UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 25, 2024

AMERICAN AIRLINES GROUP INC.

AMERICAN AIRLINES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 1-8400 | 75-1825172 | ||||||||||||

| Delaware | 1-2691 | 13-1502798 | ||||||||||||

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| 1 Skyview Drive, | Fort Worth, | Texas | 76155 | ||||||||||||||

| 1 Skyview Drive, | Fort Worth, | Texas | 76155 | ||||||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||||||||

Registrant’s telephone number, including area code:

(682) 278-9000

(682) 278-9000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

||||||||||||

| Common Stock, $0.01 par value per share | AAL | The Nasdaq Global Select Market | ||||||||||||

| Preferred Stock Purchase Rights | — |

(1) |

||||||||||||

(1) Attached to the Common Stock

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

| Emerging growth company | ☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 2.02. | RESULTS OF OPERATIONS AND FINANCIAL CONDITION. | ||||

On July 25, 2024, American Airlines Group Inc. (the Company, we, us and our) issued a press release reporting financial results for the three and six months ended June 30, 2024. The press release is furnished as Exhibit 99.1 to this report.

| ITEM 7.01. | REGULATION FD DISCLOSURE. | ||||

On July 25, 2024, the Company provided a presentation to investors. This investor presentation is located on the Company’s website at www.aa.com under “Investor Relations” and is furnished as Exhibit 99.2 to this report.

Also on July 25, 2024, the Company provided an update for investors presenting information relating to its financial and operational outlook for the third quarter and full year 2024. This investor update is located on the Company’s website at www.aa.com under “Investor Relations” and is furnished as Exhibit 99.3 to this report.

The information in Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibits 99.1, 99.2 and 99.3, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| ITEM 9.01. | FINANCIAL STATEMENTS AND EXHIBITS. | ||||

| (d) Exhibits. | ||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 104.1 | Cover page interactive data file (embedded within the Inline XBRL document). | |||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines Group Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AMERICAN AIRLINES GROUP INC. |

|||||||||||

| Date: July 25, 2024 | By: | /s/ Devon E. May | |||||||||

| Devon E. May | |||||||||||

| Executive Vice President and Chief Financial Officer |

|||||||||||

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AMERICAN AIRLINES, INC. |

|||||||||||

| Date: July 25, 2024 | By: | /s/ Devon E. May | |||||||||

| Devon E. May | |||||||||||

| Executive Vice President and Chief Financial Officer |

|||||||||||

Exhibit 99.1

|

Corporate Communications | |||||||

| mediarelations@aa.com | ||||||||

| Investor Relations | ||||||||

| investor.relations@aa.com | ||||||||

FOR RELEASE: Thursday, July 25, 2024

AMERICAN AIRLINES REPORTS SECOND-QUARTER 2024 FINANCIAL RESULTS

FORT WORTH, Texas –– American Airlines Group Inc. (NASDAQ: AAL) today reported its second-quarter 2024 financial results, including:

•Highest-ever quarterly revenue of $14.3 billion.

•Second-quarter net income of $717 million, or $1.01 per diluted share. Excluding net special items1, second-quarter net income of $774 million, or $1.09 per diluted share.

•Generated operating cash flow of approximately $1.1 billion and free cash flow2 of approximately $850 million in the second quarter.

•Reduced total debt3 by approximately $680 million in the second quarter.

•On track to reduce total debt3 from peak levels by $15 billion by year-end 2025.

•Full-year adjusted earnings per diluted share4 expected to be between $0.70 and $1.30.

“American has a fleet, network and product built to deliver results, but during the second quarter, we did not perform to our initial expectations due to our prior sales and distribution strategy and an imbalance of domestic supply and demand,” said American’s CEO Robert Isom. “We are taking this challenge head-on, with clear and decisive actions to deliver on a strategy that maximizes our revenue and profitability, and importantly, one that makes it easy for customers to do business with American. When we return to the level of revenue generation we know we can achieve, and we couple that with our operational reliability and best-in-class cost management, we will unlock significant value.”

Sales and distribution

American has taken swift and aggressive action to reorient its sales and distribution strategy in ways that continue to be customer-centric, while addressing feedback from corporate and agency partners. Since May, the airline has focused its near-term efforts in three areas:

Ensuring content availability

•Restored content. American has reinstated competitive fares in the distribution channel traditionally used by travel agencies and corporate managed travel programs.

•Removed plans to differentiate mileage earn by channel. Travelers continue to earn in the AAdvantage® program as usual, no matter where they book.

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 2

Making it easy, attractive and rewarding to do business with American

•Expanded availability of AAdvantage Business™ benefits to agencies. Companies will earn AAdvantage® miles and travelers will earn Loyalty Points anywhere business travel is booked, including when booked through travel agencies.

•Announced new features coming to AAdvantage Business™. Improvements will enhance the travel management and end-traveler experience.

Strengthening relationships and regaining the trust of partners

•Listening to feedback. The company has conducted extensive outreach to customers to inform them of changes being made to address pain points.

•Updating agreements. American is renegotiating contracts with corporate customers and travel agencies.

•Improving support. The airline is adding account managers for corporate customers, has established a dedicated AAdvantage Business™ customer service team and is increasing sales support for agencies.

Operational performance

The American Airlines team continues to produce strong operational results and demonstrate its resilience in recovering from irregular operations, as evidenced by its second-quarter performance, despite significant storms that impacted several key hubs in May and June. The airline also delivered a fantastic operation over the Fourth of July holiday, carrying 7.2 million customers and operating its largest-ever schedule while producing its best-ever combined completion factor over the holiday period. American quickly rebounded from the technology outage that impacted businesses worldwide on July 19. By that evening, its operation had fully recovered, and the airline delivered a 98.9% completion factor the next day — the best operational performance among U.S. network carriers.

Financial performance

American produced record quarterly revenue of $14.3 billion in the second quarter, an increase of 2% year over year. On both a GAAP basis and excluding the impact of net special items1, the company produced an operating margin of 9.7% in the quarter.

Balance sheet and liquidity

American remains committed to strengthening its balance sheet. In the second quarter, the company reduced total debt3 by approximately $680 million and is now more than $13 billion, or approximately 87%, toward its goal of reducing total debt3 by $15 billion by the end of 2025. The company ended the quarter with approximately $11.7 billion of total available liquidity, comprised of cash and short-term investments plus undrawn capacity under revolving credit facilities.

Guidance and investor update

American has taken aggressive action to improve its revenue performance, however, the company’s previous sales and distribution strategy will continue to impact its revenue performance and earnings through the remainder of the year. Accounting for these impacts and based on present demand trends, the current fuel price forecast and excluding the impact of special items, the company expects its third-quarter 2024 adjusted earnings per diluted share4 to be approximately breakeven. The company now expects its full-year 2024 adjusted earnings per diluted share4 to be between $0.70 and $1.30.

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 3

For additional financial forecasting detail, please refer to the company’s investor update, furnished with this press release with the SEC on Form 8-K. This filing is also available at aa.com/investorrelations.

Conference call and webcast details

The company will conduct a live audio webcast of its financial results conference call at 7:30 a.m. CT today. The call will be available to the public on a listen-only basis at

aa.com/investorrelations. An archive of the webcast will be available through Aug. 25.

Notes

See the accompanying notes in the financial tables section of this press release for further explanation, including a reconciliation of all GAAP to non-GAAP financial information and the calculation of free cash flow.

1.The company recognized $57 million of net special items in the second quarter after the effect of taxes, which principally included nonoperating net special items for charges associated with debt refinancings and mark-to-market net unrealized losses on certain equity investments.

2.Please see the accompanying notes for the company’s definition of free cash flow, which is a non-GAAP measure.

3.All references to total debt include debt, finance and operating lease liabilities and pension obligations.

4.Adjusted earnings per diluted share guidance excludes the impact of net special items. The company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time.

About American Airlines Group

To Care for People on Life’s Journey®. Shares of American Airlines Group Inc. trade on Nasdaq under the ticker symbol AAL and the company’s stock is included in the S&P 500. Learn more about what’s happening at American by visiting news.aa.com and connect with American @AmericanAir and at Facebook.com/AmericanAirlines.

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 4

Cautionary statement regarding forward-looking statements and information

Certain of the statements contained in this report should be considered forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in the company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors), and other risks and uncertainties listed from time to time in the company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement.

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 5

American Airlines Group Inc.

Condensed Consolidated Statements of Operations

(In millions, except share and per share amounts)

(Unaudited)

| 3 Months Ended June 30, |

Percent Increase (Decrease) |

6 Months Ended June 30, |

Percent Increase (Decrease) |

||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

| Operating revenues: | |||||||||||||||||||||||||||||||||||

| Passenger | $ | 13,202 | $ | 12,978 | 1.7 | $ | 24,661 | $ | 24,081 | 2.4 | |||||||||||||||||||||||||

| Cargo | 195 | 197 | (1.3) | 382 | 420 | (9.1) | |||||||||||||||||||||||||||||

| Other | 937 | 880 | 6.4 | 1,861 | 1,743 | 6.8 | |||||||||||||||||||||||||||||

| Total operating revenues | 14,334 | 14,055 | 2.0 | 26,904 | 26,244 | 2.5 | |||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||

| Aircraft fuel and related taxes | 3,061 | 2,723 | 12.4 | 6,042 | 5,890 | 2.6 | |||||||||||||||||||||||||||||

| Salaries, wages and benefits | 3,953 | 3,635 | 8.7 | 7,820 | 6,917 | 13.1 | |||||||||||||||||||||||||||||

| Regional expenses: | |||||||||||||||||||||||||||||||||||

| Regional operating expenses | 1,189 | 1,073 | 10.7 | 2,311 | 2,135 | 8.2 | |||||||||||||||||||||||||||||

| Regional depreciation and amortization | 79 | 80 | (0.1) | 158 | 160 | (0.7) | |||||||||||||||||||||||||||||

| Maintenance, materials and repairs | 950 | 808 | 17.6 | 1,834 | 1,520 | 20.7 | |||||||||||||||||||||||||||||

| Other rent and landing fees | 834 | 762 | 9.5 | 1,653 | 1,470 | 12.5 | |||||||||||||||||||||||||||||

| Aircraft rent | 314 | 344 | (8.6) | 642 | 688 | (6.7) | |||||||||||||||||||||||||||||

| Selling expenses | 456 | 489 | (6.8) | 864 | 927 | (6.8) | |||||||||||||||||||||||||||||

| Depreciation and amortization | 474 | 483 | (1.9) | 944 | 969 | (2.6) | |||||||||||||||||||||||||||||

| Special items, net | — | — | — | 70 | 13 | nm | |||||||||||||||||||||||||||||

| Other | 1,640 | 1,495 | 9.7 | 3,175 | 2,955 | 7.5 | |||||||||||||||||||||||||||||

| Total operating expenses | 12,950 | 11,892 | 8.9 | 25,513 | 23,644 | 7.9 | |||||||||||||||||||||||||||||

| Operating income | 1,384 | 2,163 | (36.0) | 1,391 | 2,600 | (46.5) | |||||||||||||||||||||||||||||

| Nonoperating income (expense): | |||||||||||||||||||||||||||||||||||

| Interest income | 128 | 162 | (21.3) | 246 | 288 | (14.7) | |||||||||||||||||||||||||||||

| Interest expense, net | (486) | (548) | (11.3) | (984) | (1,088) | (9.7) | |||||||||||||||||||||||||||||

| Other income (expense), net | 2 | (14) | nm | (1) |

(38) | (21) | 86.1 | ||||||||||||||||||||||||||||

| Total nonoperating expense, net | (356) | (400) | (11.0) | (776) | (821) | (5.5) | |||||||||||||||||||||||||||||

| Income before income taxes | 1,028 | 1,763 | (41.7) | 615 | 1,779 | (65.4) | |||||||||||||||||||||||||||||

| Income tax provision | 311 | 425 | (26.6) | 210 | 431 | (51.2) | |||||||||||||||||||||||||||||

| Net income | $ | 717 | $ | 1,338 | (46.4) | $ | 405 | $ | 1,348 | (70.0) | |||||||||||||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||||||||||||||

| Basic | $ | 1.09 | $ | 2.05 | $ | 0.62 | $ | 2.06 | |||||||||||||||||||||||||||

| Diluted | $ | 1.01 | $ | 1.88 | $ | 0.59 | $ | 1.91 | |||||||||||||||||||||||||||

| Weighted average shares outstanding (in thousands): | |||||||||||||||||||||||||||||||||||

| Basic | 656,965 | 653,602 | 656,406 | 652,801 | |||||||||||||||||||||||||||||||

| Diluted | 720,302 | 719,345 | 720,712 | 718,890 | |||||||||||||||||||||||||||||||

Note: Percent change may not recalculate due to rounding.

(1)Not meaningful or greater than 100% change.

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 6

American Airlines Group Inc.

Consolidated Operating Statistics (1)

(Unaudited)

| 3 Months Ended June 30, |

Increase (Decrease) |

6 Months Ended June 30, |

Increase (Decrease) |

||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 65,144 | 60,020 | 8.5 % | 122,617 | 112,034 | 9.4 % | |||||||||||||||||||||||||||||

| Available seat miles (ASM) (millions) | 75,263 | 69,658 | 8.0 % | 145,779 | 134,665 | 8.3 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 86.6 | 86.2 | 0.4 pts | 84.1 | 83.2 | 0.9 pts | |||||||||||||||||||||||||||||

| Yield (cents) | 20.27 | 21.62 | (6.3) % | 20.11 | 21.49 | (6.4) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 17.54 | 18.63 | (5.8) % | 16.92 | 17.88 | (5.4) % | |||||||||||||||||||||||||||||

| Total revenue per ASM (cents) | 19.05 | 20.18 | (5.6) % | 18.46 | 19.49 | (5.3) % | |||||||||||||||||||||||||||||

| Cargo ton miles (millions) | 515 | 427 | 20.6 % | 999 | 849 | 17.7 % | |||||||||||||||||||||||||||||

| Cargo yield per ton mile (cents) | 37.87 | 46.31 | (18.2) % | 38.25 | 49.51 | (22.8) % | |||||||||||||||||||||||||||||

| Fuel consumption (gallons in millions) | 1,132 | 1,041 | 8.8 % | 2,174 | 2,006 | 8.4 % | |||||||||||||||||||||||||||||

| Average aircraft fuel price including related taxes (dollars per gallon) | 2.70 | 2.62 | 3.3 % | 2.78 | 2.94 | (5.4) % | |||||||||||||||||||||||||||||

| Operating cost per ASM (cents) | 17.21 | 17.07 | 0.8 % | 17.50 | 17.56 | (0.3) % | |||||||||||||||||||||||||||||

| Operating cost per ASM excluding net special items (cents) | 17.21 | 17.06 | 0.8 % | 17.45 | 17.54 | (0.5) % | |||||||||||||||||||||||||||||

| Operating cost per ASM excluding net special items and fuel (cents) | 13.14 | 13.16 | (0.1) % | 13.31 | 13.17 | 1.1 % | |||||||||||||||||||||||||||||

| Passenger enplanements (thousands) | 59,188 | 54,285 | 9.0 % | 111,954 | 102,517 | 9.2 % | |||||||||||||||||||||||||||||

| Departures (thousands): | |||||||||||||||||||||||||||||||||||

| Mainline | 306 | 289 | 5.9 % | 596 | 564 | 5.8 % | |||||||||||||||||||||||||||||

| Regional | 243 | 209 | 16.2 % | 462 | 411 | 12.6 % | |||||||||||||||||||||||||||||

| Total | 549 | 498 | 10.3 % | 1,058 | 975 | 8.6 % | |||||||||||||||||||||||||||||

| Average stage length (miles): | |||||||||||||||||||||||||||||||||||

| Mainline | 1,154 | 1,141 | 1.2 % | 1,155 | 1,132 | 2.0 % | |||||||||||||||||||||||||||||

| Regional | 457 | 463 | (1.4) % | 460 | 466 | (1.1) % | |||||||||||||||||||||||||||||

| Total | 845 | 856 | (1.3) % | 852 | 851 | — % | |||||||||||||||||||||||||||||

| Aircraft at end of period: | |||||||||||||||||||||||||||||||||||

| Mainline | 970 | 944 | 2.8 % | 970 | 944 | 2.8 % | |||||||||||||||||||||||||||||

Regional (2) |

559 | 526 | 6.3 % | 559 | 526 | 6.3 % | |||||||||||||||||||||||||||||

| Total | 1,529 | 1,470 | 4.0 % | 1,529 | 1,470 | 4.0 % | |||||||||||||||||||||||||||||

| Full-time equivalent employees at end of period: | |||||||||||||||||||||||||||||||||||

| Mainline | 107,400 | 104,400 | 2.9 % | 107,400 | 104,400 | 2.9 % | |||||||||||||||||||||||||||||

Regional (3) |

30,000 | 28,100 | 6.8 % | 30,000 | 28,100 | 6.8 % | |||||||||||||||||||||||||||||

| Total | 137,400 | 132,500 | 3.7 % | 137,400 | 132,500 | 3.7 % | |||||||||||||||||||||||||||||

Note: Amounts may not recalculate due to rounding.

(1)Unless otherwise noted, operating statistics include mainline and regional operations. Regional includes wholly-owned regional airline subsidiaries and operating results from capacity purchase carriers.

(2)Includes aircraft owned and leased by American as well as aircraft operated by third-party regional carriers under capacity purchase agreements. Excluded from the aircraft count above are 65 regional aircraft in temporary storage as of June 30, 2024 as follows: 55 Embraer 145, eight Bombardier CRJ 700, and two Embraer 170.

(3)Regional full-time equivalent employees only include our wholly-owned regional airline subsidiaries.

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 7

American Airlines Group Inc.

Consolidated Revenue Statistics by Region

(Unaudited)

| 3 Months Ended June 30, |

Increase (Decrease) |

6 Months Ended June 30, |

Increase (Decrease) |

||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

Domestic (1) |

|||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 43,183 | 39,758 | 8.6 % | 81,994 | 75,509 | 8.6 % | |||||||||||||||||||||||||||||

| Available seat miles (ASM) (millions) | 49,613 | 45,700 | 8.6 % | 96,716 | 90,255 | 7.2 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 87.0 | 87.0 | — pts | 84.8 | 83.7 | 1.1 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 9,342 | 9,195 | 1.6 % | 17,604 | 17,232 | 2.2 % | |||||||||||||||||||||||||||||

| Yield (cents) | 21.63 | 23.13 | (6.5) % | 21.47 | 22.82 | (5.9) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 18.83 | 20.12 | (6.4) % | 18.20 | 19.09 | (4.7) % | |||||||||||||||||||||||||||||

Latin America (2) |

|||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 8,576 | 7,926 | 8.2 % | 18,672 | 16,934 | 10.3 % | |||||||||||||||||||||||||||||

| Available seat miles (millions) | 9,873 | 9,200 | 7.3 % | 21,611 | 19,710 | 9.6 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 86.9 | 86.2 | 0.7 pts | 86.4 | 85.9 | 0.5 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 1,562 | 1,640 | (4.8) % | 3,464 | 3,555 | (2.6) % | |||||||||||||||||||||||||||||

| Yield (cents) | 18.21 | 20.69 | (12.0) % | 18.55 | 20.99 | (11.6) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 15.82 | 17.82 | (11.2) % | 16.03 | 18.04 | (11.1) % | |||||||||||||||||||||||||||||

| Atlantic | |||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 11,527 | 10,689 | 7.8 % | 17,982 | 16,510 | 8.9 % | |||||||||||||||||||||||||||||

| Available seat miles (millions) | 13,629 | 12,823 | 6.3 % | 22,671 | 21,065 | 7.6 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 84.6 | 83.4 | 1.2 pts | 79.3 | 78.4 | 0.9 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 2,019 | 1,888 | 7.0 % | 3,012 | 2,819 | 6.8 % | |||||||||||||||||||||||||||||

| Yield (cents) | 17.52 | 17.66 | (0.8) % | 16.75 | 17.07 | (1.9) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 14.82 | 14.72 | 0.7 % | 13.28 | 13.38 | (0.7) % | |||||||||||||||||||||||||||||

| Pacific | |||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 1,858 | 1,647 | 12.9 % | 3,969 | 3,081 | 28.8 % | |||||||||||||||||||||||||||||

| Available seat miles (millions) | 2,148 | 1,935 | 11.0 % | 4,781 | 3,635 | 31.5 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 86.5 | 85.1 | 1.4 pts | 83.0 | 84.8 | (1.8) pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 279 | 255 | 9.4 % | 581 | 475 | 22.4 % | |||||||||||||||||||||||||||||

| Yield (cents) | 15.02 | 15.50 | (3.1) % | 14.64 | 15.40 | (5.0) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 13.00 | 13.19 | (1.4) % | 12.15 | 13.06 | (6.9) % | |||||||||||||||||||||||||||||

| Total International | |||||||||||||||||||||||||||||||||||

| Revenue passenger miles (millions) | 21,961 | 20,262 | 8.4 % | 40,623 | 36,525 | 11.2 % | |||||||||||||||||||||||||||||

| Available seat miles (millions) | 25,650 | 23,958 | 7.1 % | 49,063 | 44,410 | 10.5 % | |||||||||||||||||||||||||||||

| Passenger load factor (percent) | 85.6 | 84.6 | 1.0 pts | 82.8 | 82.2 | 0.6 pts | |||||||||||||||||||||||||||||

| Passenger revenue (dollars in millions) | 3,860 | 3,783 | 2.1 % | 7,057 | 6,849 | 3.0 % | |||||||||||||||||||||||||||||

| Yield (cents) | 17.58 | 18.67 | (5.8) % | 17.37 | 18.75 | (7.4) % | |||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 15.05 | 15.79 | (4.7) % | 14.38 | 15.42 | (6.7) % | |||||||||||||||||||||||||||||

Note: Amounts may not recalculate due to rounding.

(1)Domestic results include Canada, Puerto Rico and U.S. Virgin Islands.

(2)Latin America results include the Caribbean.

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 8

Reconciliation of GAAP Financial Information to Non-GAAP Financial Information

American Airlines Group Inc. (the Company) sometimes uses financial measures that are derived from the condensed consolidated financial statements but that are not presented in accordance with GAAP to understand and evaluate its current operating performance and to allow for period-to-period comparisons. The Company believes these non-GAAP financial measures may also provide useful information to investors and others. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. The Company is providing a reconciliation of reported non-GAAP financial measures to their comparable financial measures on a GAAP basis.

The tables below present the reconciliations of the following GAAP measures to their non-GAAP measures:

–Operating Income (GAAP measure) to Operating Income Excluding Net Special Items (non-GAAP measure)

–Operating Margin (GAAP measure) to Operating Margin Excluding Net Special Items (non-GAAP measure)

–Pre-Tax Income (GAAP measure) to Pre-Tax Income Excluding Net Special Items (non-GAAP measure)

–Pre-Tax Margin (GAAP measure) to Pre-Tax Margin Excluding Net Special Items (non-GAAP measure)

–Net Income (GAAP measure) to Net Income Excluding Net Special Items (non-GAAP measure)

–Basic and Diluted Earnings Per Share (GAAP measure) to Basic and Diluted Earnings Per Share Excluding Net Special Items (non-GAAP measure)

Management uses these non-GAAP financial measures to evaluate the Company's current operating performance and to allow for period-to-period comparisons. As net special items may vary from period-to-period in nature and amount, the adjustment to exclude net special items allows management an additional tool to understand the Company’s core operating performance.

