000002409012/312025Q3FALSExbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pure00000240902025-01-012025-09-3000000240902025-10-3100000240902025-09-3000000240902024-12-310000024090us-gaap:LifeInsuranceSegmentMember2025-09-300000024090us-gaap:LifeInsuranceSegmentMember2024-12-310000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2025-09-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-12-310000024090us-gaap:CommonClassAMember2025-09-300000024090us-gaap:CommonClassAMember2024-12-310000024090us-gaap:CommonClassBMember2025-09-300000024090us-gaap:CommonClassBMember2024-12-310000024090us-gaap:LifeInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:LifeInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:LifeInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:LifeInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-01-012024-09-3000000240902025-07-012025-09-3000000240902024-07-012024-09-3000000240902024-01-012024-09-300000024090us-gaap:CommonClassAMember2025-07-012025-09-300000024090us-gaap:CommonClassAMember2024-07-012024-09-300000024090us-gaap:CommonClassAMember2025-01-012025-09-300000024090us-gaap:CommonClassAMember2024-01-012024-09-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-12-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-12-310000024090us-gaap:RetainedEarningsMember2024-12-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000024090us-gaap:TreasuryStockCommonMember2024-12-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-01-012025-03-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-01-012025-03-310000024090us-gaap:RetainedEarningsMember2025-01-012025-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310000024090us-gaap:TreasuryStockCommonMember2025-01-012025-03-3100000240902025-01-012025-03-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-03-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-03-310000024090us-gaap:RetainedEarningsMember2025-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310000024090us-gaap:TreasuryStockCommonMember2025-03-3100000240902025-03-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-04-012025-06-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-04-012025-06-300000024090us-gaap:RetainedEarningsMember2025-04-012025-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-04-012025-06-300000024090us-gaap:TreasuryStockCommonMember2025-04-012025-06-3000000240902025-04-012025-06-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-06-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-06-300000024090us-gaap:RetainedEarningsMember2025-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300000024090us-gaap:TreasuryStockCommonMember2025-06-3000000240902025-06-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-07-012025-09-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-07-012025-09-300000024090us-gaap:RetainedEarningsMember2025-07-012025-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-07-012025-09-300000024090us-gaap:TreasuryStockCommonMember2025-07-012025-09-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-09-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-09-300000024090us-gaap:RetainedEarningsMember2025-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-300000024090us-gaap:TreasuryStockCommonMember2025-09-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310000024090us-gaap:RetainedEarningsMember2023-12-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000024090us-gaap:TreasuryStockCommonMember2023-12-3100000240902023-12-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-03-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-01-012024-03-310000024090us-gaap:RetainedEarningsMember2024-01-012024-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000024090us-gaap:TreasuryStockCommonMember2024-01-012024-03-3100000240902024-01-012024-03-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-03-310000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-03-310000024090us-gaap:RetainedEarningsMember2024-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000024090us-gaap:TreasuryStockCommonMember2024-03-3100000240902024-03-310000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-04-012024-06-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-04-012024-06-300000024090us-gaap:RetainedEarningsMember2024-04-012024-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000024090us-gaap:TreasuryStockCommonMember2024-04-012024-06-3000000240902024-04-012024-06-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-06-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-06-300000024090us-gaap:RetainedEarningsMember2024-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000024090us-gaap:TreasuryStockCommonMember2024-06-3000000240902024-06-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-07-012024-09-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-07-012024-09-300000024090us-gaap:RetainedEarningsMember2024-07-012024-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000024090us-gaap:TreasuryStockCommonMember2024-07-012024-09-300000024090us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-09-300000024090us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-09-300000024090us-gaap:RetainedEarningsMember2024-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000024090us-gaap:TreasuryStockCommonMember2024-09-3000000240902024-09-300000024090us-gaap:USTreasurySecuritiesMember2025-09-300000024090us-gaap:USGovernmentAgenciesDebtSecuritiesMember2025-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2025-09-300000024090cia:CorporateDebtSecuritiesFinancialSectorMember2025-09-300000024090cia:CorporateDebtSecurityConsumerSectorMember2025-09-300000024090cia:CorporateDebtSecurityUtilitiesSectorMember2025-09-300000024090cia:CorporateDebtSecurityEnergySectorMember2025-09-300000024090cia:CorporateDebtSecurityCommunicationsSectorMember2025-09-300000024090cia:CorporateDebtSecurityAllOtherSectorMember2025-09-300000024090us-gaap:CommercialMortgageBackedSecuritiesMember2025-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2025-09-300000024090us-gaap:AssetBackedSecuritiesMember2025-09-300000024090us-gaap:USTreasurySecuritiesMember2024-12-310000024090us-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000024090cia:CorporateDebtSecuritiesFinancialSectorMember2024-12-310000024090cia:CorporateDebtSecurityConsumerSectorMember2024-12-310000024090cia:CorporateDebtSecurityUtilitiesSectorMember2024-12-310000024090cia:CorporateDebtSecurityEnergySectorMember2024-12-310000024090cia:CorporateDebtSecurityCommunicationsSectorMember2024-12-310000024090cia:CorporateDebtSecurityAllOtherSectorMember2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMember2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310000024090us-gaap:AssetBackedSecuritiesMember2024-12-310000024090us-gaap:FixedIncomeFundsMember2025-09-300000024090us-gaap:FixedIncomeFundsMember2024-12-310000024090us-gaap:CommonStockMember2025-09-300000024090us-gaap:CommonStockMember2024-12-310000024090us-gaap:NonredeemablePreferredStockMember2025-09-300000024090us-gaap:NonredeemablePreferredStockMember2024-12-310000024090cia:CIA_NonredeemablePreferredStockFundMemberMember2025-09-300000024090cia:CIA_NonredeemablePreferredStockFundMemberMember2024-12-310000024090us-gaap:EquitySecuritiesMember2025-07-012025-09-300000024090us-gaap:EquitySecuritiesMember2025-01-012025-09-300000024090us-gaap:EquitySecuritiesMember2024-07-012024-09-300000024090us-gaap:EquitySecuritiesMember2024-01-012024-09-300000024090us-gaap:DebtSecuritiesMember2025-09-300000024090us-gaap:DebtSecuritiesMember2024-12-310000024090cia:DiscoveryCommunicationsLLCMember2025-01-012025-09-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:USTreasuryAndGovernmentMember2025-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2025-09-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:CorporateDebtSecuritiesMember2025-09-300000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:CommercialMortgageBackedSecuritiesMember2025-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2025-09-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:AssetBackedSecuritiesMember2025-09-300000