false0000035527Fifth Third BancorpDepositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock00000355272025-11-062025-11-060000035527us-gaap:CommonStockMember2025-11-062025-11-060000035527fitb:DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf6.625FixedToFloatingRateNotCumulativePerpetualPreferredStockSeriesI2Member2025-11-062025-11-060000035527fitb:DepositarySharesRepresentingA140thOwnershipInterestInAShareOf6.00NotCumulativePerpetualClassBPreferredStockSeriesAMember2025-11-062025-11-060000035527fitb:DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf4.95NotCumulativePerpetualPreferredStockSeriesKMember2025-11-062025-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 6, 2025

Fifth Third Bancorp

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ohio |

|

001-33653 |

|

31-0854434 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fifth Third Center |

|

|

| 38 Fountain Square Plaza |

, |

Cincinnati |

, |

Ohio |

|

45263 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(800) 972-3030

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, Without Par Value |

|

FITB |

|

The |

NASDAQ |

Stock Market LLC |

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series I |

|

FITBI |

|

The |

NASDAQ |

Stock Market LLC |

| Depositary Shares Representing a 1/40th Ownership Interest in a Share of 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A |

|

FITBP |

|

The |

NASDAQ |

Stock Market LLC |

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 4.95% Non-Cumulative Perpetual Preferred Stock, Series K |

|

FITBO |

|

The |

NASDAQ |

Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On November 7, 2025, Fifth Third Bancorp will present at the 2025 BancAnalysts Association of Boston's Annual Bank Conference. A copy of this presentation is attached as Exhibit 99.1.

The information in this Form 8-K and Exhibits attached hereto shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Exchange Act of 1934 or the Securities Act of 1933, except as shall be expressly set forth by specific reference.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “achieve,” “anticipate,” “assume,” “believe,” “could,” “deliver,” “drive,” “enhance,” “estimate,” “expect,” “focus,” “future,” “goal,” “grow,” “guidance,” “intend,” “may,” “might,” “plan,” “position,” “potential,” “predict,” “project,” “opportunity,” “outlook,” “should,” “strategy,” “target,” “trajectory,” “trend,” “will,” “would,” and other similar words and expressions or the negative of such terms or other comparable terminology. Forward-looking statements include, but are not limited to, statements about our business strategy, goals and objectives, projected financial and operating results, including outlook for future growth, and future common share dividends, common share repurchases and other uses of capital. These statements are not historical facts, but instead represent our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of our control.

Comerica Incorporated’s (“Comerica”) and Fifth Third Bancorp’s (“Fifth Third”) actual results and financial condition may differ materially from those indicated in these forward-looking statements. Important factors that could cause Comerica’s and Fifth Third’s actual results, financial condition and predictions to differ materially from those indicated in such forward-looking statements include, in addition to those set forth in our and Fifth Third’s filings with the U.S. Securities and Exchange Commission (the “SEC”): (1) the risk that the cost savings and synergies from the merger of Comerica with Fifth Third (the “Transaction”) may not be fully realized or may take longer than anticipated to be realized; (2) the failure of the closing conditions in the merger agreement between Comerica and Fifth Third providing for the Transaction to be satisfied, or any unexpected delay in closing the Transaction or the occurrence of any event, change or other circumstances, including the impact and timing of any government shutdown, that could delay the Transaction or could give rise to the termination of the merger agreement; (3) the outcome of any legal or regulatory proceedings or governmental inquiries or investigations that may be currently pending or later instituted against Comerica, Fifth Third or the combined company; (4) the possibility that the Transaction does not close when expected or at all because required regulatory, stockholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed Transaction); (5) the risk that the benefits from the Transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in, or problems arising from, general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Comerica and Fifth Third operate; (6) disruption to the parties’ businesses as a result of the announcement and pendency of the Transaction; (7) the costs associated with the anticipated length of time of the pendency of the Transaction, including the restrictions contained in the definitive merger agreement on the ability of Comerica or Fifth Third to operate its business outside the ordinary course during the pendency of the Transaction; (8) risks related to management and oversight of the expanded business and operations of the combined company following the closing of the proposed Transaction; (9) the risk that the integration of each party’s operations will be materially delayed or will be more costly or difficult than expected or that the parties are otherwise unable to successfully integrate each party’s businesses into the other’s businesses; (10) the possibility that the Transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (11) reputational risk and potential adverse reactions of Comerica or Fifth Third customers, employees, vendors, contractors or other business partners, including those resulting from the announcement or completion of the Transaction; (12) the dilution caused by Fifth Third’s issuance of additional shares of its common stock in connection with the Transaction; (13) a material adverse change in the condition of Comerica or Fifth Third;(14) the extent to which Comerica’s or Fifth Third’s businesses perform consistent with management’s expectations; (15) Comerica’s and Fifth Third’s ability to take advantage of growth opportunities and implement targeted initiatives in the timeframe and on the terms currently expected; (16) the inability to sustain revenue and earnings growth; (17) the execution and efficacy of recent strategic investments; (18) the timing and impact of Comerica’s Direct Express transition; (19) the impact of macroeconomic factors, such as changes in general economic conditions and monetary and fiscal policy, particularly on interest rates; (20) changes in customer behavior; (21) unfavorable developments concerning credit quality; (22) declines in the businesses or industries of Comerica’s or Fifth Third’s customers; (23) the possibility that the combined company is subject to additional regulatory requirements as a result of the proposed Transaction of expansion of the combined company’s business operations following the proposed Transaction;(24) general competitive, political and market conditions and other factors that may affect future results of Comerica and Fifth Third including changes in asset quality and credit risk; (25) security risks, including cybersecurity and data privacy risks, and capital markets; (26) inflation; (27) the impact, extent and timing of technological changes; (28) capital management activities; (29) competitive product and pricing pressures; (30) the outcomes of legal and regulatory proceedings and related financial services industry matters; and (31) compliance with regulatory requirements.

Any forward-looking statement made in this Current Report on Form 8-K is based solely on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except to the extent required by law. These and other important factors, including those discussed under “Risk Factors” in Comerica’s Annual Report on Form 10-K for the year ended December 31, 2024 (available at:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000028412/000002841225000108/cma-20241231.htm), and in Fifth Third’s Annual Report on Form 10-K for the year ended December 31, 2024 (available at: https://www.sec.gov/ix?doc=/Archives/edgar/data/0000035527/000003552725000079/fitb-20241231.htm), as well as Comerica’s and Fifth Third’s subsequent filings with the SEC, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements herein are made only as of the date they were first issued, and unless otherwise required by applicable securities laws, Comerica and Fifth Third disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

ADDITIONAL INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT

Fifth Third filed a registration statement on Form S-4 (File No. 333-291296) with the SEC to register the shares of Fifth Third common stock that will be issued to Comerica stockholders in connection with the proposed Transaction. The registration statement, which is not yet effective, includes a joint proxy statement of Comerica and Fifth Third that also constitutes a prospectus of Fifth Third. The definitive joint proxy statement/prospectus will be sent to the stockholders of Comerica and shareholders of Fifth Third in connection with the proposed Transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION REGARDING COMERICA, FIFTH THIRD, THE TRANSACTION AND RELATED MATTERS.

Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Comerica or Fifth Third through the website maintained by the SEC at https://www.sec.gov or by contacting the investor relations department of Comerica or Fifth Third at:

Comerica Inc. Fifth Third Bancorp

Comerica Bank Tower 38 Fountain Square Plaza

1717 Main Street, MC 6404 MD 1090FV

Dallas, TX 75201 Cincinnati, OH 45263

Attention: Investor Relations Attention: Investor Relations

InvestorRelations@comerica.com IR@53.com

(833) 571-0486 (866) 670-0468

Before making any voting or investment decision, investors and security holders of Comerica and Fifth Third are urged to read carefully the entire registration statement and joint proxy statement/prospectus, including any amendments thereto when they become available, because they contain or will contain important information about the proposed Transaction. Free copies of these documents may be obtained as described above.

PARTICIPANTS IN THE SOLICITATION

Comerica, Fifth Third and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Comerica and shareholders of Fifth Third in connection with the Transaction under the rules of the SEC. Information regarding the directors and executive officers of each of Comerica and Fifth Third is set forth in (i) Comerica’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, including under the headings entitled “Information about Nominees and Other Directors”, “Director Independence”, “Transactions with Related Persons”, “Compensation Committee Interlocks and Insider Participation”, “Compensation of Directors”, “Proposal 3 Submitted for your Vote – Non-Binding, Advisory Proposal Approving Executive Compensation”, “Pay Versus Performance”, “Pay Ratio Disclosure” and “Security Ownership of Management”, which was filed with the SEC on March 17, 2025 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000028412/000002841225000135/cma-20250313.htm, and (ii) Fifth Third’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, including under the headings entitled “Board of Directors Compensation”, “Compensation Discussion and Analysis”, “Human Capital and Compensation Committee Report”, “Compensation of Named Executive Officers”, “CEO Pay Ratio”, “Pay vs Performance”, “Company Proposal No.

2: Advisory Vote on Compensation of Named Executive Officers (Item 3 on Proxy Card)” and “Compensation Committee Interlocks and Insider Participation”, which was filed with the SEC on March 4, 2025 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000035527/000119312525045653/d901598ddef14a.htm. To the extent holdings of each of Comerica’s or Fifth Third’s securities by its directors or executive officers have changed since the amounts set forth in Comerica’s or Fifth Third’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC, which are available at https://www.sec.gov/edgar/browse/?CIK=35527&owner=exclude, and at https://www.sec.gov/edgar/browse/?CIK=28412&owner=exclude.

Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the proxy statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of these documents through the website maintained by the SEC at https://www.sec.gov.

NO OFFER OR SOLICITATION

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits

Exhibit 104 – Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FIFTH THIRD BANCORP |

|

|

(Registrant) |

| |

|

|

Date: November 6, 2025 |

|

/s/ Bryan D. Preston |

| |

|

|

|

|

Bryan D. Preston |

|

|

Executive Vice President and

Chief Financial Officer |

EX-99.1

2

a2025baabconference-fina.htm

EX-99.1

a2025baabconference-fina

ibdroot\projects\IBD-NY\burger2025\973442_1\Presentations\05. Investor Presentation\PPT\Express_2.0_v2 - From FITB_v01.pptx © Fifth Third Bancorp | All Rights Reserved BancAnalysts Association of Boston Conference Jamie Leonard | Chief Operating Officer Bryan Preston | Chief Financial Officer November 7, 2025

