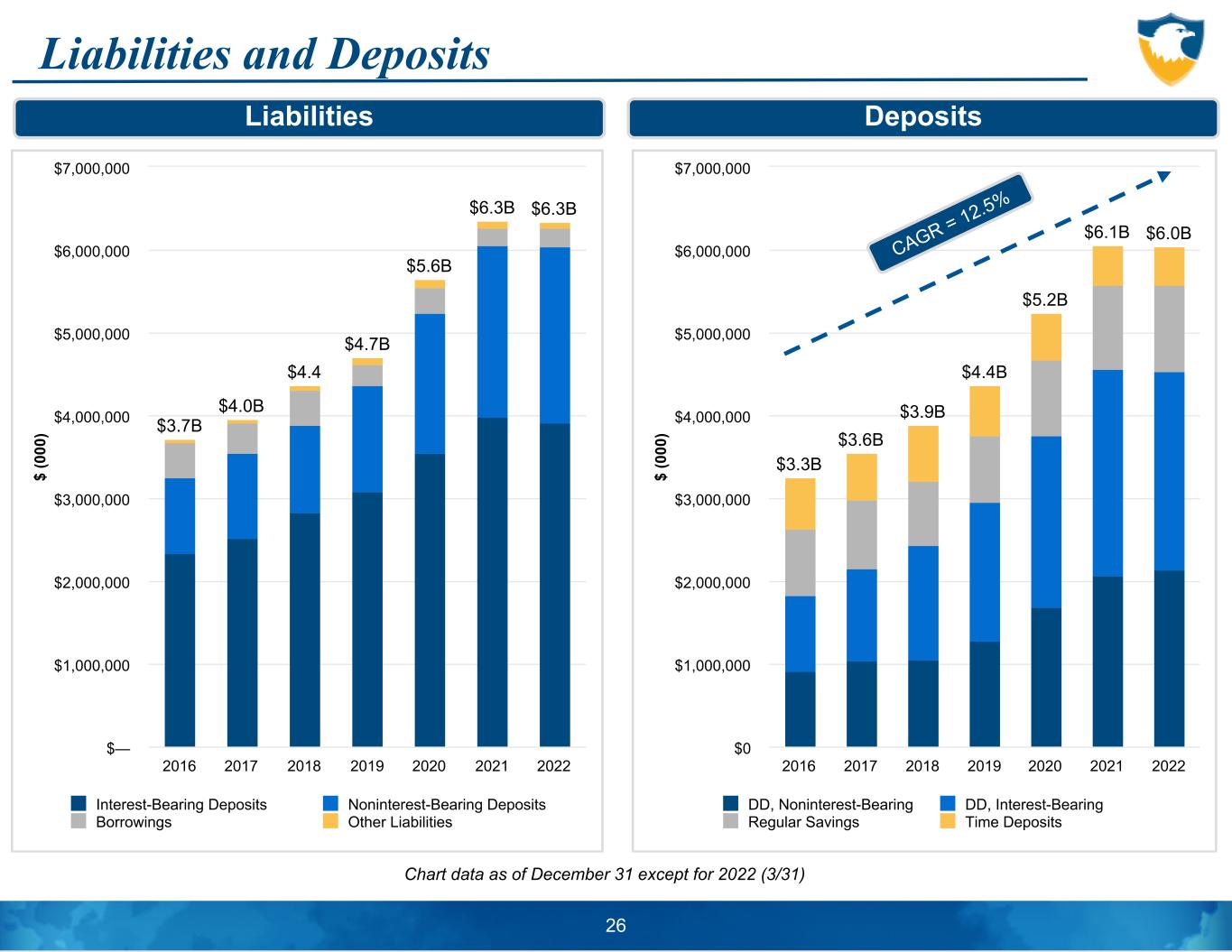

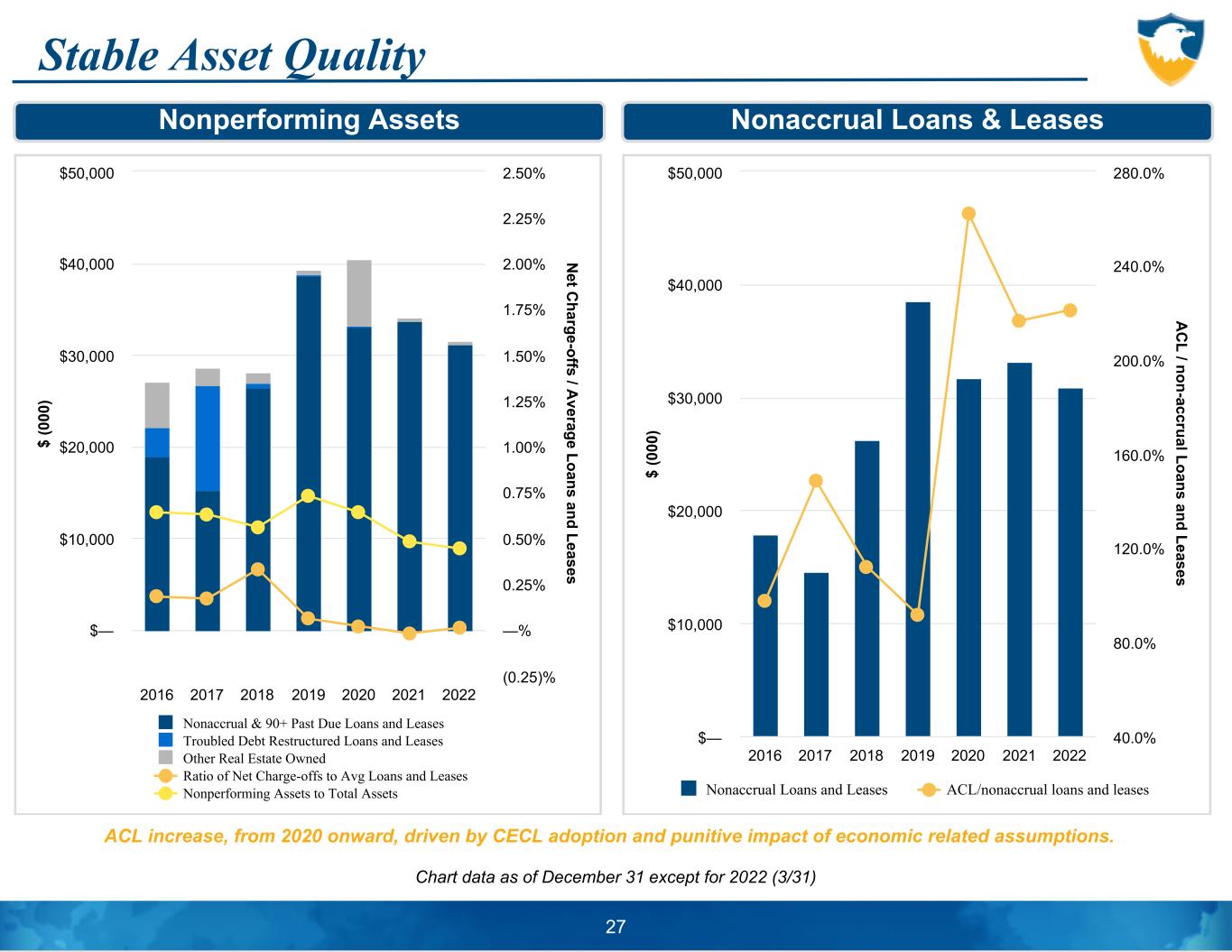

Liabilities and Deposits Chart data as of December 31 except for 2022 (3/31) $ (0 00 ) $3.7B $4.0B $4.4 $4.7B $5.6B $6.3B $6.3B Interest-Bearing Deposits Noninterest-Bearing Deposits Borrowings Other Liabilities 2016 2017 2018 2019 2020 2021 2022 $— $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 $ (0 00 ) $3.3B $3.6B $3.9B $4.4B $5.2B $6.1B $6.0B DD, Noninterest-Bearing DD, Interest-Bearing Regular Savings Time Deposits 2016 2017 2018 2019 2020 2021 2022 $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 26 CAGR = 12.5% Liabilities Deposits Stable Asset Quality Chart data as of December 31 except for 2022 (3/31) ACL increase, from 2020 onward, driven by CECL adoption and punitive impact of economic related assumptions.

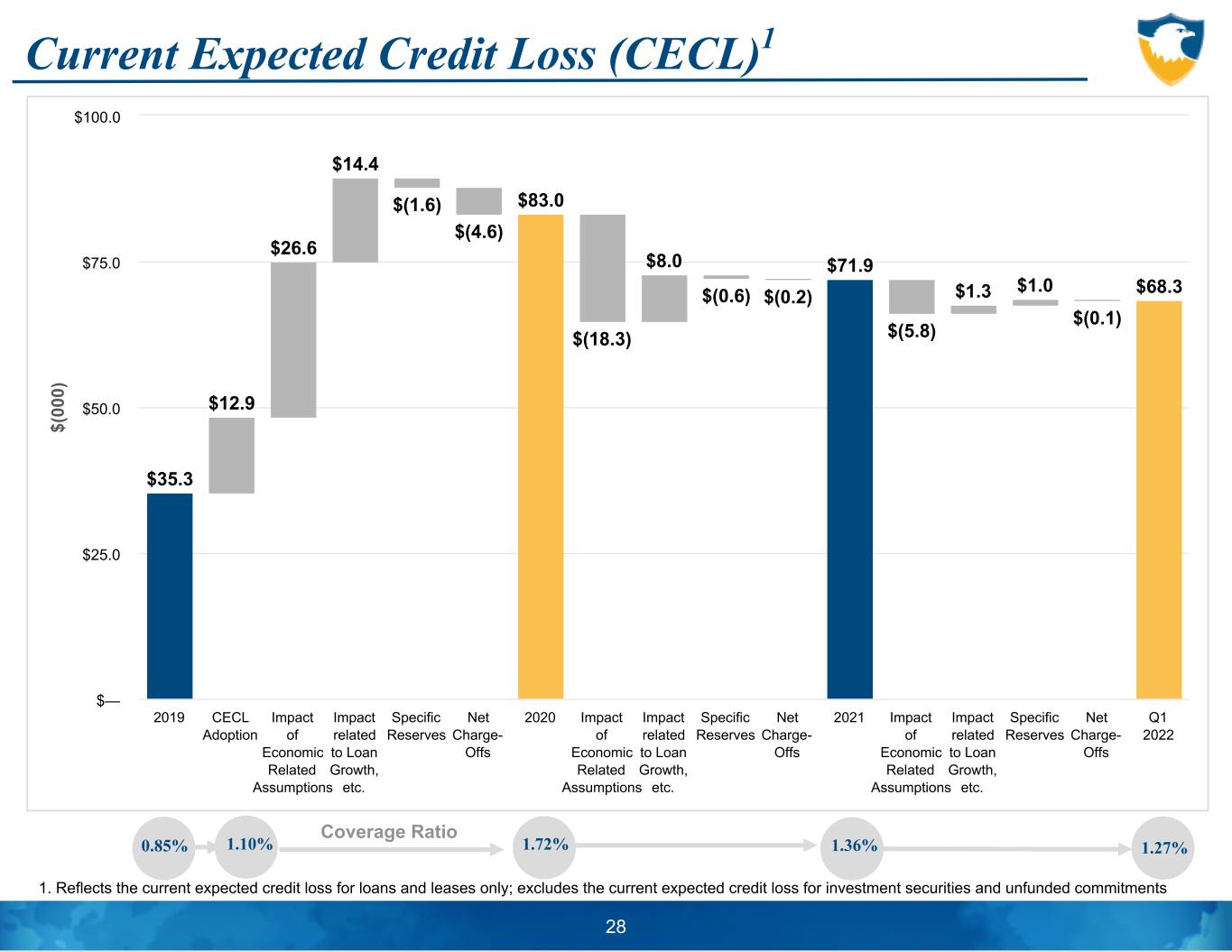

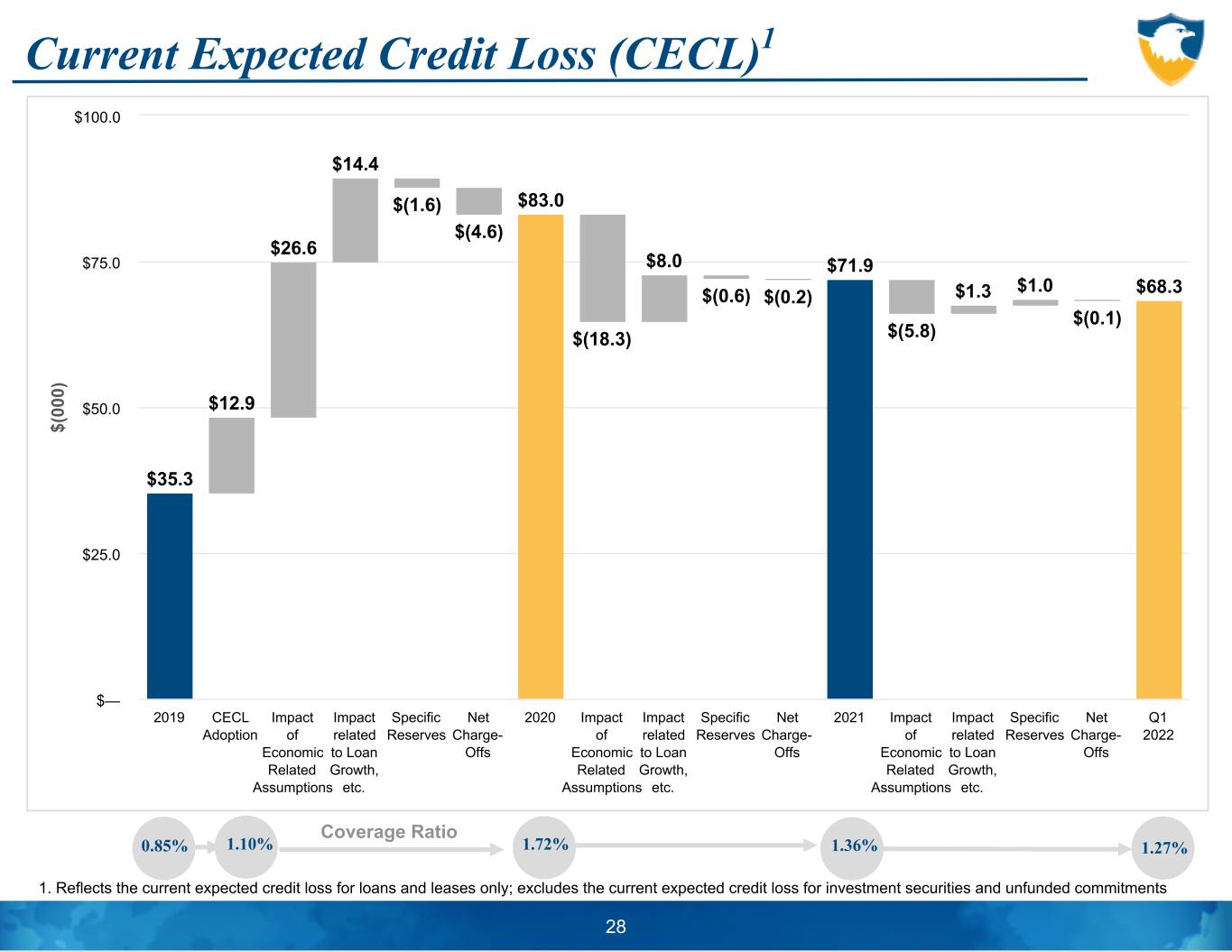

$ (0 00 ) A C L / non-accrual Loans and Leases Nonaccrual Loans and Leases ACL/nonaccrual loans and leases 2016 2017 2018 2019 2020 2021 2022 $— $10,000 $20,000 $30,000 $40,000 $50,000 40.0% 80.0% 120.0% 160.0% 200.0% 240.0% 280.0% $ (0 00 ) N et C harge-offs / A verage Loans and Leases Nonaccrual & 90+ Past Due Loans and Leases Troubled Debt Restructured Loans and Leases Other Real Estate Owned Ratio of Net Charge-offs to Avg Loans and Leases Nonperforming Assets to Total Assets 2016 2017 2018 2019 2020 2021 2022 $— $10,000 $20,000 $30,000 $40,000 $50,000 (0.25)% —% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00% 2.25% 2.50% 27 Nonperforming Assets Nonaccrual Loans & Leases Current Expected Credit Loss (CECL)1 28 $( 00 0) $35.3 $12.9 $26.6 $14.4 $(1.6) $(4.6) $83.0 $(18.3) $8.0 $(0.6) $(0.2) $71.9 $(5.8) $1.3 $1.0 $(0.1) $68.3 2019 CECL Adoption Impact of Economic Related Assumptions Impact related to Loan Growth, etc. Specific Reserves Net Charge- Offs 2020 Impact of Economic Related Assumptions Impact related to Loan Growth, etc. Specific Reserves Net Charge- Offs 2021 Impact of Economic Related Assumptions Impact related to Loan Growth, etc. Specific Reserves Net Charge- Offs Q1 2022 $— $25.0 $50.0 $75.0 $100.0 1.72% 1.36% 1.27% Coverage Ratio 0.85% 1.10% 1.