Additionally, the tables below present the reconciliations of total operating costs (GAAP measure) to total operating costs excluding net special items and fuel (non-GAAP measure) and total operating costs per ASM (CASM) to CASM excluding net special items and fuel. Management uses total operating costs excluding net special items and fuel and CASM excluding net special items and fuel to evaluate the Company's current operating performance and for period-to-period comparisons. The price of fuel, over which the Company has no control, impacts the comparability of period-to-period financial performance. The adjustment to exclude fuel and net special items allows management an additional tool to understand and analyze the Company’s non-fuel costs and core operating performance.

| Reconciliation of Operating Income Excluding Net Special Items | 3 Months Ended June 30, |

Percent Increase (Decrease) |

6 Months Ended June 30, |

Percent Increase (Decrease) |

||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||||

| Operating income as reported | $ | 1,384 | $ | 2,163 | $ | 1,391 | $ | 2,600 | ||||||||||||||||||||||||||||||

| Operating net special items: | ||||||||||||||||||||||||||||||||||||||

Mainline operating special items, net (1) |

— | — | 70 | 13 | ||||||||||||||||||||||||||||||||||

| Regional operating special items, net | — | 6 | — | 6 | ||||||||||||||||||||||||||||||||||

| Operating income excluding net special items | $ | 1,384 | $ | 2,169 | (36.2%) | $ | 1,461 | $ | 2,619 | (44.2%) | ||||||||||||||||||||||||||||

| Calculation of Operating Margin | ||||||||||||||||||||||||||||||||||||||

| Operating income as reported | $ | 1,384 | $ | 2,163 | $ | 1,391 | $ | 2,600 | ||||||||||||||||||||||||||||||

| Total operating revenues as reported | $ | 14,334 | $ | 14,055 | $ | 26,904 | $ | 26,244 | ||||||||||||||||||||||||||||||

| Operating margin | 9.7 | % | 15.4 | % | 5.2 | % | 9.9 | % | ||||||||||||||||||||||||||||||

| Calculation of Operating Margin Excluding Net Special Items | ||||||||||||||||||||||||||||||||||||||

| Operating income excluding net special items | $ | 1,384 | $ | 2,169 | $ | 1,461 | $ | 2,619 | ||||||||||||||||||||||||||||||

| Total operating revenues as reported | $ | 14,334 | $ | 14,055 | $ | 26,904 | $ | 26,244 | ||||||||||||||||||||||||||||||

| Operating margin excluding net special items | 9.7 | % | 15.4 | % | 5.4 | % | 10.0 | % | ||||||||||||||||||||||||||||||

| Reconciliation of Pre-Tax Income Excluding Net Special Items | ||||||||||||||||||||||||||||||||||||||

| Pre-tax income as reported | $ | 1,028 | $ | 1,763 | $ | 615 | $ | 1,779 | ||||||||||||||||||||||||||||||

| Pre-tax net special items: | ||||||||||||||||||||||||||||||||||||||

Mainline operating special items, net (1) |

— | — | 70 | 13 | ||||||||||||||||||||||||||||||||||

| Regional operating special items, net | — | 6 | — | 6 | ||||||||||||||||||||||||||||||||||

Nonoperating special items, net (2) |

12 | 28 | 58 | 45 | ||||||||||||||||||||||||||||||||||

| Total pre-tax net special items | 12 | 34 | 128 | 64 | ||||||||||||||||||||||||||||||||||

| Pre-tax income excluding net special items | $ | 1,040 | $ | 1,797 | (42.1%) | $ | 743 | $ | 1,843 | (59.7%) | ||||||||||||||||||||||||||||

| Calculation of Pre-Tax Margin | ||||||||||||||||||||||||||||||||||||||

| Pre-tax income as reported | $ | 1,028 | $ | 1,763 | $ | 615 | $ | 1,779 | ||||||||||||||||||||||||||||||

| Total operating revenues as reported | $ | 14,334 | $ | 14,055 | $ | 26,904 | $ | 26,244 | ||||||||||||||||||||||||||||||

| Pre-tax margin | 7.2 | % | 12.5 | % | 2.3 | % | 6.8 | % | ||||||||||||||||||||||||||||||

| Calculation of Pre-Tax Margin Excluding Net Special Items | ||||||||||||||||||||||||||||||||||||||

| Pre-tax income excluding net special items | $ | 1,040 | $ | 1,797 | $ | 743 | $ | 1,843 | ||||||||||||||||||||||||||||||

| Total operating revenues as reported | $ | 14,334 | $ | 14,055 | $ | 26,904 | $ | 26,244 | ||||||||||||||||||||||||||||||

| Pre-tax margin excluding net special items | 7.3 | % | 12.8 | % | 2.8 | % | 7.0 | % | ||||||||||||||||||||||||||||||

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 9

| Reconciliation of Net Income Excluding Net Special Items | 3 Months Ended June 30, |

Percent Increase (Decrease) |

6 Months Ended June 30, |

Percent Increase (Decrease) |

||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||

| (in millions, except share and per share amounts) | (in millions, except share and per share amounts) | |||||||||||||||||||||||||||||||||||||

| Net income as reported | $ | 717 | $ | 1,338 | $ | 405 | $ | 1,348 | ||||||||||||||||||||||||||||||

| Net special items: | ||||||||||||||||||||||||||||||||||||||

Total pre-tax net special items (1), (2) |

12 | 34 | 128 | 64 | ||||||||||||||||||||||||||||||||||

| Net tax effect of net special items | 45 | (1) | 15 | (8) | ||||||||||||||||||||||||||||||||||

| Net income excluding net special items | $ | 774 | $ | 1,371 | (43.6%) | $ | 548 | $ | 1,404 | (60.9%) | ||||||||||||||||||||||||||||

| Reconciliation of Basic and Diluted Earnings Per Share Excluding Net Special Items | ||||||||||||||||||||||||||||||||||||||

| Net income excluding net special items | $ | 774 | $ | 1,371 | $ | 548 | $ | 1,404 | ||||||||||||||||||||||||||||||

| Shares used for computation (in thousands): | ||||||||||||||||||||||||||||||||||||||

| Basic | 656,965 | 653,602 | 656,406 | 652,801 | ||||||||||||||||||||||||||||||||||

| Diluted | 720,302 | 719,345 | 720,712 | 718,890 | ||||||||||||||||||||||||||||||||||

| Earnings per share excluding net special items: | ||||||||||||||||||||||||||||||||||||||

| Basic | $ | 1.18 | $ | 2.10 | $ | 0.84 | $ | 2.15 | ||||||||||||||||||||||||||||||

Diluted (3) |

$ | 1.09 | $ | 1.92 | $ | 0.79 | $ | 1.98 | ||||||||||||||||||||||||||||||

| Reconciliation of Total Operating Costs per ASM Excluding Net Special Items and Fuel | ||||||||||||||||||||||||||||||||||||||

| Total operating expenses as reported | $ | 12,950 | $ | 11,892 | $ | 25,513 | $ | 23,644 | ||||||||||||||||||||||||||||||

| Operating net special items: | ||||||||||||||||||||||||||||||||||||||

Mainline operating special items, net (1) |

— | — | (70) | (13) | ||||||||||||||||||||||||||||||||||

| Regional operating special items, net | — | (6) | — | (6) | ||||||||||||||||||||||||||||||||||

| Total operating expenses excluding net special items | 12,950 | 11,886 | 25,443 | 23,625 | ||||||||||||||||||||||||||||||||||

| Aircraft fuel and related taxes | (3,061) | (2,723) | (6,042) | (5,890) | ||||||||||||||||||||||||||||||||||

| Total operating expenses excluding net special items and fuel | $ | 9,889 | $ | 9,163 | $ | 19,401 | $ | 17,735 | ||||||||||||||||||||||||||||||

| (in cents) | (in cents) | |||||||||||||||||||||||||||||||||||||

| Total operating expenses per ASM as reported | 17.21 | 17.07 | 17.50 | 17.56 | ||||||||||||||||||||||||||||||||||

| Operating net special items per ASM: | ||||||||||||||||||||||||||||||||||||||

Mainline operating special items, net (1) |

— | — | (0.05) | (0.01) | ||||||||||||||||||||||||||||||||||

| Regional operating special items, net | — | (0.01) | — | — | ||||||||||||||||||||||||||||||||||

| Total operating expenses per ASM excluding net special items | 17.21 | 17.06 | 17.45 | 17.54 | ||||||||||||||||||||||||||||||||||

| Aircraft fuel and related taxes per ASM | (4.07) | (3.91) | (4.14) | (4.37) | ||||||||||||||||||||||||||||||||||

| Total operating expenses per ASM excluding net special items and fuel | 13.14 | 13.16 | 13.31 | 13.17 | ||||||||||||||||||||||||||||||||||

Note: Amounts may not recalculate due to rounding.

FOOTNOTES:

(1)The 2024 six month period mainline operating special items, net principally included $57 million of one-time charges resulting from the ratification of a new collective bargaining agreement with our mainline passenger service team members, including a one-time signing bonus.

(2)Principally included charges associated with debt refinancings and extinguishments as well as mark-to-market net unrealized gains and losses associated with certain equity investments.

(3)The 2024 three and six month period diluted earnings per share gives effect to, among other things, the Company's outstanding 6.5% senior convertible notes by (a) adding back to earnings $9 million and $22 million of interest expense, respectively, related to such convertible notes, net of estimated profit sharing and tax effects and (b) including in the diluted shares outstanding, 61.7 million shares issuable in respect to such convertible notes.

The 2023 three and six month period diluted earnings per share gives effect to, among other things, the Company's outstanding 6.5% senior convertible notes by (a) adding back to earnings $12 million and $23 million of interest expense, respectively, related to such convertible notes, net of estimated profit sharing, short-term incentive and tax effects and (b) including in the diluted shares outstanding, 61.7 million shares issuable in respect to such convertible notes.

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 10

American Airlines Group Inc.

Condensed Consolidated Statements of Cash Flows

(In millions)(Unaudited)

| 6 Months Ended June 30, |

|||||||||||

| 2024 | 2023 | ||||||||||

| Net cash provided by operating activities | $ | 3,308 | $ | 5,096 | |||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures and aircraft purchase deposits | (1,475) | (1,244) | |||||||||

| Proceeds from sale-leaseback transactions and sale of property and equipment | 353 | 183 | |||||||||

| Purchases of short-term investments | (4,714) | (7,587) | |||||||||

| Sales of short-term investments | 3,881 | 4,656 | |||||||||

| Decrease in restricted short-term investments | 68 | 33 | |||||||||

| Other investing activities | (5) | 214 | |||||||||

| Net cash used in investing activities | (1,892) | (3,745) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Payments on long-term debt and finance leases | (1,836) | (3,246) | |||||||||

| Proceeds from issuance of long-term debt | 527 | 2,143 | |||||||||

| Other financing activities | (48) | (55) | |||||||||

| Net cash used in financing activities | (1,357) | (1,158) | |||||||||

| Net increase in cash and restricted cash | 59 | 193 | |||||||||

| Cash and restricted cash at beginning of period | 681 | 586 | |||||||||

Cash and restricted cash at end of period (1) |

$ | 740 | $ | 779 | |||||||

(1)The following table provides a reconciliation of cash and restricted cash to amounts reported within the condensed consolidated balance sheets:

| Cash | $ | 605 | $ | 614 | |||||||

| Restricted cash included in restricted cash and short-term investments | 135 | 165 | |||||||||

| Total cash and restricted cash | $ | 740 | $ | 779 | |||||||

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 11

Free Cash Flow

The Company's free cash flow summary is presented in the table below, which is a non-GAAP measure that management believes is useful information to investors and others in evaluating the Company's ability to generate cash from its core operating performance that is available for use to reinvest in the business or to reduce debt. The Company defines free cash flows as net cash provided by operating activities less net cash used in investing activities, adjusted for (1) net purchases of short-term investments and (2) change in restricted cash. We believe that calculating free cash flow as adjusted for these items is more useful for investors because short-term investment activity and restricted cash are not representative of activity core to our operations.

This non-GAAP measure may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. Our calculation of free cash flow is not intended, and should not be used, to measure the residual cash flow available for discretionary expenditures because, among other things, it excludes mandatory debt service requirements and certain other non-discretionary expenditures.

| 6 Months Ended June 30, 2024 |

|||||

| (in millions) | |||||

| Net cash provided by operating activities | $ | 3,308 | |||

Adjusted net cash used in investing activities (1) |

(1,091) | ||||

| Free cash flow | $ | 2,217 | |||

(1)The following table provides a reconciliation of adjusted net cash used in investing activities for the six months ended June 30, 2024 (in millions):

| Net cash used in investing activities | $ | (1,892) | |||

| Adjustments: | |||||

| Net purchases of short-term investments | 833 | ||||

| Increase in restricted cash | (32) | ||||

| Adjusted net cash used in investing activities | $ | (1,091) | |||

American Airlines Reports Second-Quarter 2024 Financial Results

July 25, 2024

Page 12

American Airlines Group Inc.