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:DebtSecuritiesMember2025-09-300000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:FixedIncomeFundsMember2025-09-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:CommonStockMember2025-09-300000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:NonredeemablePreferredStockMember2025-09-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:EquitySecuritiesMember2025-09-300000024090us-gaap:FairValueInputsLevel1Member2025-09-300000024090us-gaap:FairValueInputsLevel2Member2025-09-300000024090us-gaap:FairValueInputsLevel3Member2025-09-300000024090us-gaap:OtherLongTermInvestmentsMember2025-09-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:USTreasuryAndGovernmentMember2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:CorporateDebtSecuritiesMember2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMember2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:AssetBackedSecuritiesMember2024-12-310000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:DebtSecuritiesMember2024-12-310000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:FixedIncomeFundsMember2024-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:CommonStockMember2024-12-310000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:NonredeemablePreferredStockMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:NonredeemablePreferredStockMember2024-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090cia:CIA_NonRedeemablePreferredStockFundMember2024-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:EquitySecuritiesMember2024-12-310000024090us-gaap:FairValueInputsLevel1Member2024-12-310000024090us-gaap:FairValueInputsLevel2Member2024-12-310000024090us-gaap:FairValueInputsLevel3Member2024-12-310000024090us-gaap:OtherLongTermInvestmentsMember2024-12-310000024090us-gaap:OtherAggregatedInvestmentsMemberus-gaap:UnfundedLoanCommitmentMember2025-09-300000024090us-gaap:PrivateEquityFundsMember2025-07-012025-09-300000024090us-gaap:PrivateEquityFundsMember2025-01-012025-09-300000024090us-gaap:PrivateEquityFundsMember2024-07-012024-09-300000024090us-gaap:PrivateEquityFundsMember2024-01-012024-09-300000024090cia:PrivateEquityFundsMiddleMarketMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-09-300000024090cia:PrivateEquityFundsMiddleMarketMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-09-300000024090cia:PrivateEquityFundsMiddleMarketMember2025-01-012025-09-300000024090cia:PrivateEquityFundsMiddleMarketMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090cia:PrivateEquityFundsMiddleMarketMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090cia:PrivateEquityFundsMiddleMarketMember2024-01-012024-12-310000024090cia:PrivateEquityFundsGlobalMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-09-300000024090cia:PrivateEquityFundsGlobalMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-09-300000024090cia:PrivateEquityFundsGlobalMember2025-01-012025-09-300000024090cia:PrivateEquityFundsGlobalMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090cia:PrivateEquityFundsGlobalMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090cia:PrivateEquityFundsGlobalMember2024-01-012024-12-310000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-09-300000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-09-300000024090srt:MinimumMembercia:PrivateEquityFundsLateStageGrowthMember2025-01-012025-09-300000024090srt:MaximumMembercia:PrivateEquityFundsLateStageGrowthMember2025-01-012025-09-300000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090srt:MinimumMembercia:PrivateEquityFundsLateStageGrowthMember2024-01-012024-12-310000024090srt:MaximumMembercia:PrivateEquityFundsLateStageGrowthMember2024-01-012024-12-310000024090cia:PrivateEquityFundsInfrastructureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-09-300000024090cia:PrivateEquityFundsInfrastructureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-09-300000024090srt:MinimumMembercia:PrivateEquityFundsInfrastructureMember2025-01-012025-09-300000024090srt:MaximumMembercia:PrivateEquityFundsInfrastructureMember2025-01-012025-09-300000024090cia:PrivateEquityFundsInfrastructureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090cia:PrivateEquityFundsInfrastructureMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090srt:MinimumMembercia:PrivateEquityFundsInfrastructureMember2024-01-012024-12-310000024090srt:MaximumMembercia:PrivateEquityFundsInfrastructureMember2024-01-012024-12-310000024090us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2025-09-300000024090us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2025-09-300000024090us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310000024090us-gaap:PrivateEquityFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2024-12-310000024090us-gaap:CarryingReportedAmountFairValueDisclosureMember2025-09-300000024090us-gaap:EstimateOfFairValueFairValueDisclosureMember2025-09-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000024090us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000024090srt:SingleFamilyMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2025-09-300000024090srt:SingleFamilyMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2025-09-300000024090srt:SingleFamilyMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000024090srt:SingleFamilyMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-3100000240902024-01-012024-12-310000024090srt:SingleFamilyMember2024-01-012024-12-310000024090srt:SingleFamilyMember2025-01-012025-09-300000024090srt:SingleFamilyMember2025-09-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:PartnerTypeOfPartnersCapitalAccountNameDomain2025-09-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CommonStockMember2024-12-310000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2024-12-310000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2024-12-310000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2024-12-310000024090cia:LifeInsuranceBusinessSegmentMember2024-12-310000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090cia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2025-09-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2025-09-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2025-09-300000024090cia:LifeInsuranceBusinessSegmentMember2025-09-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2024-12-310000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2024-12-310000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2024-12-310000024090cia:HomeServiceInsuranceSegmentMember2024-12-310000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090cia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2025-09-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2025-09-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2025-09-300000024090cia:HomeServiceInsuranceSegmentMember2025-09-300000024090cia:PermanentMember2024-12-310000024090cia:PermanentLimitedPayMember2024-12-310000024090cia:OtherBusinessMember2024-12-310000024090cia:PermanentMember2025-01-012025-09-300000024090cia:PermanentLimitedPayMember2025-01-012025-09-300000024090cia:OtherBusinessMember2025-01-012025-09-300000024090cia:PermanentMember2025-09-300000024090cia:PermanentLimitedPayMember2025-09-300000024090cia:OtherBusinessMember2025-09-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:LifeInsuranceBusinessSegmentMember2023-12-310000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090cia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090cia:PermanentMembercia:LifeInsuranceBusinessSegmentMember2024-09-300000024090cia:PermanentLimitedPayMembercia:LifeInsuranceBusinessSegmentMember2024-09-300000024090cia:OtherBusinessMembercia:LifeInsuranceBusinessSegmentMember2024-09-300000024090cia:LifeInsuranceBusinessSegmentMember2024-09-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:HomeServiceInsuranceSegmentMember2023-12-310000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090cia:PermanentMembercia:HomeServiceInsuranceSegmentMember2024-09-300000024090cia:PermanentLimitedPayMembercia:HomeServiceInsuranceSegmentMember2024-09-300000024090cia:OtherBusinessMembercia:HomeServiceInsuranceSegmentMember2024-09-300000024090cia:HomeServiceInsuranceSegmentMember2024-09-300000024090cia:PermanentMember2023-12-310000024090cia:PermanentLimitedPayMember2023-12-310000024090cia:OtherBusinessMember2023-12-310000024090cia:PermanentMember2024-01-012024-09-300000024090cia:PermanentLimitedPayMember2024-01-012024-09-300000024090cia:OtherBusinessMember2024-01-012024-09-300000024090cia:PermanentMember2024-09-300000024090cia:PermanentLimitedPayMember2024-09-300000024090cia:OtherBusinessMember2024-09-300000024090cia:LifeInsuranceDeferredProfitLiabilityMember2025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceDeferredProfitLiabilityMember2025-09-300000024090cia:DeferredProfitLiabilityMember2025-09-300000024090cia:LifeInsuranceDeferredProfitLiabilityMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceDeferredProfitLiabilityMember2024-09-300000024090cia:DeferredProfitLiabilityMember2024-09-300000024090cia:LifeInsuranceOtherMember2025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2025-09-300000024090cia:OtherMember2025-09-300000024090cia:LifeInsuranceOtherMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-09-300000024090cia:OtherMember2024-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2025-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-09-300000024090us-gaap:LifeInsuranceSegmentMember2024-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2025-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2025-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-09-300000024090us-gaap:AccidentAndHealthInsuranceSegmentMember2024-09-300000024090cia:LifeInsuranceAndAccidentAndHealthMember2025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceAndHomeServiceInsuranceAccidentAndHealthMember2025-09-300000024090cia:LifeInsuranceAndAccidentAndHealthMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceAndHomeServiceInsuranceAccidentAndHealthMember2024-09-300000024090cia:LifeInsurancePermanentMember2025-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2025-09-300000024090cia:LifeInsurancePermanentMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2025-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2025-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-09-300000024090cia:LifeInsurancePermanentMember2025-07-012025-09-300000024090cia:LifeInsurancePermanentMember2024-07-012024-09-300000024090cia:LifeInsurancePermanentMember2025-01-012025-09-300000024090cia:LifeInsurancePermanentMember2024-01-012024-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2025-07-012025-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-07-012024-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2025-01-012025-09-300000024090cia:LifeInsurancePermanentLimitedPayMember2024-01-012024-09-300000024090cia:LifeInsuranceOtherMember2025-07-012025-09-300000024090cia:LifeInsuranceOtherMember2024-07-012024-09-300000024090cia:LifeInsuranceOtherMember2025-01-012025-09-300000024090cia:LifeInsuranceOtherMember2024-01-012024-09-300000024090cia:LifeInsuranceReinsuranceMember2025-07-012025-09-300000024090cia:LifeInsuranceReinsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceReinsuranceMember2025-01-012025-09-300000024090cia:LifeInsuranceReinsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2025-07-012025-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2025-01-012025-09-300000024090cia:LifeInsuranceNetOfReinsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2025-07-012025-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-07-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2025-01-012025-09-300000024090cia:LifeInsuranceAccidentAndHealthOtherMember2024-01-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2025-07-012025-09-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2025-01-012025-09-300000024090cia:LifeInsuranceAccidentAndHealthReinsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2025-07-012025-09-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2025-01-012025-09-300000024090cia:LifeInsuranceAccidentAndHealthNetOfReinsuranceMember2024-01-012024-09-300000024090cia:LifeInsuranceMember2025-07-012025-09-300000024090cia:LifeInsuranceMember2024-07-012024-09-300000024090cia:LifeInsuranceMember2025-01-012025-09-300000024090cia:LifeInsuranceMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2025-07-012025-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2025-01-012025-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2025-07-012025-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2025-01-012025-09-300000024090cia:HomeServiceInsuranceLifeInsurancePermanentLimitedPayMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2025-07-012025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2025-01-012025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceOtherMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2025-07-012025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2025-01-012025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceReinsuranceMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2025-07-012025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2025-01-012025-09-300000024090cia:HomeServiceInsuranceLifeInsuranceNetOfReinsuranceMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2025-07-012025-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-07-012024-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2025-01-012025-09-300000024090cia:HomeServiceInsuranceAccidentAndHealthOtherMember2024-01-012024-09-300000024090cia:HomeServiceInsuranceSegmentMember2025-07-012025-09-300000024090cia:HomeServiceInsuranceSegmentMember2024-07-012024-09-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-09-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2025-09-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-09-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2025-09-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-09-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2025-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMember2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Member2025-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMember2025-09-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0000To0149Member2024-09-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0150To0299Member2024-09-300000024090srt:MinimumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090srt:MaximumMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFrom0300To0449Member2024-09-300000024090cia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Membercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMembercia:PolicyholderAccountBalanceGuaranteedMinimumCreditingRateRangeFromGreaterThanOrEqualTo0450Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAtGuaranteedMinimumCreditingRateMember2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0001To0050Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0051To0150Member2024-09-300000024090us-gaap:PolicyholderAccountBalanceAboveGuaranteedMinimumCreditingRateRangeFrom0151AndGreaterMember2024-09-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2024-12-310000024090us-gaap:FixedAnnuityMember2024-12-310000024090cia:DividendAccumulationsMember2024-12-310000024090cia:PremiumsPaidInAdvanceMember2024-12-310000024090cia:SupplementalContractsWithoutLifeContingenciesMember2025-01-012025-09-300000024090us-gaap:FixedAnnuityMember2025-01-012025-09-300000024090cia:DividendAccumulationsMember2025-01-012025-09-300000024090cia:PremiumsPaidInAdvanceMember2025-01-012025-09-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2025-09-300000024090us-gaap:FixedAnnuityMember2025-09-300000024090cia:DividendAccumulationsMember2025-09-300000024090cia:PremiumsPaidInAdvanceMember2025-09-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2023-12-310000024090us-gaap:FixedAnnuityMember2023-12-310000024090cia:DividendAccumulationsMember2023-12-310000024090cia:PremiumsPaidInAdvanceMember2023-12-310000024090cia:SupplementalContractsWithoutLifeContingenciesMember2024-01-012024-09-300000024090us-gaap:FixedAnnuityMember2024-01-012024-09-300000024090cia:DividendAccumulationsMember2024-01-012024-09-300000024090cia:PremiumsPaidInAdvanceMember2024-01-012024-09-300000024090cia:SupplementalContractsWithoutLifeContingenciesMember2024-09-300000024090us-gaap:FixedAnnuityMember2024-09-300000024090cia:DividendAccumulationsMember2024-09-300000024090cia:PremiumsPaidInAdvanceMember2024-09-300000024090cia:UnearnedRevenueReserveMember2025-09-300000024090cia:UnearnedRevenueReserveMember2024-09-300000024090us-gaap:AccidentAndHealthInsuranceExcludingWorkersCompensationMember2025-01-012025-09-300000024090us-gaap:OtherInsuranceProductLineMember2025-09-300000024090us-gaap:OtherInsuranceProductLineMember2024-12-310000024090us-gaap:OtherShortdurationInsuranceProductLineMember2025-07-012025-09-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2024-07-012024-09-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2025-01-012025-09-300000024090us-gaap:OtherShortdurationInsuranceProductLineMember2024-01-012024-09-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2025-07-012025-09-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2024-07-012024-09-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2025-01-012025-09-300000024090us-gaap:OtherLongdurationInsuranceProductLineMember2024-01-012024-09-300000024090us-gaap:UnfundedLoanCommitmentMember2025-09-3000000240902024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2024-05-0300000240902024-05-030000024090us-gaap:FederalFundsEffectiveSwapRateMember2024-05-032024-05-030000024090us-gaap:SecuredOvernightFinancingRateSofrMember2024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2024-05-032024-05-030000024090us-gaap:RevolvingCreditFacilityMember2025-09-3000000240902004-03-040000024090us-gaap:CommonClassAMember2004-03-040000024090us-gaap:CommonClassBMember2004-03-040000024090us-gaap:TreasuryStockCommonMember2024-12-310000024090us-gaap:CommonClassAMember2023-12-310000024090us-gaap:TreasuryStockCommonMember2023-12-310000024090us-gaap:TreasuryStockCommonMember2025-01-012025-09-300000024090us-gaap:TreasuryStockCommonMember2024-01-012024-09-300000024090us-gaap:TreasuryStockCommonMember2025-09-300000024090us-gaap:CommonClassAMember2024-09-300000024090us-gaap:TreasuryStockCommonMember2024-09-300000024090srt:ParentCompanyMember2024-03-272024-03-270000024090cia:CICALifeInsuranceCompanyOfAmericaAColoradoCompanyMembersrt:ParentCompanyMember2024-03-272024-03-270000024090cia:CICALifeInsuranceCompanyOfAmericaAColoradoCompanyMember2025-01-012025-09-300000024090country:PR2025-01-012025-09-300000024090cia:CICALifeAIAPuertoRicoCompanyMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:LifeInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:AccidentAndHealthInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:CorporateNonSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:LifeInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:AccidentAndHealthInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:CorporateNonSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:LifeInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:AccidentAndHealthInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:CorporateNonSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:LifeInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:LifeInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMemberus-gaap:AccidentAndHealthInsuranceSegmentMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:CorporateNonSegmentMemberus-gaap:AccidentAndHealthInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:CorporateNonSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:LifeInsuranceBusinessSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:LifeInsuranceBusinessSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:LifeInsuranceBusinessSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:LifeInsuranceBusinessSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:LifeInsuranceBusinessSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:LifeInsuranceBusinessSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:HomeServiceInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:HomeServiceInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectFirstYearPremiumMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:HomeServiceInsuranceSegmentMember2025-07-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:HomeServiceInsuranceSegmentMember2024-07-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:HomeServiceInsuranceSegmentMember2025-01-012025-09-300000024090us-gaap:OperatingSegmentsMembercia:DirectRenewalPremiumMembercia:HomeServiceInsuranceSegmentMember2024-01-012024-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2025-09-300000024090us-gaap:OperatingSegmentsMembercia:LifeInsuranceBusinessSegmentMember2024-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2025-09-300000024090us-gaap:OperatingSegmentsMembercia:HomeServiceInsuranceSegmentMember2024-09-300000024090us-gaap:OperatingSegmentsMember2025-09-300000024090us-gaap:OperatingSegmentsMember2024-09-300000024090us-gaap:CorporateNonSegmentMember2025-09-300000024090us-gaap:CorporateNonSegmentMember2024-09-300000024090country:US2025-07-012025-09-300000024090country:US2024-07-012024-09-300000024090country:US2025-01-012025-09-300000024090country:US2024-01-012024-09-300000024090country:CO2025-07-012025-09-300000024090country:CO2024-07-012024-09-300000024090country:CO2025-01-012025-09-300000024090country:CO2024-01-012024-09-300000024090country:EC2025-07-012025-09-300000024090country:EC2024-07-012024-09-300000024090country:EC2025-01-012025-09-300000024090country:EC2024-01-012024-09-300000024090country:TW2025-07-012025-09-300000024090country:TW2024-07-012024-09-300000024090country:TW2025-01-012025-09-300000024090country:TW2024-01-012024-09-300000024090country:VE2025-07-012025-09-300000024090country:VE2024-07-012024-09-300000024090country:VE2025-01-012025-09-300000024090country:VE2024-01-012024-09-300000024090country:AR2025-07-012025-09-300000024090country:AR2024-07-012024-09-300000024090country:AR2025-01-012025-09-300000024090country:AR2024-01-012024-09-300000024090cia:OtherNonUSMember2025-07-012025-09-300000024090cia:OtherNonUSMember2024-07-012024-09-300000024090cia:OtherNonUSMember2025-01-012025-09-300000024090cia:OtherNonUSMember2024-01-012024-09-300000024090country:AllCountriesDomain2025-07-012025-09-300000024090country:AllCountriesDomain2024-07-012024-09-300000024090country:AllCountriesDomain2025-01-012025-09-300000024090country:AllCountriesDomain2024-01-012024-09-300000024090cia:GovernmentOfPuertoRicoMember2025-01-012025-09-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-12-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-12-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-01-012025-03-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-01-012025-03-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-03-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-03-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-04-012025-06-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-04-012025-06-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-06-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-06-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-07-012025-09-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-07-012025-09-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-09-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2025-09-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2023-12-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-03-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-01-012024-03-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-03-310000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-03-310000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-04-012024-06-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-04-012024-06-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-06-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-06-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-07-012024-09-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-07-012024-09-300000024090us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-09-300000024090us-gaap:AociLiabilityForFuturePolicyBenefitParentMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2025