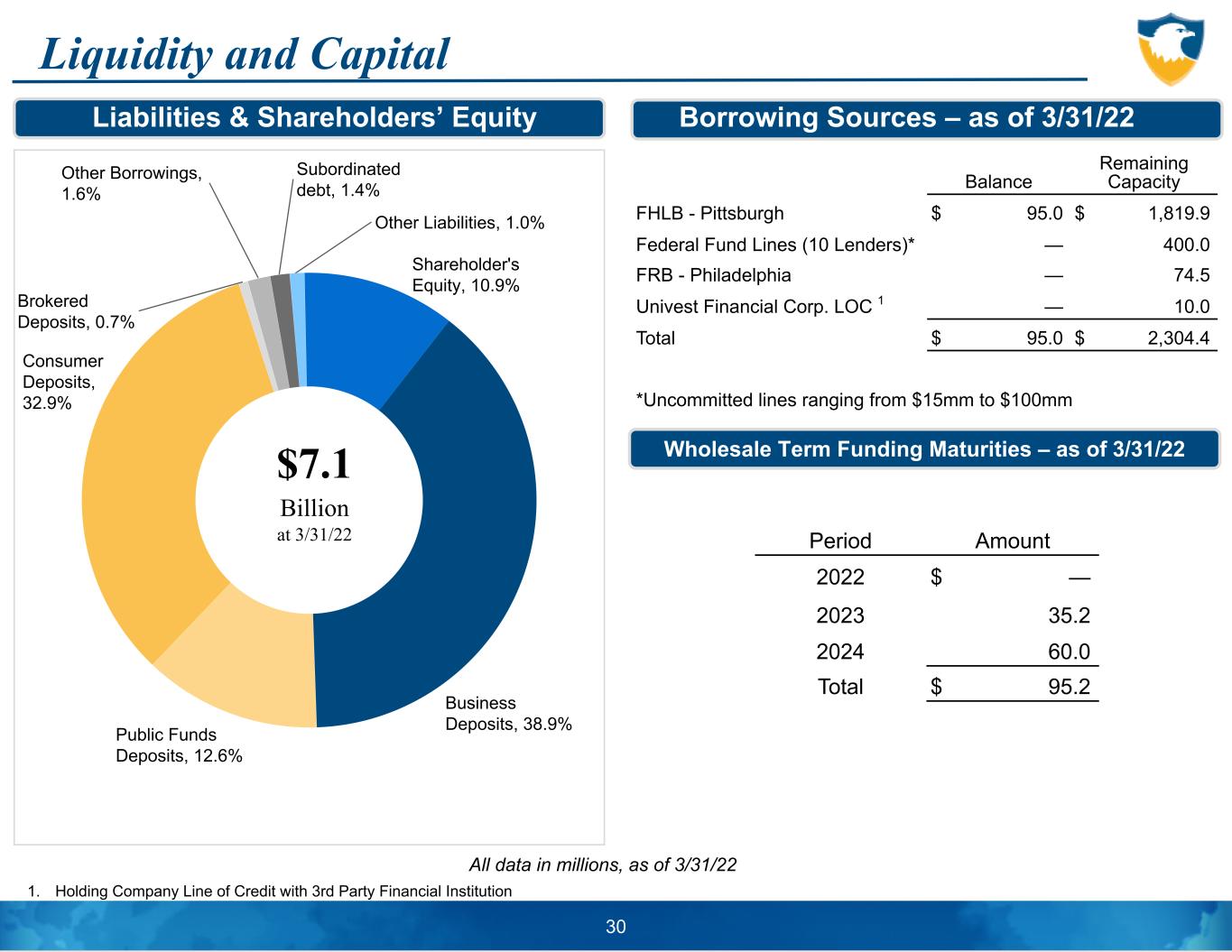

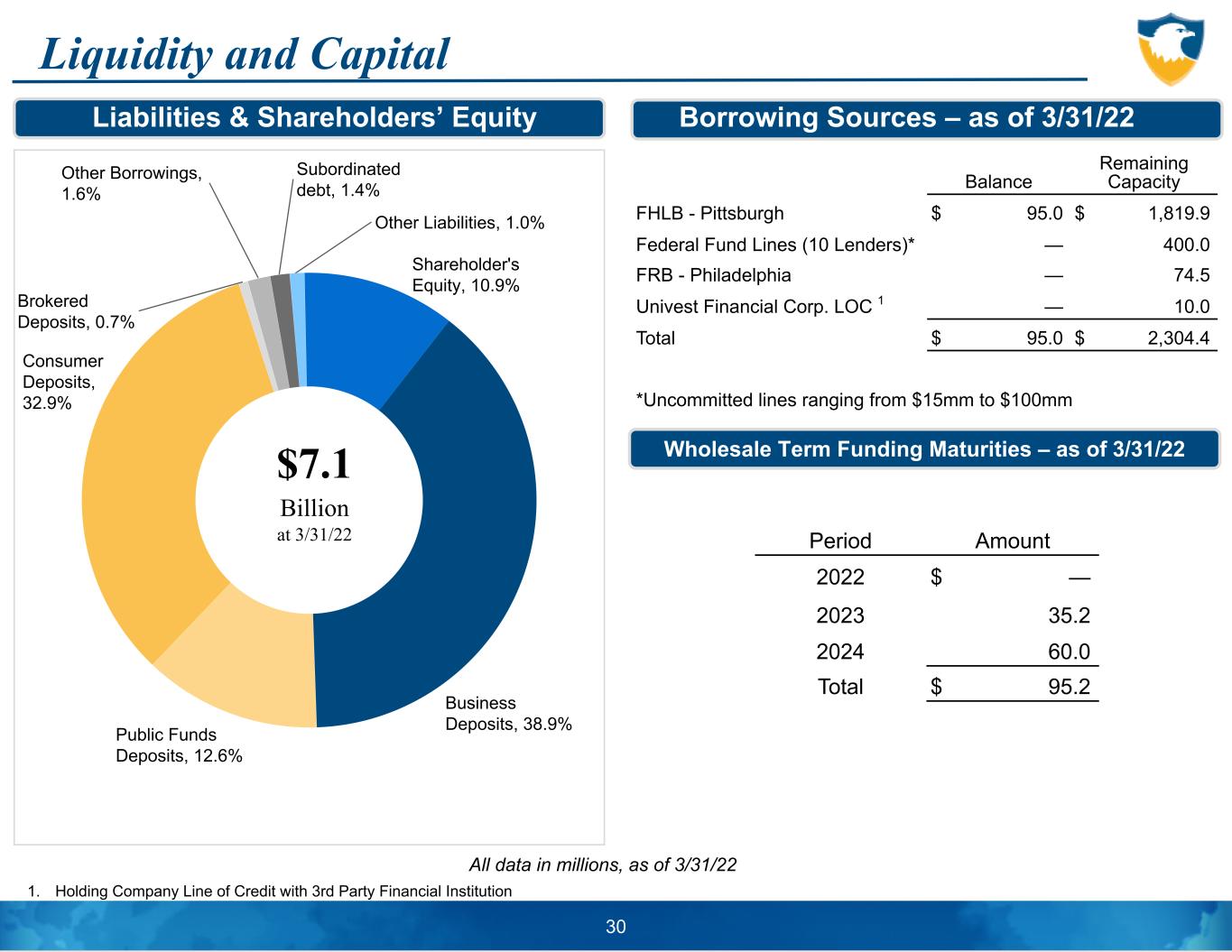

Reflects the current expected credit loss for loans and leases only; excludes the current expected credit loss for investment securities and unfunded commitments Liquidity and Capital All data in millions, as of 3/31/22 Balance Remaining Capacity FHLB - Pittsburgh $ 95.0 $ 1,819.9 Federal Fund Lines (10 Lenders)* — 400.0 FRB - Philadelphia — 74.5 Univest Financial Corp.

LIQUIDITY AND CAPITAL

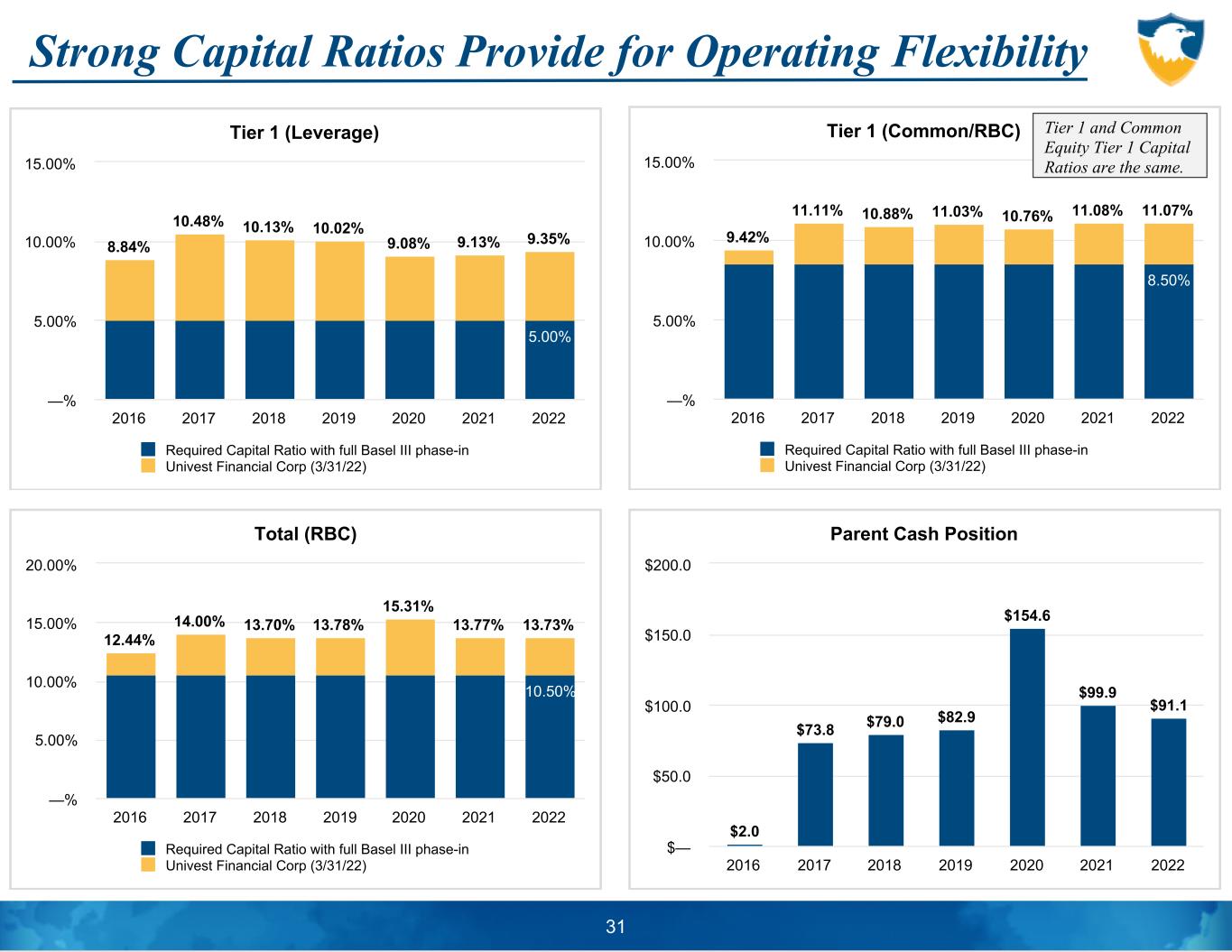

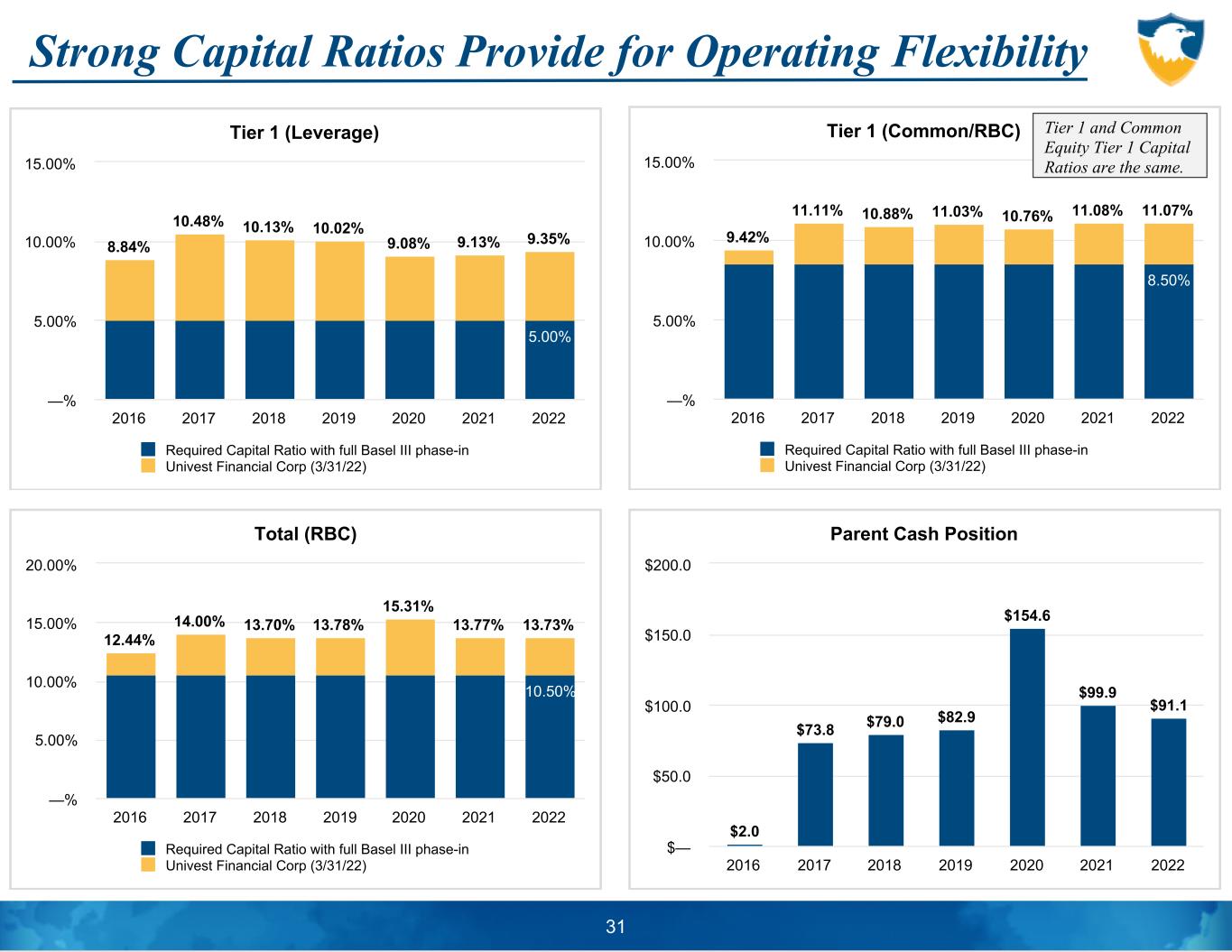

LOC 1 — 10.0 Total $ 95.0 $ 2,304.4 *Uncommitted lines ranging from $15mm to $100mm Period Amount 2022 $ — 2023 35.2 2024 60.0 Total $ 95.2 30 Liabilities & Shareholders’ Equity Borrowing Sources – as of 3/31/22 Wholesale Term Funding Maturities – as of 3/31/22 Business Deposits, 38.9%Public Funds Deposits, 12.6% Consumer Deposits, 32.9% Brokered Deposits, 0.7% Other Borrowings, 1.6% Subordinated debt, 1.4% Other Liabilities, 1.0% Shareholder's Equity, 10.9% $7.1 Billion at 3/31/22 1. Holding Company Line of Credit with 3rd Party Financial Institution Strong Capital Ratios Provide for Operating Flexibility 31 Tier 1 (Leverage) 8.84% 10.48% 10.13% 10.02% 9.08% 9.13% 9.35% 5.00% Required Capital Ratio with full Basel III phase-in Univest Financial Corp (3/31/22) 2016 2017 2018 2019 2020 2021 2022 —% 5.00% 10.00% 15.00% Tier 1 (Common/RBC) 9.42% 11.11% 10.88% 11.03% 10.76% 11.08% 11.07% 8.50% Required Capital Ratio with full Basel III phase-in Univest Financial Corp (3/31/22) 2016 2017 2018 2019 2020 2021 2022 —% 5.00% 10.00% 15.00% Total (RBC) 12.44% 14.00% 13.70% 13.78% 15.31% 13.77% 13.73% 10.50% Required Capital Ratio with full Basel III phase-in Univest Financial Corp (3/31/22) 2016 2017 2018 2019 2020 2021 2022 —% 5.00% 10.00% 15.00% 20.00% Parent Cash Position $2.0 $73.8 $79.0 $82.9 $154.6 $99.9 $91.1 2016 2017 2018 2019 2020 2021 2022 $— $50.0 $100.0 $150.0 $200.0 Tier 1 and Common Equity Tier 1 Capital Ratios are the same.