Condensed Consolidated Balance Sheets

(In millions, except shares)

| June 30, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash | $ | 605 | $ | 578 | |||||||

| Short-term investments | 7,841 | 7,000 | |||||||||

| Restricted cash and short-term investments | 875 | 910 | |||||||||

| Accounts receivable, net | 2,067 | 2,026 | |||||||||

| Aircraft fuel, spare parts and supplies, net | 2,575 | 2,400 | |||||||||

| Prepaid expenses and other | 832 | 658 | |||||||||

| Total current assets | 14,795 | 13,572 | |||||||||

| Operating property and equipment | |||||||||||

| Flight equipment | 42,752 | 41,794 | |||||||||

| Ground property and equipment | 10,198 | 10,307 | |||||||||

| Equipment purchase deposits | 1,052 | 760 | |||||||||

| Total property and equipment, at cost | 54,002 | 52,861 | |||||||||

| Less accumulated depreciation and amortization | (22,958) | (22,097) | |||||||||

| Total property and equipment, net | 31,044 | 30,764 | |||||||||

| Operating lease right-of-use assets | 7,873 | 7,939 | |||||||||

| Other assets | |||||||||||

| Goodwill | 4,091 | 4,091 | |||||||||

| Intangibles, net | 2,047 | 2,051 | |||||||||

| Deferred tax asset | 2,668 | 2,888 | |||||||||

| Other assets | 1,607 | 1,753 | |||||||||

| Total other assets | 10,413 | 10,783 | |||||||||

| Total assets | $ | 64,125 | $ | 63,058 | |||||||

| Liabilities and Stockholders’ Equity (Deficit) | |||||||||||

| Current liabilities | |||||||||||

| Current maturities of long-term debt and finance leases | $ | 4,120 | $ | 3,632 | |||||||

| Accounts payable | 3,016 | 2,353 | |||||||||

| Accrued salaries and wages | 1,767 | 2,377 | |||||||||

| Air traffic liability | 8,030 | 6,200 | |||||||||

| Loyalty program liability | 3,619 | 3,453 | |||||||||

| Operating lease liabilities | 1,209 | 1,309 | |||||||||

| Other accrued liabilities | 2,849 | 2,738 | |||||||||

| Total current liabilities | 24,610 | 22,062 | |||||||||

| Noncurrent liabilities | |||||||||||

| Long-term debt and finance leases, net of current maturities | 27,636 | 29,270 | |||||||||

| Pension and postretirement benefits | 2,652 | 3,044 | |||||||||

| Loyalty program liability | 6,031 | 5,874 | |||||||||

| Operating lease liabilities | 6,482 | 6,452 | |||||||||

| Other liabilities | 1,460 | 1,558 | |||||||||

| Total noncurrent liabilities | 44,261 | 46,198 | |||||||||

| Stockholders' equity (deficit) | |||||||||||

Common stock, 656,607,802 shares outstanding at June 30, 2024 |

7 | 7 | |||||||||

| Additional paid-in capital | 7,389 | 7,374 | |||||||||

| Accumulated other comprehensive loss | (4,858) | (4,894) | |||||||||

| Retained deficit | (7,284) | (7,689) | |||||||||

| Total stockholders' deficit | (4,746) | (5,202) | |||||||||

| Total liabilities and stockholders’ equity (deficit) | $ | 64,125 | $ | 63,058 | |||||||

July 25, 2024 SECOND- QUARTER 2024 FINANCIAL RESULTS American Airlines Group Inc. Exhibit 99.2

Certain of the statements contained in this presentation should be considered forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward- looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors), and other risks and uncertainties listed from time to time in the Company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement. Forward-looking statements 2

Second-quarter results • Record quarterly revenue of $14.3 billion. • Second-quarter net income per diluted share of $1.01. Excluding net special items1, second-quarter net income per diluted share of $1.09. • Strong second-quarter completion factor, despite significant weather disruptions. • Reduced total debt2 by ~$680 million in the quarter. Now, ~87% of the way to $15 billion total debt reduction goal by year-end 2025. 1. See GAAP to non-GAAP reconciliations at the end of this presentation. 2. Total debt includes debt, finance and operating lease liabilities and pension obligations. Source: Airline financials. 3

Taking action to reset our sales and distribution strategy 4 Ensuring our product is available wherever customers want to buy it • Returned content to the distribution channel traditionally used by travel agencies and corporate managed travel programs. • Removed plans to differentiate how customers earn AAdvantage® miles and Loyalty Points based on where they purchase. All members continue to earn in the AAdvantage® program – no matter where they book. Making it easy and attractive to do business with us • Enhanced AAdvantage Business™ program by adding new features and allowing companies to earn AAdvantage® miles and Loyalty Points as part of the program, including when booking through travel agencies. • Increasing customer support with dedicated AAdvantage Business™ customer service team. Strengthening our relationships and regaining our partners’ trust • Listening to feedback from corporate and agency partners. • Renegotiating contracts with corporate customers and travel agencies. • Increasing sales support for agencies.

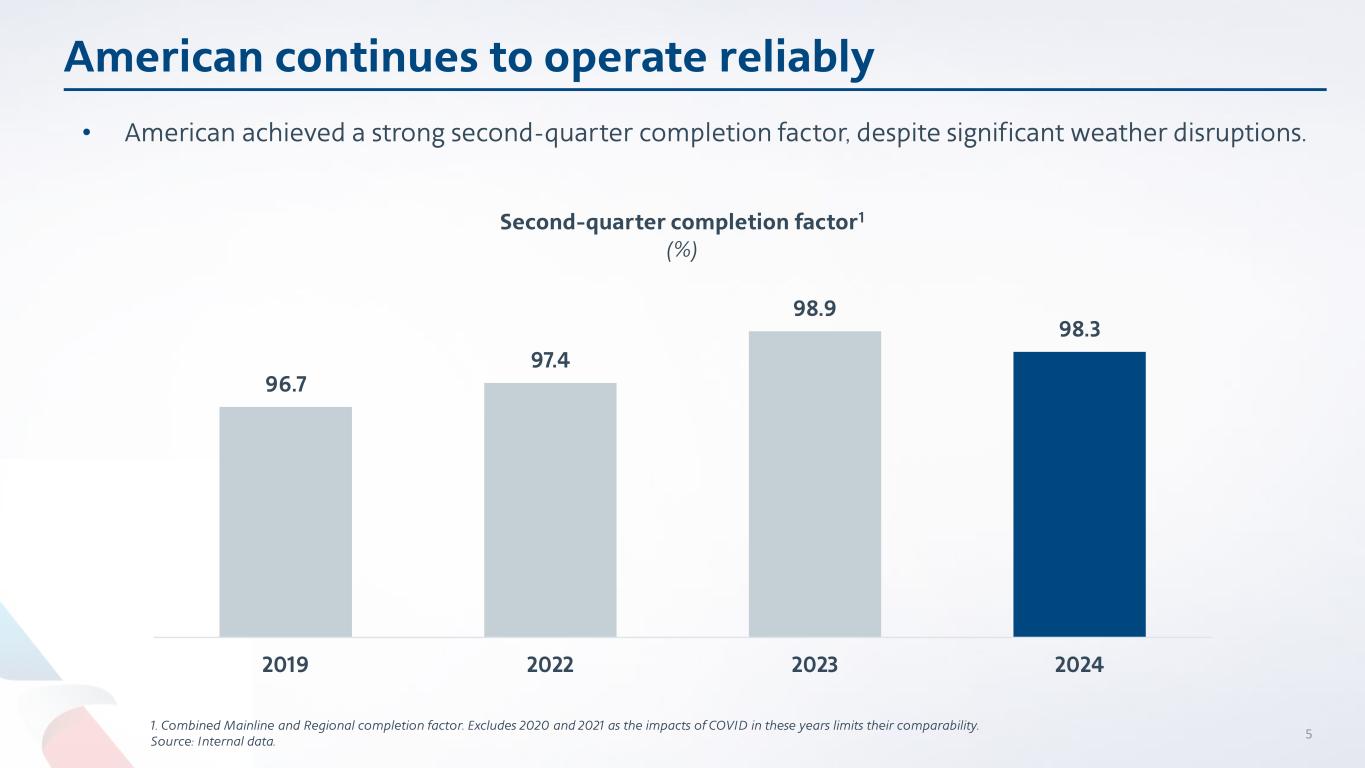

96.7 97.4 98.9 98.3 2019 2022 2023 2024 American continues to operate reliably • American achieved a strong second-quarter completion factor, despite significant weather disruptions. Second-quarter completion factor1 (%) 1. Combined Mainline and Regional completion factor. Excludes 2020 and 2021 as the impacts of COVID in these years limits their comparability. Source: Internal data. 5

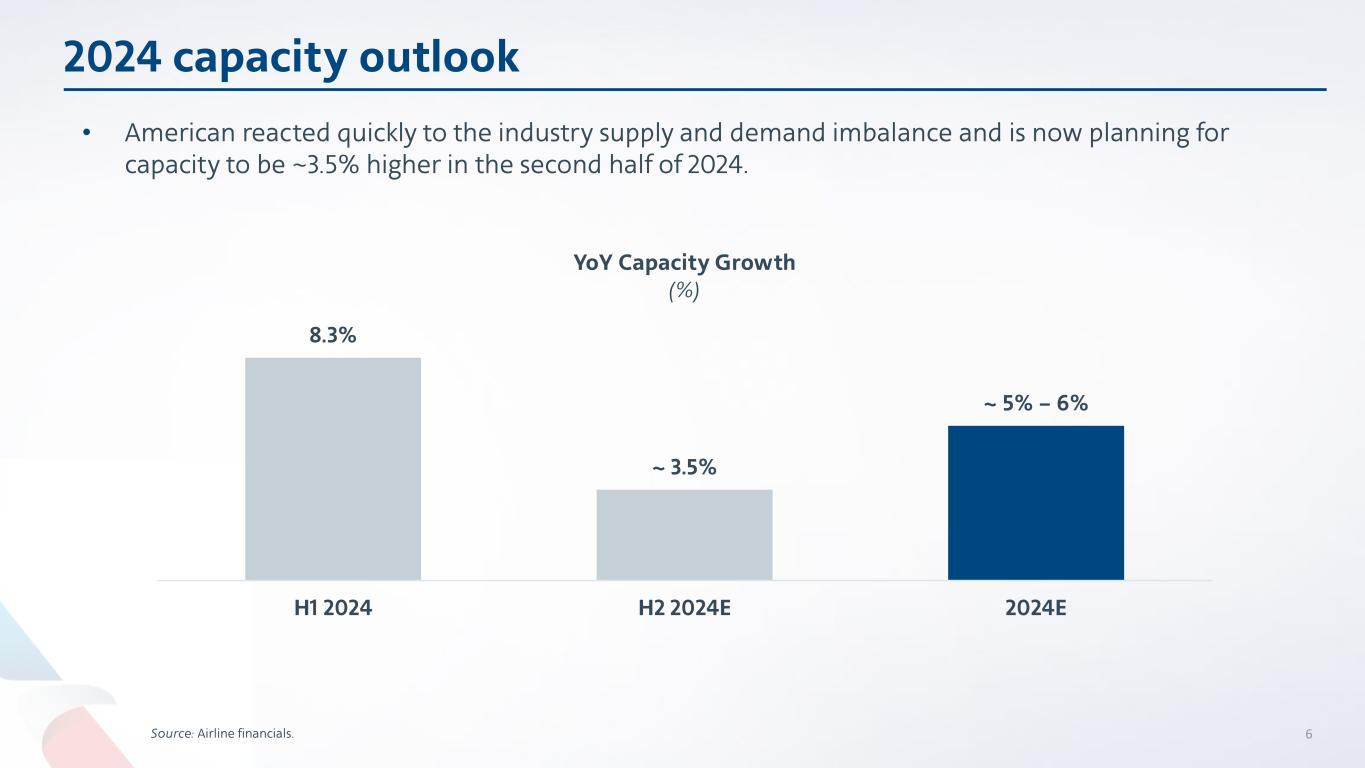

8.3% ~ 3.5% ~ 5% – 6% H1 2024 H2 2024E 2024E 2024 capacity outlook • American reacted quickly to the industry supply and demand imbalance and is now planning for capacity to be ~3.5% higher in the second half of 2024. YoY Capacity Growth (%) Source: Airline financials. 6