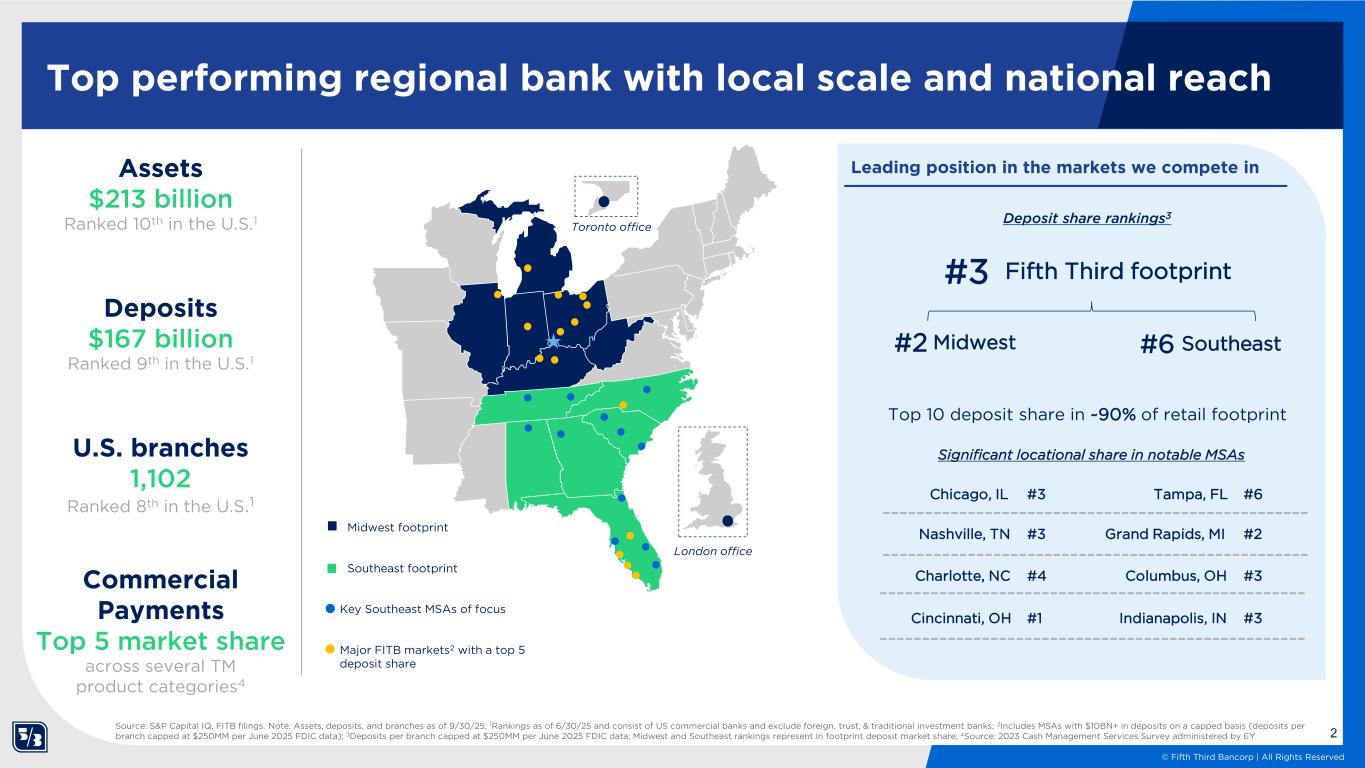

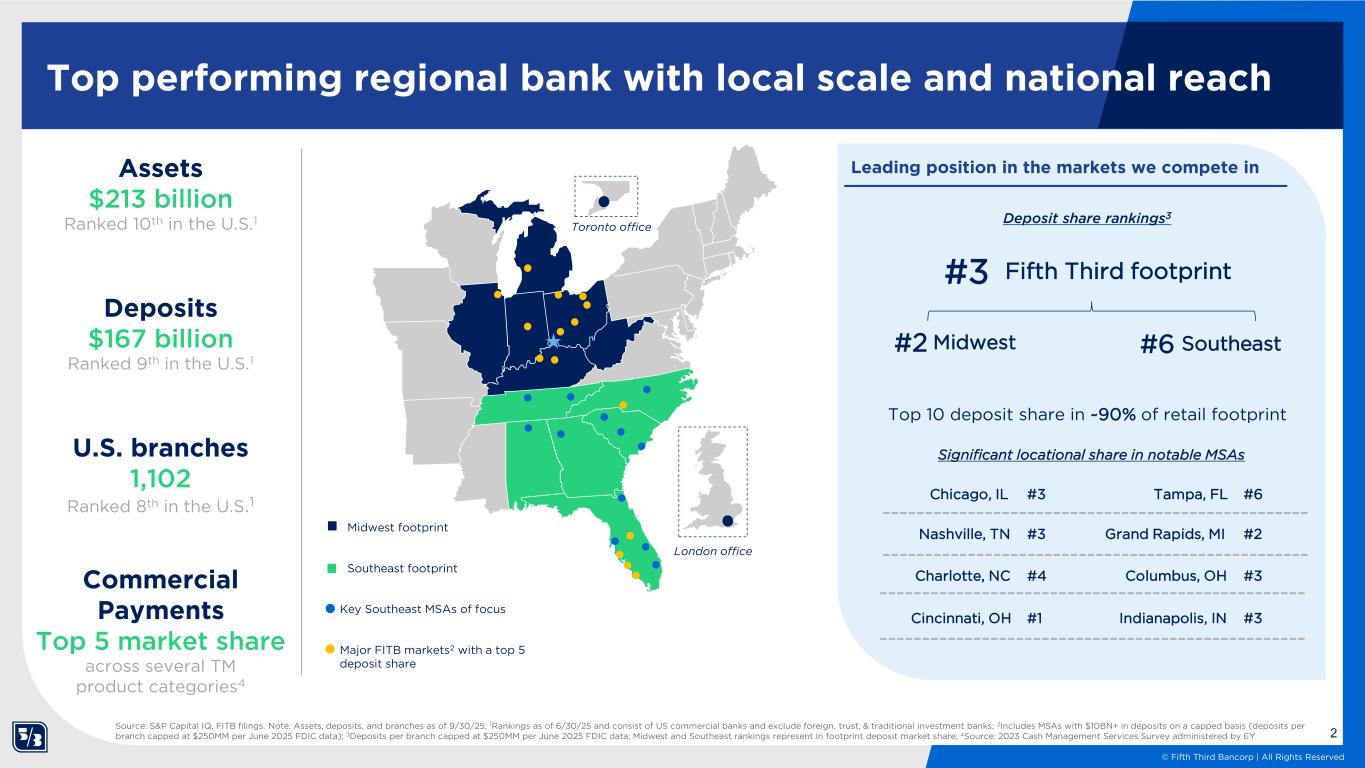

2 © Fifth Third Bancorp | All Rights Reserved Top performing regional bank with local scale and national reach Midwest footprint Major FITB markets2 with a top 5 deposit share Key Southeast MSAs of focus Assets $213 billion Ranked 10th in the U.S.1 Deposits $167 billion Ranked 9th in the U.S.1 U.S. branches 1,102 Ranked 8th in the U.S.1 Commercial Payments Top 5 market share across several TM product categories4 Southeast footprint Leading position in the markets we compete in Toronto office London office Source: S&P Capital IQ, FITB filings. Note: Assets, deposits, and branches as of 9/30/25; 1Rankings as of 6/30/25 and consist of US commercial banks and exclude foreign, trust, & traditional investment banks; 2Includes MSAs with $10BN+ in deposits on a capped basis (deposits per branch capped at $250MM per June 2025 FDIC data); 3Deposits per branch capped at $250MM per June 2025 FDIC data; Midwest and Southeast rankings represent in footprint deposit market share; 4Source: 2023 Cash Management Services Survey administered by EY Deposit share rankings3 #2 #6Midwest Southeast #3 Fifth Third footprint Significant locational share in notable MSAs Nashville, TN Charlotte, NC #3 #4 Cincinnati, OH #1 Chicago, IL #3 Top 10 deposit share in ~90% of retail footprint Columbus, OH Indianapolis, IN #3 #3 Tampa, FL #6 Grand Rapids, MI #2

3 © Fifth Third Bancorp | All Rights Reserved NII contribution1 34% 63% 3% 46% 40% 14%Fee contribution1 A simple, diversified business portfolio • Texas • Commercial Banking Loans $51B Deposits $92B Loans $5B Deposits $10B Loans $68B Deposits $61B Consumer & Small Business Banking Wealth & Asset Management Lending / Deposits / Capital Markets / Treasury Management & Payments Lending / Deposits / Payments Wealth Management / Trust / Custody NII contribution1 Fee contribution1 NII contribution1 Fee contribution1 Business Offerings Business Offerings Business Offerings Note: "World's Most Ethical Companies" and "Ethisphere" names and marks are registered trademarks of Ethisphere LLC.“; #1 for Retail Banking Customer Satisfaction in Florida and the Best Mobile Banking App for Customer Satisfaction among Regional Banks. Tied in 2025. For J.D. Power 2025 award information, visit jdpower.com/awards. J.D. Power 2025 U.S. Banking Mobile App Satisfaction Study; among banks with $65B to $250B in deposits. Visit jdpower.com/awards for more details. 1As a percent of 3Q25 segment revenue, which excludes Other Corporate