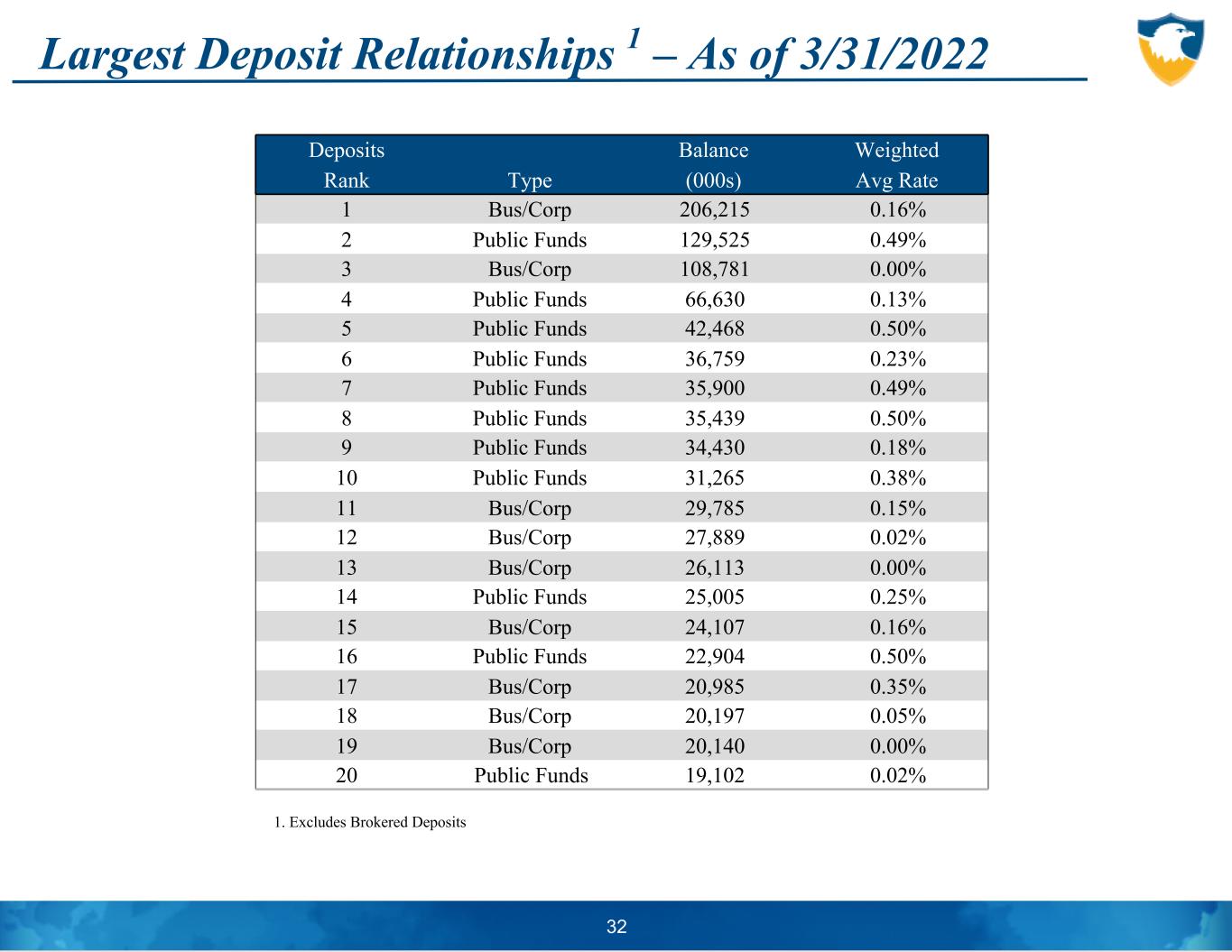

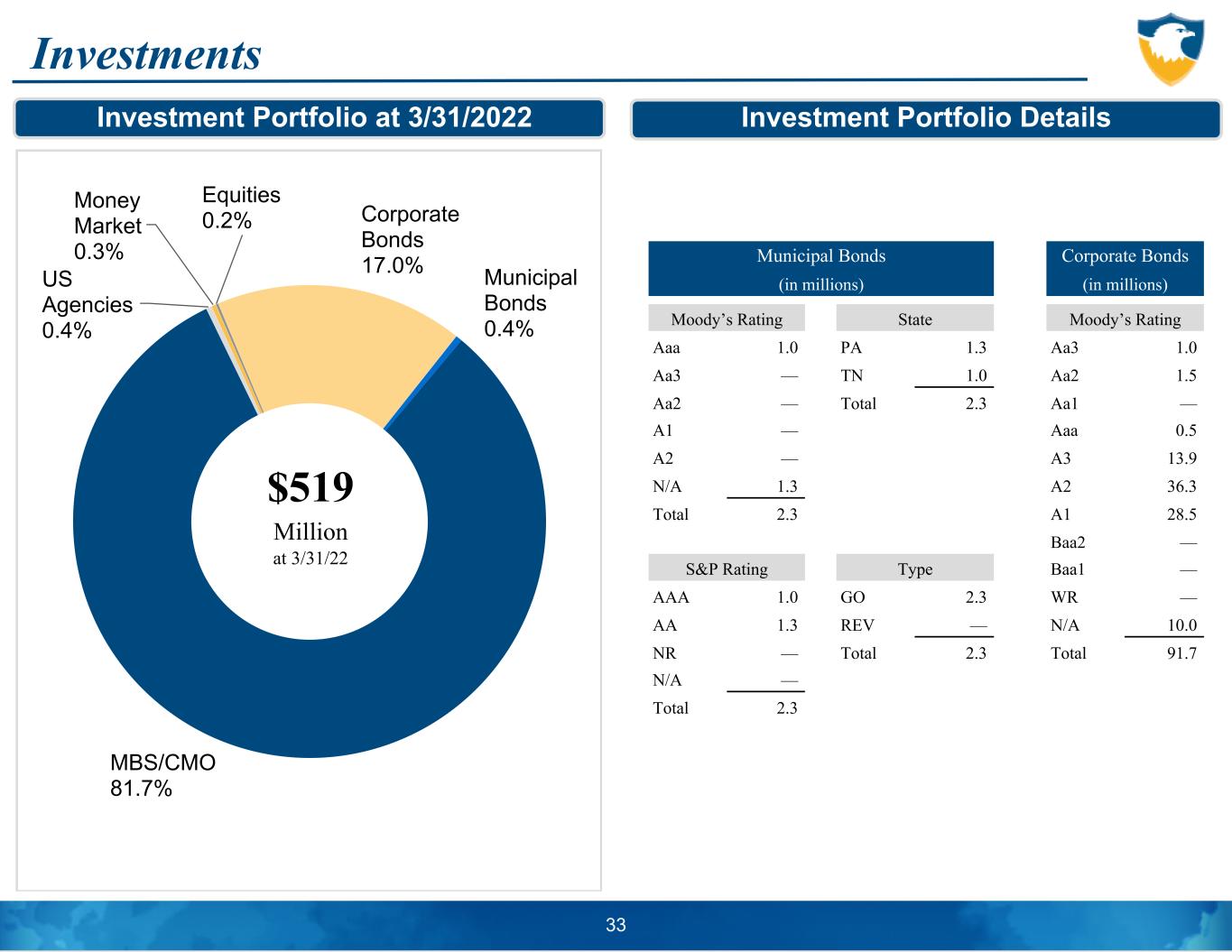

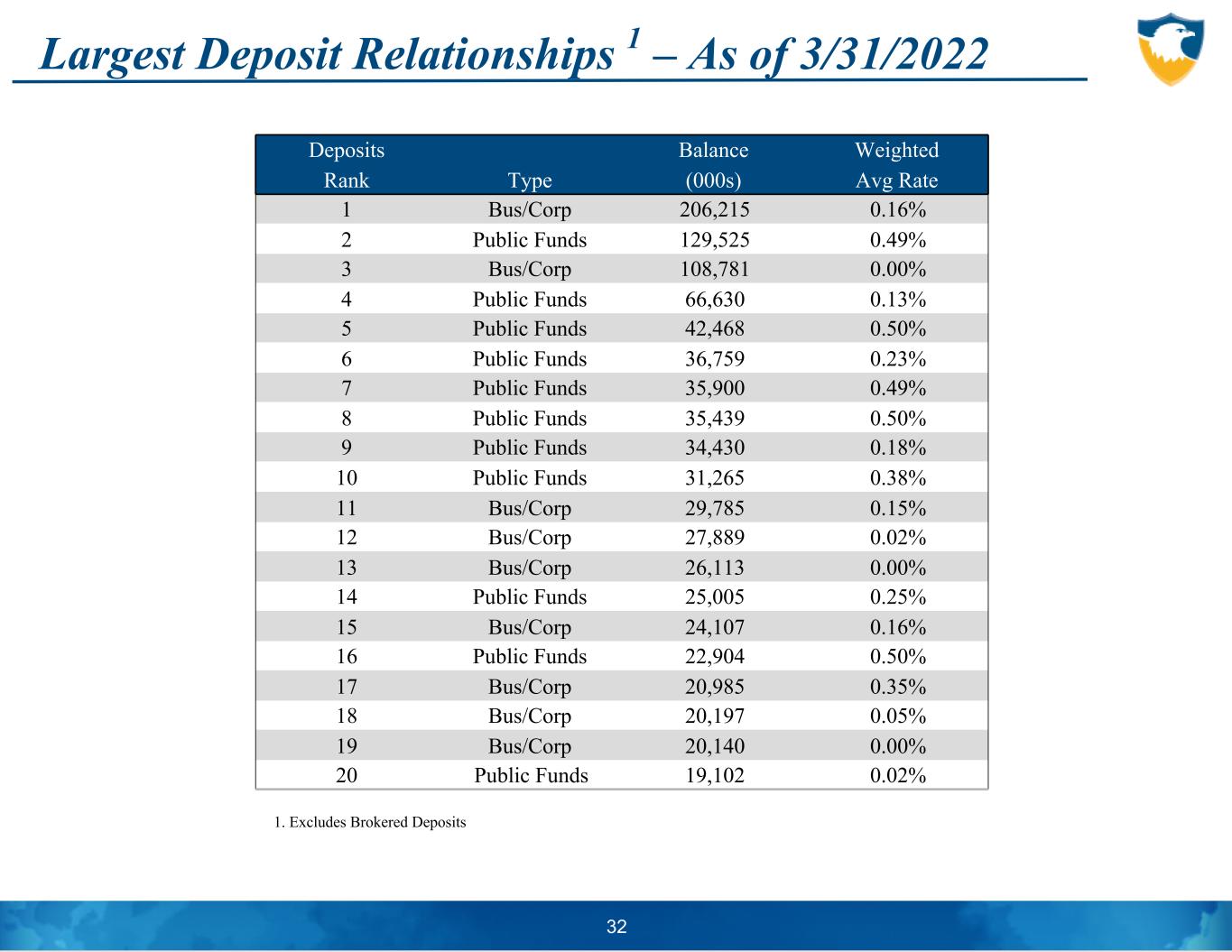

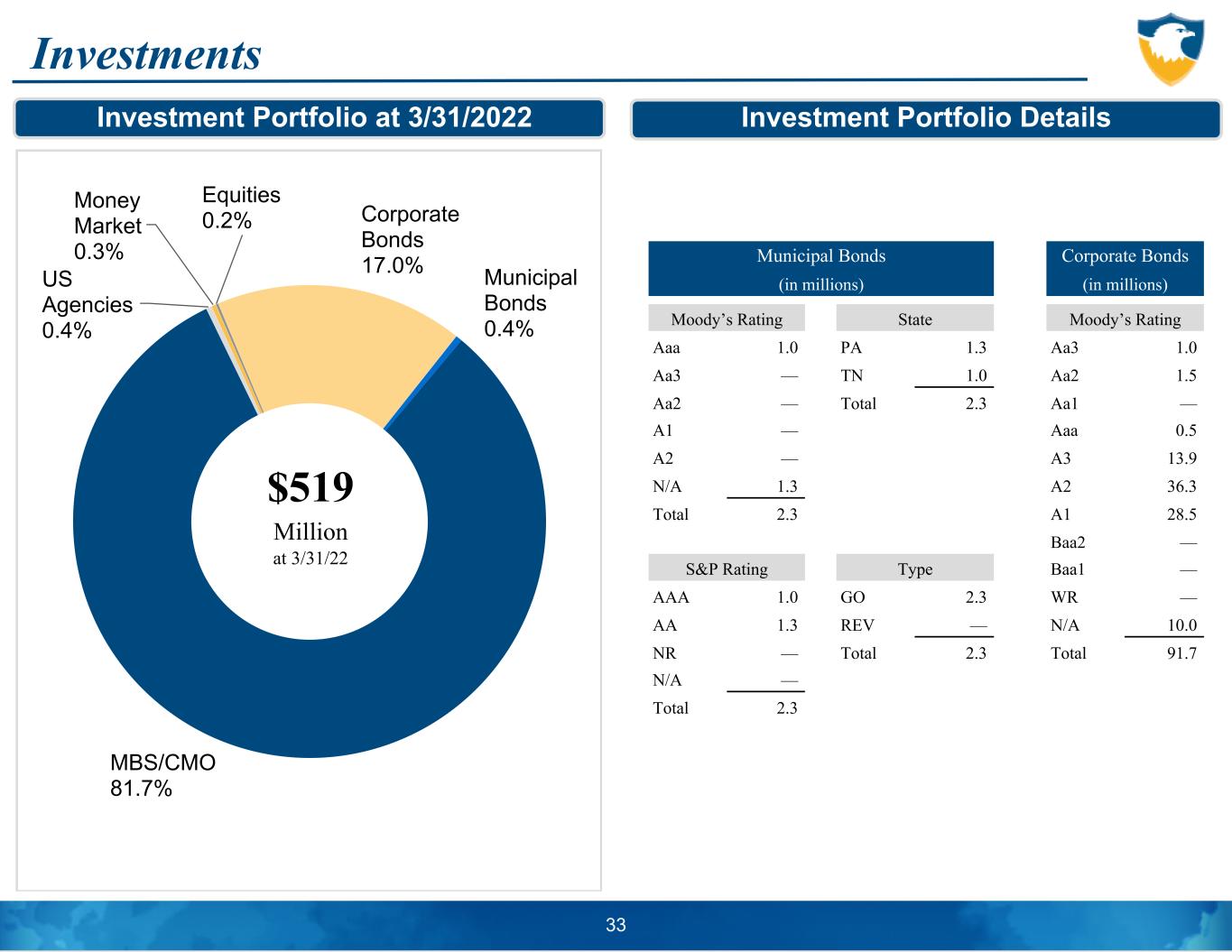

Largest Deposit Relationships 1 – As of 3/31/2022 32 Deposits Balance Weighted Rank Type (000s) Avg Rate 1 Bus/Corp 206,215 0.16% 2 Public Funds 129,525 0.49% 3 Bus/Corp 108,781 0.00% 4 Public Funds 66,630 0.13% 5 Public Funds 42,468 0.50% 6 Public Funds 36,759 0.23% 7 Public Funds 35,900 0.49% 8 Public Funds 35,439 0.50% 9 Public Funds 34,430 0.18% 10 Public Funds 31,265 0.38% 11 Bus/Corp 29,785 0.15% 12 Bus/Corp 27,889 0.02% 13 Bus/Corp 26,113 0.00% 14 Public Funds 25,005 0.25% 15 Bus/Corp 24,107 0.16% 16 Public Funds 22,904 0.50% 17 Bus/Corp 20,985 0.35% 18 Bus/Corp 20,197 0.05% 19 Bus/Corp 20,140 0.00% 20 Public Funds 19,102 0.02% 1. Excludes Brokered Deposits Investments Municipal Bonds Corporate Bonds (in millions) (in millions) Moody’s Rating State Moody’s Rating Aaa 1.0 PA 1.3 Aa3 1.0 Aa3 — TN 1.0 Aa2 1.5 Aa2 — Total 2.3 Aa1 — A1 — Aaa 0.5 A2 — A3 13.9 N/A 1.3 A2 36.3 Total 2.3 A1 28.5 Baa2 — S&P Rating Type Baa1 — AAA 1.0 GO 2.3 WR — AA 1.3 REV — N/A 10.0 NR — Total 2.3 Total 91.7 N/A — Total 2.3 33 MBS/CMO 81.7% US Agencies 0.4% Money Market 0.3% Equities 0.2% Corporate Bonds 17.0% Municipal Bonds 0.4% $519 Million at 3/31/22 Investment Portfolio at 3/31/2022 Investment Portfolio Details