Financial update

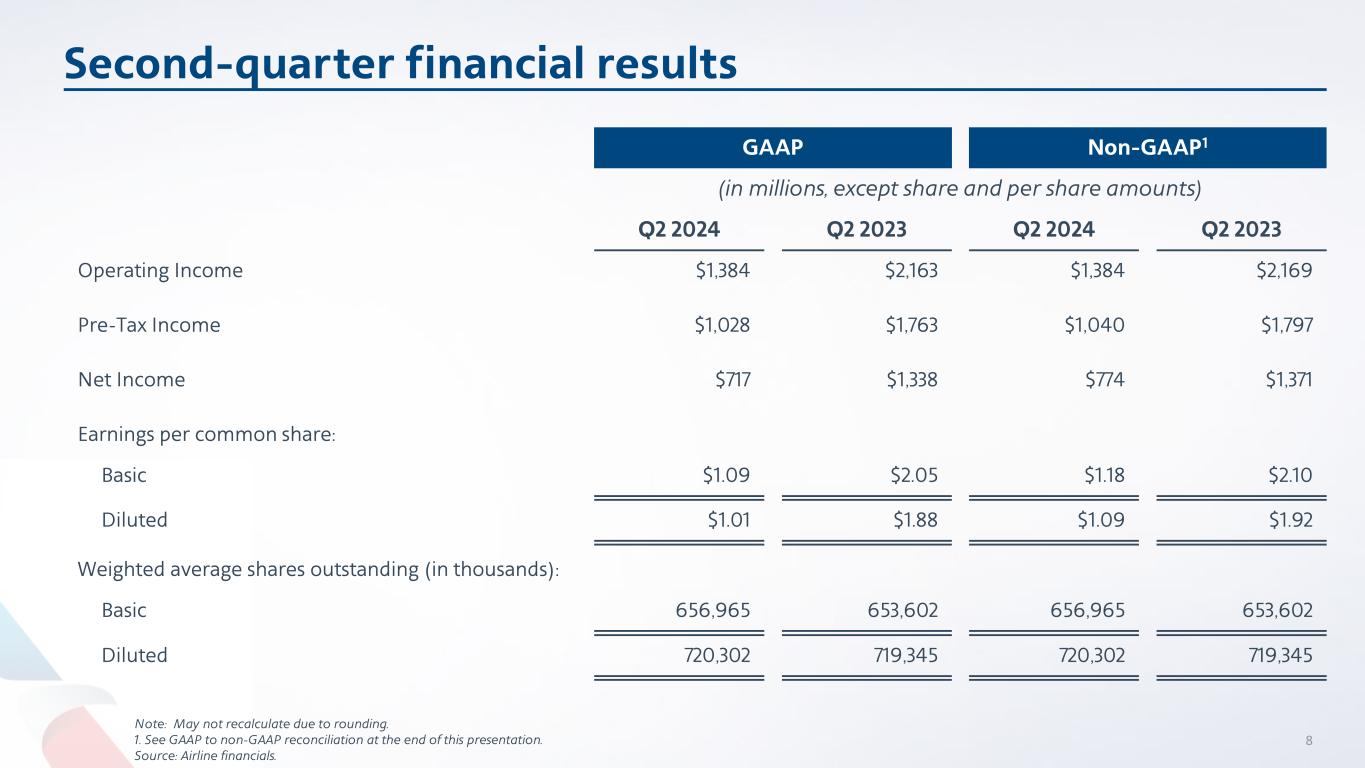

Second-quarter financial results Note: May not recalculate due to rounding. 1. See GAAP to non-GAAP reconciliation at the end of this presentation. Source: Airline financials. GAAP Non-GAAP1 (in millions, except share and per share amounts) Q2 2024 Q2 2023 Q2 2024 Q2 2023 Operating Income $1,384 $2,163 $1,384 $2,169 Pre-Tax Income $1,028 $1,763 $1,040 $1,797 Net Income $717 $1,338 $774 $1,371 Earnings per common share: Basic $1.09 $2.05 $1.18 $2.10 Diluted $1.01 $1.88 $1.09 $1.92 Weighted average shares outstanding (in thousands): Basic 656,965 653,602 656,965 653,602 Diluted 720,302 719,345 720,302 719,345 8

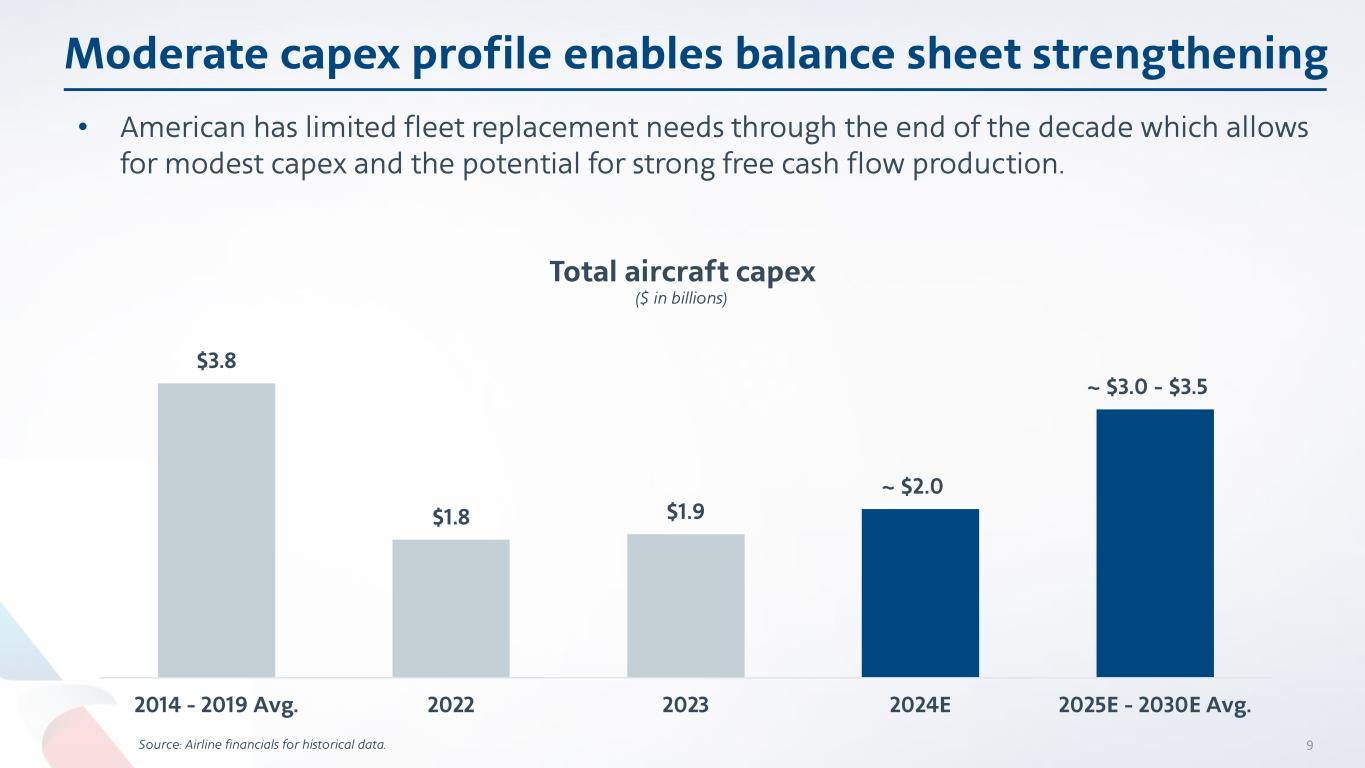

$3.8 $1.8 $1.9 ~ $2.0 ~ $3.0 - $3.5 2014 - 2019 Avg. 2022 2023 2024E 2025E - 2030E Avg. Moderate capex profile enables balance sheet strengthening Source: Airline financials for historical data. Total aircraft capex ($ in billions) • American has limited fleet replacement needs through the end of the decade which allows for modest capex and the potential for strong free cash flow production. 9

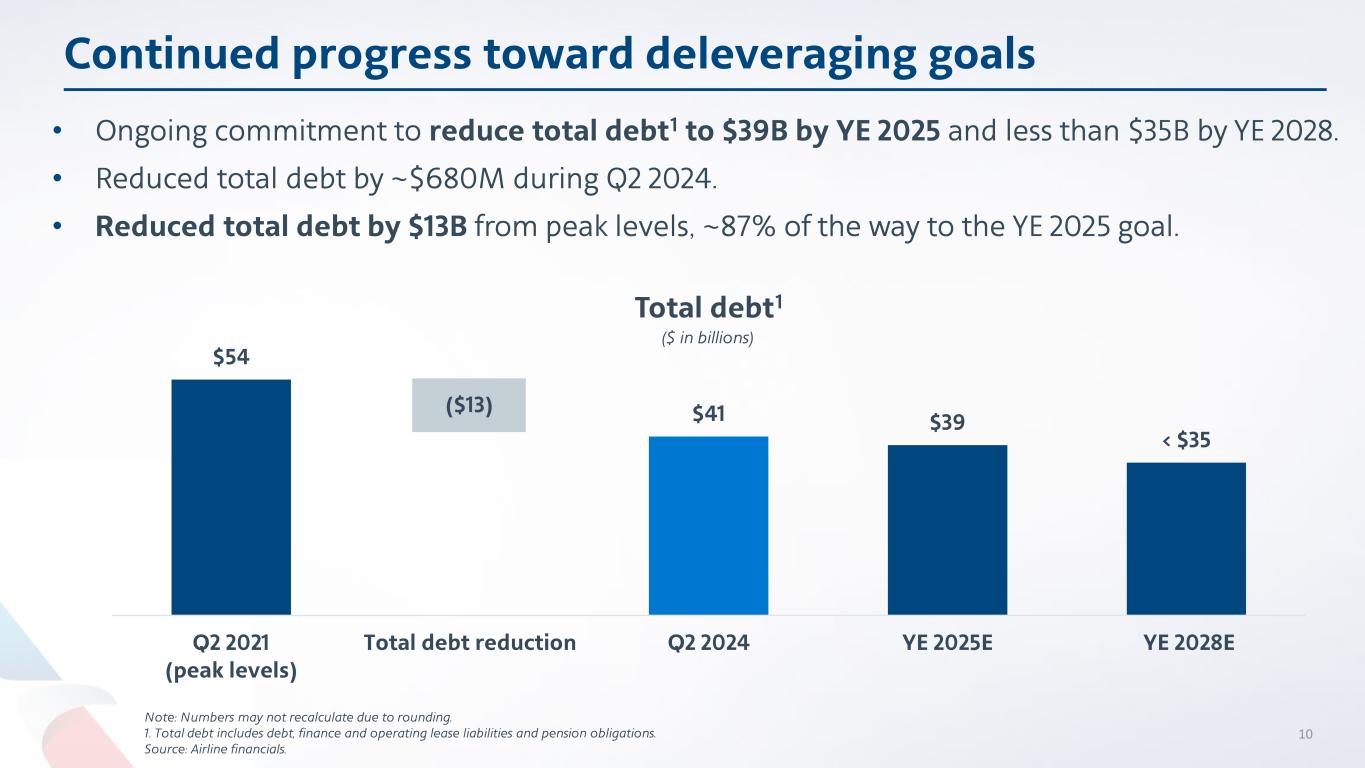

Continued progress toward deleveraging goals Note: Numbers may not recalculate due to rounding. 1. Total debt includes debt, finance and operating lease liabilities and pension obligations. Source: Airline financials. • Ongoing commitment to reduce total debt1 to $39B by YE 2025 and less than $35B by YE 2028. • Reduced total debt by ~$680M during Q2 2024. • Reduced total debt by $13B from peak levels, ~87% of the way to the YE 2025 goal. Total debt1 $54 $41 $39 < $35 Q2 2021 (peak levels) Total debt reduction Q2 2024 YE 2025E YE 2028E ($13) ($ in billions) 10