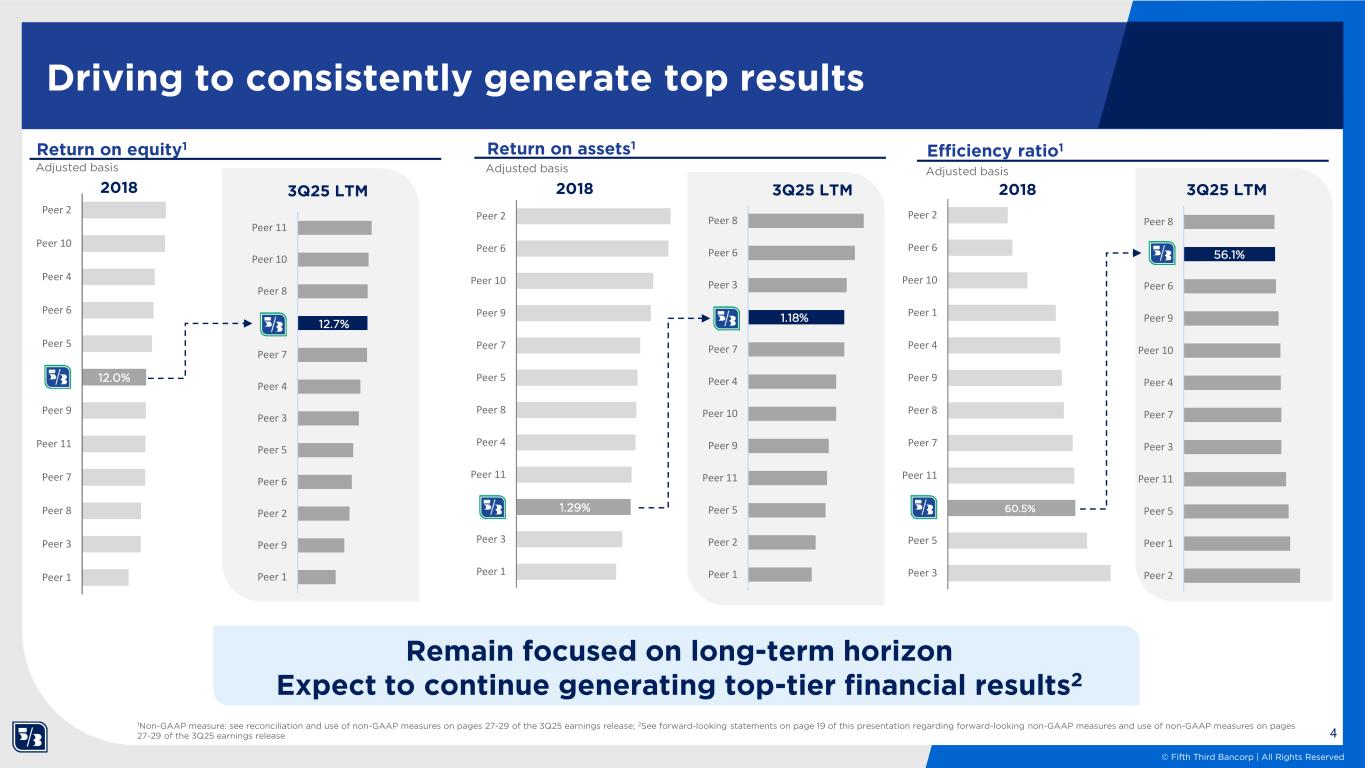

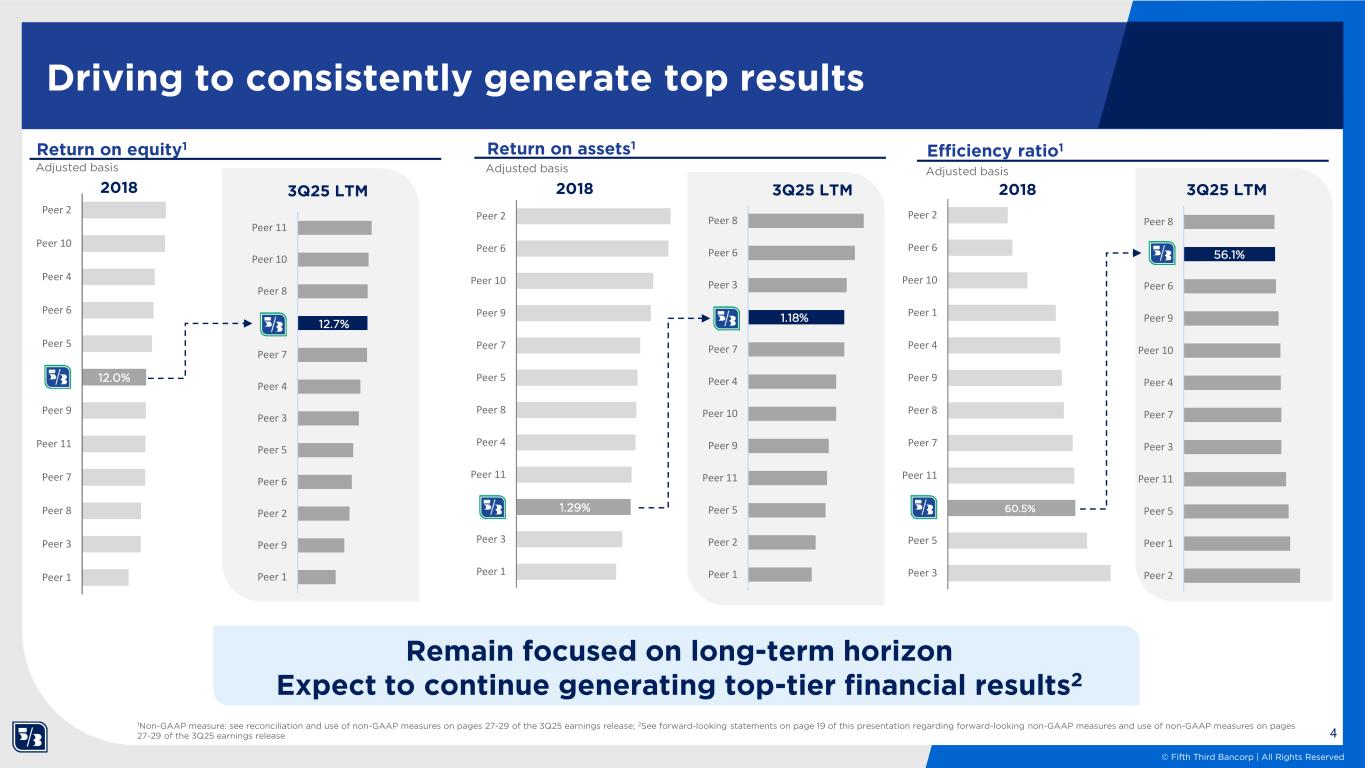

4 © Fifth Third Bancorp | All Rights Reserved 12.7% Peer 1 Peer 9 Peer 2 Peer 6 Peer 5 Peer 3 Peer 4 Peer 7 x Peer 8 Peer 10 Peer 11 3Q25 LTM 56.1% Peer 2 Peer 1 Peer 5 Peer 11 Peer 3 Peer 7 Peer 4 Peer 10 Peer 9 Peer 6 X Peer 8 3Q25 LTM 1.18% Peer 1 Peer 2 Peer 5 Peer 11 Peer 9 Peer 10 Peer 4 Peer 7 x Peer 3 Peer 6 Peer 8 3Q25 LTM Adjusted basis Driving to consistently generate top results 60.5% Peer 3 Peer 5 x Peer 11 Peer 7 Peer 8 Peer 9 Peer 4 Peer 1 Peer 10 Peer 6 Peer 2 1.29% Peer 2 Peer 6 Peer 10 Peer 9 Peer 7 Peer 5 Peer 8 Peer 4 Peer 11 x Peer 3 Peer 1 Return on equity1 2018 2018 Return on assets1 Efficiency ratio1 Adjusted basis Adjusted basis Remain focused on long-term horizon Expect to continue generating top-tier financial results2 1Non-GAAP measure: see reconciliation and use of non-GAAP measures on pages 27-29 of the 3Q25 earnings release; 2See forward-looking statements on page 19 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 3Q25 earnings release 2018 12.0% Peer 2 Peer 10 Peer 4 Peer 6 Peer 5 X Peer 9 Peer 11 Peer 7 Peer 8 Peer 3 Peer 1

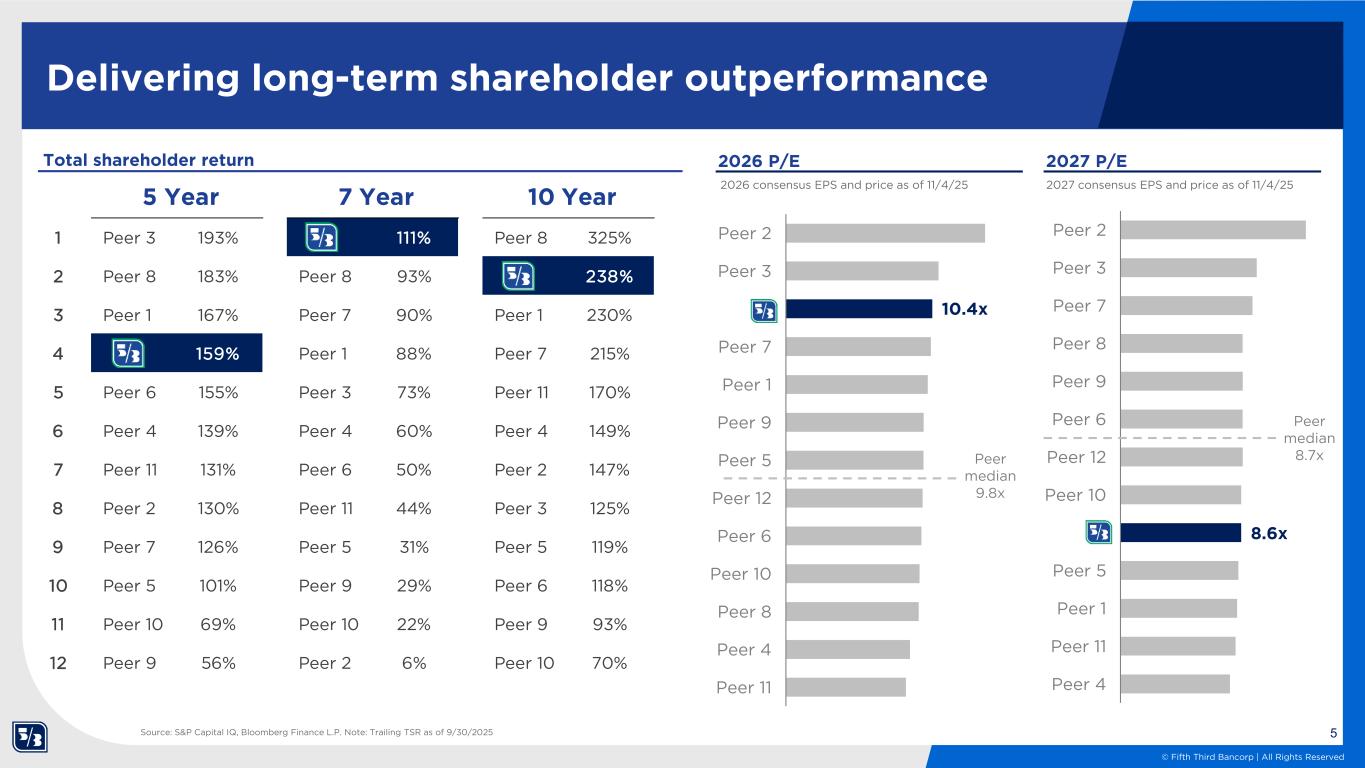

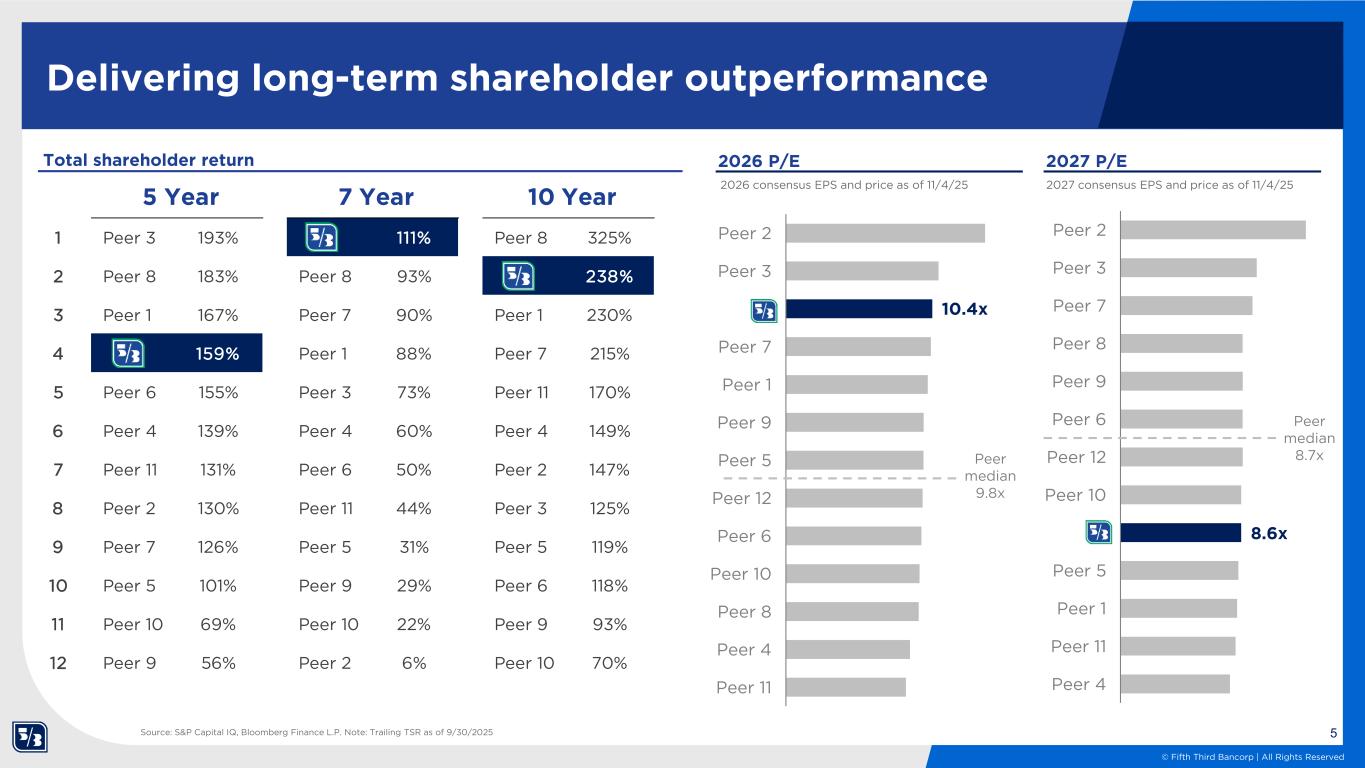

5 © Fifth Third Bancorp | All Rights Reserved Peer 2 Peer 3 x Peer 7 Peer 1 Peer 9 Peer 5 Peer 12 Peer 6 Peer 10 Peer 8 Peer 4 Peer 11 1 Peer 3 193% FITB 111% Peer 8 325% 2 Peer 8 183% Peer 8 93% FITB 238% 3 Peer 1 167% Peer 7 90% Peer 1 230% 4 FITB 159% Peer 1 88% Peer 7 215% 5 Peer 6 155% Peer 3 73% Peer 11 170% 6 Peer 4 139% Peer 4 60% Peer 4 149% 7 Peer 11 131% Peer 6 50% Peer 2 147% 8 Peer 2 130% Peer 11 44% Peer 3 125% 9 Peer 7 126% Peer 5 31% Peer 5 119% 10 Peer 5 101% Peer 9 29% Peer 6 118% 11 Peer 10 69% Peer 10 22% Peer 9 93% 12 Peer 9 56% Peer 2 6% Peer 10 70% 5 Year 7 Year 10 Year Delivering long-term shareholder outperformance Total shareholder return Source: S&P Capital IQ, Bloomberg Finance L.P. Note: Trailing TSR as of 9/30/2025 2026 P/E 2027 P/E 2026 consensus EPS and price as of 11/4/25 2027 consensus EPS and price as of 11/4/25 Peer median 9.8x 10.4x Peer 2 Peer 3 Peer 7 Peer 8 Peer 9 Peer 6 Peer 12 Peer 10 x Peer 5 Peer 1 Peer 11 Peer 4 8.6x Peer median 8.7x