LOAN PORTFOLIO DETAIL AND CREDIT OVERVIEW

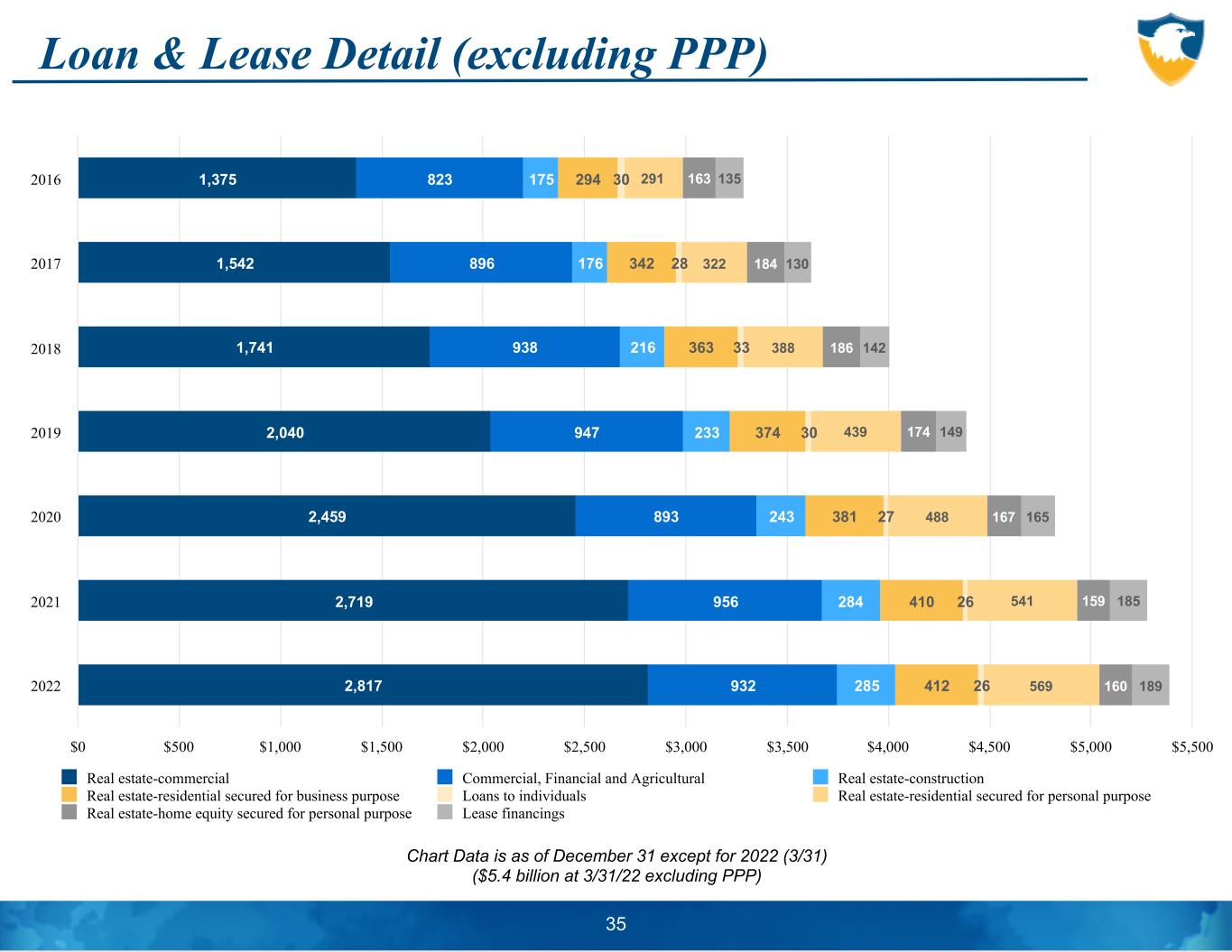

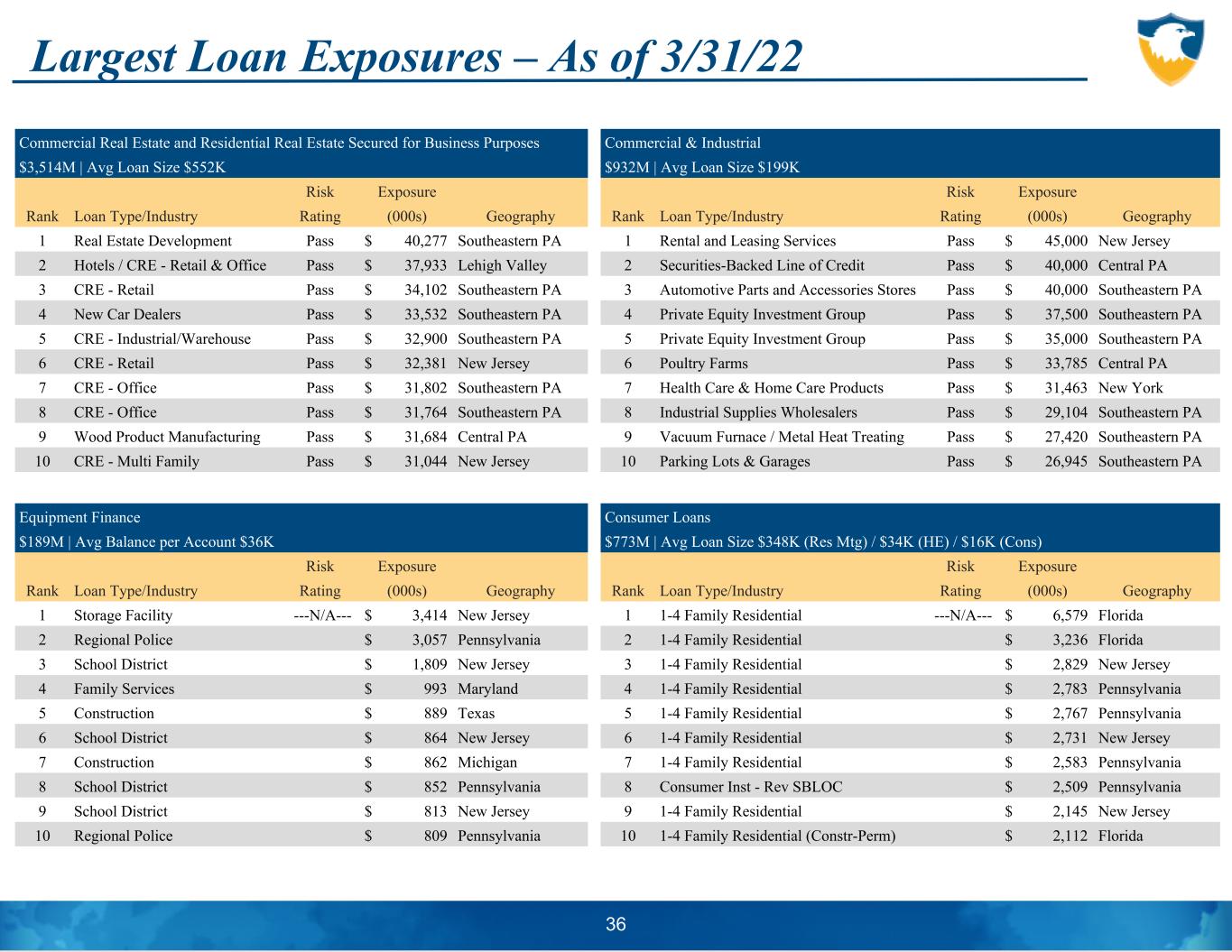

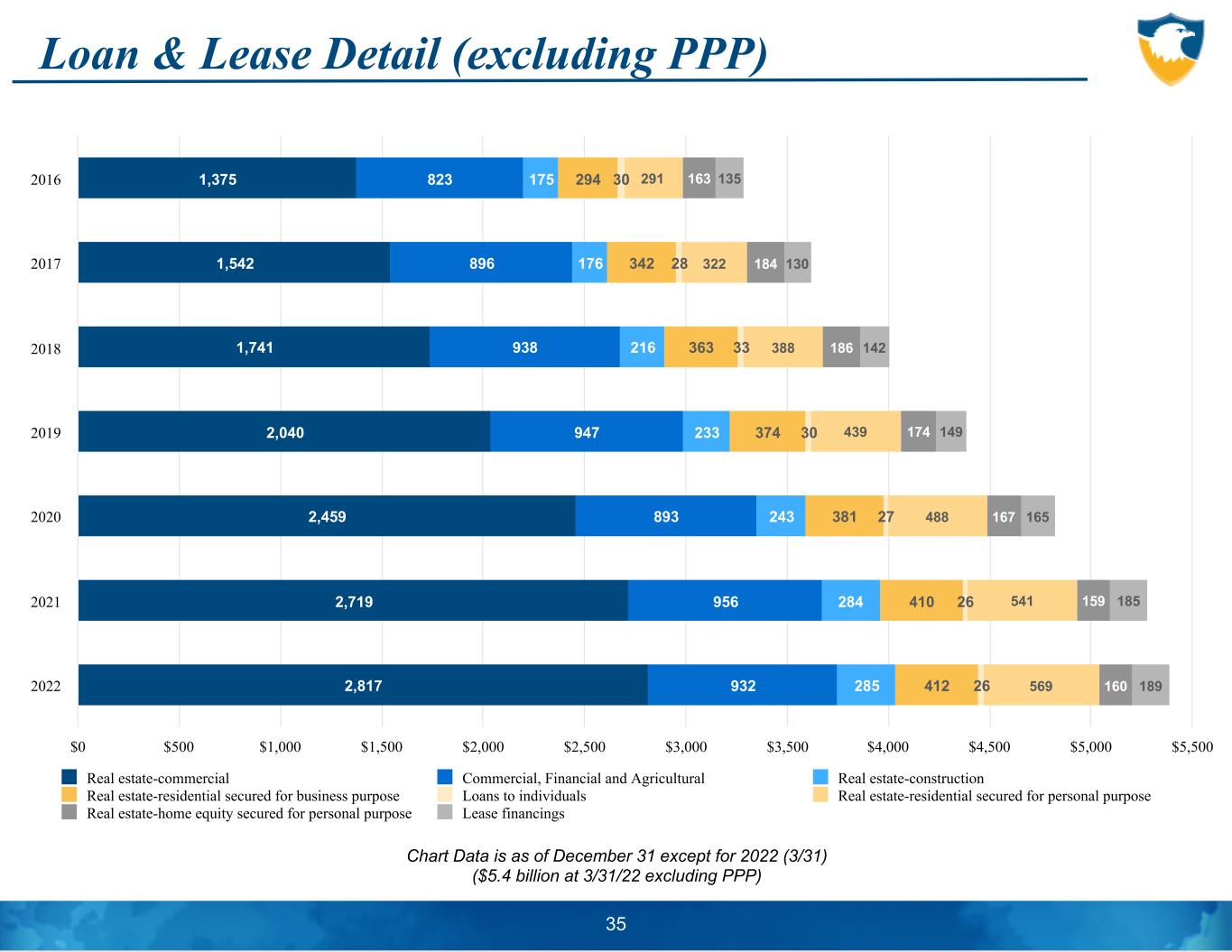

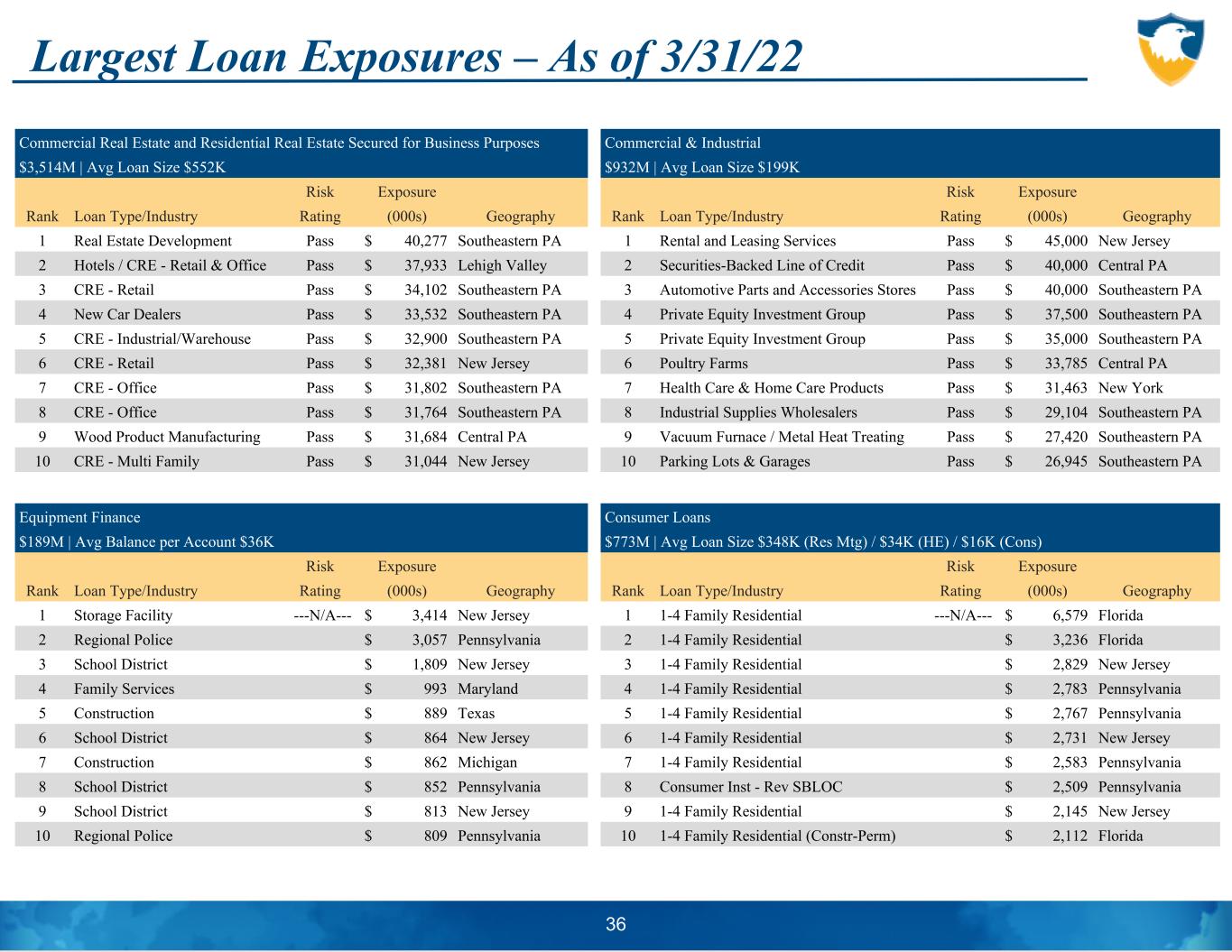

Loan & Lease Detail (excluding PPP) Chart Data is as of December 31 except for 2022 (3/31) ($5.4 billion at 3/31/22 excluding PPP) 35 1,375 1,542 1,741 2,040 2,459 2,719 2,817 823 896 938 947 893 956 932 175 176 216 233 243 284 285 294 342 363 374 381 410 412 30 28 33 30 27 26 26 291 322 388 439 488 541 569 163 184 186 174 167 159 160 135 130 142 149 165 185 189 Real estate-commercial Commercial, Financial and Agricultural Real estate-construction Real estate-residential secured for business purpose Loans to individuals Real estate-residential secured for personal purpose Real estate-home equity secured for personal purpose Lease financings 2016 2017 2018 2019 2020 2021 2022 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 Largest Loan Exposures – As of 3/31/22 36 Commercial Real Estate and Residential Real Estate Secured for Business Purposes Commercial & Industrial $3,514M | Avg Loan Size $552K $932M | Avg Loan Size $199K Risk Exposure Risk Exposure Rank Loan Type/Industry Rating (000s) Geography Rank Loan Type/Industry Rating (000s) Geography 1 Real Estate Development Pass $ 40,277 Southeastern PA 1 Rental and Leasing Services Pass $ 45,000 New Jersey 2 Hotels / CRE - Retail & Office Pass $ 37,933 Lehigh Valley 2 Securities-Backed Line of Credit Pass $ 40,000 Central PA 3 CRE - Retail Pass $ 34,102 Southeastern PA 3 Automotive Parts and Accessories Stores Pass $ 40,000 Southeastern PA 4 New Car Dealers Pass $ 33,532 Southeastern PA 4 Private Equity Investment Group Pass $ 37,500 Southeastern PA 5 CRE - Industrial/Warehouse Pass $ 32,900 Southeastern PA 5 Private Equity Investment Group Pass $ 35,000 Southeastern PA 6 CRE - Retail Pass $ 32,381 New Jersey 6 Poultry Farms Pass $ 33,785 Central PA 7 CRE - Office Pass $ 31,802 Southeastern PA 7 Health Care & Home Care Products Pass $ 31,463 New York 8 CRE - Office Pass $ 31,764 Southeastern PA 8 Industrial Supplies Wholesalers Pass $ 29,104 Southeastern PA 9 Wood Product Manufacturing Pass $ 31,684 Central PA 9 Vacuum Furnace / Metal Heat Treating Pass $ 27,420 Southeastern PA 10 CRE - Multi Family Pass $ 31,044 New Jersey 10 Parking Lots & Garages Pass $ 26,945 Southeastern PA Equipment Finance Consumer Loans $189M | Avg Balance per Account $36K $773M | Avg Loan Size $348K (Res Mtg) / $34K (HE) / $16K (Cons) Risk Exposure Risk Exposure Rank Loan Type/Industry Rating (000s) Geography Rank Loan Type/Industry Rating (000s) Geography 1 Storage Facility ‘---N/A--- $ 3,414 New Jersey 1 1-4 Family Residential ‘---N/A--- $ 6,579 Florida 2 Regional Police $ 3,057 Pennsylvania 2 1-4 Family Residential $ 3,236 Florida 3 School District $ 1,809 New Jersey 3 1-4 Family Residential $ 2,829 New Jersey 4 Family Services $ 993 Maryland 4 1-4 Family Residential $ 2,783 Pennsylvania 5 Construction $ 889 Texas 5 1-4 Family Residential $ 2,767 Pennsylvania 6 School District $ 864 New Jersey 6 1-4 Family Residential $ 2,731 New Jersey 7 Construction $ 862 Michigan 7 1-4 Family Residential $ 2,583 Pennsylvania 8 School District $ 852 Pennsylvania 8 Consumer Inst - Rev SBLOC $ 2,509 Pennsylvania 9 School District $ 813 New Jersey 9 1-4 Family Residential $ 2,145 New Jersey 10 Regional Police $ 809 Pennsylvania 10 1-4 Family Residential (Constr-Perm) $ 2,112 Florida