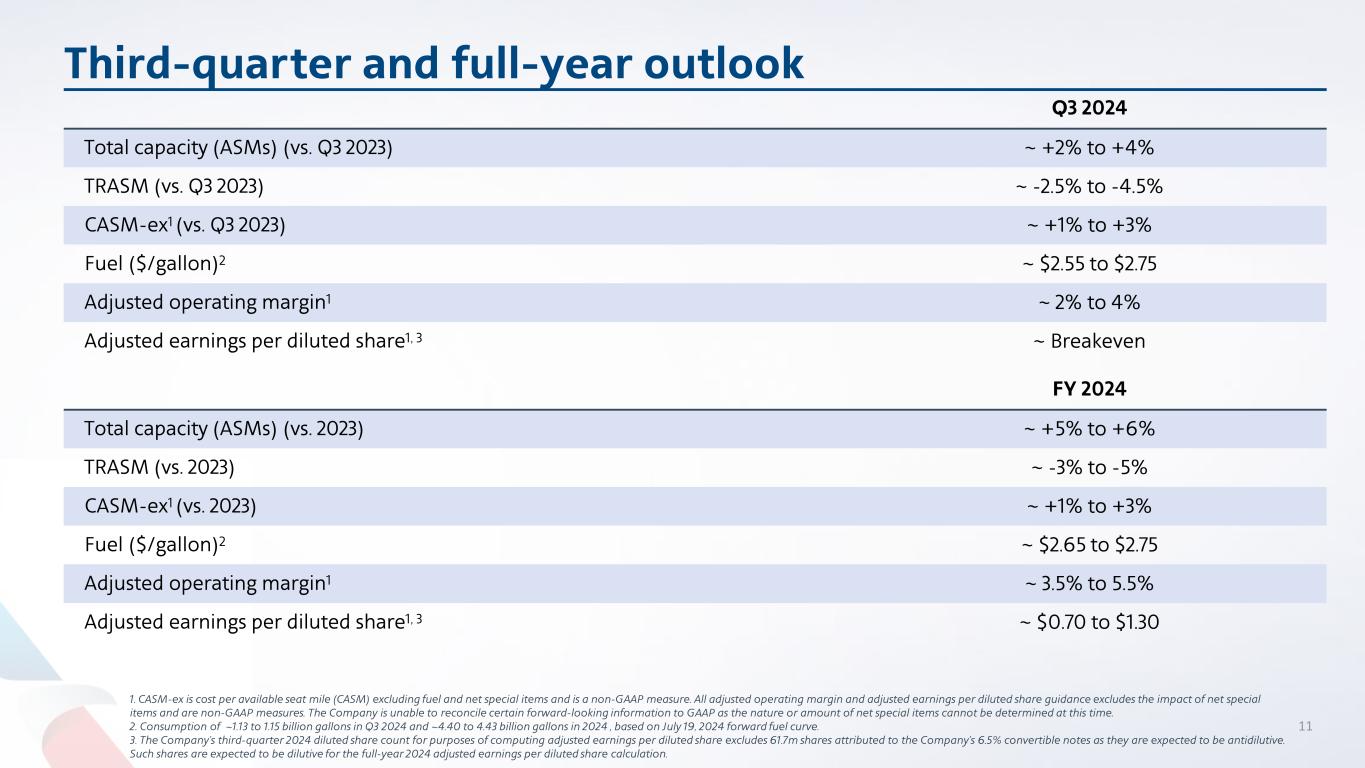

Third-quarter and full-year outlook 1. CASM-ex is cost per available seat mile (CASM) excluding fuel and net special items and is a non-GAAP measure. All adjusted operating margin and adjusted earnings per diluted share guidance excludes the impact of net special items and are non-GAAP measures. The Company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time. 2. Consumption of ~1.13 to 1.15 billion gallons in Q3 2024 and ~4.40 to 4.43 billion gallons in 2024 , based on July 19, 2024 forward fuel curve. 3. The Company’s third-quarter 2024 diluted share count for purposes of computing adjusted earnings per diluted share excludes 61.7m shares attributed to the Company’s 6.5% convertible notes as they are expected to be antidilutive. Such shares are expected to be dilutive for the full-year 2024 adjusted earnings per diluted share calculation. Q3 2024 Total capacity (ASMs) (vs. Q3 2023) ~ +2% to +4% TRASM (vs. Q3 2023) ~ -2.5% to -4.5% CASM-ex1 (vs. Q3 2023) ~ +1% to +3% Fuel ($/gallon)2 ~ $2.55 to $2.75 Adjusted operating margin1 ~ 2% to 4% Adjusted earnings per diluted share1, 3 ~ Breakeven FY 2024 Total capacity (ASMs) (vs. 2023) ~ +5% to +6% TRASM (vs. 2023) ~ -3% to -5% CASM-ex1 (vs. 2023) ~ +1% to +3% Fuel ($/gallon)2 ~ $2.65 to $2.75 Adjusted operating margin1 ~ 3.5% to 5.5% Adjusted earnings per diluted share1, 3 ~ $0.70 to $1.30 11

Thank you, #AATeam

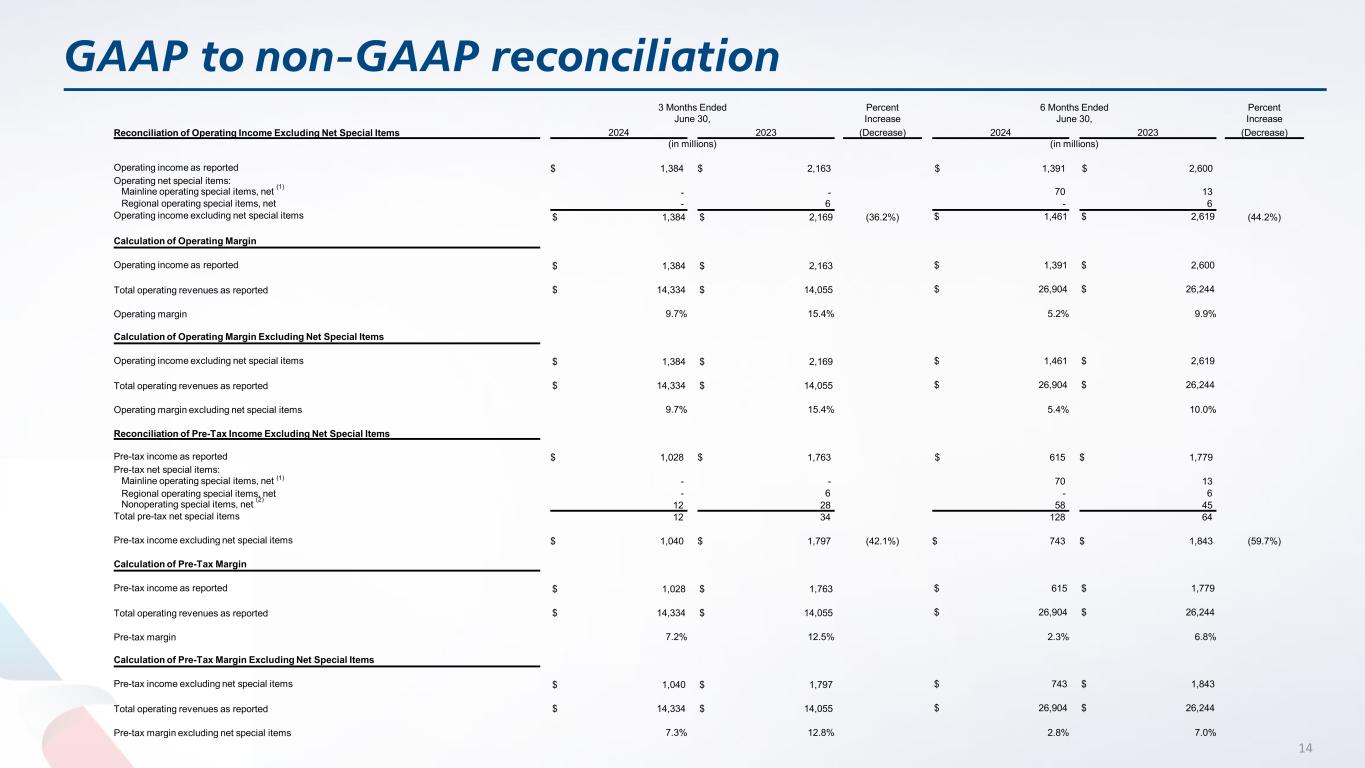

GAAP to non-GAAP reconciliation Reconciliation of GAAP Financial Information to Non-GAAP Financial Information American Airlines Group Inc. (the Company) sometimes uses financial measures that are derived from the condensed consolidated financial statements but that are not presented in accordance with GAAP to understand and evaluate its current operating performance and to allow for period-to-period comparisons. The Company believes these non-GAAP financial measures may also provide useful information to investors and others. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. The Company is providing a reconciliation of reported non-GAAP financial measures to their comparable financial measures on a GAAP basis. The tables below present the reconciliations of the following GAAP measures to their non-GAAP measures: - Operating Income (GAAP measure) to Operating Income Excluding Net Special Items (non-GAAP measure) - Operating Margin (GAAP measure) to Operating Margin Excluding Net Special Items (non-GAAP measure) - Pre-Tax Income (GAAP measure) to Pre-Tax Income Excluding Net Special Items (non-GAAP measure) - Pre-Tax Margin (GAAP measure) to Pre-Tax Margin Excluding Net Special Items (non-GAAP measure) - Net Income (GAAP measure) to Net Income Excluding Net Special Items (non-GAAP measure) - Basic and Diluted Earnings Per Share (GAAP measure) to Basic and Diluted Earnings Per Share Excluding Net Special Items (non-GAAP measure) Management uses these non-GAAP financial measures to evaluate the Company's current operating performance and to allow for period-to-period comparisons. As net special items may vary from period-to-period in nature and amount, the adjustment to exclude net special items allows management an additional tool to understand the Company’s core operating performance. Additionally, the tables below present the reconciliations of total operating costs (GAAP measure) to total operating costs excluding net special items and fuel (non- GAAP measure) and total operating costs per ASM (CASM) to CASM excluding net special items and fuel. Management uses total operating costs excluding net special items and fuel and CASM excluding net special items and fuel to evaluate the Company's current operating performance and for period-to-period comparisons. The price of fuel, over which the Company has no control, impacts the comparability of period-to-period financial performance. The adjustment to exclude fuel and net special items allows management an additional tool to understand and analyze the Company’s non-fuel costs and core operating performance. 13

GAAP to non-GAAP reconciliation Reconciliation of Operating Income Excluding Net Special Items 3 Months Ended June 30, Percent Increase 6 Months Ended June 30, Percent Increase 2024 2023 (Decrease) 2024 2023 (Decrease) (in millions) (in millions) Operating income as reported $ 1,384 $ 2,163 $ 1,391 $ 2,600 Operating net special items: Mainline operating special items, net (1) - - 70 13 Regional operating special items, net - 6 - 6 Operating income excluding net special items $ 1,384 $ 2,169 (36.2%) $ 1,461 $ 2,619 (44.2%) Calculation of Operating Margin Operating income as reported $ 1,384 $ 2,163 $ 1,391 $ 2,600 Total operating revenues as reported $ 14,334 $ 14,055 $ 26,904 $ 26,244 Operating margin 9.7% 15.4% 5.2% 9.9% Calculation of Operating Margin Excluding Net Special Items Operating income excluding net special items $ 1,384 $ 2,169 $ 1,461 $ 2,619 Total operating revenues as reported $ 14,334 $ 14,055 $ 26,904 $ 26,244 Operating margin excluding net special items 9.7% 15.4% 5.4% 10.0% Reconciliation of Pre-Tax Income Excluding Net Special Items Pre-tax income as reported $ 1,028 $ 1,763 $ 615 $ 1,779 Pre-tax net special items: Mainline operating special items, net (1) - - 70 13 Regional operating special items, net - 6 - 6 Nonoperating special items, net (2) 12 28 58 45 Total pre-tax net special items 12 34 128 64 Pre-tax income excluding net special items $ 1,040 $ 1,797 (42.1%) $ 743 $ 1,843 (59.7%) Calculation of Pre-Tax Margin Pre-tax income as reported $ 1,028 $ 1,763 $ 615 $ 1,779 Total operating revenues as reported $ 14,334 $ 14,055 $ 26,904 $ 26,244 Pre-tax margin 7.2% 12.5% 2.3% 6.8% Calculation of Pre-Tax Margin Excluding Net Special Items Pre-tax income excluding net special items $ 1,040 $ 1,797 $ 743 $ 1,843 Total operating revenues as reported $ 14,334 $ 14,055 $ 26,904 $ 26,244 Pre-tax margin excluding net special items 7.3% 12.8% 2.8% 7.0% 14