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

COMMISSION FILE NUMBER: 000-16509

|

|

|

| CITIZENS, INC. |

| (Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

| Colorado |

84-0755371 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

11815 Alterra Pkwy, Floor 15, Austin, TX 78758

(Current Address)

Registrant's telephone number, including area code: (512) 837-7100

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act |

|

| Class A Common Stock |

CIA |

NYSE |

| (Title of each class) |

(Trading symbol(s)) |

(Name of each exchange on which registered) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☒ |

|

Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

As of October 31, 2025, the Registrant had 50,296,848 shares of Class A common stock outstanding.

THIS PAGE INTENTIONALLY LEFT BLANK

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page Number |

| Part I. FINANCIAL INFORMATION |

|

|

|

|

|

| |

Item 1. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Item 2. |

|

|

|

|

|

|

| |

Item 3. |

|

|

|

|

|

|

| |

Item 4. |

|

|

|

|

|

|

| Part II. OTHER INFORMATION |

|

|

|

|

|

| |

Item 1. |

|

|

|

|

|

|

|

Item 1A. |

|

|

|

|

|

|

| |

Item 2. |

|

|

|

|

|

|

| |

Item 3. |

|

|

|

|

|

|

| |

Item 4. |

|

|

|

|

|

|

| |

Item 5. |

|

|

|

|

|

|

| |

Item 6. |

|

|

September 30, 2025 | 10-Q 1

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

September 30, 2025 |

|

December 31, 2024 |

|

(Unaudited) |

|

|

Assets: |

|

|

|

| Investments: |

|

|

|

Fixed maturity securities available-for-sale, at fair value (amortized cost: $1,409,626 and $1,401,301 in 2025 and 2024, respectively) |

$ |

1,270,045 |

|

|

1,220,961 |

|

|

|

|

|

| Equity securities, at fair value |

1,371 |

|

|

5,447 |

|

|

|

|

|

| Policy loans |

68,717 |

|

|

71,216 |

|

|

|

|

|

|

|

|

|

Other long-term investments (portion measured at fair value $85,455 and $93,337 in 2025 and 2024, respectively) |

85,738 |

|

|

93,604 |

|

|

|

|

|

| Total investments |

1,425,871 |

|

|

1,391,228 |

|

Cash and cash equivalents (restricted portion: $1,554 in both 2025 and 2024) |

23,123 |

|

|

29,271 |

|

| Accrued investment income |

17,285 |

|

|

17,546 |

|

| Receivable for securities |

12,946 |

|

|

— |

|

| Reinsurance recoverable |

10,385 |

|

|

6,941 |

|

| Deferred policy acquisition costs |

214,123 |

|

|

199,635 |

|

| Cost of insurance acquired |

9,141 |

|

|

9,446 |

|

| Current federal income tax receivable |

532 |

|

|

148 |

|

|

|

|

|

| Property and equipment, net |

9,584 |

|

|

10,574 |

|

| Due premiums |

9,937 |

|

|

11,721 |

|

|

|

|

|

Other assets (less allowance for losses of $725 and $516 in 2025 and 2024, respectively) |

9,438 |

|

|

8,815 |

|

| Total assets |

$ |

1,742,365 |

|

|

1,685,325 |

|

See accompanying Notes to Consolidated Financial Statements.

September 30, 2025 | 10-Q 2

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets, Continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except share amounts) |

September 30, 2025 |

|

December 31, 2024 |

|

(Unaudited) |

|

|

Liabilities and Stockholders' Equity: |

|

|

|

| Liabilities: |

|

|

|

| Policy liabilities: |

|

|

|

| Future policy benefit reserves: |

|

|

|

| Life insurance |

$ |

1,192,390 |

|

|

1,172,034 |

|

| Accident and health insurance |

1,241 |

|

|

1,071 |

|

| Total future policy benefit reserves |

1,193,631 |

|

|

1,173,105 |

|

| Policyholders' funds: |

|

|

|

| Annuities |

168,396 |

|

|

149,977 |

|

| Dividend accumulations |

50,145 |

|

|

47,768 |

|

| Premiums paid in advance |

30,628 |

|

|

31,182 |

|

| Policy claims payable |

8,806 |

|

|

8,822 |

|

| Other policyholders' funds |

7,943 |

|

|

7,271 |

|

| Total policyholders' funds |

265,918 |

|

|

245,020 |

|

| Total policy liabilities |

1,459,549 |

|

|

1,418,125 |

|

| Commissions payable |

4,343 |

|

|

4,546 |

|

|

|

|

|

| Deferred federal income tax liability |

5,224 |

|

|

3,442 |

|

Payable for securities |

454 |

|

|

— |

|

| Other liabilities |

47,191 |

|

|

48,857 |

|

| Total liabilities |

1,516,761 |

|

|

1,474,970 |

|

Commitments and contingencies ( Notes 7 and 8) |

|

|

|

| Stockholders' Equity: |

|

|

|

| Common stock: |

|

|

|

Class A, no par value, 100,000,000 shares authorized, 54,615,810 and 54,235,165 shares issued and outstanding in 2025 and 2024, respectively, including shares in treasury of 4,327,810 in 2025 and 2024 |