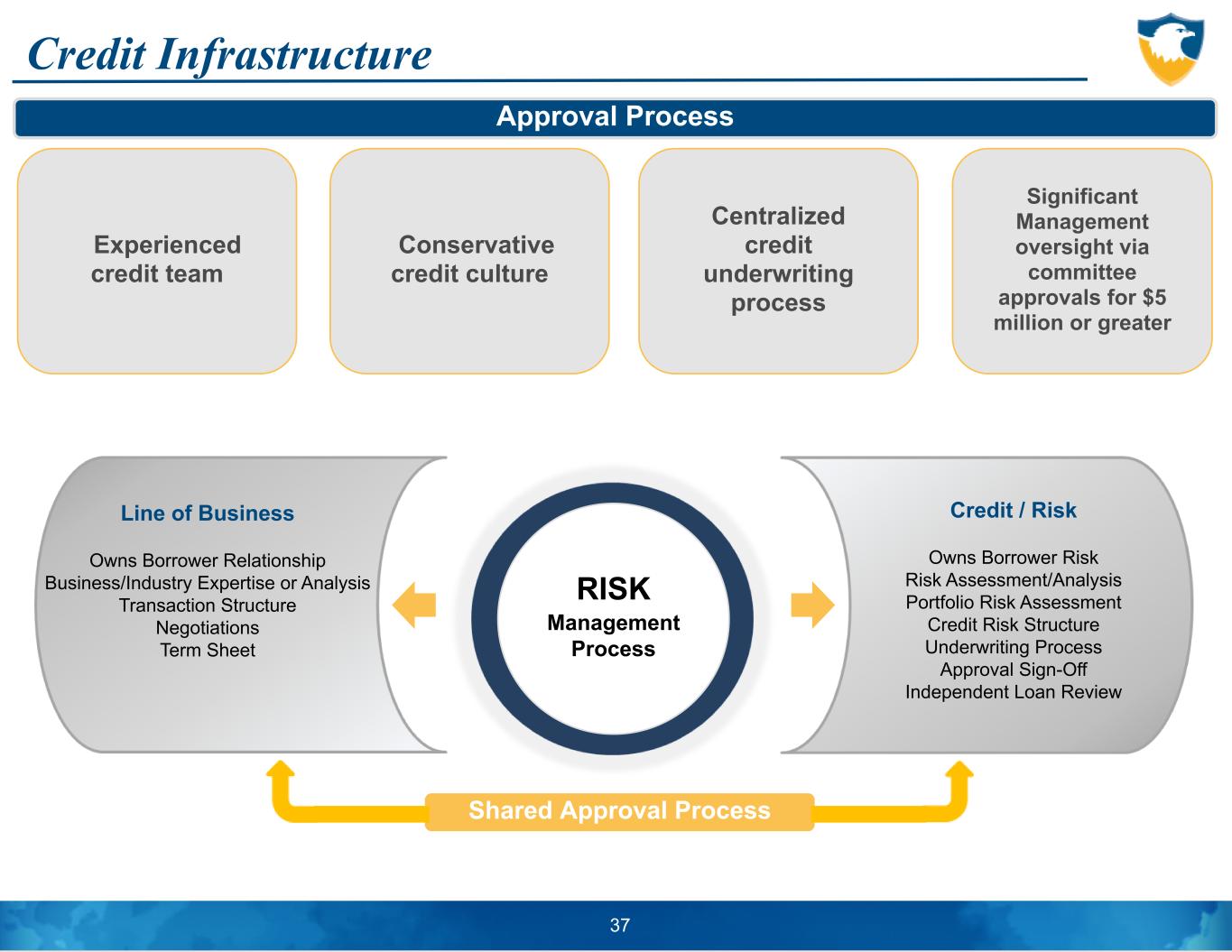

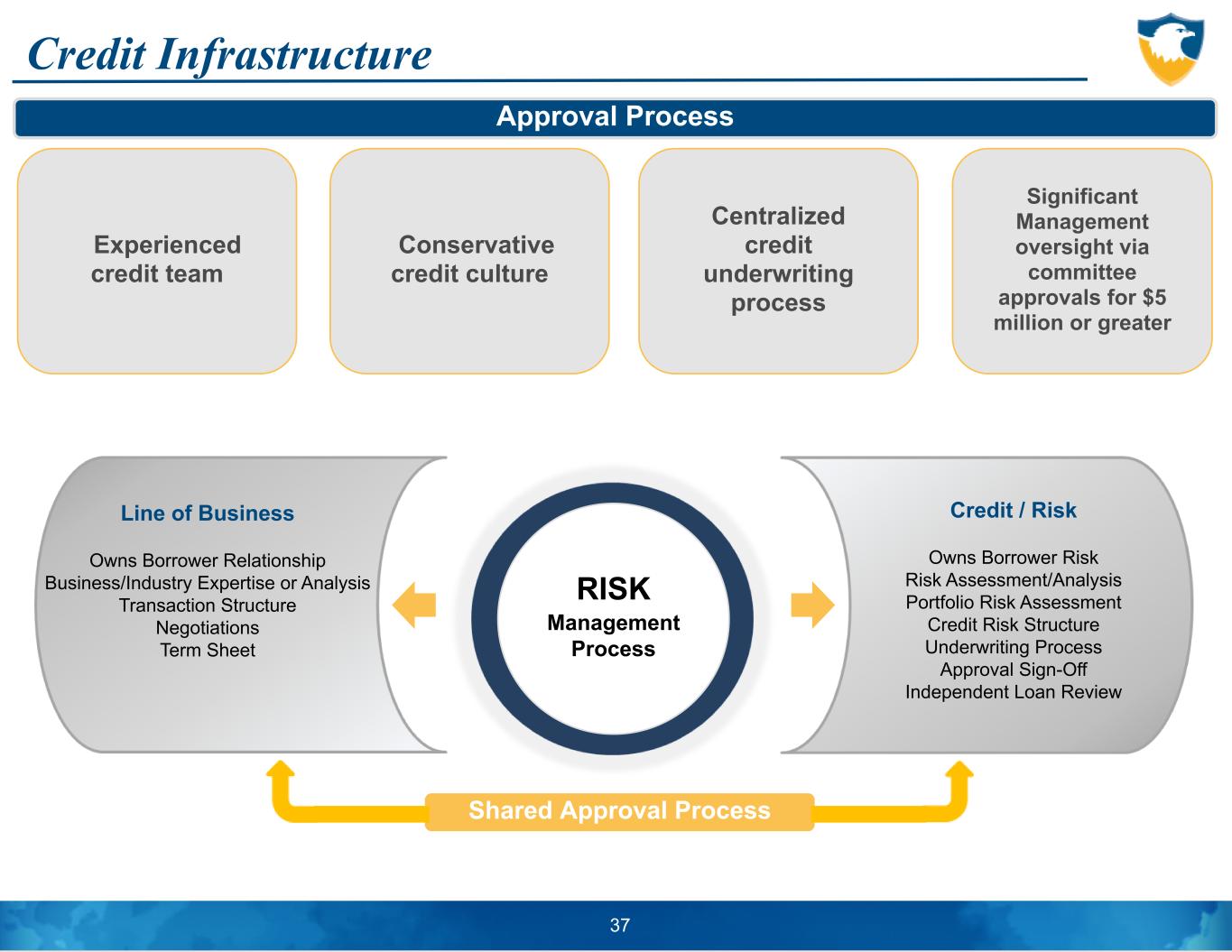

Credit Infrastructure 37 Approval Process Credit / Risk Owns Borrower Risk Risk Assessment/Analysis Portfolio Risk Assessment Credit Risk Structure Underwriting Process Approval Sign-Off Independent Loan Review Line of Business Owns Borrower Relationship Business/Industry Expertise or Analysis Transaction Structure Negotiations Term Sheet Shared Approval Process RISK Management Process Experienced credit team Conservative credit culture Centralized credit underwriting process Significant Management oversight via committee approvals for $5 million or greater • Limited single signature lending authority.

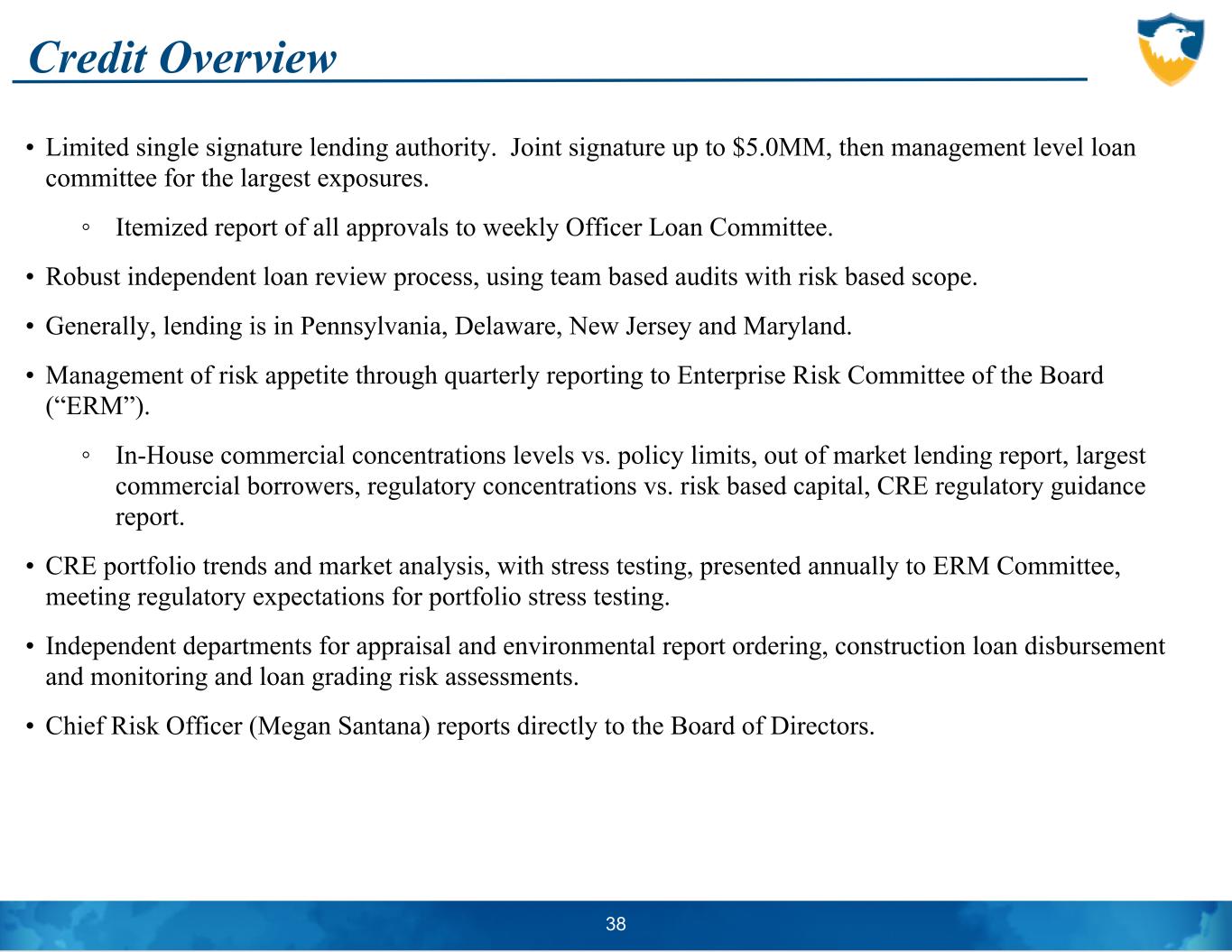

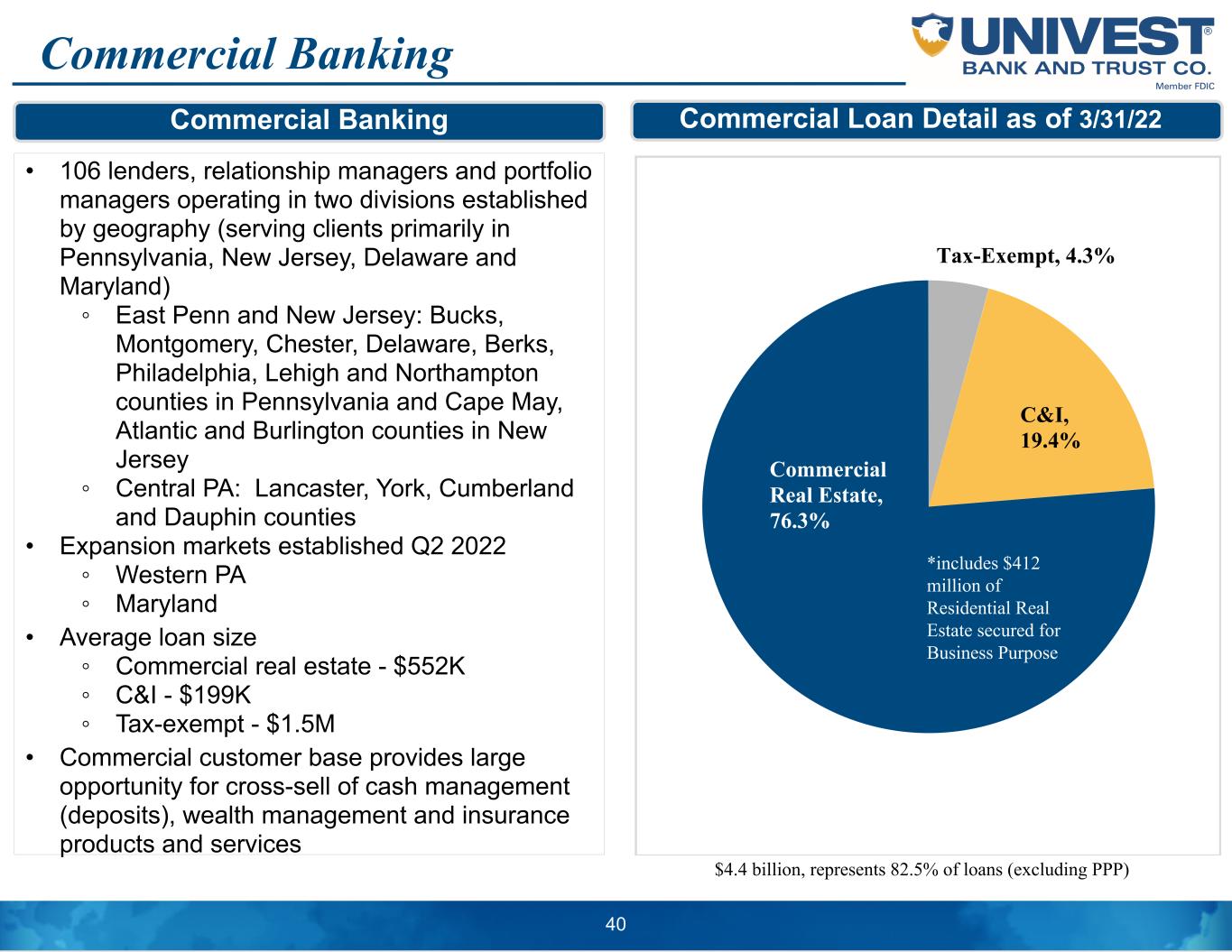

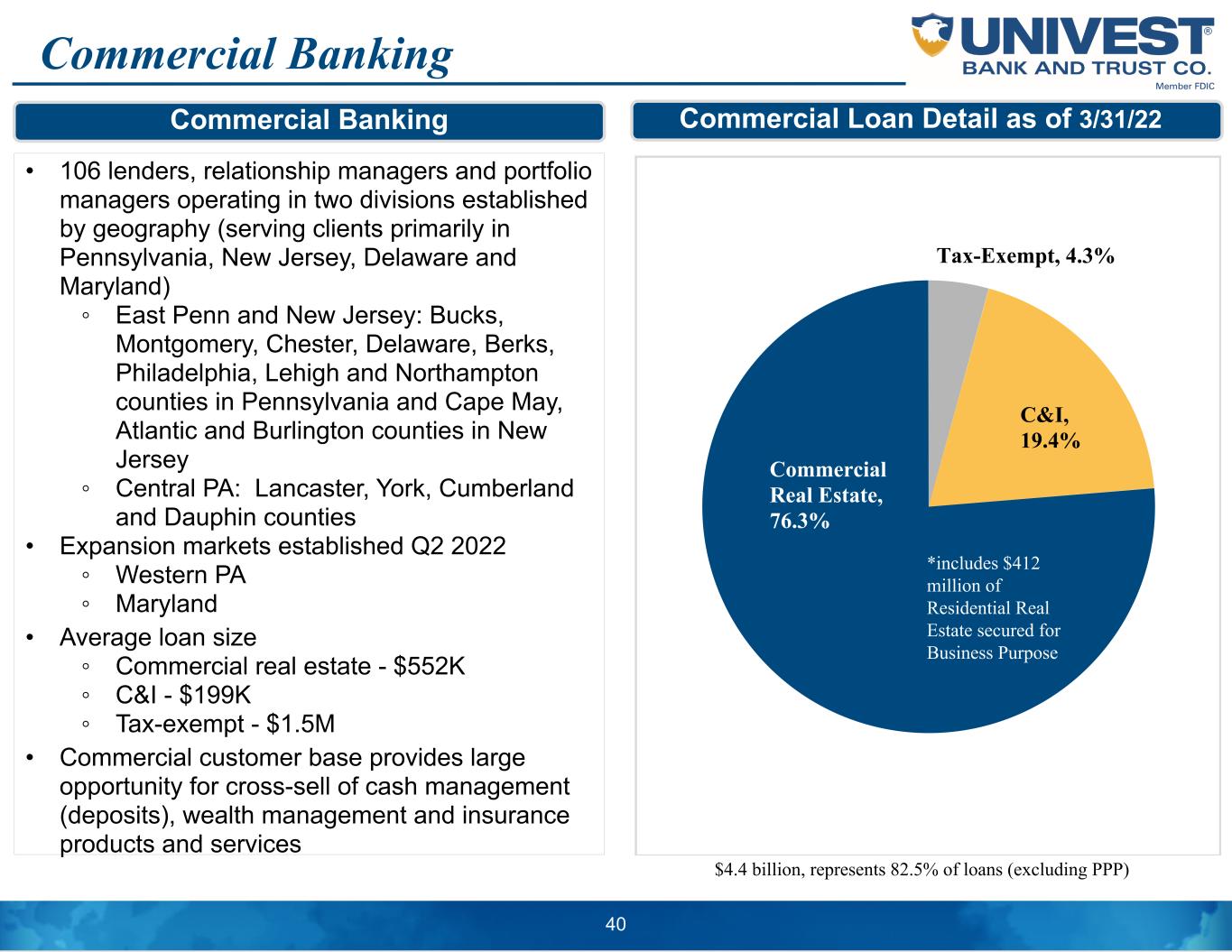

Joint signature up to $5.0MM, then management level loan committee for the largest exposures. ◦ Itemized report of all approvals to weekly Officer Loan Committee. • Robust independent loan review process, using team based audits with risk based scope. • Generally, lending is in Pennsylvania, Delaware, New Jersey and Maryland. • Management of risk appetite through quarterly reporting to Enterprise Risk Committee of the Board (“ERM”). ◦ In-House commercial concentrations levels vs. policy limits, out of market lending report, largest commercial borrowers, regulatory concentrations vs. risk based capital, CRE regulatory guidance report. • CRE portfolio trends and market analysis, with stress testing, presented annually to ERM Committee, meeting regulatory expectations for portfolio stress testing. • Independent departments for appraisal and environmental report ordering, construction loan disbursement and monitoring and loan grading risk assessments. • Chief Risk Officer (Megan Santana) reports directly to the Board of Directors. Credit Overview 38 Commercial Banking • 106 lenders, relationship managers and portfolio managers operating in two divisions established by geography (serving clients primarily in Pennsylvania, New Jersey, Delaware and Maryland) ◦ East Penn and New Jersey: Bucks, Montgomery, Chester, Delaware, Berks, Philadelphia, Lehigh and Northampton counties in Pennsylvania and Cape May, Atlantic and Burlington counties in New Jersey ◦ Central PA: Lancaster, York, Cumberland and Dauphin counties • Expansion markets established Q2 2022 ◦ Western PA ◦ Maryland • Average loan size ◦ Commercial real estate - $552K ◦ C&I - $199K ◦ Tax-exempt - $1.5M • Commercial customer base provides large opportunity for cross-sell of cash management (deposits), wealth management and insurance products and services Tax-Exempt, 4.3% C&I, 19.4% Commercial Real Estate, 76.3% $4.4 billion, represents 82.5% of loans (excluding PPP) *includes $412 million of Residential Real Estate secured for Business Purpose 40 Commercial Banking Commercial Loan Detail as of 3/31/22