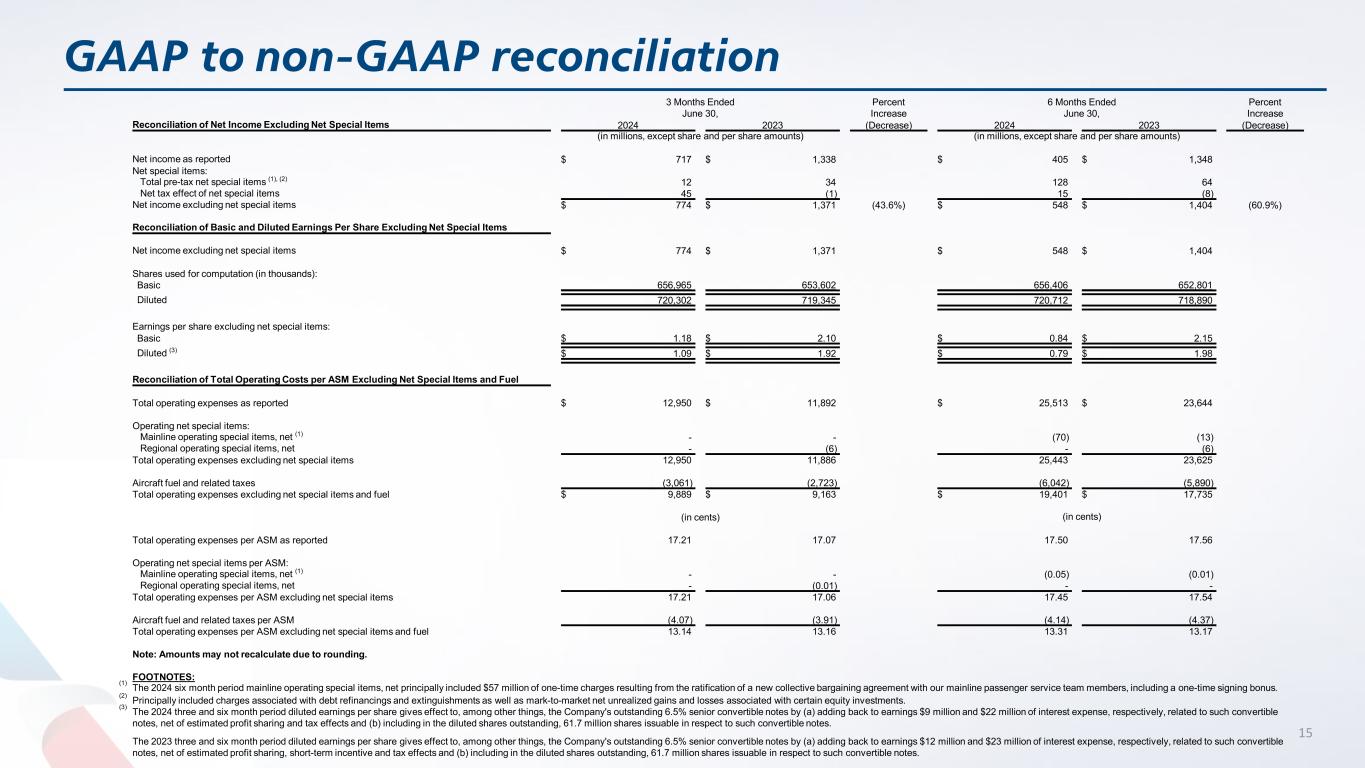

GAAP to non-GAAP reconciliation 3 Months Ended June 30, Percent Increase 6 Months Ended June 30, Percent Increase Reconciliation of Net Income Excluding Net Special Items 2024 2023 (Decrease) 2024 2023 (Decrease) (in millions, except share and per share amounts) (in millions, except share and per share amounts) Net income as reported $ 717 $ 1,338 $ 405 $ 1,348 Net special items: Total pre-tax net special items (1), (2) 12 34 128 64 Net tax effect of net special items 45 (1) 15 (8) Net income excluding net special items $ 774 $ 1,371 (43.6%) $ 548 $ 1,404 (60.9%) Reconciliation of Basic and Diluted Earnings Per Share Excluding Net Special Items Net income excluding net special items $ 774 $ 1,371 $ 548 $ 1,404 Shares used for computation (in thousands): Basic 656,965 653,602 656,406 652,801 Diluted 720,302 719,345 720,712 718,890 Earnings per share excluding net special items: Basic $ 1.18 $ 2.10 $ 0.84 $ 2.15 Diluted (3) $ 1.09 $ 1.92 $ 0.79 $ 1.98 Reconciliation of Total Operating Costs per ASM Excluding Net Special Items and Fuel Total operating expenses as reported $ 12,950 $ 11,892 $ 25,513 $ 23,644 Operating net special items: Mainline operating special items, net (1) - - (70) (13) Regional operating special items, net - (6) - (6) Total operating expenses excluding net special items 12,950 11,886 25,443 23,625 Aircraft fuel and related taxes (3,061) (2,723) (6,042) (5,890) Total operating expenses excluding net special items and fuel $ 9,889 $ 9,163 $ 19,401 $ 17,735 (in cents) (in cents) Total operating expenses per ASM as reported 17.21 17.07 17.50 17.56 Operating net special items per ASM: Mainline operating special items, net (1) - - (0.05) (0.01) Regional operating special items, net - (0.01) - - Total operating expenses per ASM excluding net special items 17.21 17.06 17.45 17.54 Aircraft fuel and related taxes per ASM (4.07) (3.91) (4.14) (4.37) Total operating expenses per ASM excluding net special items and fuel 13.14 13.16 13.31 13.17 Note: Amounts may not recalculate due to rounding. FOOTNOTES: (1) The 2024 six month period mainline operating special items, net principally included $57 million of one-time charges resulting from the ratification of a new collective bargaining agreement with our mainline passenger service team members, including a one-time signing bonus. (2) Principally included charges associated with debt refinancings and extinguishments as well as mark-to-market net unrealized gains and losses associated with certain equity investments. (3) The 2024 three and six month period diluted earnings per share gives effect to, among other things, the Company's outstanding 6.5% senior convertible notes by (a) adding back to earnings $9 million and $22 million of interest expense, respectively, related to such convertible notes, net of estimated profit sharing and tax effects and (b) including in the diluted shares outstanding, 61.7 million shares issuable in respect to such convertible notes. The 2023 three and six month period diluted earnings per share gives effect to, among other things, the Company's outstanding 6.5% senior convertible notes by (a) adding back to earnings $12 million and $23 million of interest expense, respectively, related to such convertible notes, net of estimated profit sharing, short-term incentive and tax effects and (b) including in the diluted shares outstanding, 61.7 million shares issuable in respect to such convertible notes. 15

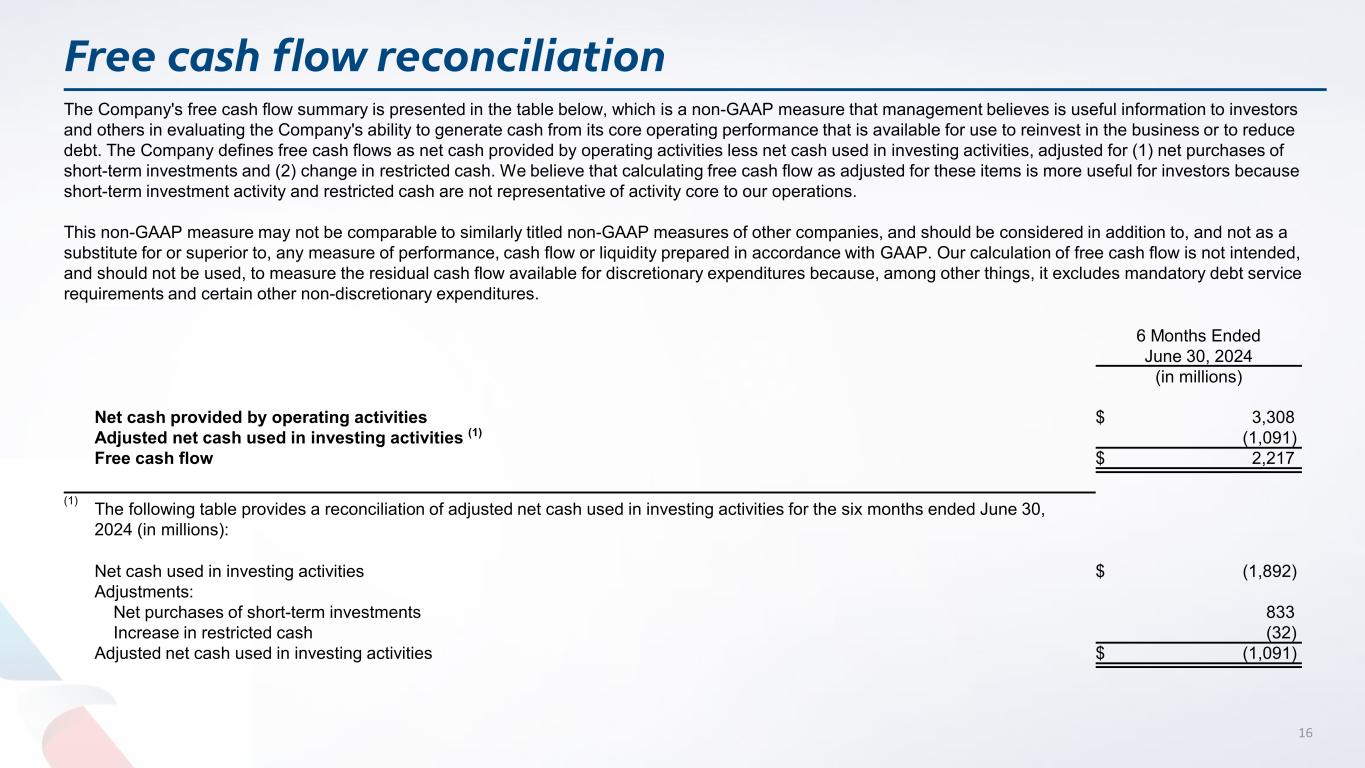

Free cash flow reconciliation The Company's free cash flow summary is presented in the table below, which is a non-GAAP measure that management believes is useful information to investors and others in evaluating the Company's ability to generate cash from its core operating performance that is available for use to reinvest in the business or to reduce debt. The Company defines free cash flows as net cash provided by operating activities less net cash used in investing activities, adjusted for (1) net purchases of short-term investments and (2) change in restricted cash. We believe that calculating free cash flow as adjusted for these items is more useful for investors because short-term investment activity and restricted cash are not representative of activity core to our operations. This non-GAAP measure may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. Our calculation of free cash flow is not intended, and should not be used, to measure the residual cash flow available for discretionary expenditures because, among other things, it excludes mandatory debt service requirements and certain other non-discretionary expenditures. 6 Months Ended June 30, 2024 (in millions) Net cash provided by operating activities $ 3,308 Adjusted net cash used in investing activities (1) (1,091) Free cash flow $ 2,217 (1) The following table provides a reconciliation of adjusted net cash used in investing activities for the six months ended June 30, 2024 (in millions): Net cash used in investing activities $ (1,892) Adjustments: Net purchases of short-term investments 833 Increase in restricted cash (32) Adjusted net cash used in investing activities $ (1,091) 16