271,246 |

|

|

269,799 |

|

Class B, no par value, 2,000,000 shares authorized, 1,001,714 shares issued and outstanding in 2025 and 2024, including shares in treasury of 1,001,714 in 2025 and 2024 |

3,184 |

|

|

3,184 |

|

| Retained earnings |

64,315 |

|

|

57,062 |

|

| Accumulated other comprehensive income (loss) |

(89,416) |

|

|

(95,965) |

|

| Treasury stock, at cost |

(23,725) |

|

|

(23,725) |

|

| Total stockholders' equity |

225,604 |

|

|

210,355 |

|

| Total liabilities and stockholders' equity |

$ |

1,742,365 |

|

|

1,685,325 |

|

See accompanying Notes to Consolidated Financial Statements.

September 30, 2025 | 10-Q 3

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, |

|

September 30, |

(In thousands, except per share amounts) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

| Premiums: |

|

|

|

|

|

|

|

| Life insurance |

$ |

42,872 |

|

|

42,461 |

|

|

125,158 |

|

|

122,823 |

|

| Accident and health insurance |

431 |

|

|

452 |

|

|

1,330 |

|

|

1,324 |

|

| Property insurance |

— |

|

|

(16) |

|

|

— |

|

|

(18) |

|

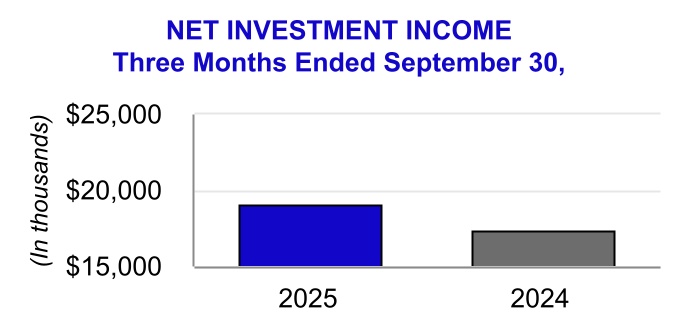

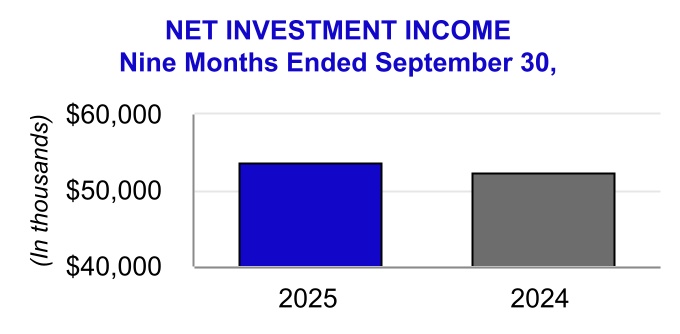

| Net investment income |

19,117 |

|

|

17,377 |

|

|

53,663 |

|

|

52,404 |

|

| Investment related gains (losses), net |

(1,255) |

|

|

827 |

|

|

(1,741) |

|

|

1,537 |

|

| Other income |

1,643 |

|

|

630 |

|

|

5,136 |

|

|

3,457 |

|

| Total revenues |

62,808 |

|

|

61,731 |

|

|

183,546 |

|

|

181,527 |

|

| Benefits and Expenses: |

|

|

|

|

|

|

|

| Insurance benefits paid or provided: |

|

|

|

|

|

|

|

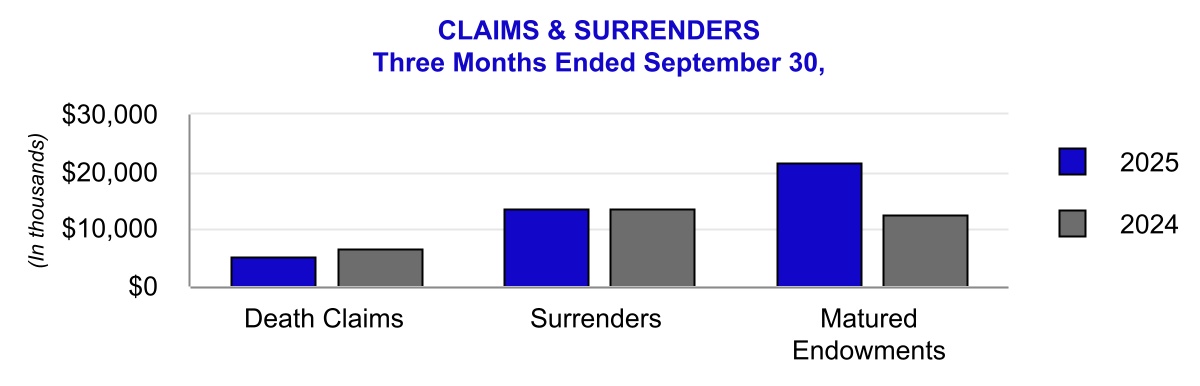

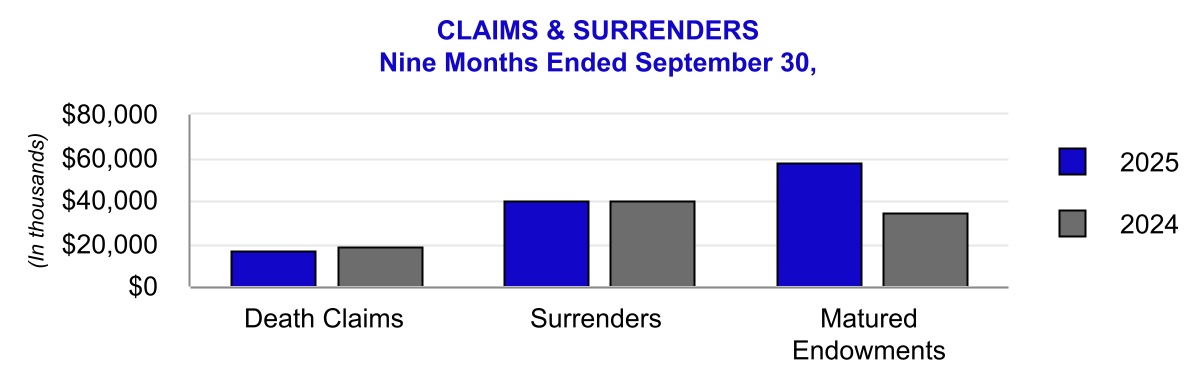

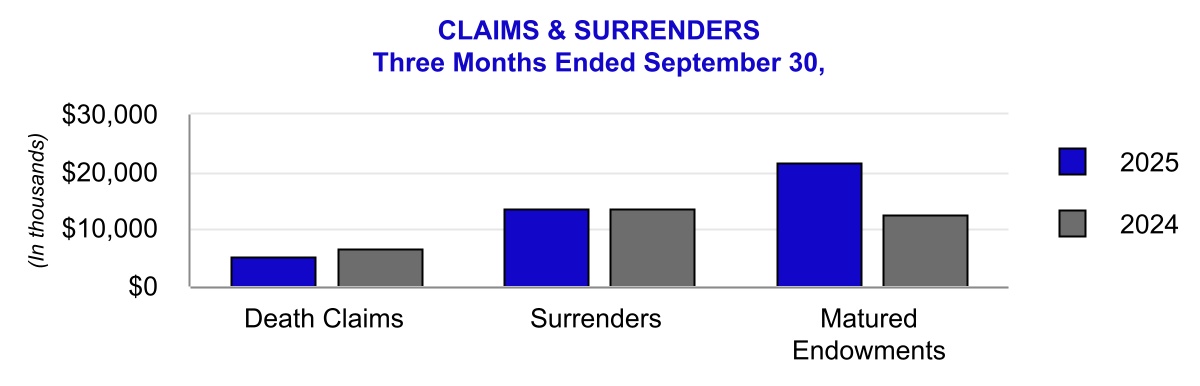

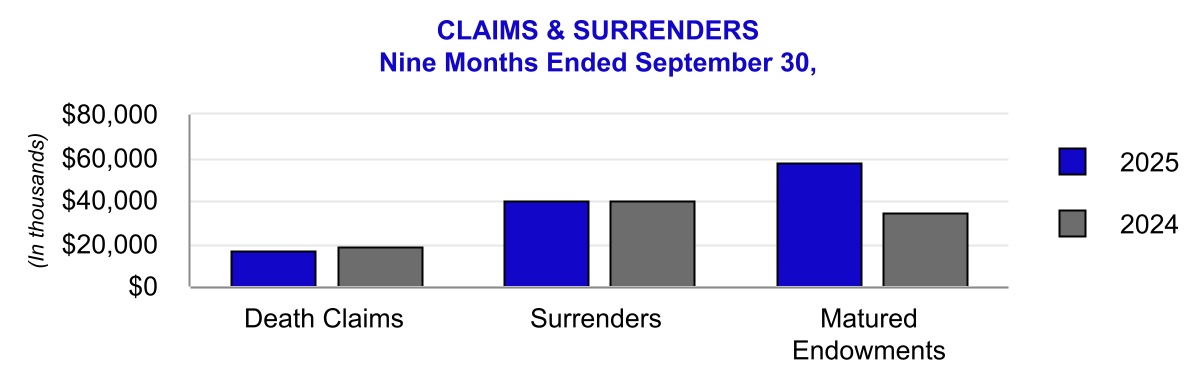

| Claims and surrenders |

44,276 |

|

|

36,478 |

|

|

124,594 |

|

|

104,121 |

|

| Increase (decrease) in future policy benefit reserves |

(6,760) |

|

|

471 |

|

|

(14,960) |

|

|

(130) |