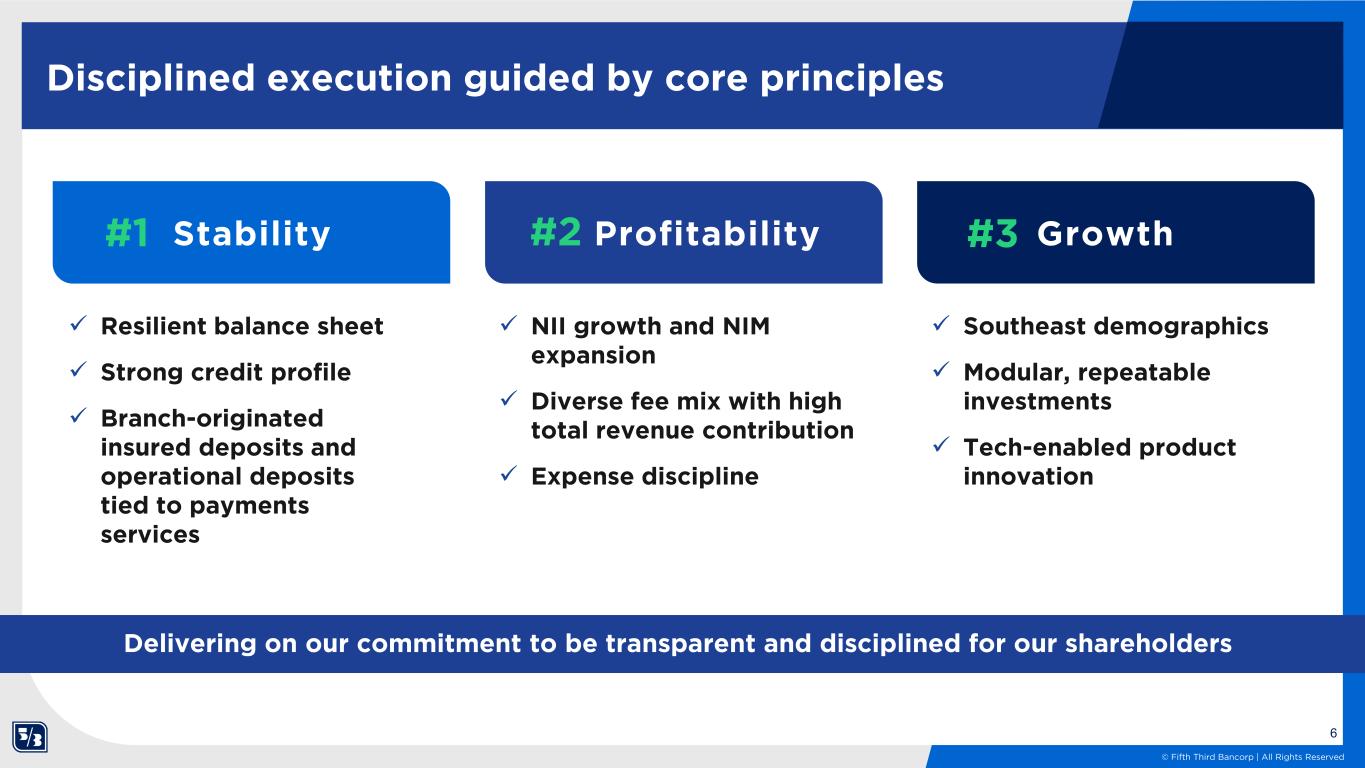

ibdroot\projects\IBD-NY\burger2025\973442_1\Presentations\05. Investor Presentation\PPT\Project Express Investor Presentation_v24.pptx 6 © Fifth Third Bancorp | All Rights Reserved Disciplined execution guided by core principles Stability Profitability Growth ✓ Resilient balance sheet ✓ Strong credit profile ✓ Branch-originated insured deposits and operational deposits tied to payments services ✓ NII growth and NIM expansion ✓ Diverse fee mix with high total revenue contribution ✓ Expense discipline ✓ Southeast demographics ✓ Modular, repeatable investments ✓ Tech-enabled product innovation #2 #3#1 Delivering on our commitment to be transparent and disciplined for our shareholders

ibdroot\projects\IBD-NY\burger2025\973442_1\Presentations\05. Investor Presentation\PPT\Project Express Investor Presentation_v24.pptx 7 © Fifth Third Bancorp | All Rights Reserved Fifth Third and Comerica: Advancing growth and profitability Now: A compelling strategic transaction Within 2 years: An even more stable and profitable company Assets² $288B Deposits² $224B Loans² $174B Creating the 9th Largest U.S. Bank¹ Long-term: A platform for growth Source: S&P Capital IQ, FactSet, FITB filings and management and CMA filings. Financial data as of June 30, 2025. ¹Based on total assets. Ranking consists of US commercial banks and excludes foreign, trust, and traditional investment banks; ²Pro forma balance sheet metrics as of June 30, 2025 and exclude purchase accounting adjustments for illustrative purposes.

ibdroot\projects\IBD-NY\burger2025\973442_1\Presentations\05. Investor Presentation\PPT\Project Express Investor Presentation_v24.pptx 8 © Fifth Third Bancorp | All Rights Reserved Combination leverages franchise strengths for value creation Now: A compelling strategic transaction Accelerates our strategy • Drives density and granularity in core and high growth markets • Expands presence in the fastest- growing U.S. markets • Strengthens and scales high-ROE, recurring fee platforms Superior financial outcomes • No tangible book value per share dilution — immediate “cash-on- cash” return of investment • 22% IRR with identified and achievable expense synergies — superior to organic alternatives Long term: A platform for growth Within 2 years: An even more stable and profitable company We have the proven expertise and track record to deliver on this compelling strategic opportunity Market leadership and expansion • Fortress #2 position in our Midwest markets — top 4 in all our Midwest states² • Clear path to top 5 locational share in high-growth Southeast and Texas markets³ — operating in 17 of the 20 fastest-growing large MSAs⁴ Transformational growth potential • Creates a national middle market banking powerhouse with specialty verticals • Two $1B+ high-growth, recurring revenue engines: Commercial Payments and Wealth and Asset Management Further boosts stability and profitability • 19%+ ROTCE¹ — 200+ bps improvement • Efficiency ratio¹ in the low-to-mid 50s — 200+ bps improvement Broader, more resilient business mix • Well-diversified in business lines, geographies, and fees • More granular loan portfolio • Durable, recurring revenue from scaled fee businesses Source: S&P Capital IQ, FactSet, FDIC, FITB filings and management and CMA filings. Branch and deposit data per June 2025 FDIC Summary of Deposits. Pro forma impact is presented for illustrative purposes only. 1Non-GAAP measure: see reconciliation and use of non-GAAP measures on pages 26-28 of the 2Q25 earnings release. Pro forma metrics are based on 2027E consensus estimates and incorporate all transaction adjustments; ²Rankings are on a capped basis (deposits per branch capped at $250MM); ³Location share based on June 2025 branch counts and management projections for de novo builds; ⁴MSAs with populations greater than 500,000 ranked by percent population growth (2020-2024) per US Census Bureau.

9 © Fifth Third Bancorp | All Rights Reserved 55% 53% Peer 5 Peer 3 Peer 2 Peer 1 Peer 10 Peer 4 Peer 7 Peer 9 Peer 8 Peer 6 x PF 57% Peer 1 Peer 5 Peer 11 Peer 10 Peer 7 Peer 4 Peer 3 Peer 9 Peer 6 x Peer 8 Peer 2 Peer 1 Peer 3 Peer 9 Peer 5 Peer 4 Peer 10 Peer 7 x Peer 6 PF Peer 8 1.15% Peer 1 Peer 5 Peer 11 Peer 9 Peer 10 Peer 4 Peer 7 x Peer 3 Peer 6 Peer 8 Peer 2 Peer 3 Peer 5 Peer 9 Peer 1 Peer 7 Peer 6 Peer 4 Peer 10 x Peer 8 PF 18% Peer 1 Peer 5 Peer 9 Peer 3 Peer 6 Peer 7 Peer 4 Peer 11 x Peer 10 Peer 8 2025 LTM Taking our profitability from strong to stronger 2025 LTM Efficiency ratio1 2027E2 2027E2 Return on average assets1 2027E2 ROTCE1 2025 LTM Adjusted basis 200 bps improvement 11 bps improvement 200 bps improvement Adjusted basis Adjusted basis 1.3-1.4% 1.2-1.3% 19%+ 17%+ Source: S&P Capital IQ, FactSet, FDIC, FITB filings and management and CMA filings. Financial data as of June 30, 2025. Pro forma impact is presented for illustrative purposes only. 1Non-GAAP measure: see reconciliation and use of non-GAAP measures on pages 26-28 of the 2Q25 earnings release; 2Pro forma metrics are based on 2027E consensus estimates and incorporate all transaction adjustments.