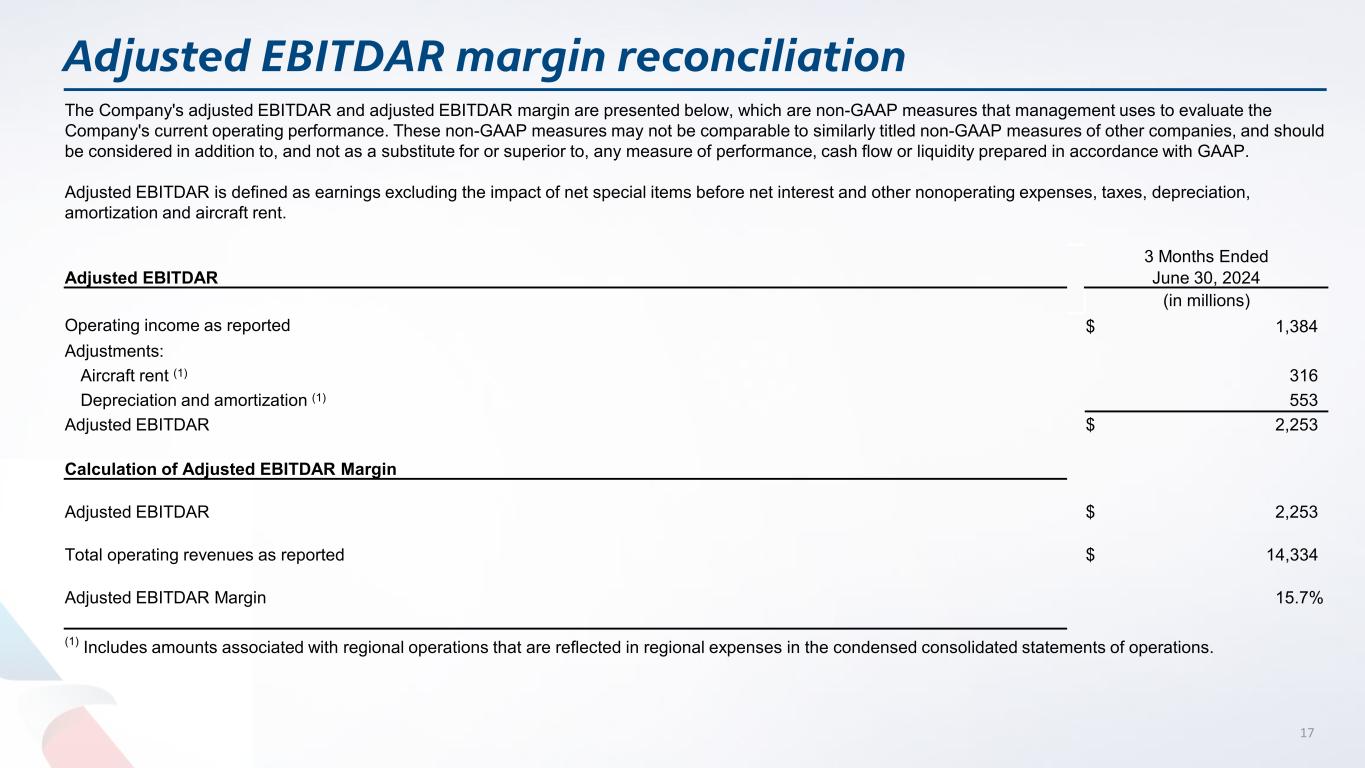

Adjusted EBITDAR margin reconciliation The Company's adjusted EBITDAR and adjusted EBITDAR margin are presented below, which are non-GAAP measures that management uses to evaluate the Company's current operating performance. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. Adjusted EBITDAR is defined as earnings excluding the impact of net special items before net interest and other nonoperating expenses, taxes, depreciation, amortization and aircraft rent. 3 Months Ended Adjusted EBITDAR June 30, 2024 (in millions) Operating income as reported $ 1,384 Adjustments: Aircraft rent (1) 316 Depreciation and amortization (1) 553 Adjusted EBITDAR $ 2,253 Calculation of Adjusted EBITDAR Margin Adjusted EBITDAR $ 2,253 Total operating revenues as reported $ 14,334 Adjusted EBITDAR Margin 15.7% (1) Includes amounts associated with regional operations that are reflected in regional expenses in the condensed consolidated statements of operations. 17

Exhibit 99.3

Investor Relations Update

July 25, 2024

General Overview

| ● | Capacity - The Company expects its third-quarter capacity to be up 2% to 4% versus the third quarter of 2023. The Company expects its 2024 second-half capacity to be up approximately 3.5% and its full-year capacity to be up 5% to 6% year over year. |

||||

| ● | TRASM - Third-quarter total revenue per available seat mile (TRASM) is expected to be down approximately 2.5% to 4.5% versus the third quarter of 2023. Full-year TRASM is expected to be down approximately 3% to 5% versus 2023. |

||||

| ● | CASM-ex1 - The Company expects both its third-quarter and full-year CASM-ex to be up approximately 1% to 3% year over year. |

||||

| ● | Fuel - Based on the July 19, 2024, forward fuel curve, the Company expects to pay an average of between $2.55 and $2.75 per gallon of jet fuel (including taxes) in the third quarter and between $2.65 and $2.75 per gallon of jet fuel (including taxes) for the full year. The Company expects to consume between approximately 1.13 and 1.15 billion gallons of jet fuel in the third quarter and between approximately 4.40 and 4.43 billion gallons of jet fuel for the full year. |

||||

| ● | Adjusted operating margin1 - Based on current assumptions, the Company expects an adjusted operating margin of approximately 2% to 4% for the third quarter and 3.5% to 5.5% for the full year. |

||||

| ● | Adjusted nonoperating expense1 - The Company expects its total adjusted nonoperating expense to be approximately $365 million in the third quarter. The Company continues to expect its full-year total adjusted nonoperating expense to be approximately $1.44 billion. |

||||

| ● | Taxes - The Company expects a provision for income taxes at an estimated effective tax rate of approximately 27% for the third quarter and full year, which is expected to be substantially non-cash. |

||||

| ● | Adjusted EPS1 - Based on the assumptions outlined above, the Company expects its third-quarter adjusted earnings per diluted share to be approximately breakeven based on an expected share count of 658.7 million shares2. Based on current assumptions, the Company expects its full-year adjusted earnings per diluted share to be between $0.70 and $1.30 using a share count of 720.9 million shares2. |

||||

| ● | Free cash flow3 - Based on current assumptions, the Company expects its full-year free cash flow to be approximately $500 million. |

||||

Notes:

| 1. | CASM-ex is cost per available seat mile (CASM) excluding fuel and net special items and is a non-GAAP measure. Adjusted operating margin, adjusted nonoperating expense and adjusted earnings per diluted share exclude the impact of net special items and are non-GAAP measures. The Company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time. Please see GAAP to non-GAAP reconciliation at the end of this document. |

||||

| 2. | The Company’s third-quarter 2024 diluted share count for purposes of computing adjusted earnings per diluted share excludes 61.7m shares attributed to the Company’s 6.5% convertible notes as they are expected to be antidilutive. Such shares are expected to be dilutive for the full-year 2024 adjusted earnings per diluted share calculation. |

||||

| 3. | The Company defines free cash flow as net cash provided by operating activities less net cash used in investing activities, adjusted for (1) net purchases of short-term investments and (2) change in restricted cash. Free cash flow is a non-GAAP measure. |

||||

Please refer to the footnotes and the forward-looking statements page of this document for additional information.

Financial Update

July 25, 2024

Q3 20241 |

||||||||||||||||||||

| Available seat miles (ASMs) | ~ +2% to +4% (vs. Q3 23) | |||||||||||||||||||

| TRASM | ~ -2.5% to -4.5% (vs. Q3 23) | |||||||||||||||||||

| CASM excluding fuel and net special items | ~ +1% to +3% (vs. Q3 23) | |||||||||||||||||||

| Average fuel price (incl. taxes) ($/gal) | ~ $2.55 to $2.75 | |||||||||||||||||||

| Fuel gallons consumed (bil) | ~ 1.13 to 1.15 | |||||||||||||||||||

Adjusted operating margin |

~ 2% to 4% | |||||||||||||||||||

| Adjusted nonoperating expense ($ mil) | ~ $365 | |||||||||||||||||||

| Adjusted earnings per diluted share ($/share) | ~ Breakeven | |||||||||||||||||||

| Q3 2024 Shares Forecast | ||||||||||||||||||||

Shares (mil)2 |

||||||||||||||||||||

| Earnings Level ($ mil) | Basic | Diluted | Addback ($ mil)3 |

|||||||||||||||||

| Earnings above $122 | 657.4 | 720.4 | $11 | |||||||||||||||||

| Earnings up to $122 | 657.4 | 658.7 | — | |||||||||||||||||

| Net loss | 657.4 | 657.4 | — | |||||||||||||||||

FY 20241 |

||||||||||||||||||||

| Available seat miles (ASMs) | ~ +5% to +6% (vs. 2023) | |||||||||||||||||||

| TRASM | ~ -3% to -5% (vs. 2023) | |||||||||||||||||||

| CASM excluding fuel and net special items | ~ +1% to +3% (vs. 2023) | |||||||||||||||||||

| Average fuel price (incl. taxes) ($/gal) | ~ $2.65 to $2.75 | |||||||||||||||||||

| Fuel gallons consumed (bil) | ~ 4.40 to 4.43 | |||||||||||||||||||

Adjusted operating margin |

~ 3.5% to 5.5% | |||||||||||||||||||

| Adjusted nonoperating expense ($ bil) | ~ $1.44 | |||||||||||||||||||

| Adjusted earnings per diluted share ($/share) | ~ $0.70 to $1.30 | |||||||||||||||||||

| FY 2024 Shares Forecast | ||||||||||||||||||||

Shares (mil)2 |

||||||||||||||||||||

| Earnings Level ($ mil) | Basic | Diluted | Addback ($ mil)3 |

|||||||||||||||||

| Earnings above $533 | 657.0 | 720.9 | $50 | |||||||||||||||||

| Earnings up to $533 | 657.0 | 659.1 | — | |||||||||||||||||

| Net loss | 657.0 | 657.0 | — | |||||||||||||||||

Notes:

| 1. | Includes guidance on certain non-GAAP measures, which exclude, among other things, net special items. The Company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time. Please see the GAAP to non-GAAP reconciliation at the end of this document. Numbers may not recalculate due to rounding. |

||||

| 2. | Shares outstanding are based upon several estimates and assumptions, including average per share stock price and stock award activity. The number of shares in actual calculations of earnings per share will likely be different from those set forth above. | ||||

| 3. | Interest addback for earnings per diluted share calculation for 6.5% convertible notes, net of estimated profit sharing and tax effects. | ||||

Please refer to the footnotes and the forward-looking statements page of this document for additional information.

GAAP to Non-GAAP Reconciliation

July 25, 2024

The Company sometimes uses financial measures that are derived from the condensed consolidated financial statements or otherwise provided in the form of guidance but that are not presented in accordance with GAAP to understand and evaluate its current operating performance and to allow for period-to-period comparisons. The Company believes these non-GAAP financial measures may also provide useful information to investors and others. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. The Company is providing a reconciliation of reported non-GAAP financial measures to their comparable financial measures on a GAAP basis. The table below presents the reconciliation of total operating costs (GAAP measure) to total operating costs excluding fuel and net special items (non-GAAP measure) and total operating costs per ASM (CASM) to CASM excluding fuel and net special items. Management uses total operating costs excluding fuel and net special items and CASM excluding fuel and net special items to evaluate the Company's current operating performance and for period-to-period comparisons. The price of fuel, over which the Company has no control, impacts the comparability of period-to-period financial performance. Additionally, net special items may vary from period-to-period in nature and amount. These adjustments to exclude fuel and net special items allow management an additional tool to understand and analyze the Company’s non-fuel costs and core operating performance.

GAAP to Non-GAAP Reconciliation of Total Operating Costs and CASM ($ mil, except ASM and CASM data) | ||||||||||||||||||||||||||

Q3 2024 Range1 |

FY 2024 Range1 |

|||||||||||||||||||||||||

| Low | High | Low | High | |||||||||||||||||||||||

| Total operating expenses | $12,712 | $13,384 | $50,390 | $52,056 | ||||||||||||||||||||||

| Less fuel expense | 2,882 | 3,163 | 11,660 | 12,183 | ||||||||||||||||||||||

| Less operating net special items | — | — | — | — | ||||||||||||||||||||||

| Total operating expenses excluding fuel and net special items (non-GAAP) | $9,830 | $10,221 | $38,730 | $39,873 | ||||||||||||||||||||||

| Total CASM (cts) | 17.01 | 17.56 | 17.28 | 17.68 | ||||||||||||||||||||||

| Total CASM excluding fuel and net special items (cts) (non-GAAP) | 13.15 | 13.41 | 13.28 | 13.54 | ||||||||||||||||||||||

| Percentage change compared to 2023 (%) | ~ 1.0% | ~ 3.0% | ~ 1.0% | ~ 3.0% | ||||||||||||||||||||||

| Total ASMs (bil) | 74.8 | 76.2 | 291.6 | 294.4 | ||||||||||||||||||||||

| Amounts may not recalculate due to rounding. | |||||

Notes:

| 1. | The Company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time. |

||||

Please refer to the footnotes and the forward-looking statements page of this document for additional information.

Forward-Looking Statements

July 25, 2024

Cautionary Statement Regarding Forward-Looking Statements

Certain of the statements contained in this report should be considered forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors), and other risks and uncertainties listed from time to time in the Company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement.

Please refer to the footnotes and the forward-looking statements page of this document for additional information.