|

| Policyholder liability remeasurement (gain) loss |

(459) |

|

|

1,157 |

|

|

720 |

|

|

2,836 |

|

| Policyholders' dividends |

1,377 |

|

|

1,320 |

|

|

3,987 |

|

|

3,748 |

|

| Total insurance benefits paid or provided |

38,434 |

|

|

39,426 |

|

|

114,341 |

|

|

110,575 |

|

|

|

|

|

|

|

|

|

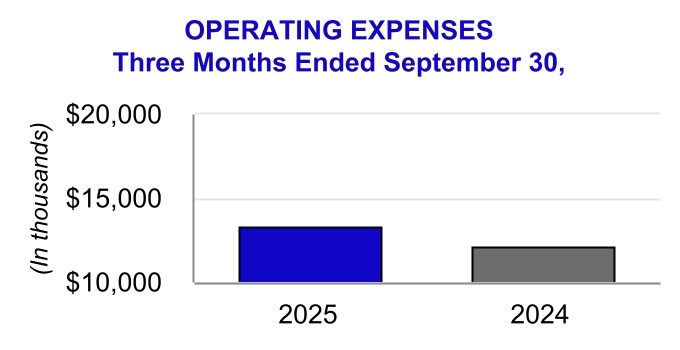

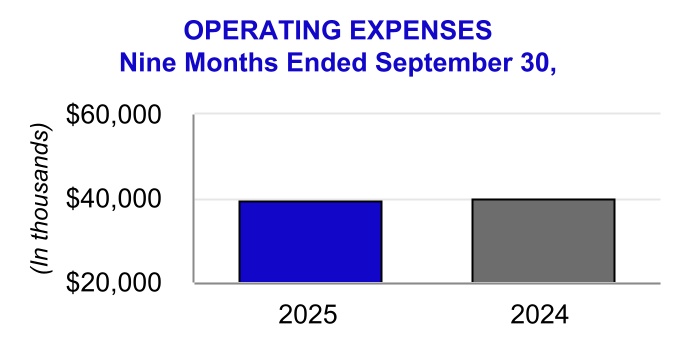

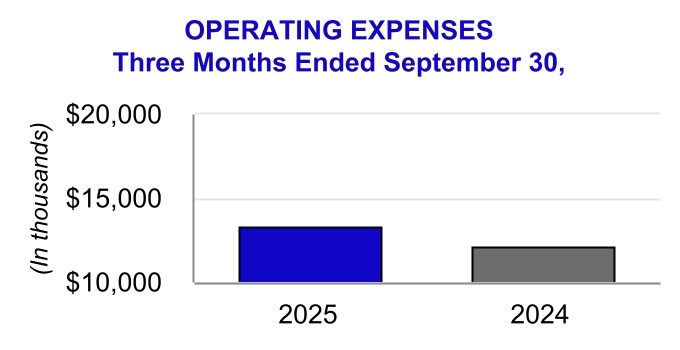

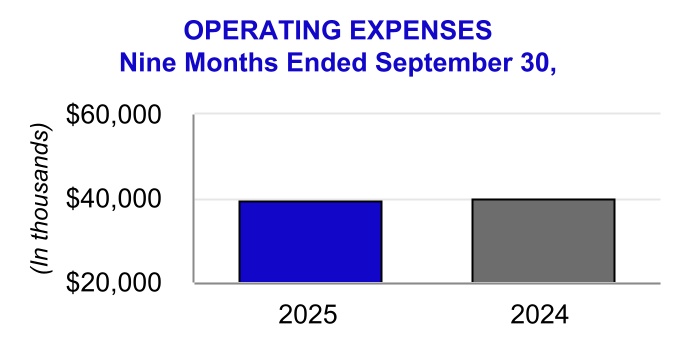

| Commissions |

11,655 |

|

|

12,957 |

|

|

34,339 |

|

|

35,639 |

|

| Other general expenses |

13,291 |

|

|

12,095 |

|

|

39,443 |

|

|

40,072 |

|

| Capitalization of deferred policy acquisition costs |

(9,974) |

|

|

(10,430) |

|

|

(28,543) |

|

|

(29,304) |

|

| Amortization of deferred policy acquisition costs |

4,795 |

|

|

4,493 |

|

|

14,055 |

|

|

12,804 |

|

| Amortization of cost of insurance acquired |

128 |

|

|

153 |

|

|

305 |

|

|

477 |

|

| Total benefits and expenses |

58,329 |

|

|

58,694 |

|

|

173,940 |

|

|

170,263 |

|

Income (loss) before federal income tax |

4,479 |

|

|

3,037 |

|

|

9,606 |

|

|

11,264 |

|

Federal income tax expense (benefit) |

2,062 |

|

|

247 |

|

|

2,353 |

|

|

(27) |

|

Net income (loss) |

2,417 |

|

|

2,790 |

|

|

7,253 |

|

|

11,291 |

|

|

|

|

|

|

|

|

|

| Per Share Amounts: |

|

|

|

|

|

|

|

| Basic earnings (loss) per share of Class A common stock |

0.04 |

|

|

0.06 |

|

|

0.14 |

|

|

0.23 |

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share of Class A common stock |

0.04 |

|

|

0.05 |

|

|

0.14 |

|

|

0.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Comprehensive Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized gains (losses) on fixed maturity securities: |

|

|

|

|

|

|

|

| Unrealized holding gains (losses) arising during period |

22,623 |

|

|

59,101 |

|

|

41,200 |

|

|

31,427 |

|