LINE OF BUSINESS OVERVIEW

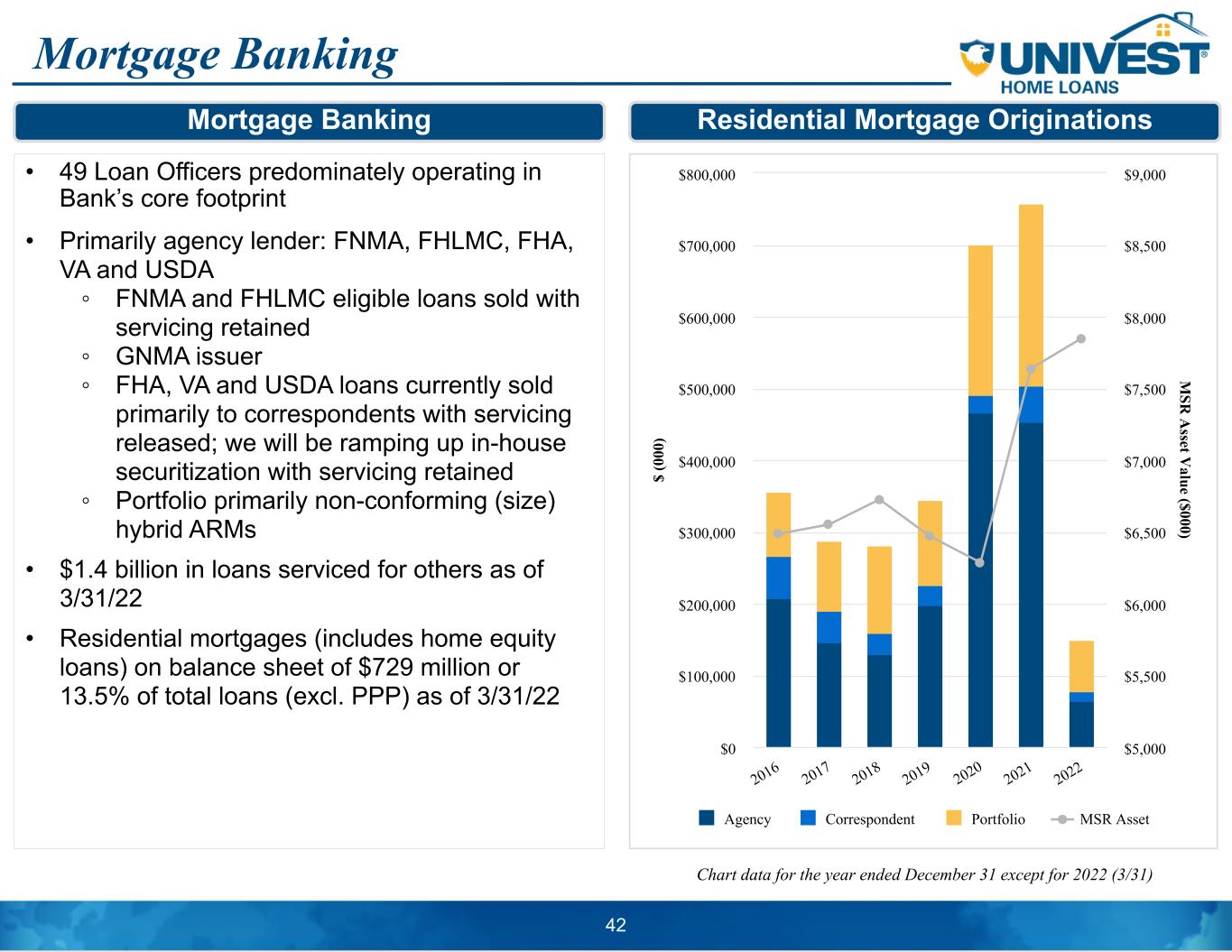

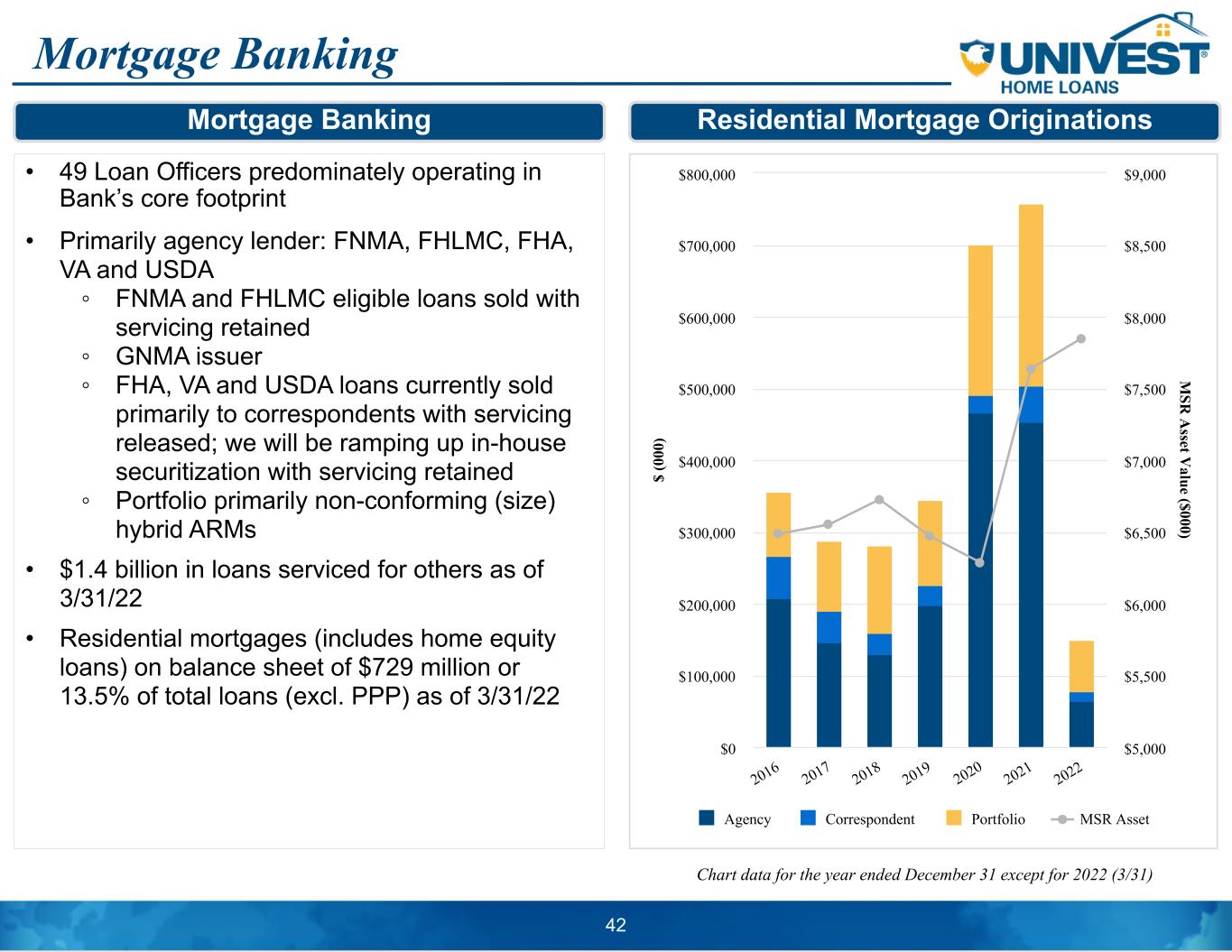

Consumer Banking • 28 financial service centers located in Bucks, Chester, Lancaster, Lehigh, Montgomery, Northampton, Philadelphia, Dauphin and York counties in PA and Ocean City, NJ; also operating 14 retirement centers in Bucks and Montgomery counties and 9 Regional Centers (Deposit Taking) • Proactively addressed continued reduction in transactional volume by closing 21 financial centers since September 2015; Reinvesting savings in our digital solutions and expanded operating footprint • Financial centers staffed by combination of personal bankers and tellers, providing both transaction and consultative services augmented by technology • Focused on creating seamless customer experience between in-person and digital • Growth strategy focused on obtaining consumer business from commercial customers and their employee base 41 Mortgage Banking • 49 Loan Officers predominately operating in Bank’s core footprint • Primarily agency lender: FNMA, FHLMC, FHA, VA and USDA ◦ FNMA and FHLMC eligible loans sold with servicing retained ◦ GNMA issuer ◦ FHA, VA and USDA loans currently sold primarily to correspondents with servicing released; we will be ramping up in-house securitization with servicing retained ◦ Portfolio primarily non-conforming (size) hybrid ARMs • $1.4 billion in loans serviced for others as of 3/31/22 • Residential mortgages (includes home equity loans) on balance sheet of $729 million or 13.5% of total loans (excl.

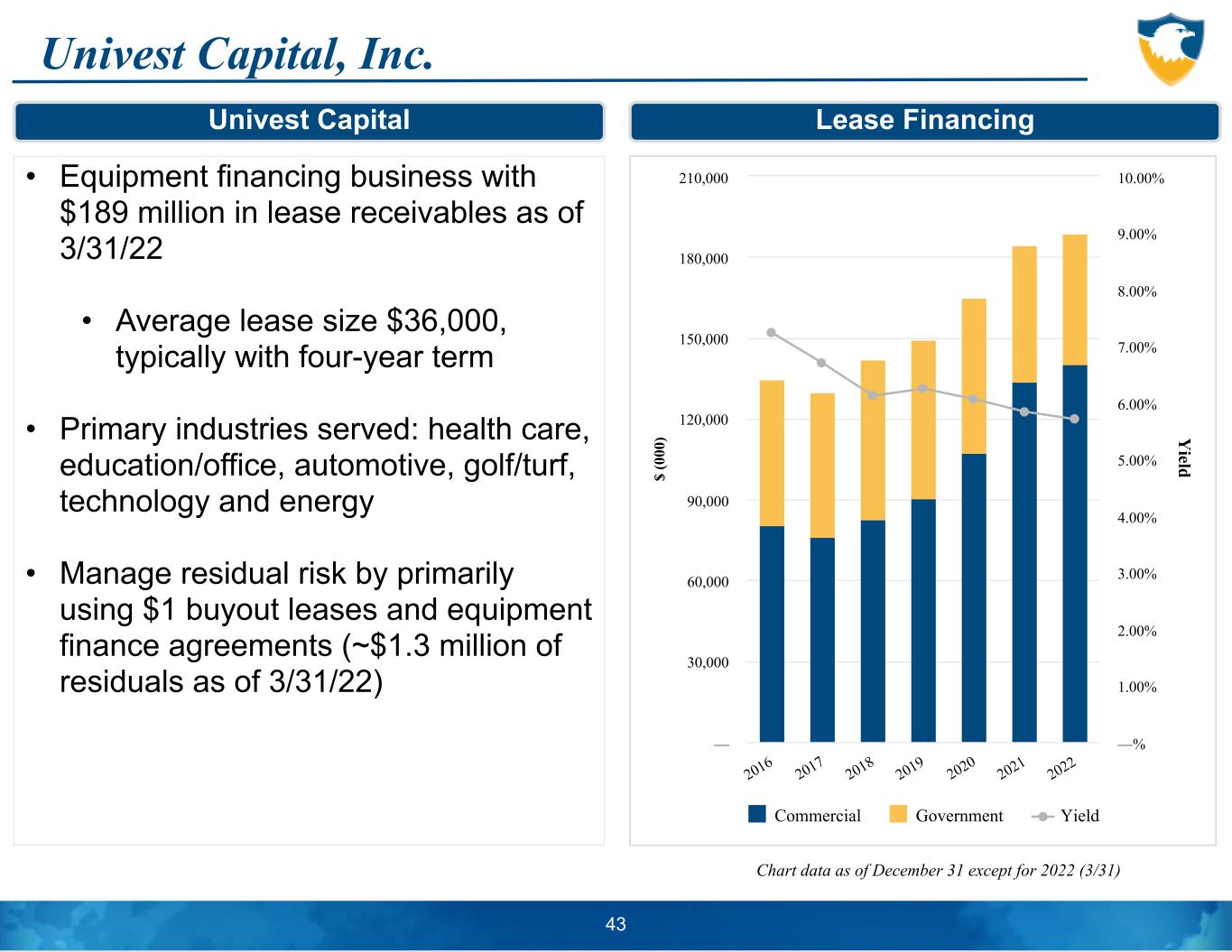

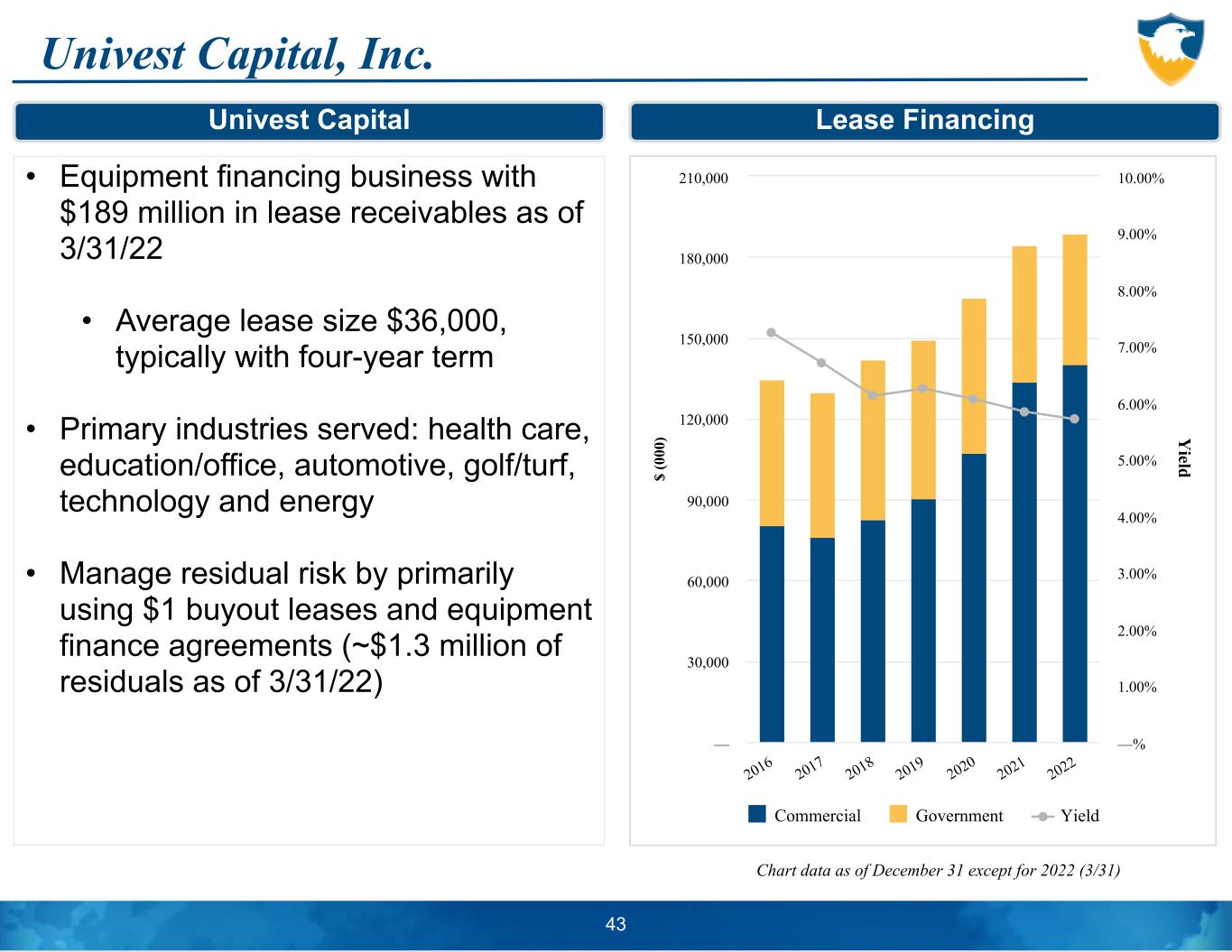

PPP) as of 3/31/22 Chart data for the year ended December 31 except for 2022 (3/31) 42 $ (0 00 ) M SR A sset V alue ($000) Agency Correspondent Portfolio MSR Asset 2016 2017 2018 2019 2020 2021 2022 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $5,000 $5,500 $6,000 $6,500 $7,000 $7,500 $8,000 $8,500 $9,000 Mortgage Banking Residential Mortgage Originations Univest Capital, Inc. • Equipment financing business with $189 million in lease receivables as of 3/31/22 • Average lease size $36,000, typically with four-year term • Primary industries served: health care, education/office, automotive, golf/turf, technology and energy • Manage residual risk by primarily using $1 buyout leases and equipment finance agreements (~$1.3 million of residuals as of 3/31/22) Chart data as of December 31 except for 2022 (3/31) 43 $ (0 00 ) Y ield Commercial Government Yield 2016 2017 2018 2019 2020 2021 2022 — 30,000 60,000 90,000 120,000 150,000 180,000 210,000 —% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% Univest Capital Lease Financing