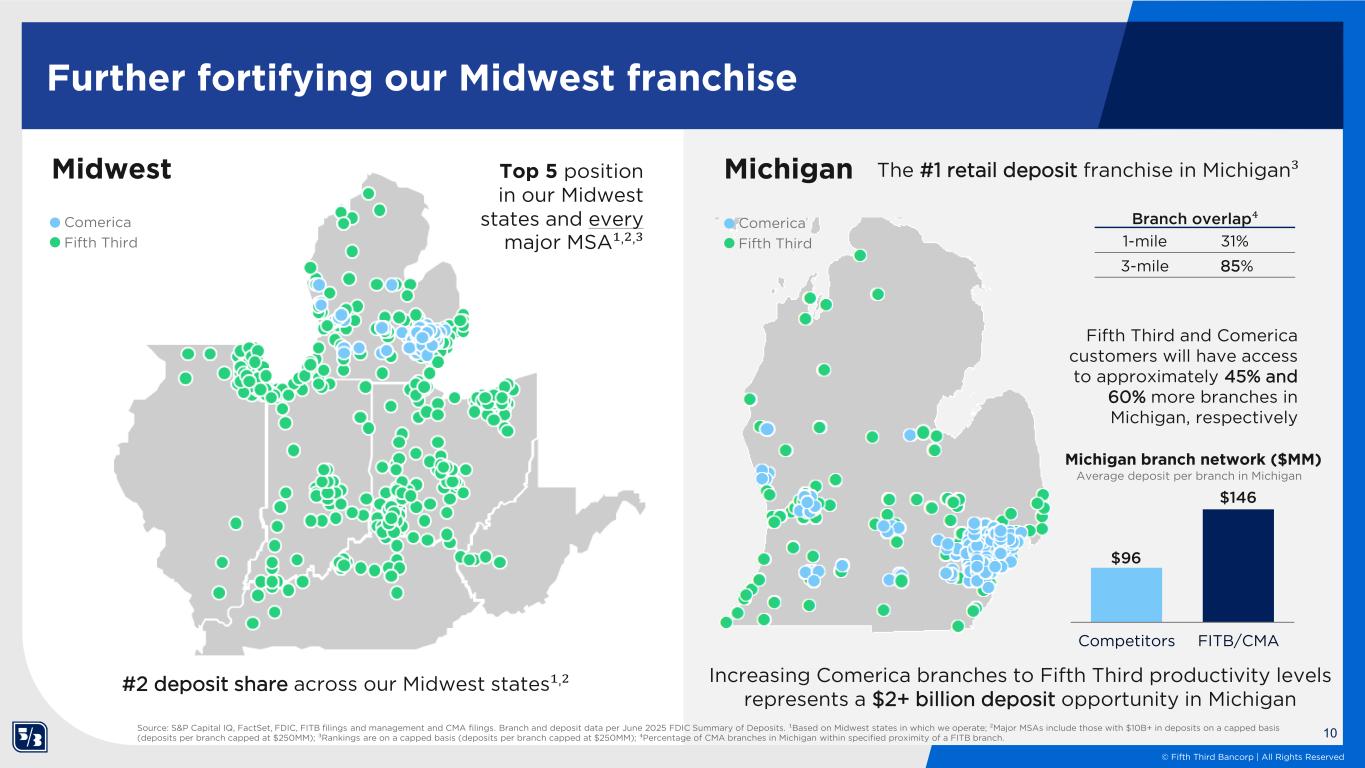

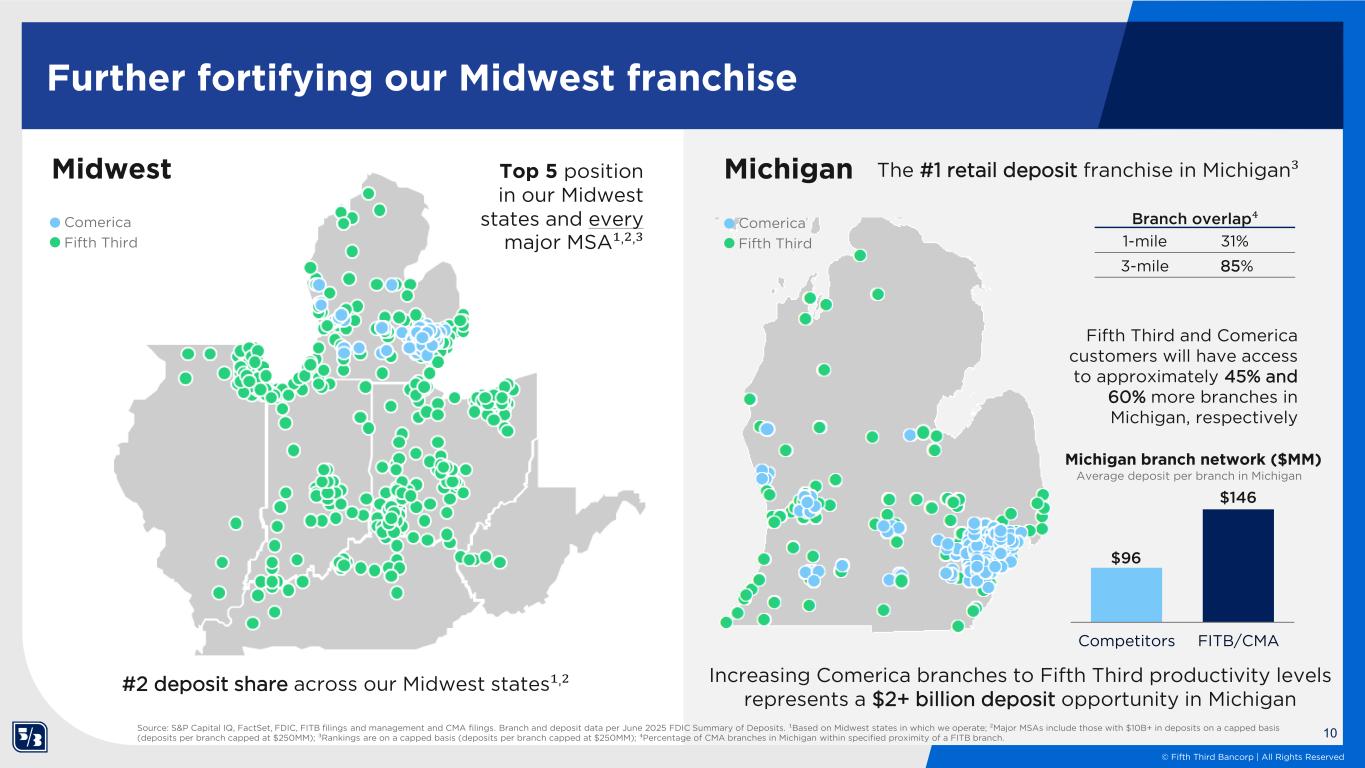

10 © Fifth Third Bancorp | All Rights Reserved Further fortifying our Midwest franchise Branch overlap⁴ 1-mile 31% 3-mile 85% Michigan Competitors FITB/CMA Fifth Third and Comerica customers will have access to approximately 45% and 60% more branches in Michigan, respectively Increasing Comerica branches to Fifth Third productivity levels represents a $2+ billion deposit opportunity in Michigan Midwest #2 deposit share across our Midwest states¹,² Comerica Fifth Third Comerica Fifth Third Michigan branch network ($MM) Average deposit per branch in Michigan The #1 retail deposit franchise in Michigan³ Top 5 position in our Midwest states and every major MSA¹,²,³ $96 $146 Source: S&P Capital IQ, FactSet, FDIC, FITB filings and management and CMA filings. Branch and deposit data per June 2025 FDIC Summary of Deposits. ¹Based on Midwest states in which we operate; ²Major MSAs include those with $10B+ in deposits on a capped basis (deposits per branch capped at $250MM); ³Rankings are on a capped basis (deposits per branch capped at $250MM); ⁴Percentage of CMA branches in Michigan within specified proximity of a FITB branch.

11 © Fifth Third Bancorp | All Rights Reserved Middle market banking powerhouse positioned to grow Middle Market Salesforce Middle Market Loans ($B) Middle Market Deposits ($B) • Deep, relationship driven Middle Market platform serving diverse industries across the country • Recognized by Greenwich as Best Bank for Satisfaction with Relationship Manager • Proven experience in industry leading specialty verticals, including environmental services, entertainment, and energy 2018 2025 +188% 259 487 2018 2025 +280% $47 2018 2025 +293% $55 $17 $19 + • Leading payments products in core treasury management and an industry leader in embedded payments • Broad capital market capabilities, including customer derivatives, syndications, debt and equity capital markets, and M&A • Award-winning Private Bank with specialized business transition advisory teams Fifth ThirdComerica Source: Coalition Greenwich, FITB filings and management and CMA filings. Financial data as of June 30, 2025.

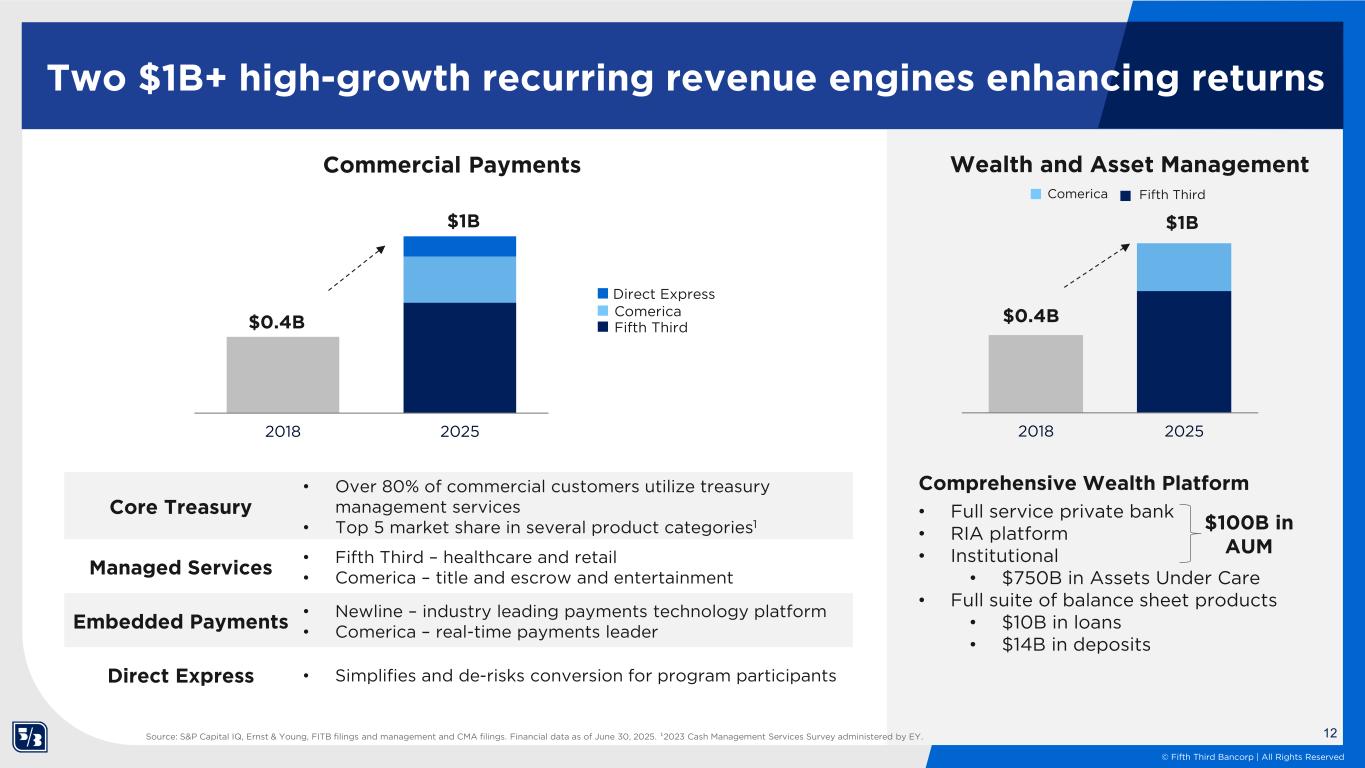

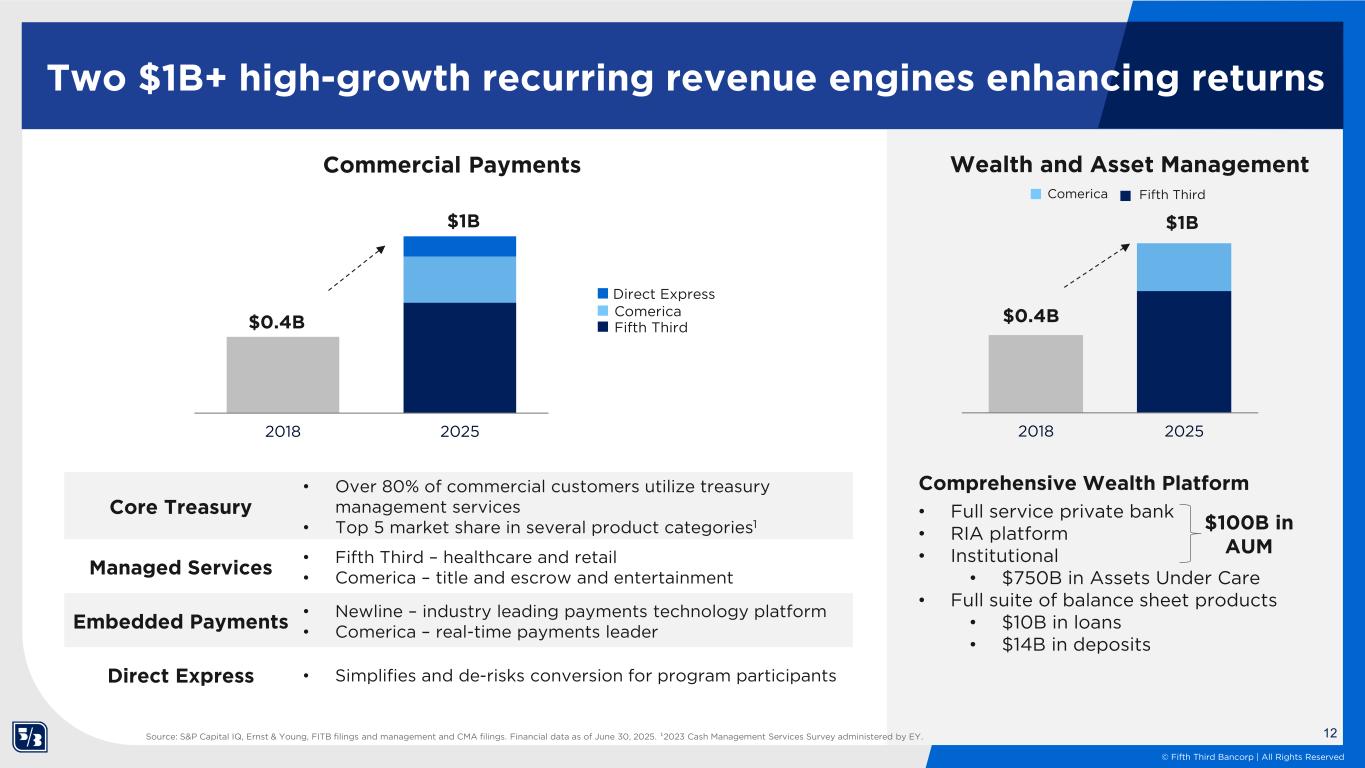

12 © Fifth Third Bancorp | All Rights Reserved Comprehensive Wealth Platform • Full service private bank • RIA platform • Institutional • $750B in Assets Under Care • Full suite of balance sheet products • $10B in loans • $14B in deposits $100B in AUM Wealth and Asset Management Two $1B+ high-growth recurring revenue engines enhancing returns Commercial Payments 2018 2025 $0.4B $1B 2018 2025 Core Treasury • Over 80% of commercial customers utilize treasury management services • Top 5 market share in several product categories1 Managed Services • Fifth Third – healthcare and retail • Comerica – title and escrow and entertainment Embedded Payments • Newline – industry leading payments technology platform • Comerica – real-time payments leader Direct Express • Simplifies and de-risks conversion for program participants $0.4B $1B Fifth Third Comerica Direct Express Fifth ThirdComerica Source: S&P Capital IQ, Ernst & Young, FITB filings and management and CMA filings. Financial data as of June 30, 2025. ¹2023 Cash Management Services Survey administered by EY.