Reclassification adjustment for (gains) losses included in net income (loss) |

(691) |

|

|

(100) |

|

|

(440) |

|

|

547 |

|

| Unrealized gains (losses) on fixed maturity securities, net |

21,932 |

|

|

59,001 |

|

|

40,760 |

|

|

31,974 |

|

| Change in current discount rate for liability for future policy benefits |

(29,058) |

|

|

(45,404) |

|

|

(33,644) |

|

|

(5,887) |

|

| Income tax expense (benefit) on other comprehensive income items |

(1,365) |

|

|

356 |

|

|

567 |

|

|

2,615 |

|

| Other comprehensive income (loss) |

(5,761) |

|

|

13,241 |

|

|

6,549 |

|

|

23,472 |

|

| Total comprehensive income (loss) |

$ |

(3,344) |

|

|

16,031 |

|

|

13,802 |

|

|

34,763 |

|

See accompanying Notes to Consolidated Financial Statements.

September 30, 2025 | 10-Q 4

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Stockholders' Equity

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Treasury Stock |

Total Stockholders' Equity |

| (In thousands) |

Class A |

Class B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2024 |

$ |

269,799 |

|

|

3,184 |

|

|

57,062 |

|

|

(95,965) |

|

|

(23,725) |

|

|

210,355 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

— |

|

|

— |

|

|

(1,623) |

|

|

— |

|

|

— |

|

|

(1,623) |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

8,891 |

|

|

— |

|

|

8,891 |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

(1,623) |

|

|

8,891 |

|

|

— |

|

|

7,268 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

516 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

516 |

|

| Balance at March 31, 2025 |

270,315 |

|

|

3,184 |

|

|

55,439 |

|

|

(87,074) |

|

|

(23,725) |

|

|

218,139 |

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

— |

|

|

— |

|

|

6,459 |

|

|

— |

|

|

— |

|

|

6,459 |

|

| Other comprehensive income (loss) |

— |

|

|

— |

|

|

— |

|

|

3,419 |

|

|

— |

|

|

3,419 |

|

| Total comprehensive income (loss) |

— |

|

|

— |

|

|

6,459 |

|

|