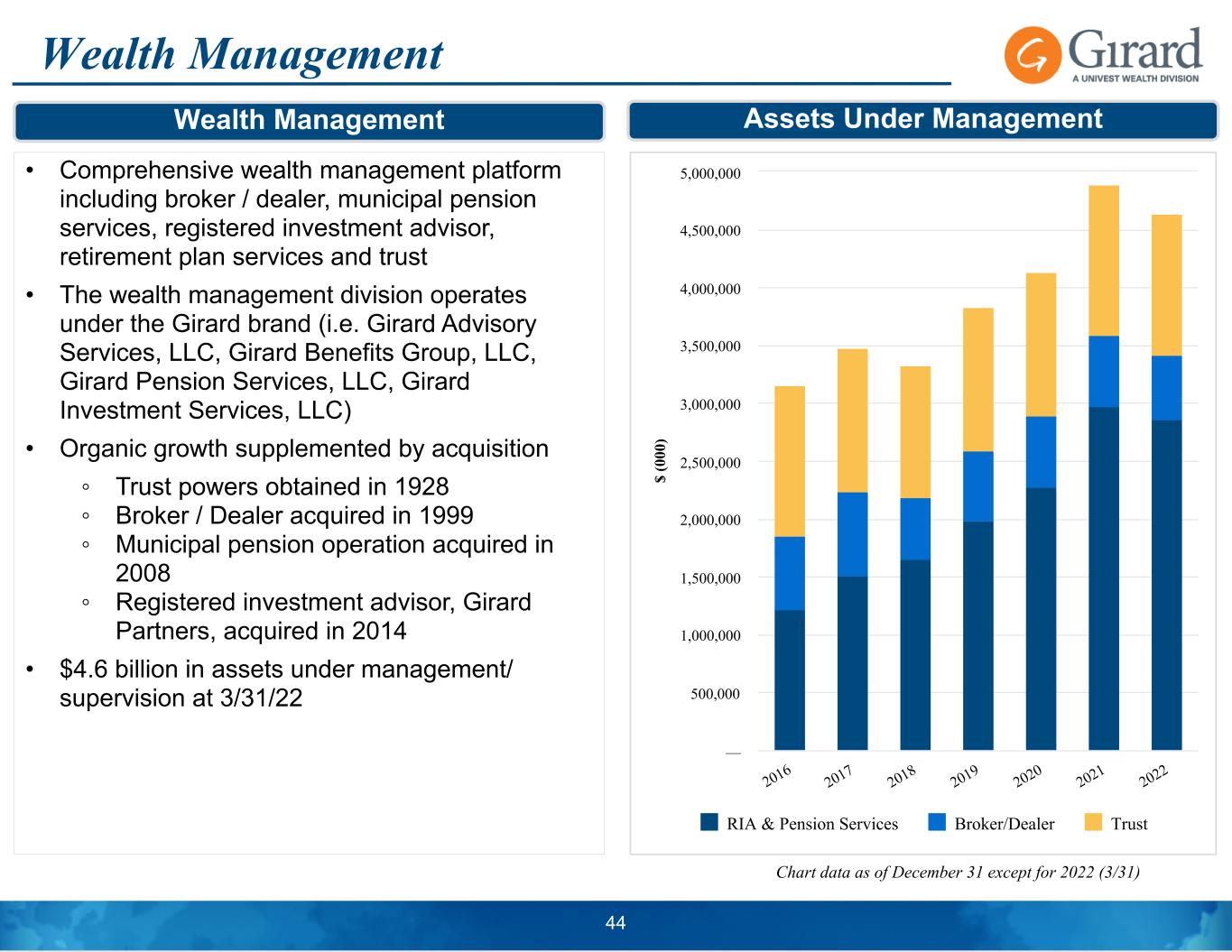

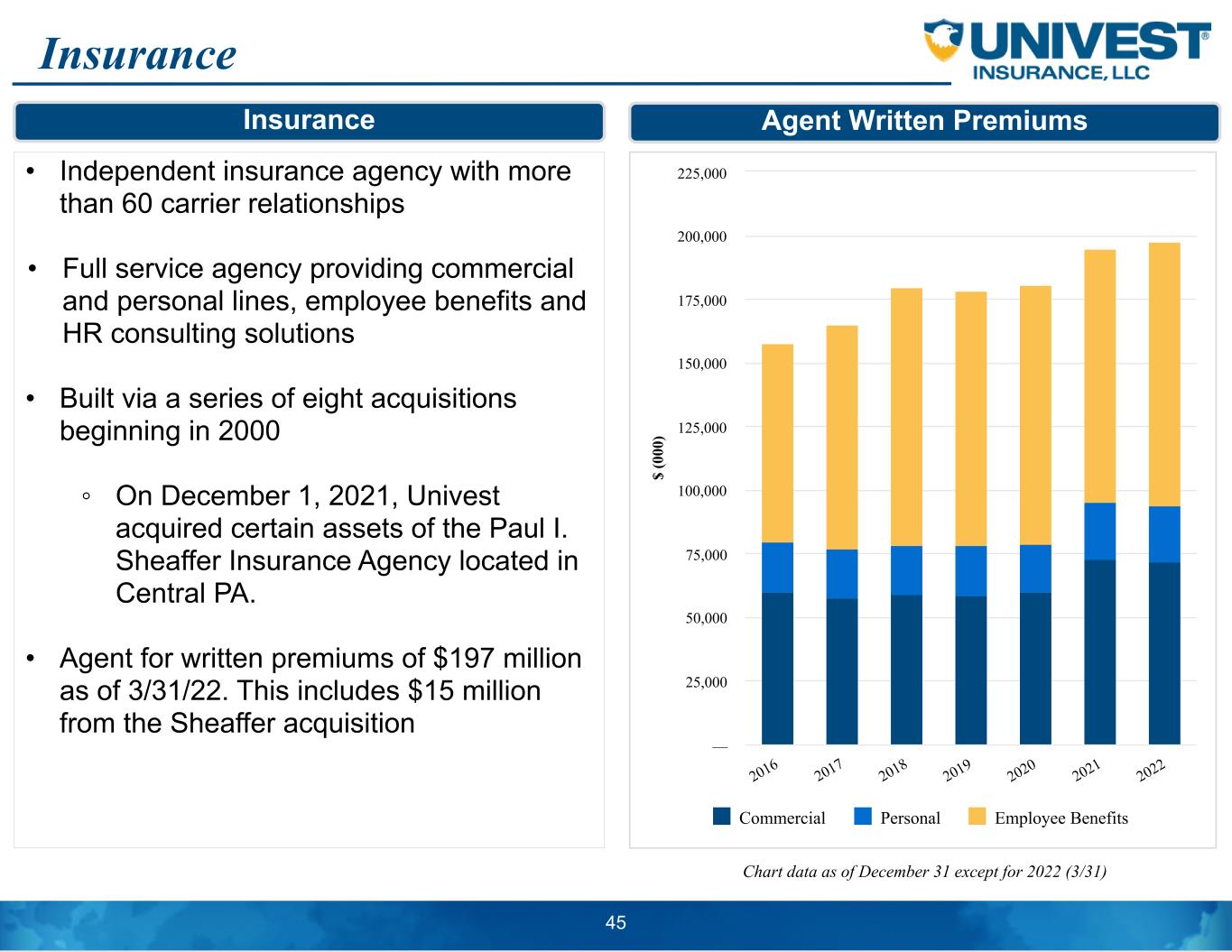

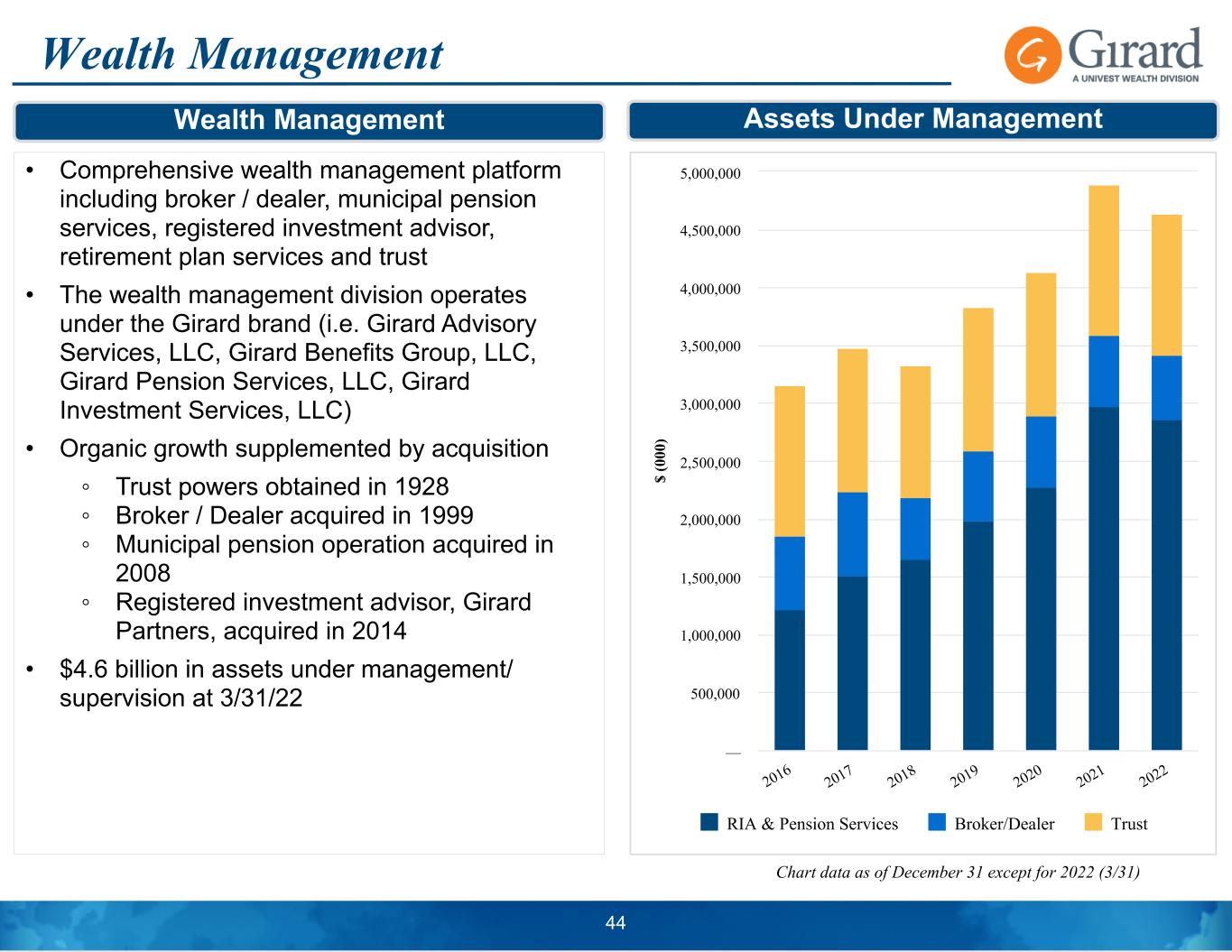

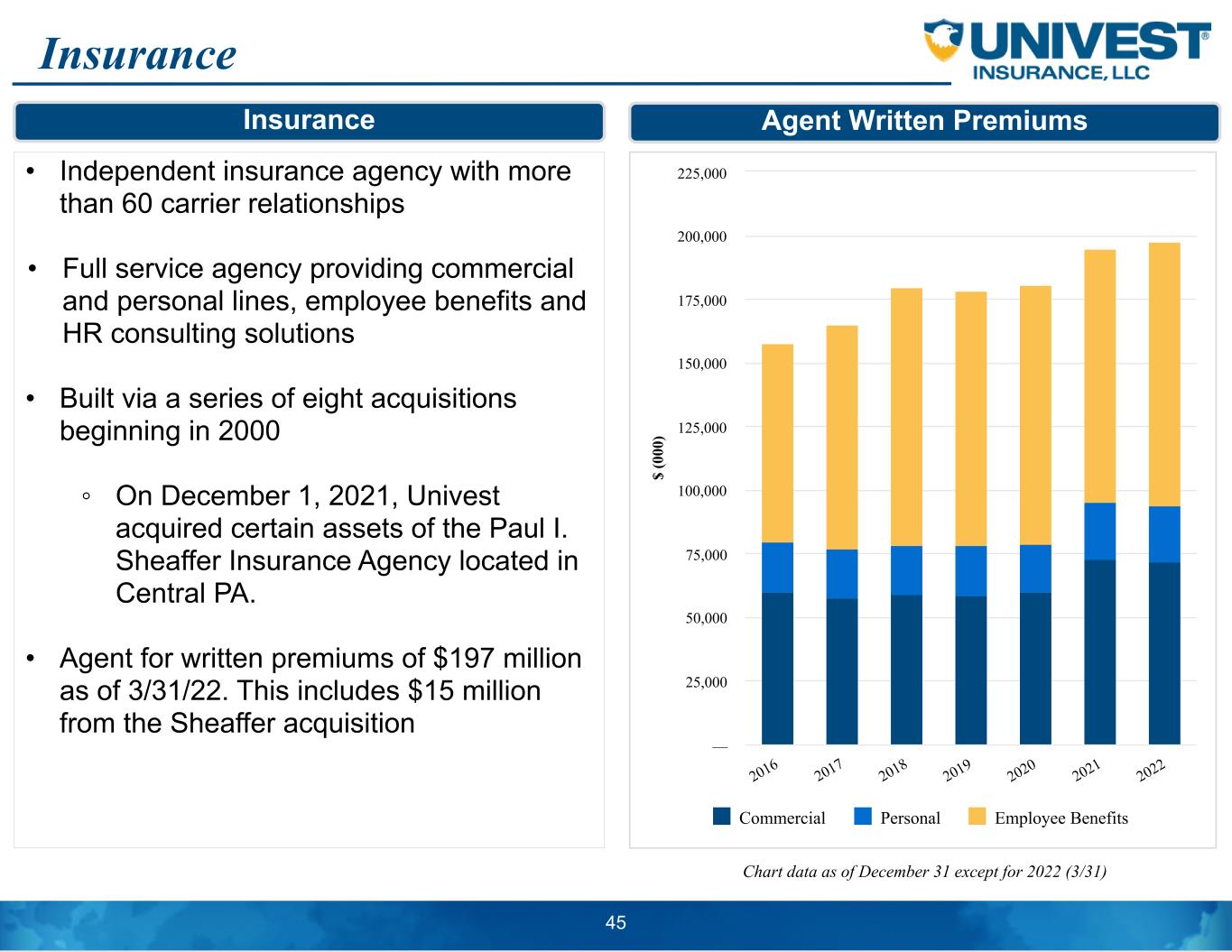

Wealth Management • Comprehensive wealth management platform including broker / dealer, municipal pension services, registered investment advisor, retirement plan services and trust • The wealth management division operates under the Girard brand (i.e. Girard Advisory Services, LLC, Girard Benefits Group, LLC, Girard Pension Services, LLC, Girard Investment Services, LLC) • Organic growth supplemented by acquisition ◦ Trust powers obtained in 1928 ◦ Broker / Dealer acquired in 1999 ◦ Municipal pension operation acquired in 2008 ◦ Registered investment advisor, Girard Partners, acquired in 2014 • $4.6 billion in assets under management/ supervision at 3/31/22 Chart data as of December 31 except for 2022 (3/31) $ (0 00 ) RIA & Pension Services Broker/Dealer Trust 2016 2017 2018 2019 2020 2021 2022 — 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 5,000,000 44 Wealth Management Assets Under Management Insurance • Independent insurance agency with more than 60 carrier relationships • Full service agency providing commercial and personal lines, employee benefits and HR consulting solutions • Built via a series of eight acquisitions beginning in 2000 ◦ On December 1, 2021, Univest acquired certain assets of the Paul I. Sheaffer Insurance Agency located in Central PA. • Agent for written premiums of $197 million as of 3/31/22.

This includes $15 million from the Sheaffer acquisition Chart data as of December 31 except for 2022 (3/31) $ (0 00 ) Commercial Personal Employee Benefits 2016 2017 2018 2019 2020 2021 2022 — 25,000 50,000 75,000 100,000 125,000 150,000 175,000 200,000 225,000 45 Insurance Agent Written Premiums Appendix – Non-GAAP Reconciliations 1.