13 © Fifth Third Bancorp | All Rights Reserved Scaled to win in the best markets in the U.S. Fifth Third will operate in 17 of the 20 fastest growing large U.S. metro areas² California • Texas • Opportunity to achieve rapid density with 101 existing Comerica branches plus 150 new de novos • By 2030, Fifth Third will achieve Top 3 location share in Dallas, Houston and Austin1 • Fifth Third adds 63 experienced bankers to Comerica’s Middle Market platform • Comerica’s Tech and Life Sciences vertical combined with Newline’s embedded payments capabilities creates a differentiated platform for the innovation economy Loans $21.1B Deposits $9.2B Loans $27.4B Deposits $17.0B • No disruption to Southeast expansion • Fifth Third has already secured 85% of planned Southeast de novo sites • Comerica increases Middle Market sales force by 20% Loans $19.2B Deposits $31.6B Source: S&P Capital IQ, FactSet, FDIC, J.D. Power, Coalition Greenwich, FITB filings and management and CMA filings. Financial data as of June 30, 2025. ¹Location share based on June 2025 branch counts and management projections for de novo builds; ²MSAs with populations greater than 500,000 ranked by percent population growth (2020-2024) per US Census Bureau. Southeast Texas

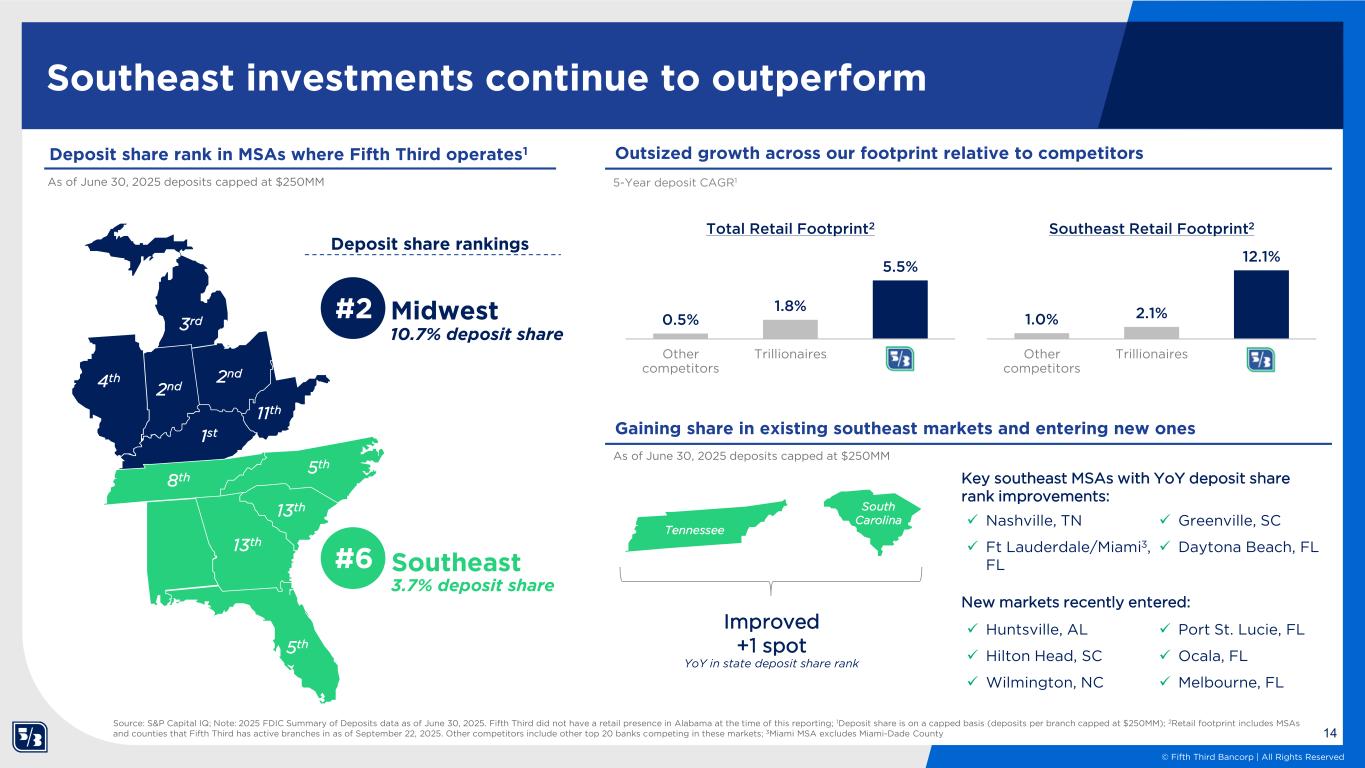

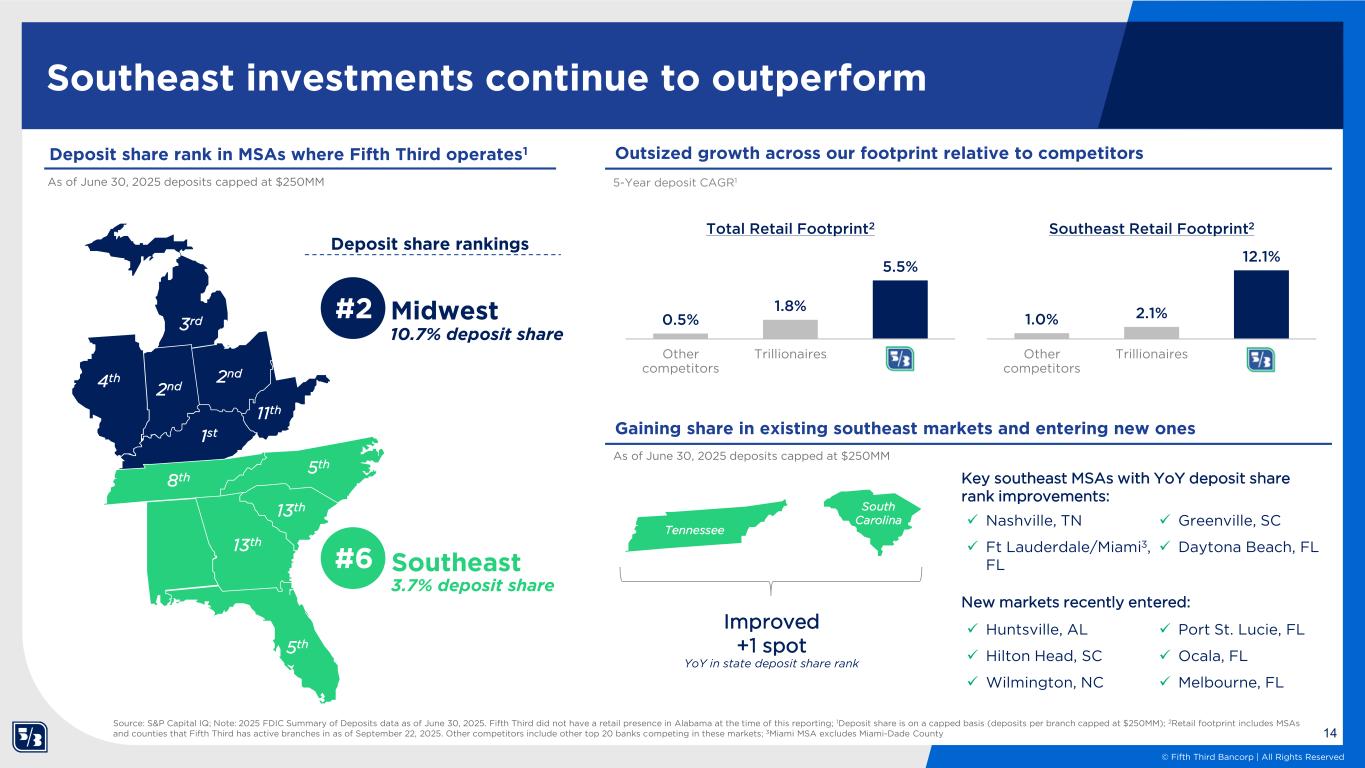

14 © Fifth Third Bancorp | All Rights Reserved Southeast investments continue to outperform Deposit share rank in MSAs where Fifth Third operates1 As of June 30, 2025 deposits capped at $250MM 8th 11th 5th 13th 13th 4th 2nd 1st 5th 2nd 3rd Outsized growth across our footprint relative to competitors 5-Year deposit CAGR1 Midwest#2 Southeast#6 10.7% deposit share 3.7% deposit share Source: S&P Capital IQ; Note: 2025 FDIC Summary of Deposits data as of June 30, 2025. Fifth Third did not have a retail presence in Alabama at the time of this reporting; 1Deposit share is on a capped basis (deposits per branch capped at $250MM); 2Retail footprint includes MSAs and counties that Fifth Third has active branches in as of September 22, 2025. Other competitors include other top 20 banks competing in these markets; 3Miami MSA excludes Miami-Dade County Deposit share rankings 0.5% 1.8% 5.5% Other competitors Trillionaires x Total Retail Footprint2 Gaining share in existing southeast markets and entering new ones 1.0% 2.1% 12.1% Other competitors Trillionaires x Southeast Retail Footprint2 Tennessee South Carolina Improved +1 spot YoY in state deposit share rank Key southeast MSAs with YoY deposit share rank improvements: ✓ Nashville, TN ✓ Ft Lauderdale/Miami3, FL ✓ Greenville, SC ✓ Daytona Beach, FL New markets recently entered: ✓ Huntsville, AL ✓ Hilton Head, SC ✓ Wilmington, NC ✓ Port St. Lucie, FL ✓ Ocala, FL ✓ Melbourne, FL As of June 30, 2025 deposits capped at $250MM

15 © Fifth Third Bancorp | All Rights Reserved De novo expansion leading to strong deposit growth and profitability The southeast’s share of total retail deposits continues to grow as the de novo network matures Percentage of total retail deposits Continued investment in southeast through 2028 Southeast investments driving strong granular retail deposit growth at attractive rates 2017 2025E3 2028E3 Total branches 1,154 1,130 ~1,250 Midwest branches 881 732 ~675 Southeast branches 273 398 ~575 % of branches in Southeast 24% 35% ~50% Southeast locational share 7th 6th 5th Disciplined deposit pricing 3Q25 southeast total cost of retail deposits 84% 82% 77% 16% 18% 23% 2019 2022 2025 Midwest Southeast 1.93% 4.46% x Avg. FF Rate 48 296 149 Peer Median Trillionaire Median x National Among leaders in de novos built nationally and in footprint 10 96 149 Peer Median Trillionaire Median x Total retail footprint2 Source: S&P Capital IQ, internal management reporting; Note: Branch data as of September 22, 2025, Management reporting reflects data as of September 30, 2025; 12025 FDIC data capped at $250MM and filtered for de novos opened since 2018. Not all de novos have been open for 5 years; 2Retail footprint includes MSAs and counties that Fifth Third has active branches in as of September 22, 2025; 3See forward-looking statements on page 19 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27- 29 of the 3Q25 earnings release. 2028 branch counts do not incorporate Comerica impact. De novos built since 2018 Rank 4th Rank 2nd $0 $10 $20 $30 $40 $50 Year 1 Year 2 Year 3 Year 4 Year 5 Fifth Third Peer Avg Average de novo deposits per branch by year1 $ in millions

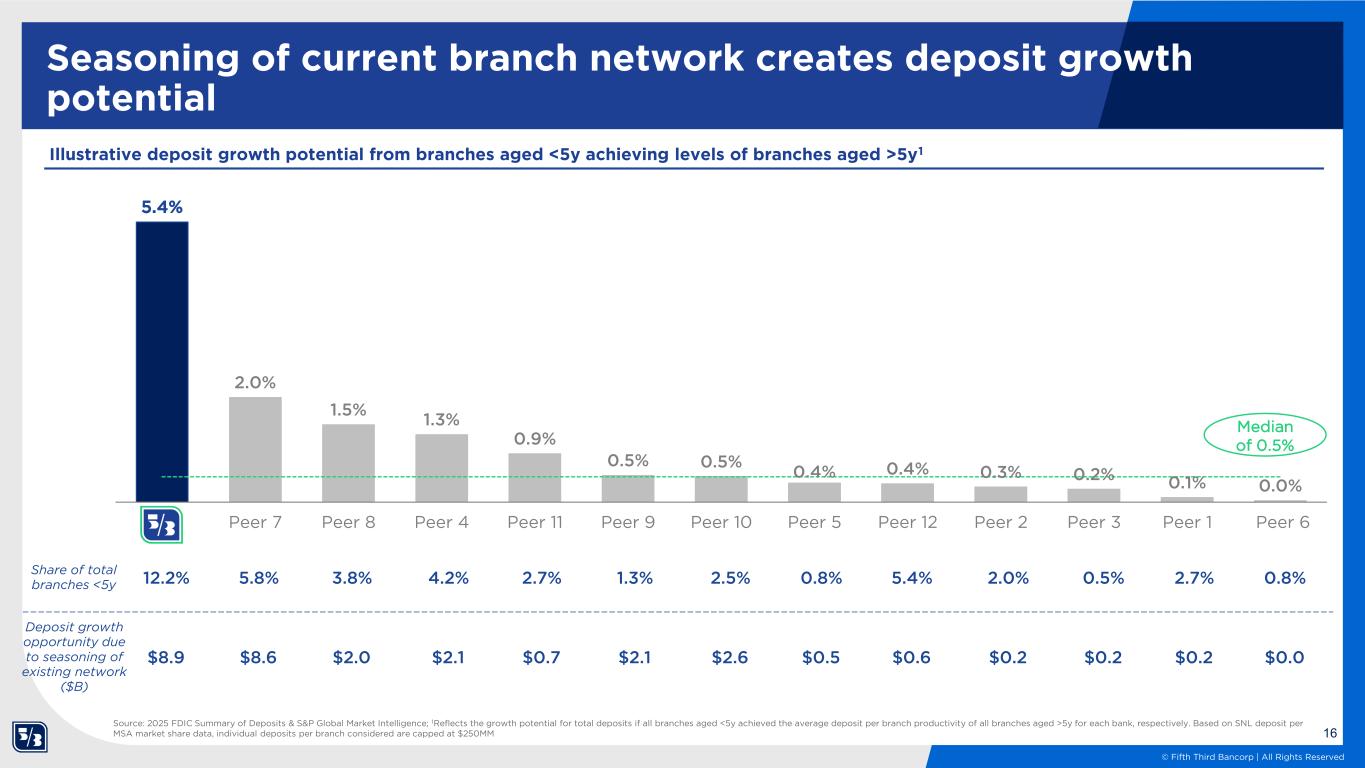

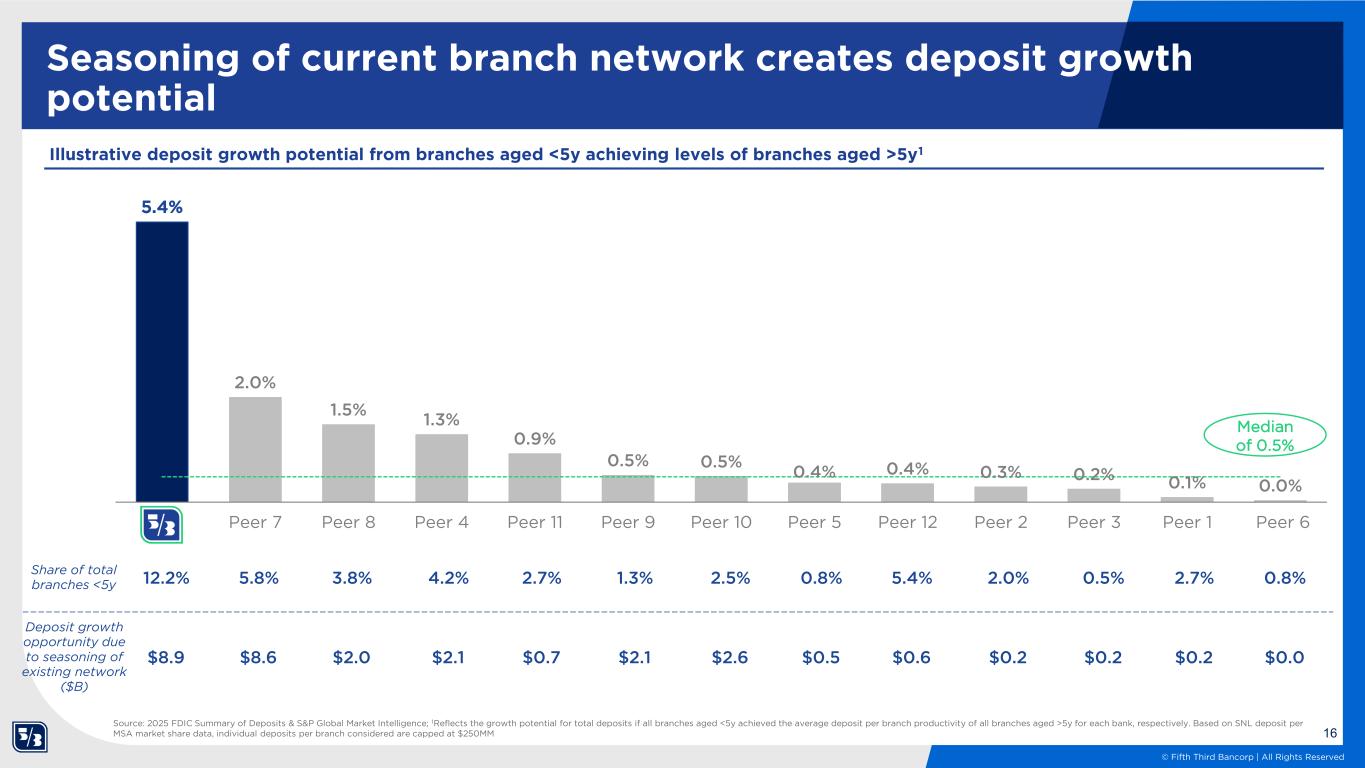

16 © Fifth Third Bancorp | All Rights Reserved Seasoning of current branch network creates deposit growth potential 5.4% 2.0% 1.5% 1.3% 0.9% 0.5% 0.5% 0.4% 0.4% 0.3% 0.2% 0.1% 0.0% Peer 7 Peer 8 Peer 4 Peer 11 Peer 9 Peer 10 Peer 5 Peer 12 Peer 2 Peer 3 Peer 1 Peer 6 Share of total branches <5y 2.0%3.8%5.8% 4.2% 2.7% 1.3% 2.5% 0.8%12.2% 5.4% 0.5% 2.7% Median of 0.5% Deposit growth opportunity due to seasoning of existing network ($B) $0.2$2.0$8.6 $2.1 $0.7 $2.1 $2.6 $0.0$8.9 $0.6 $0.2 $0.2 Source: 2025 FDIC Summary of Deposits & S&P Global Market Intelligence; 1Reflects the growth potential for total deposits if all branches aged <5y achieved the average deposit per branch productivity of all branches aged >5y for each bank, respectively. Based on SNL deposit per MSA market share data, individual deposits per branch considered are capped at $250MM Illustrative deposit growth potential from branches aged <5y achieving levels of branches aged >5y1 0.8% $0.5

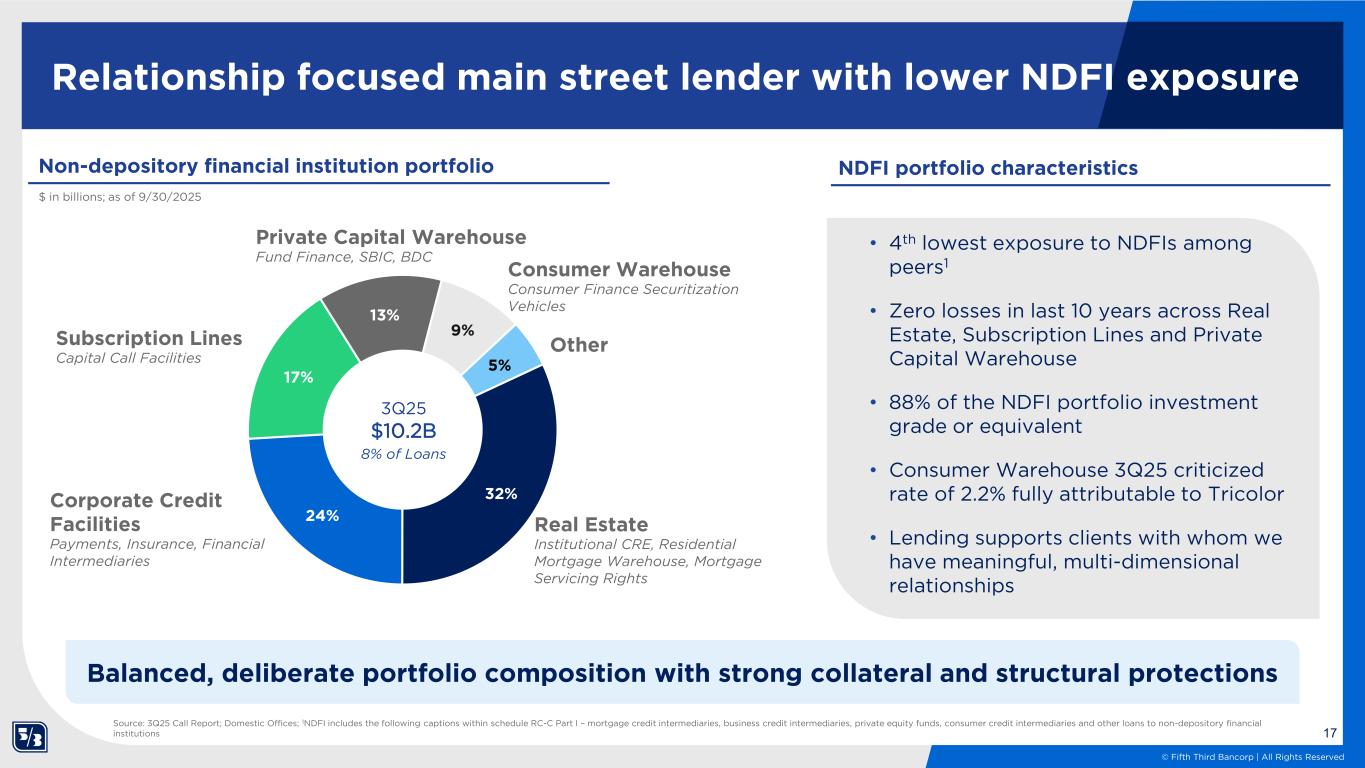

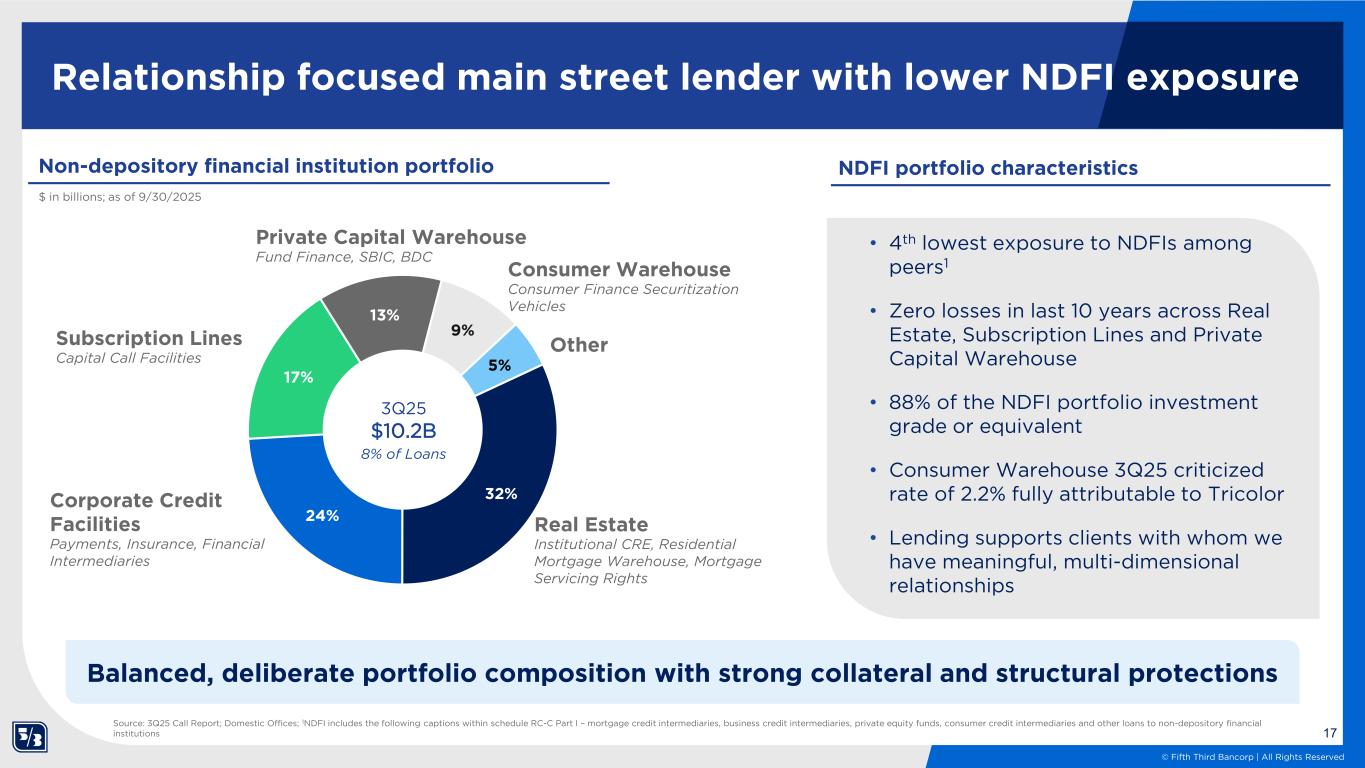

17 © Fifth Third Bancorp | All Rights Reserved Relationship focused main street lender with lower NDFI exposure 32% 24% 17% 13% 9% 5% 3Q25 $10.2B 8% of Loans Non-depository financial institution portfolio $ in billions; as of 9/30/2025 • 4th lowest exposure to NDFIs among peers1 • Zero losses in last 10 years across Real Estate, Subscription Lines and Private Capital Warehouse • 88% of the NDFI portfolio investment grade or equivalent • Consumer Warehouse 3Q25 criticized rate of 2.2% fully attributable to Tricolor • Lending supports clients with whom we have meaningful, multi-dimensional relationships Consumer Warehouse Consumer Finance Securitization Vehicles Private Capital Warehouse Fund Finance, SBIC, BDC Other Real Estate Institutional CRE, Residential Mortgage Warehouse, Mortgage Servicing Rights Corporate Credit Facilities Payments, Insurance, Financial Intermediaries Subscription Lines Capital Call Facilities NDFI portfolio characteristics Balanced, deliberate portfolio composition with strong collateral and structural protections Source: 3Q25 Call Report; Domestic Offices; 1NDFI includes the following captions within schedule RC-C Part I – mortgage credit intermediaries, business credit intermediaries, private equity funds, consumer credit intermediaries and other loans to non-depository financial institutions