APPENDIX (Non-GAAP Reconciliations)

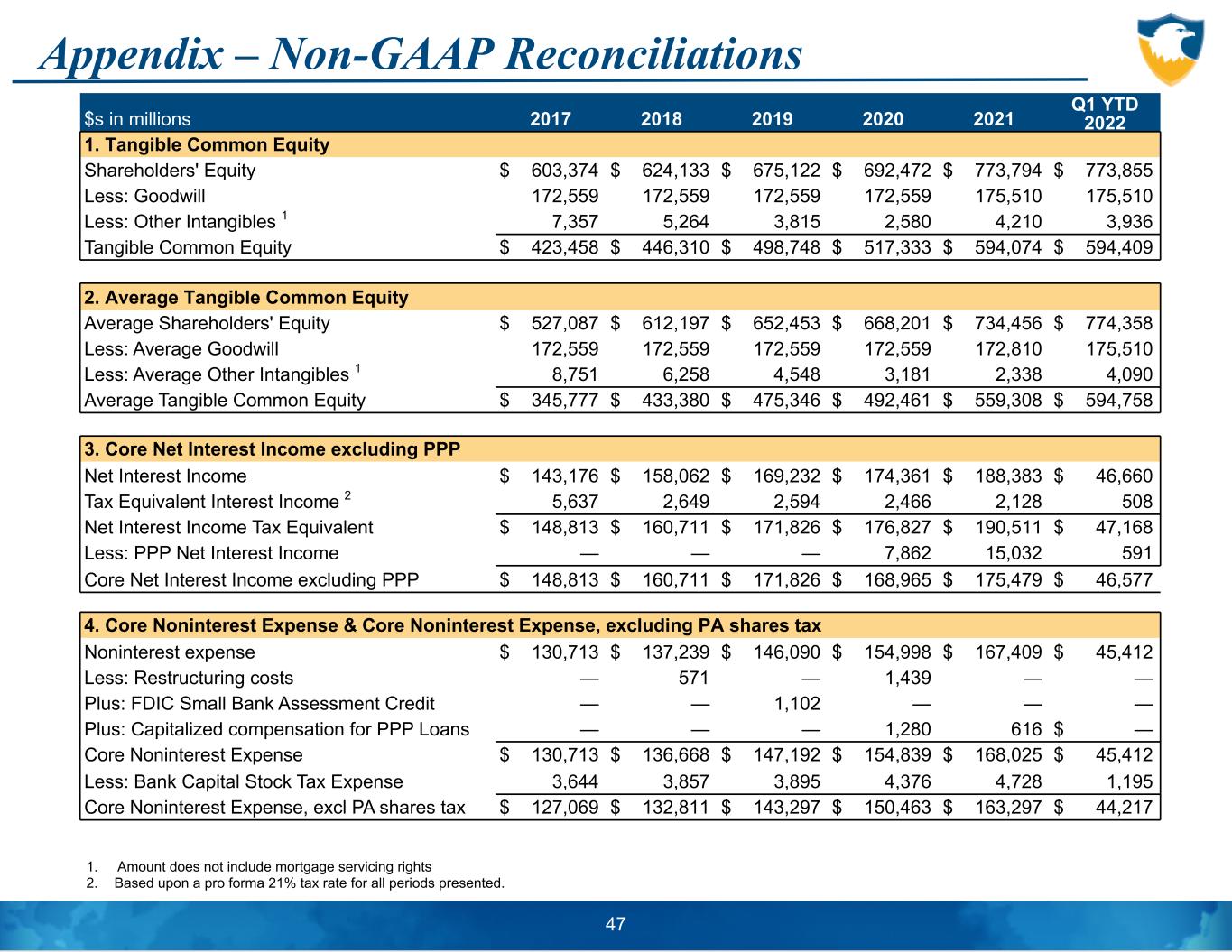

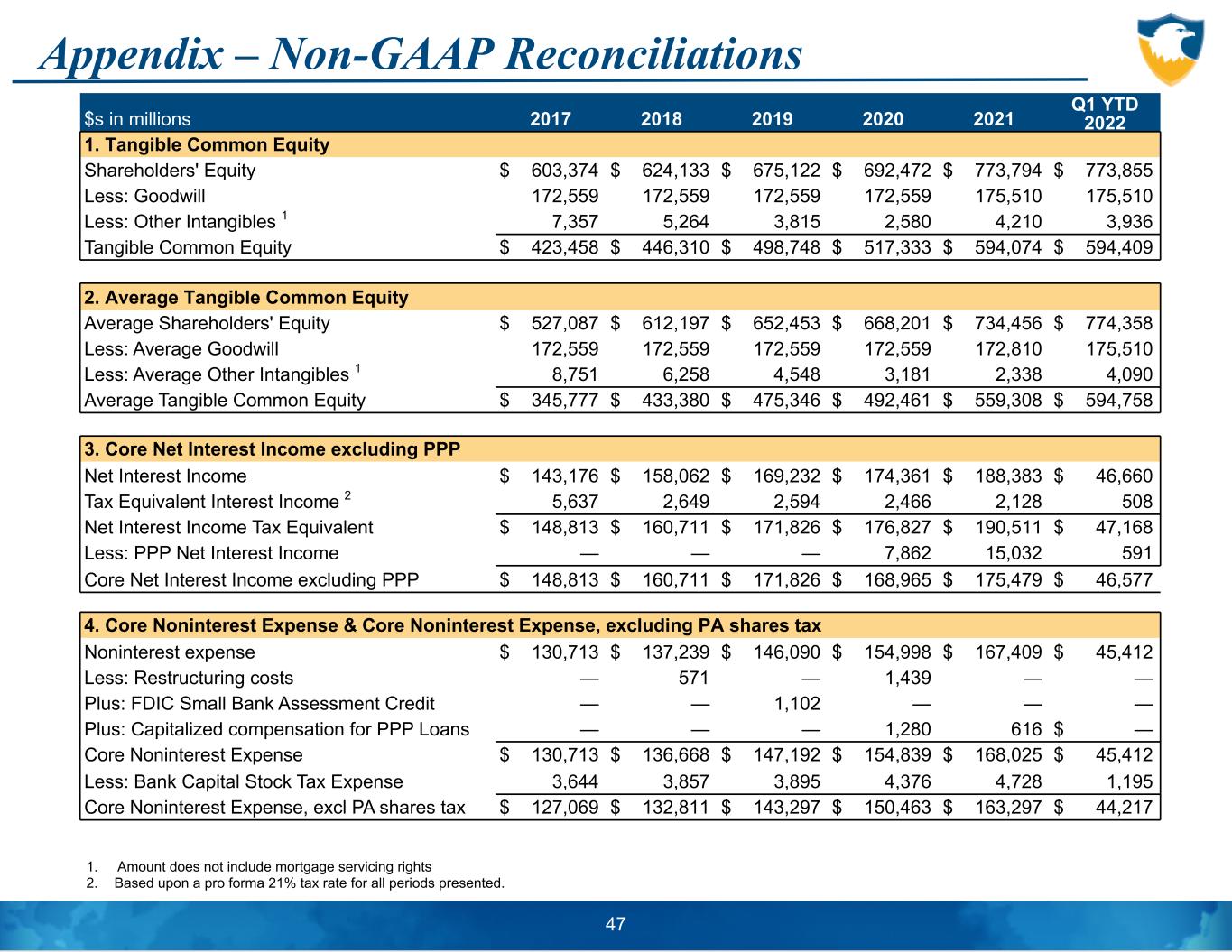

Amount does not include mortgage servicing rights 2. Based upon a pro forma 21% tax rate for all periods presented. $s in millions 2017 2018 2019 2020 2021 Q1 YTD 2022 1. Tangible Common Equity Shareholders' Equity $ 603,374 $ 624,133 $ 675,122 $ 692,472 $ 773,794 $ 773,855 Less: Goodwill 172,559 172,559 172,559 172,559 175,510 175,510 Less: Other Intangibles 1 7,357 5,264 3,815 2,580 4,210 3,936 Tangible Common Equity $ 423,458 $ 446,310 $ 498,748 $ 517,333 $ 594,074 $ 594,409 2. Average Tangible Common Equity Average Shareholders' Equity $ 527,087 $ 612,197 $ 652,453 $ 668,201 $ 734,456 $ 774,358 Less: Average Goodwill 172,559 172,559 172,559 172,559 172,810 175,510 Less: Average Other Intangibles 1 8,751 6,258 4,548 3,181 2,338 4,090 Average Tangible Common Equity $ 345,777 $ 433,380 $ 475,346 $ 492,461 $ 559,308 $ 594,758 3. Core Net Interest Income excluding PPP Net Interest Income $ 143,176 $ 158,062 $ 169,232 $ 174,361 $ 188,383 $ 46,660 Tax Equivalent Interest Income 2 5,637 2,649 2,594 2,466 2,128 508 Net Interest Income Tax Equivalent $ 148,813 $ 160,711 $ 171,826 $ 176,827 $ 190,511 $ 47,168 Less: PPP Net Interest Income — — — 7,862 15,032 591 Core Net Interest Income excluding PPP $ 148,813 $ 160,711 $ 171,826 $ 168,965 $ 175,479 $ 46,577 4. Core Noninterest Expense & Core Noninterest Expense, excluding PA shares tax Noninterest expense $ 130,713 $ 137,239 $ 146,090 $ 154,998 $ 167,409 $ 45,412 Less: Restructuring costs — 571 — 1,439 — — Plus: FDIC Small Bank Assessment Credit — — 1,102 — — — Plus: Capitalized compensation for PPP Loans — — — 1,280 616 $ — Core Noninterest Expense $ 130,713 $ 136,668 $ 147,192 $ 154,839 $ 168,025 $ 45,412 Less: Bank Capital Stock Tax Expense 3,644 3,857 3,895 4,376 4,728 1,195 Core Noninterest Expense, excl PA shares tax $ 127,069 $ 132,811 $ 143,297 $ 150,463 $ 163,297 $ 44,217 47 Appendix – Non-GAAP Reconciliations (cont.) 1.

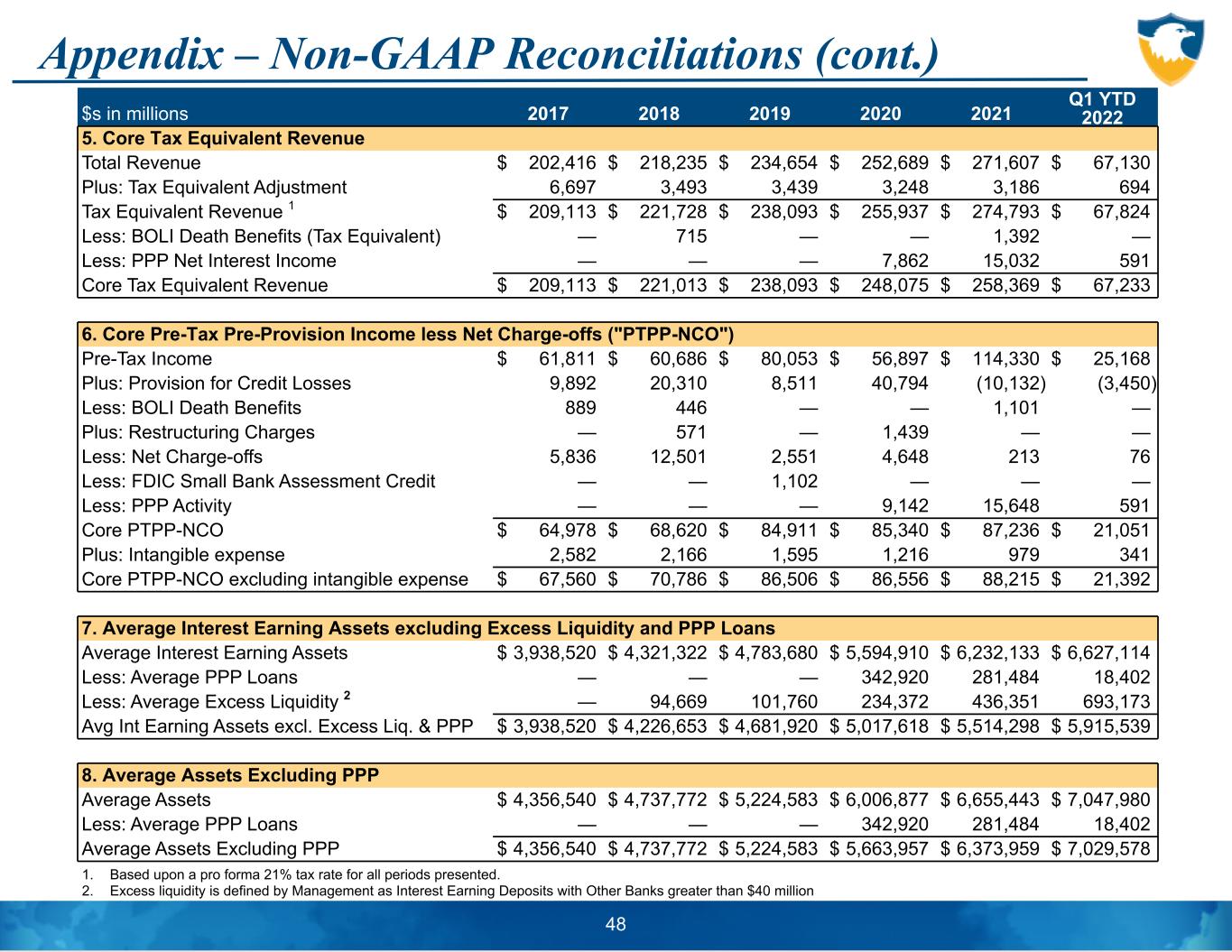

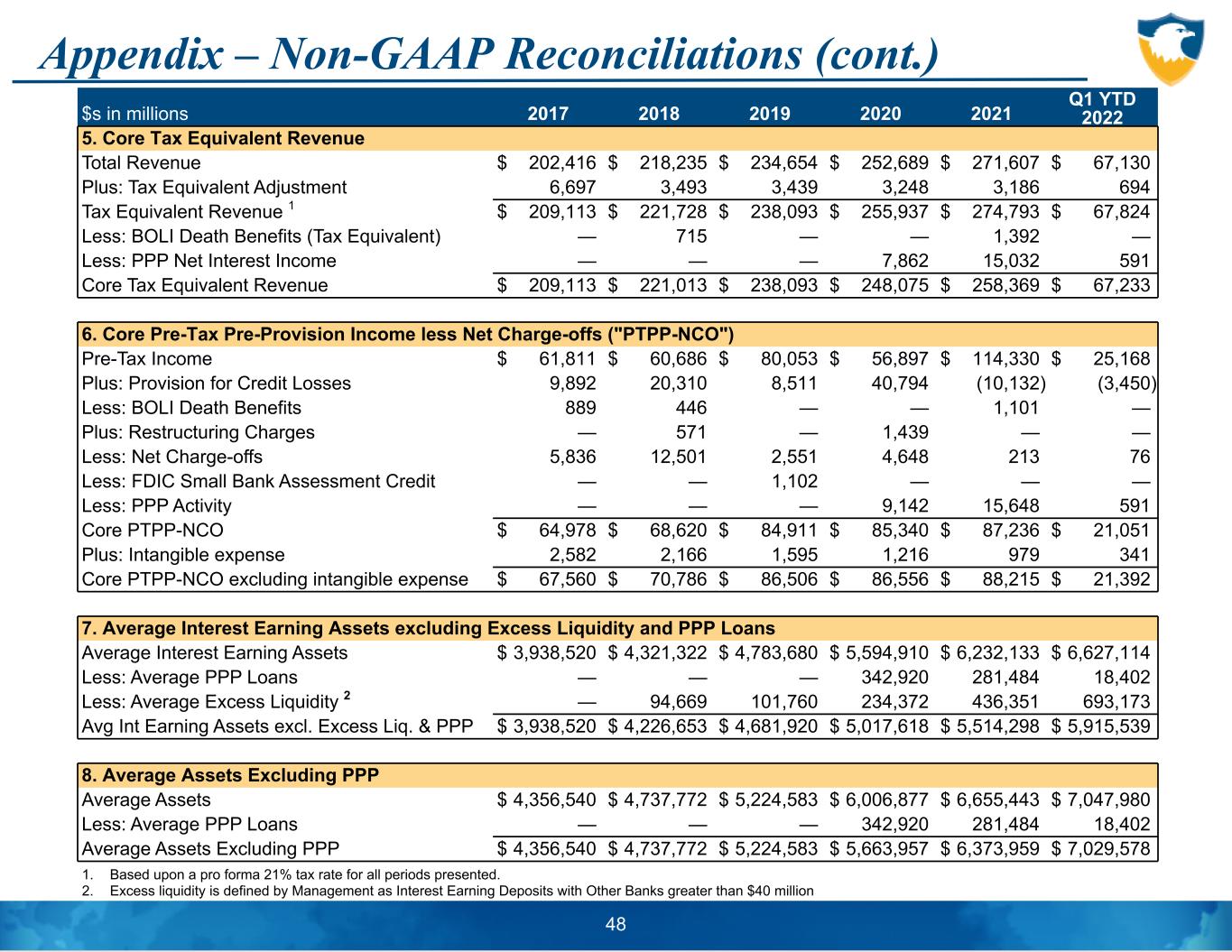

Based upon a pro forma 21% tax rate for all periods presented. 2. Excess liquidity is defined by Management as Interest Earning Deposits with Other Banks greater than $40 million 48 $s in millions 2017 2018 2019 2020 2021 Q1 YTD 2022 5. Core Tax Equivalent Revenue Total Revenue $ 202,416 $ 218,235 $ 234,654 $ 252,689 $ 271,607 $ 67,130 Plus: Tax Equivalent Adjustment 6,697 3,493 3,439 3,248 3,186 694 Tax Equivalent Revenue 1 $ 209,113 $ 221,728 $ 238,093 $ 255,937 $ 274,793 $ 67,824 Less: BOLI Death Benefits (Tax Equivalent) — 715 — — 1,392 — Less: PPP Net Interest Income — — — 7,862 15,032 591 Core Tax Equivalent Revenue $ 209,113 $ 221,013 $ 238,093 $ 248,075 $ 258,369 $ 67,233 6. Core Pre-Tax Pre-Provision Income less Net Charge-offs ("PTPP-NCO") Pre-Tax Income $ 61,811 $ 60,686 $ 80,053 $ 56,897 $ 114,330 $ 25,168 Plus: Provision for Credit Losses 9,892 20,310 8,511 40,794 (10,132) (3,450) Less: BOLI Death Benefits 889 446 — — 1,101 — Plus: Restructuring Charges — 571 — 1,439 — — Less: Net Charge-offs 5,836 12,501 2,551 4,648 213 76 Less: FDIC Small Bank Assessment Credit — — 1,102 — — — Less: PPP Activity — — — 9,142 15,648 591 Core PTPP-NCO $ 64,978 $ 68,620 $ 84,911 $ 85,340 $ 87,236 $ 21,051 Plus: Intangible expense 2,582 2,166 1,595 1,216 979 341 Core PTPP-NCO excluding intangible expense $ 67,560 $ 70,786 $ 86,506 $ 86,556 $ 88,215 $ 21,392 7. Average Interest Earning Assets excluding Excess Liquidity and PPP Loans Average Interest Earning Assets $ 3,938,520 $ 4,321,322 $ 4,783,680 $ 5,594,910 $ 6,232,133 $ 6,627,114 Less: Average PPP Loans — — — 342,920 281,484 18,402 Less: Average Excess Liquidity 2 — 94,669 101,760 234,372 436,351 693,173 Avg Int Earning Assets excl. Excess Liq. & PPP $ 3,938,520 $ 4,226,653 $ 4,681,920 $ 5,017,618 $ 5,514,298 $ 5,915,539 8. Average Assets Excluding PPP Average Assets $ 4,356,540 $ 4,737,772 $ 5,224,583 $ 6,006,877 $ 6,655,443 $ 7,047,980 Less: Average PPP Loans — — — 342,920 281,484 18,402 Average Assets Excluding PPP $ 4,356,540 $ 4,737,772 $ 5,224,583 $ 5,663,957 $ 6,373,959 $ 7,029,578