18 © Fifth Third Bancorp | All Rights Reserved Why Fifth Third Positioned to generate long-term sustainable value to shareholders ✓ Well-diversified and resilient balance sheet to provide stability and profitability ✓ Consistent investments to generate balanced and growing revenue streams while maintaining peer-leading expense discipline ✓ Multi-year track record of making appropriate and preemptive changes to the business ✓ Transparent management team

19 © Fifth Third Bancorp | All Rights Reserved This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. All statements other than statements of historical fact are forward-looking statements. These statements relate to our financial condition, results of operations, plans, objectives, future performance, capital actions or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission (“SEC”). There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) deteriorating credit quality; (2) loan concentration by location or industry of borrowers or collateral; (3) problems encountered by other financial institutions; (4) inadequate sources of funding or liquidity; (5) unfavorable actions of rating agencies; (6) inability to maintain or grow deposits; (7) limitations on the ability to receive dividends from subsidiaries; (8) cyber-security risks; (9) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (10) failures by third-party service providers; (11) inability to manage strategic initiatives and/or organizational changes; (12) inability to implement technology system enhancements, including the use of artificial intelligence; (13) failure of internal controls and other risk management programs; (14) losses related to fraud, theft, misappropriation or violence; (15) inability to attract and retain skilled personnel; (16) adverse impacts of government regulation; (17) governmental or regulatory changes or other actions; (18) failures to meet applicable capital requirements; (19) regulatory objections to Fifth Third’s capital plan; (20) regulation of Fifth Third’s derivatives activities; (21) deposit insurance premiums; (22) assessments for the orderly liquidation fund; (23) weakness in the national or local economies; (24) global political and economic uncertainty or negative actions; (25) changes in interest rates and the effects of inflation; (26) changes in U.S. trade policies, including the imposition of tariffs and retaliatory tariffs; (27) changes and trends in capital markets; (28) fluctuation of Fifth Third’s stock price; (29) volatility in mortgage banking revenue; (30) litigation, investigations, and enforcement proceedings; (31) breaches of contractual covenants, representations and warranties; (32) competition and changes in the financial services industry; (33) potential impacts of the adoption of real-time payment networks; (34) changing retail distribution strategies, customer preferences and behavior; (35) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisitions; (36) potential dilution from future acquisitions; (37) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (38) results of investments or acquired entities; (39) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (40) inaccuracies or other failures from the use of models; (41) effects of critical accounting policies and judgments or the use of inaccurate estimates; (42) weather-related events, other natural disasters, or health emergencies (including pandemics); (43) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity; (44) changes in law or requirements imposed by Fifth Third’s regulators impacting our capital actions, including dividend payments and stock repurchases; (45) Fifth Third's ability to meet its environmental and/or social targets, goals and commitments; and (46) risks relating to the pending merger with Comerica Incorporated, including Fifth Third’s inability to realize the anticipated benefits of the pending merger, the failure to satisfy the closing conditions of the pending merger or an unexpected delay in the closing of the pending merger, the failure to receive required regulatory, stockholder or other approvals and the disruption of Fifth Third’s business as a result of the pending merger. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The information contained herein is intended to be reviewed in its totality, and any stipulations, conditions or provisos that apply to a given piece of information in one part of this press release should be read as applying mutatis mutandis to every other instance of such information appearing herein. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures in slides 39-40 of our 3Q25 earnings presentation, as well as on pages 27 through 29 of our 3Q25 earnings release. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp's control or cannot be reasonably predicted. For the same reasons, Bancorp's management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. See pages 20-21 for additional forward-looking statements regarding the pending merger with Comerica. Cautionary Statement

20 © Fifth Third Bancorp | All Rights Reserved FORWARD-LOOKING STATEMENTS This presentation contains statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “achieve,” “anticipate,” “assume,” “believe,” “could,” “deliver,” “drive,” “enhance,” “estimate,” “expect,” “focus,” “future,” “goal,” “grow,” “guidance,” “intend,” “may,” “might,” “plan,” “position,” “potential,” “predict,” “project,” “opportunity,” “outlook,” “should,” “strategy,” “target,” “trajectory,” “trend,” “will,” “would,” and other similar words and expressions or the negative of such terms or other comparable terminology. Forward-looking statements include, but are not limited to, statements about our business strategy, goals and objectives, projected financial and operating results, including outlook for future growth, and future common share dividends, common share repurchases and other uses of capital. These statements are not historical facts, but instead represent our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of our control. Comerica Incorporated’s (“Comerica”) and Fifth Third Bancorp’s (“Fifth Third”) actual results and financial condition may differ materially from those indicated in these forward-looking statements. Important factors that could cause Comerica’s and Fifth Third’s actual results, financial condition and predictions to differ materially from those indicated in such forward-looking statements include, in addition to those set forth in our and Fifth Third’s filings with the U.S. Securities and Exchange Commission (the “SEC”): (1) the risk that the cost savings and synergies from the merger of Comerica with Fifth Third (the “Transaction”) may not be fully realized or may take longer than anticipated to be realized; (2) the failure of the closing conditions in the merger agreement between Comerica and Fifth Third providing for the Transaction to be satisfied, or any unexpected delay in closing the Transaction or the occurrence of any event, change or other circumstances, including the impact and timing of any government shutdown, that could delay the Transaction or could give rise to the termination of the merger agreement; (3) the outcome of any legal or regulatory proceedings or governmental inquiries or investigations that may be currently pending or later instituted against Comerica, Fifth Third or the combined company; (4) the possibility that the Transaction does not close when expected or at all because required regulatory, stockholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed Transaction); (5) the risk that the benefits from the Transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in, or problems arising from, general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Comerica and Fifth Third operate; (6) disruption to the parties’ businesses as a result of the announcement and pendency of the Transaction; (7) the costs associated with the anticipated length of time of the pendency of the Transaction, including the restrictions contained in the definitive merger agreement on the ability of Comerica or Fifth Third to operate its business outside the ordinary course during the pendency of the Transaction; (8) risks related to management and oversight of the expanded business and operations of the combined company following the closing of the proposed Transaction; (9) the risk that the integration of each party’s operations will be materially delayed or will be more costly or difficult than expected or that the parties are otherwise unable to successfully integrate each party’s businesses into the other’s businesses; (10) the possibility that the Transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (11) reputational risk and potential adverse reactions of Comerica or Fifth Third customers, employees, vendors, contractors or other business partners, including those resulting from the announcement or completion of the Transaction; (12) the dilution caused by Fifth Third’s issuance of additional shares of its common stock in connection with the Transaction; (13) a material adverse change in the condition of Comerica or Fifth Third; (14) the extent to which Comerica’s or Fifth Third’s businesses perform consistent with management’s expectations; (15) Comerica’s and Fifth Third’s ability to take advantage of growth opportunities and implement targeted initiatives in the timeframe and on the terms currently expected; (16) the inability to sustain revenue and earnings growth; (17) the execution and efficacy of recent strategic investments; (18) the timing and impact of Comerica’s Direct Express transition; (19) the impact of macroeconomic factors, such as changes in general economic conditions and monetary and fiscal policy, particularly on interest rates; (20) changes in customer behavior; (21) unfavorable developments concerning credit quality; (22) declines in the businesses or industries of Comerica’s or Fifth Third’s customers; (23) the possibility that the combined company is subject to additional regulatory requirements as a result of the proposed Transaction of expansion of the combined company’s business operations following the proposed Transaction; (24) general competitive, political and market conditions and other factors that may affect future results of Comerica and Fifth Third including changes in asset quality and credit risk; (25) security risks, including cybersecurity and data privacy risks, and capital markets; (26) inflation; (27) the impact, extent and timing of technological changes; (28) capital management activities; (29) competitive product and pricing pressures; (30) the outcomes of legal and regulatory proceedings and related financial services industry matters; and (31) compliance with regulatory requirements. Any forward-looking statement made in this presentation is based solely on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except to the extent required by law. These and other important factors, including those discussed under “Risk Factors” in Comerica’s Annual Report on Form 10-K for the year ended December 31, 2024 (available at: https://www.sec.gov/ix?doc=/Archives/edgar/data/0000028412/000002841225000108/cma-20241231.htm), and in Fifth Third’s Annual Report on Form 10-K for the year ended December 31, 2024 (available at: https://www.sec.gov/ix?doc=/Archives/edgar/data/0000035527/000003552725000079/fitb-20241231.htm), as well as Comerica’s and Fifth Third’s subsequent filings with the SEC, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements herein are made only as of the date they were first issued, and unless otherwise required by applicable securities laws, Comerica and Fifth Third disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Disclaimer

21 © Fifth Third Bancorp | All Rights Reserved Disclaimer (continued) ADDITIONAL INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT Fifth Third filed a registration statement on Form S-4 (File No. 333-291296) with the SEC to register the shares of Fifth Third common stock that will be issued to Comerica stockholders in connection with the proposed Transaction. The registration statement, which is not yet effective, includes a joint proxy statement of Comerica and Fifth Third that also constitutes a prospectus of Fifth Third. The definitive joint proxy statement/prospectus will be sent to the stockholders of Comerica and shareholders of Fifth Third in connection with the proposed Transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION REGARDING COMERICA, FIFTH THIRD, THE TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Comerica or Fifth Third through the website maintained by the SEC at https://www.sec.gov or by contacting the investor relations department of Comerica or Fifth Third at: Before making any voting or investment decision, investors and security holders of Comerica and Fifth Third are urged to read carefully the entire registration statement and joint proxy statement/prospectus, including any amendments thereto when they become available, because they contain or will contain important information about the proposed Transaction. Free copies of these documents may be obtained as described above. PARTICIPANTS IN THE SOLICITATION Comerica, Fifth Third and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Comerica and shareholders of Fifth Third in connection with the Transaction under the rules of the SEC. Information regarding the directors and executive officers of each of Comerica and Fifth Third is set forth in (i) Comerica’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, including under the headings entitled “Information about Nominees and Other Directors”, “Director Independence”, “Transactions with Related Persons”, “Compensation Committee Interlocks and Insider Participation”, “Compensation of Directors”, “Proposal 3 Submitted for your Vote – Non-Binding, Advisory Proposal Approving Executive Compensation”, “Pay Versus Performance”, “Pay Ratio Disclosure” and “Security Ownership of Management”, which was filed with the SEC on March 17, 2025 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000028412/000002841225000135/cma-20250313.htm, and (ii) Fifth Third’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, including under the headings entitled “Board of Directors Compensation”, “Compensation Discussion and Analysis”, “Human Capital and Compensation Committee Report”, “Compensation of Named Executive Officers”, “CEO Pay Ratio”, “Pay vs Performance”, “Company Proposal No. 2: Advisory Vote on Compensation of Named Executive Officers (Item 3 on Proxy Card)” and “Compensation Committee Interlocks and Insider Participation”, which was filed with the SEC on March 4, 2025 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000035527/000119312525045653/d901598ddef14a.htm. To the extent holdings of each of Comerica’s or Fifth Third’s securities by its directors or executive officers have changed since the amounts set forth in Comerica’s or Fifth Third’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC, which are available at https://www.sec.gov/edgar/browse/?CIK=35527&owner=exclude, and at https://www.sec.gov/edgar/browse/?CIK=28412&owner=exclude. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the proxy statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of these documents through the website maintained by the SEC at https://www.sec.gov. NO OFFER OR SOLICITATION This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Comerica Inc. Comerica Bank Tower 1717 Main Street, MC 6404 Dallas, TX 75201 Attention: Investor Relations InvestorRelations@comerica.com (833) 571-0486 Fifth Third Bancorp 38 Fountain Square Plaza MD 1090FV Cincinnati, OH 45263 Attention: Investor Relations IR@53.com (866) 670-0468